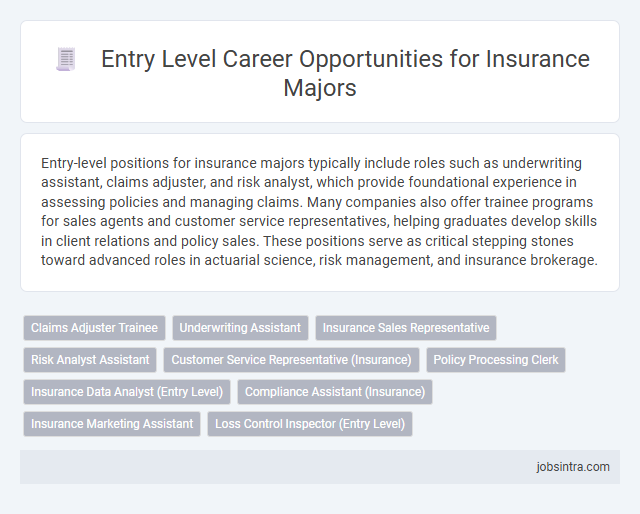

Entry-level positions for insurance majors typically include roles such as underwriting assistant, claims adjuster, and risk analyst, which provide foundational experience in assessing policies and managing claims. Many companies also offer trainee programs for sales agents and customer service representatives, helping graduates develop skills in client relations and policy sales. These positions serve as critical stepping stones toward advanced roles in actuarial science, risk management, and insurance brokerage.

Claims Adjuster Trainee

A Claims Adjuster Trainee position offers entry-level insurance majors the opportunity to develop critical skills in evaluating and processing insurance claims. You will learn to investigate claims, assess damages, and determine policy liabilities under the guidance of experienced adjusters. This role provides a strong foundation for a career in claims management and risk assessment within the insurance industry.

Underwriting Assistant

Underwriting Assistants support insurance underwriters by evaluating risk factors and processing applications to ensure accurate policy issuance. They analyze client information, verify data accuracy, and assist in preparing quotes, contributing to efficient underwriting workflows. This entry-level position builds foundational knowledge in risk assessment and insurance principles, ideal for graduates seeking career growth in underwriting.

Insurance Sales Representative

Insurance Sales Representatives play a crucial role in connecting clients with suitable insurance policies, offering entry-level opportunities for Insurance majors. You will develop skills in customer service, risk assessment, and policy explanation while gaining hands-on experience in selling life, health, auto, or property insurance. This position serves as a solid foundation for advancing in the insurance industry and building a strong professional network.

Risk Analyst Assistant

A Risk Analyst Assistant supports the evaluation and management of potential risks within an organization by analyzing data and preparing reports. This entry-level position requires strong analytical skills and attention to detail to help identify financial, operational, and compliance risks. Your role often involves collaborating with senior risk analysts to develop risk mitigation strategies and ensure regulatory compliance.

Customer Service Representative (Insurance)

A Customer Service Representative in the insurance field handles client inquiries, processes claims, and provides policy information efficiently. You develop strong communication and problem-solving skills critical for advancing your career in insurance. This entry-level role offers valuable exposure to industry operations and client management.

Policy Processing Clerk

Entry-level Insurance majors often start as Policy Processing Clerks, responsible for managing and maintaining insurance policy records. They ensure accurate data entry, verify policy details, and respond to client inquiries efficiently. This role develops foundational knowledge of insurance procedures and enhances attention to detail in a fast-paced environment.

Insurance Data Analyst (Entry Level)

Entry-level Insurance Data Analysts specialize in collecting, analyzing, and interpreting data to support risk assessment and policy development within insurance companies. They utilize statistical software and data visualization tools to identify trends and improve underwriting accuracy. These roles provide a strong foundation for career growth in actuarial science, risk management, and claims analysis.

Compliance Assistant (Insurance)

Entry-level Compliance Assistants in the insurance industry ensure companies adhere to regulatory requirements and internal policies, minimizing legal risks. They conduct audits, maintain documentation, and assist in developing compliance training programs to support ethical practices. Strong analytical skills and attention to detail are essential for monitoring industry regulations and updating compliance protocols effectively.

Insurance Marketing Assistant

An Insurance Marketing Assistant supports the development and execution of marketing strategies tailored to insurance products, helping to increase brand awareness and generate leads. This entry-level role involves conducting market research, coordinating promotional activities, and assisting in creating marketing materials to attract potential clients. Strong communication skills and a basic understanding of insurance policies enable effective collaboration with sales teams and customers.

