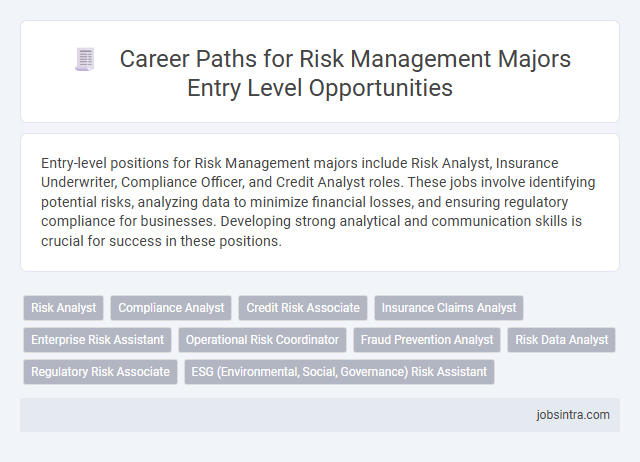

Entry-level positions for Risk Management majors include Risk Analyst, Insurance Underwriter, Compliance Officer, and Credit Analyst roles. These jobs involve identifying potential risks, analyzing data to minimize financial losses, and ensuring regulatory compliance for businesses. Developing strong analytical and communication skills is crucial for success in these positions.

Risk Analyst

Risk Analyst positions offer an ideal starting point for Risk Management majors by allowing you to assess, quantify, and mitigate financial, operational, and strategic risks within organizations. These roles demand strong analytical skills to evaluate data trends, develop risk models, and provide actionable insights that protect company assets. Entry-level Risk Analysts often collaborate with cross-functional teams to ensure risk awareness is integrated into decision-making processes.

Compliance Analyst

Compliance Analyst roles in risk management offer entry-level opportunities to ensure organizations adhere to regulatory requirements and internal policies. You will be responsible for monitoring compliance, conducting risk assessments, and assisting in the development of risk mitigation strategies. This position builds a strong foundation for understanding legal frameworks and managing operational risk effectively.

Credit Risk Associate

Credit Risk Associates analyze financial data to assess the creditworthiness of individuals and organizations, helping companies minimize potential losses from defaults. Their role involves monitoring credit risk exposure, preparing detailed reports, and supporting decision-making processes that safeguard the company's financial stability. If you are entering the field of Risk Management, this entry-level position offers a strong foundation in credit analysis and risk assessment techniques.

Insurance Claims Analyst

An Insurance Claims Analyst evaluates and processes insurance claims to ensure accuracy and compliance with policy terms. This entry-level role requires strong analytical skills and attention to detail to assess risk and determine claim validity. You will gain valuable experience in risk assessment and claims investigation, essential for a career in risk management.

Enterprise Risk Assistant

An entry-level Enterprise Risk Assistant supports organizations by identifying and assessing potential risks that could impact business operations. You will analyze risk data, assist in developing mitigation strategies, and help ensure compliance with regulatory requirements. This role is ideal for Risk Management majors seeking practical experience in risk evaluation and control processes.

Operational Risk Coordinator

An entry-level Operational Risk Coordinator monitors and evaluates organizational processes to identify potential risks impacting daily operations. They support risk mitigation strategies by collecting data, conducting assessments, and ensuring compliance with regulatory standards. This role requires strong analytical skills and attention to detail to help maintain a secure and efficient operational environment.

Fraud Prevention Analyst

Fraud Prevention Analysts play a crucial role in identifying, investigating, and mitigating fraudulent activities within organizations. They utilize data analysis, risk assessment tools, and regulatory knowledge to develop strategies that protect company assets and minimize financial losses. Entry-level roles emphasize building expertise in fraud detection techniques and compliance standards to support overall risk management objectives.

