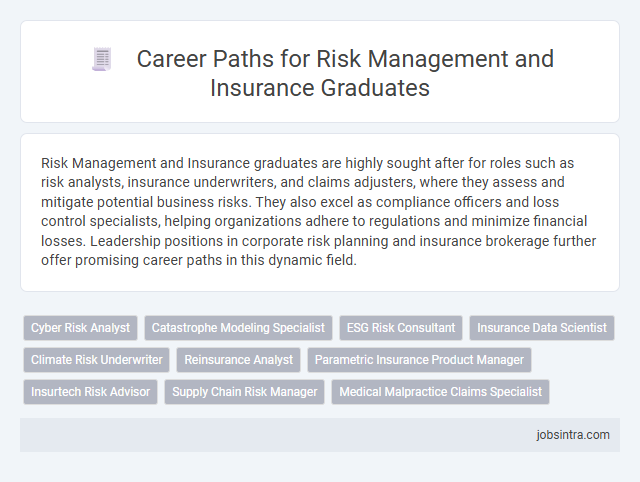

Risk Management and Insurance graduates are highly sought after for roles such as risk analysts, insurance underwriters, and claims adjusters, where they assess and mitigate potential business risks. They also excel as compliance officers and loss control specialists, helping organizations adhere to regulations and minimize financial losses. Leadership positions in corporate risk planning and insurance brokerage further offer promising career paths in this dynamic field.

Cyber Risk Analyst

Risk Management and Insurance graduates can excel as Cyber Risk Analysts by assessing and mitigating digital threats to organizations. This role involves analyzing cyber vulnerabilities, implementing risk control measures, and advising on insurance policies related to cyber incidents. Strong skills in data analysis, cybersecurity frameworks, and regulatory compliance make graduates valuable in protecting businesses from financial and reputational damage caused by cyber risks.

Catastrophe Modeling Specialist

Catastrophe Modeling Specialists analyze and predict the financial impact of natural disasters and catastrophic events to help insurance companies manage risk effectively. They utilize advanced statistical models and geospatial data to assess potential losses, guiding underwriting decisions and risk mitigation strategies. Expertise in risk management, data analysis, and software tools like RMS or AIR is essential for success in this role.

ESG Risk Consultant

ESG Risk Consultants play a crucial role in helping organizations identify and manage environmental, social, and governance risks to enhance sustainable business practices. Graduates in Risk Management and Insurance are well-equipped to analyze complex risk factors, develop mitigation strategies, and ensure compliance with evolving ESG regulations. This career path offers opportunities to influence corporate sustainability initiatives while addressing financial and reputational risks.

Insurance Data Scientist

Insurance Data Scientist roles leverage advanced analytics and machine learning to assess risk and optimize insurance products. Using large datasets, you can identify patterns that improve underwriting accuracy, fraud detection, and claims management. These positions demand strong skills in statistics, programming, and domain knowledge in risk management.

Climate Risk Underwriter

A Climate Risk Underwriter evaluates insurance applications by assessing potential environmental hazards and their financial impact, specializing in climate-related risks such as floods, hurricanes, and wildfires. You will analyze scientific data and historical trends to develop risk profiles and determine appropriate coverage terms and premiums. This role is crucial for companies aiming to mitigate losses from increasingly frequent and severe climate events.

Reinsurance Analyst

Reinsurance Analysts play a crucial role in managing risk by assessing and evaluating reinsurance contracts to help insurance companies minimize potential losses. They analyze data trends, financial reports, and risk exposures to provide strategic insights for underwriting decisions. Proficiency in data analysis and strong knowledge of insurance principles are essential for excelling in this role.

Parametric Insurance Product Manager

Risk Management and Insurance graduates fit well as Parametric Insurance Product Managers, where they design and oversee insurance products triggered by predefined parameters like weather events or natural disasters. This role requires strong analytical skills to develop innovative, data-driven solutions that minimize claim processing times and enhance customer satisfaction. Expertise in risk assessment and market trends enables these professionals to create tailored insurance offerings that meet evolving client needs efficiently.

Insurtech Risk Advisor

Graduates in Risk Management and Insurance can excel as Insurtech Risk Advisors, where expertise in both technology and traditional insurance principles is crucial. This role involves analyzing emerging risks associated with digital platforms and recommending innovative insurance solutions to mitigate potential losses. You will work closely with startups and established companies to integrate advanced risk assessment tools and ensure comprehensive coverage in a rapidly evolving market.

Supply Chain Risk Manager

Supply Chain Risk Managers identify vulnerabilities and develop strategies to mitigate disruptions in supply networks, ensuring business continuity and operational resilience. They analyze potential risks related to suppliers, logistics, and market fluctuations, implementing insurance solutions and risk transfer methods to protect company assets. Expertise in risk assessment, contract negotiation, and regulatory compliance is essential for success in this role.

Good to know: jobs for Risk Management and Insurance graduates

Overview of Career Opportunities in Risk Management and Insurance

Graduates in Risk Management and Insurance have diverse career options in finance, corporate security, and insurance sectors. Specialized skills in risk assessment and mitigation make them valuable assets for organizations managing uncertainty and compliance.

- Risk Analyst - Evaluates financial risks to help companies minimize losses and optimize risk exposure.

- Insurance Underwriter - Assesses insurance applications to determine coverage terms and pricing strategies.

- Claims Adjuster - Investigates insurance claims and negotiates settlements to ensure fair compensation.

