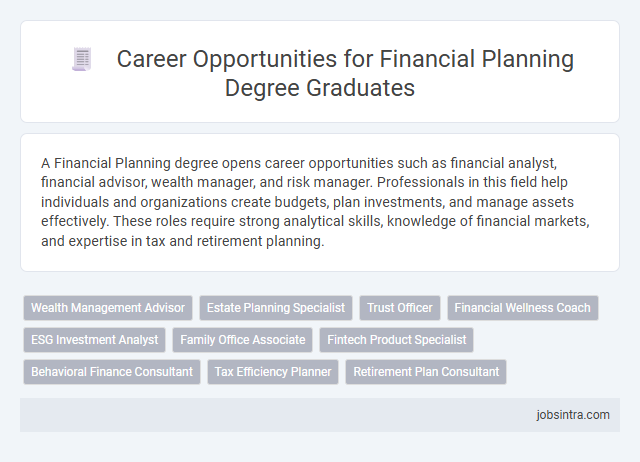

A Financial Planning degree opens career opportunities such as financial analyst, financial advisor, wealth manager, and risk manager. Professionals in this field help individuals and organizations create budgets, plan investments, and manage assets effectively. These roles require strong analytical skills, knowledge of financial markets, and expertise in tax and retirement planning.

Wealth Management Advisor

A Financial Planning degree opens the door to a career as a Wealth Management Advisor, where professionals guide clients in optimizing their financial portfolios. These advisors develop personalized strategies to manage assets, minimize risks, and achieve long-term financial goals. Expertise in investment analysis, retirement planning, and tax-efficient wealth accumulation is essential for success in this role.

Estate Planning Specialist

Estate Planning Specialists help clients organize their assets and create strategies to efficiently transfer wealth to heirs while minimizing tax liabilities. They work closely with individuals, families, and legal professionals to develop wills, trusts, and financial plans tailored to your specific needs. This role requires strong analytical skills and a deep understanding of tax laws and investment options to protect and grow your estate.

Trust Officer

A Trust Officer manages and administers trust accounts, ensuring clients' financial assets are protected and distributed according to legal and personal guidelines. This role involves working closely with clients, legal advisors, and financial institutions to manage investments, tax considerations, and estate planning. Expertise in financial planning and fiduciary responsibilities is essential for success as a Trust Officer.

Financial Wellness Coach

A Financial Planning degree opens pathways to becoming a Financial Wellness Coach, a professional who helps clients improve their financial health through personalized strategies and education. These coaches assess clients' financial habits, develop budgeting plans, and guide them in managing debt and saving for future goals. Their expertise supports individuals and organizations in achieving long-term financial stability and stress reduction.

ESG Investment Analyst

An ESG Investment Analyst evaluates environmental, social, and governance factors to guide sustainable investment decisions. This role involves analyzing company practices and market trends to ensure portfolios align with responsible and ethical standards. Professionals in this field help investors make informed choices that promote long-term value and positive societal impact.

Family Office Associate

A Family Office Associate plays a crucial role in managing the financial affairs of high-net-worth families, including investment management, estate planning, and tax strategies. This position requires strong analytical skills, attention to detail, and the ability to coordinate with various financial professionals to optimize wealth preservation. Your expertise in financial planning equips you to provide tailored solutions that meet the unique needs of affluent families.

Fintech Product Specialist

A Financial Planning degree equips you with the analytical skills and financial knowledge essential for a Fintech Product Specialist role, where you design and manage innovative financial technology products. This position requires expertise in portfolio management, risk assessment, and regulatory compliance to meet customer needs effectively. Understanding market trends and consumer behavior helps drive product development and strategic improvements in the fintech industry.

Behavioral Finance Consultant

A Financial Planning degree opens the door to a career as a Behavioral Finance Consultant, where you analyze client behavior to improve investment decisions and financial outcomes. You apply psychological insights to identify biases and develop personalized strategies that enhance financial planning effectiveness. This role blends finance expertise with behavioral science to create tailored solutions that align with clients' goals and preferences.

Tax Efficiency Planner

A Tax Efficiency Planner specializes in developing strategies to minimize tax liabilities for individuals and businesses by optimizing income, investments, and expenses. They analyze current tax laws, identify applicable deductions and credits, and implement plans that align with clients' financial goals. This role requires strong knowledge of tax codes, financial regulations, and proactive tax planning techniques to maximize after-tax wealth.

Good to know: jobs for Financial Planning degree

Overview of Financial Planning as a Career

A degree in Financial Planning opens doors to careers such as financial advisor, wealth manager, and retirement planner. These roles involve analyzing clients' financial situations and creating strategies to help achieve their long-term goals. Your expertise in budgeting, investment management, and risk assessment makes you a valuable asset in guiding individuals and businesses toward financial stability.

In-Demand Roles for Financial Planning Graduates

A degree in Financial Planning opens doors to a variety of in-demand roles within the business sector. Graduates possess skills essential for managing personal and corporate finances effectively.

Top job opportunities include Financial Analyst, Wealth Manager, and Retirement Planner, each requiring expertise in budgeting, investment strategies, and risk assessment. Financial Advisors are highly sought after for providing tailored advice to clients aiming to achieve long-term financial goals. Corporate Financial Planners help businesses optimize resource allocation and ensure sustainable growth.

Key Industries Hiring Financial Planners

Financial Planning degrees open doors to various career opportunities in industries such as banking, insurance, and investment management. Professionals equipped with financial planning skills are in demand to help businesses and individuals achieve their financial goals.

Key industries hiring financial planners include corporate finance departments, wealth management firms, and consulting agencies. These sectors rely on financial planners to provide strategies for risk management, retirement planning, and asset allocation.

Essential Skills and Certifications for Advancement

Financial Planning degrees unlock diverse career opportunities in wealth management, corporate finance, and retirement planning. Mastering essential skills and obtaining key certifications accelerates career growth and professional credibility.

- Analytical Skills - Analyze market trends and client portfolios to make informed financial decisions.

- Certified Financial Planner (CFP) Certification - Recognized credential that validates expertise and enhances job prospects.

- Communication Skills - Effectively explain complex financial concepts to clients and stakeholders.

Opportunities for Entrepreneurship and Self-Employment

A Financial Planning degree opens doors to diverse entrepreneurial opportunities in wealth management, financial consulting, and investment advisory services. Specialized knowledge empowers you to launch businesses offering tailored financial strategies to individual and corporate clients.

Self-employment options include starting a financial planning firm or providing freelance consulting for startups and small businesses. Expertise in risk management and retirement planning enhances your ability to create innovative solutions that attract a broad client base.

Salary Expectations and Career Growth Prospects

A Financial Planning degree opens doors to roles such as Financial Analyst, Investment Advisor, and Wealth Manager. Salary expectations vary, with entry-level positions starting around $55,000 and experienced professionals earning upwards of $120,000 annually. Career growth prospects are strong due to increasing demand for financial expertise and certification opportunities like CFP.

Emerging Trends Shaping the Financial Planning Field

A Financial Planning degree opens diverse career paths that adapt to rapidly evolving market needs. Emerging trends are transforming job roles by integrating technology and personalized financial strategies.

- Financial Analyst - Analyzes market data and trends to provide informed investment recommendations aligned with client goals.

- Wealth Manager - Offers comprehensive asset management by incorporating digital tools and sustainable investing practices.

- Financial Technology Specialist - Develops and implements software solutions to enhance financial planning accuracy and client engagement.

jobsintra.com

jobsintra.com