Risk Data Analyst

Risk Data Analysts in entry-level positions analyze financial, operational, and market data to identify potential risks and support decision-making processes. You will use statistical tools and software to evaluate data trends, create risk assessment reports, and help develop strategies to mitigate exposure. Strong analytical skills and attention to detail are essential for interpreting complex datasets and contributing to your organization's risk management framework.

Regulatory Risk Associate

Regulatory Risk Associates play a crucial role in helping organizations comply with laws and regulations by identifying and mitigating regulatory risks. Entry-level professionals in this position analyze policies, monitor regulatory changes, and support the implementation of compliance programs to ensure adherence to industry standards. This role offers valuable experience in risk assessment and regulatory frameworks, making it ideal for Risk Management majors seeking to start their careers.

Good to know: jobs for Risk Management majors entry level

Overview of Risk Management as a Career

Risk Management is a critical field dedicated to identifying, assessing, and mitigating potential threats that could impact an organization's financial health and operations. Entry-level positions in Risk Management include Risk Analyst, Compliance Assistant, and Junior Risk Consultant, each offering valuable experience in analyzing data and developing risk mitigation strategies. Your career in Risk Management provides opportunities to work across various industries, ensuring businesses safeguard assets and maintain regulatory compliance.

Core Skills Required for Risk Management Roles

Entry-level jobs for Risk Management majors often involve analyzing potential threats and developing strategies to minimize financial losses. These roles require a solid foundation in identifying risks and applying analytical tools to support business decisions.

- Analytical Skills - Ability to interpret data and assess risk factors affecting business operations.

- Attention to Detail - Precision in evaluating risk scenarios to prevent costly errors and ensure compliance.

- Communication Skills - Effectively conveying risk assessments and mitigation plans to stakeholders.

Popular Industries Hiring Risk Management Graduates

What entry-level jobs are available for Risk Management majors in popular industries? Risk Management graduates commonly find roles such as Risk Analyst, Compliance Associate, and Insurance Underwriter. These positions are in high demand across sectors like finance, healthcare, and manufacturing.

Which industries are actively hiring Risk Management graduates at the entry level? Financial services, including banking and investment firms, lead the hiring of Risk Management professionals. Healthcare organizations and insurance companies also recruit graduates for risk assessment and regulatory compliance roles.

Top Entry-Level Positions for Risk Management Majors

Risk Management majors have a variety of entry-level job opportunities in the business sector. These roles focus on identifying, assessing, and mitigating financial, operational, and strategic risks for organizations.

Top entry-level positions include Risk Analyst, Compliance Analyst, and Credit Risk Associate. These jobs provide practical experience in evaluating risk factors and implementing risk control measures within companies.

Certification and Training Opportunities

Risk Management majors have several entry-level job opportunities in fields such as insurance analysis, compliance, and financial risk assessment. These roles require a foundational understanding of risk principles and often value industry-recognized certifications.

Certification and training opportunities enhance your qualifications and employability in risk management careers. Programs like the Associate in Risk Management (ARM) and Certified Risk Manager (CRM) provide specialized knowledge and practical skills. Employers often look for candidates who invest in these credentials to demonstrate commitment and expertise.

Career Growth and Advancement Potential

Entry-level jobs for Risk Management majors offer strong career growth and advancement potential across various industries. Your foundational skills in identifying, assessing, and mitigating risks are highly valued in dynamic business environments.

- Risk Analyst - Analyzes financial and operational risks to support decision-making and safeguard company assets.

- Compliance Officer - Ensures business activities comply with regulatory requirements and internal policies to minimize legal risks.

- Insurance Underwriter - Evaluates risk factors to determine insurance terms, fostering expertise applicable to higher-level risk management roles.

Tips for Landing Your First Risk Management Job

Risk Management majors can pursue entry-level positions such as Risk Analyst, Compliance Assistant, or Insurance Underwriter. Tailor your resume to highlight relevant coursework, internships, and analytical skills to stand out to employers. Networking with industry professionals and obtaining certifications like FRM or CRM increases your chances of landing your first risk management job.

jobsintra.com

jobsintra.com