Essential Skills for Risk Management and Insurance Professionals

Risk Management and Insurance graduates possess essential skills such as risk assessment, analytical thinking, and strong decision-making abilities. These competencies enable professionals to identify potential threats and develop effective mitigation strategies.

Proficiency in data analysis, communication, and regulatory knowledge are critical for roles in underwriting, claims adjustment, and risk consulting. Mastery of these skills ensures successful management of insurance portfolios and compliance with industry standards.

Entry-Level Roles for Recent Graduates

| Job Title | Job Description | Key Skills | Typical Employers |

|---|---|---|---|

| Risk Analyst | Evaluate potential risks affecting company assets and operations, collect and analyze data to recommend risk mitigation strategies. | Data Analysis, Risk Assessment, Critical Thinking, Excel Proficiency | Insurance Firms, Consulting Agencies, Financial Institutions |

| Insurance Underwriter | Assess insurance applications, determine risk levels, and decide coverage terms and premiums. | Attention to Detail, Decision Making, Knowledge of Insurance Policies, Analytical Skills | Insurance Companies, Brokerage Firms, Reinsurance Firms |

| Claims Adjuster | Investigate insurance claims, review reports, and negotiate settlements to ensure accurate compensation. | Investigation, Negotiation, Communication Skills, Legal Awareness | Insurance Companies, Government Agencies, Third-Party Adjusters |

| Risk Consultant | Advise businesses on risk management practices and help implement policies to minimize exposure. | Consulting, Risk Analysis, Communication, Project Management | Consulting Firms, Insurance Brokers, Corporate Risk Departments |

| Compliance Analyst | Monitor company adherence to regulatory requirements and internal policies related to risk and insurance. | Regulatory Knowledge, Attention to Detail, Reporting, Analytical Skills | Financial Institutions, Insurance Providers, Regulatory Bodies |

| Entry-Level Actuarial Analyst | Support actuarial teams with data compilation, statistical analysis, and risk modeling for insurance products. | Mathematics, Statistics, Programming (e.g., Excel, VBA), Analytical Thinking | Insurance Companies, Consulting Firms, Pension Funds |

| Brokerage Assistant | Assist insurance brokers in client management, policy administration, and market research activities. | Customer Service, Organization, Research, Communication | Insurance Brokers, Brokerage Firms, Corporate Insurance Departments |

Your degree in Risk Management and Insurance opens doors to diverse entry-level roles across insurance companies, consulting firms, financial institutions, and regulatory bodies. Early career opportunities emphasize data analysis, risk evaluation, regulatory compliance, and client interaction skills.

Advanced Career Paths and Specializations

What advanced career paths are available for Risk Management and Insurance graduates? Graduates can pursue specialized roles such as Risk Analyst, Insurance Underwriter, and Claims Manager. These positions leverage analytical skills and industry knowledge to manage risks and optimize insurance processes.

Which specializations offer the most growth potential in the Risk Management field? Specializations like Enterprise Risk Management, Cyber Risk Insurance, and Actuarial Science show strong demand. These areas focus on emerging risks and complex financial modeling, providing critical expertise to organizations.

How do Risk Management graduates advance in their insurance careers? Professional certifications such as Chartered Property Casualty Underwriter (CPCU) and Certified Risk Manager (CRM) enhance qualifications. These credentials open doors to leadership roles and strategic advisory positions within insurance firms.

What roles involve direct decision-making in Risk Management and Insurance? Positions like Risk Control Specialist and Loss Prevention Manager play vital roles in identifying and mitigating potential threats. These roles combine technical knowledge with strategic planning to protect company assets.

Where do Risk Management and Insurance graduates typically find employment? Graduates work in industries including banking, healthcare, manufacturing, and government agencies. These sectors require expertise in managing financial exposure and compliance risks effectively.

Certifications and Professional Development in the Industry

Graduates in Risk Management and Insurance have diverse career opportunities that require specialized knowledge and certifications to advance. Professional development plays a crucial role in enhancing skills and increasing employability in this competitive field.

- Certified Risk Manager (CRM) - A widely recognized certification that validates expertise in risk assessment and mitigation strategies.

- Associate in Risk Management (ARM) - Focuses on practical risk management skills valuable for roles such as risk analysts and risk control specialists.

- Chartered Property Casualty Underwriter (CPCU) - An advanced credential that demonstrates proficiency in property-casualty insurance and risk management principles.

Industry Sectors and Work Environments

Risk Management and Insurance graduates find opportunities across diverse industry sectors including finance, healthcare, manufacturing, and government agencies. These sectors rely heavily on professionals skilled in risk assessment, claims management, and insurance underwriting to safeguard assets and ensure regulatory compliance. Your expertise is highly sought after in dynamic work environments such as corporate risk departments, insurance firms, consulting agencies, and public organizations.

Future Trends and Emerging Opportunities in Risk Management and Insurance

Risk Management and Insurance graduates are increasingly sought after in sectors such as financial services, healthcare, and technology due to the rising complexity of global risks. Careers in cyber risk analysis, regulatory compliance, and insurance underwriting are expanding rapidly as businesses adapt to evolving threats.

Future trends highlight the integration of artificial intelligence and big data analytics to predict and mitigate risks more effectively. Emerging opportunities include roles in climate risk assessment and parametric insurance, reflecting the growing impact of environmental changes on risk portfolios.

jobsintra.com

jobsintra.com