Good to know: jobs for Insurance majors entry level

Overview of Entry Level Roles for Insurance Majors

| Entry Level Role | Overview | Key Responsibilities | Skills Required |

|---|---|---|---|

| Claims Adjuster | Evaluate insurance claims and determine company liability. | Investigate claims, interview claimants, assess damages, and negotiate settlements. | Analytical thinking, communication, attention to detail, and decision-making. |

| Underwriting Assistant | Support underwriters in evaluating risk and deciding policy terms. | Review applications, analyze risk factors, prepare documentation, and assist in pricing. | Risk assessment, data analysis, organizational skills, and proficiency with underwriting software. |

| Insurance Sales Agent | Sell insurance policies to individuals and businesses. | Identify client needs, explain policy features, generate leads, and close sales. | Interpersonal skills, sales techniques, customer service, and product knowledge. |

| Risk Analyst | Analyze potential risks to minimize losses for the company. | Collect and evaluate data, create risk reports, and recommend risk management strategies. | Data analysis, statistical knowledge, critical thinking, and reporting abilities. |

| Customer Service Representative | Assist policyholders with inquiries and policy management. | Handle customer questions, process claims, update records, and provide policy information. | Communication skills, problem-solving, empathy, and familiarity with insurance products. |

In-Demand Skills for New Insurance Professionals

Entry-level jobs for Insurance majors offer a strong foundation in risk assessment and client service. In-demand skills focus on analytics, regulatory knowledge, and communication abilities.

- Data Analysis - Ability to interpret and leverage data to assess risks and trends is crucial in underwriting and claims management.

- Regulatory Compliance - Understanding insurance laws and regulations ensures accurate policy management and claims processing.

- Effective Communication - Clear communication helps in explaining complex insurance products and building client trust.

Top Insurance Companies Hiring Recent Graduates

Entry-level jobs for insurance majors often include roles such as Claims Adjuster, Underwriting Assistant, and Risk Analyst. These positions provide foundational experience in assessing risk, managing policies, and handling claims.

Top insurance companies hiring recent graduates include State Farm, Allstate, Berkshire Hathaway, and Progressive. These firms seek candidates with strong analytical skills and knowledge of insurance principles to support their growth and innovation.

Common Job Titles and Descriptions in Insurance

Insurance majors have a variety of entry-level job opportunities that allow you to apply your knowledge of risk management and policy analysis. Understanding common job titles and their responsibilities helps in finding the right career path in the insurance industry.

- Insurance Underwriter - Evaluates insurance applications to determine risk and decide policy terms.

- Claims Adjuster - Investigates insurance claims to assess the validity and amount of compensation.

- Insurance Sales Agent - Connects clients with appropriate insurance products and explains policy details.

These roles provide a strong foundation for a successful career in the insurance sector.

Growth Potential and Career Advancement Paths

Entry-level jobs for Insurance majors include roles such as Underwriter, Claims Adjuster, and Insurance Sales Agent, all offering strong growth potential within the insurance sector. These positions provide foundational experience in risk assessment, customer service, and policy management, which are critical for career advancement. Professionals can progress to specialized roles like Actuary, Risk Manager, or Insurance Analyst, leading to leadership opportunities and higher earning potential.

Tips for Landing Your First Insurance Job

Insurance majors have a variety of entry-level roles available, such as claims adjuster, underwriter assistant, risk analyst, and customer service representative. These positions provide critical experience in risk management, policy evaluation, and client interaction.

Networking within industry groups, obtaining relevant certifications like the CPCU or AINS, and tailoring your resume to highlight analytical and communication skills improve your chances. Research top insurance companies and apply to internships or trainee programs to gain practical exposure early in your career.

Industry Certifications and Training for Beginners

Insurance majors seeking entry-level jobs benefit greatly from targeted industry certifications and training programs. These credentials enhance job readiness and improve career prospects in the competitive insurance sector.

- Certified Insurance Counselor (CIC) - This certification offers foundational knowledge in insurance policies, risk management, and claims handling essential for new professionals.

- Associate in General Insurance (AINS) - AINS training provides a broad understanding of insurance principles, underwriting, and coverage types important for entry-level roles.

- Life and Health Insurance License - Obtaining this license is critical for careers focused on personal insurance products and is often required before client interaction.

jobsintra.com

jobsintra.com