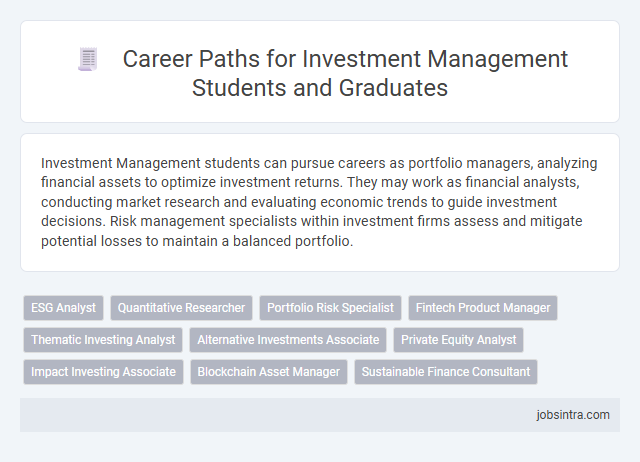

Investment Management students can pursue careers as portfolio managers, analyzing financial assets to optimize investment returns. They may work as financial analysts, conducting market research and evaluating economic trends to guide investment decisions. Risk management specialists within investment firms assess and mitigate potential losses to maintain a balanced portfolio.

ESG Analyst

ESG Analysts evaluate environmental, social, and governance factors to guide sustainable investment decisions within asset management firms. They analyze company practices and create impact reports that influence portfolio strategies. Expertise in data analysis and regulatory frameworks is essential for success in this role.

Quantitative Researcher

Investment Management students interested in data-driven decision making often pursue careers as Quantitative Researchers, where they develop mathematical models to analyze financial markets and optimize investment strategies. These professionals use statistical techniques, programming skills, and financial theory to identify trends, manage risk, and enhance portfolio performance. Their expertise bridges finance and technology, making them invaluable in hedge funds, asset management firms, and proprietary trading firms.

Portfolio Risk Specialist

Portfolio Risk Specialists analyze and manage the risks associated with investment portfolios by using quantitative models and market data. You play a crucial role in identifying potential threats to the portfolio's performance, ensuring compliance with regulatory standards and internal risk limits. Your expertise helps investment firms optimize returns while minimizing exposure to financial uncertainties.

Fintech Product Manager

Fintech Product Managers in investment management oversee the development and optimization of digital financial tools that enhance investment strategies and client experiences. Your expertise in finance combined with technology allows you to lead cross-functional teams in creating innovative solutions that streamline asset management, trading platforms, and portfolio analytics. This role demands strong analytical skills, market awareness, and the ability to translate client needs into effective fintech products.

Thematic Investing Analyst

A Thematic Investing Analyst specializes in identifying long-term macroeconomic, social, and technological trends to guide investment strategies. You will analyze data, research emerging markets, and evaluate sector dynamics to uncover opportunities aligned with specific themes. This role demands strong analytical skills and the ability to translate complex trends into actionable investment recommendations.

Alternative Investments Associate

Alternative Investments Associates specialize in analyzing and managing non-traditional asset classes such as private equity, hedge funds, real estate, and commodities. They conduct due diligence, monitor portfolio performance, and assist in structuring investment vehicles to optimize returns and mitigate risks. Expertise in market research, financial modeling, and regulatory compliance is essential for success in this role within the investment management sector.

Private Equity Analyst

Private Equity Analyst roles offer Investment Management students hands-on experience in evaluating potential investment opportunities and conducting detailed financial due diligence. You will analyze market trends, assess company performance, and support fund managers in making strategic investment decisions. This position develops critical skills in valuation, portfolio management, and risk assessment, paving the way for a successful career in private equity or related fields.

Impact Investing Associate

Impact Investing Associates analyze social and environmental factors to guide investments that generate both financial returns and positive societal impact. They collaborate with portfolio managers and stakeholders to identify opportunities in sectors like renewable energy, affordable housing, and sustainable agriculture. Proficiency in financial modeling and a strong understanding of ESG (Environmental, Social, and Governance) criteria are essential for driving effective impact investment strategies.

Blockchain Asset Manager

Blockchain asset managers specialize in overseeing digital assets and cryptocurrencies within investment portfolios. They analyze market trends, assess blockchain technology risks, and develop strategies to optimize asset allocation. Expertise in blockchain technology and financial management is essential for success in this emerging sector.

Good to know: jobs for Investment Management students

Overview of Investment Management Careers

Investment Management students can pursue careers such as portfolio management, financial analysis, and risk management. These roles involve evaluating market trends, managing asset allocations, and optimizing investment returns for clients. Key employers include asset management firms, banks, and hedge funds, offering opportunities to apply financial knowledge and strategic decision-making skills.

Essential Skills and Qualifications

Investment Management students are well-suited for roles such as financial analyst, portfolio manager, and risk analyst. These positions require a strong understanding of markets, asset valuation, and investment strategies.

Essential skills include quantitative analysis, proficiency with financial modeling software, and the ability to interpret economic trends. Strong communication skills are necessary to explain complex financial concepts to clients and stakeholders. Your qualifications should also include knowledge of regulatory environments and ethical investment practices.

Entry-Level Roles and Opportunities

Investment management students often pursue entry-level roles such as financial analyst, investment analyst, or portfolio assistant. These positions provide foundational experience in evaluating securities, market research, and supporting portfolio management decisions.

Opportunities exist in asset management firms, banks, and financial advisory companies, focusing on data analysis and client reporting. Your skills in quantitative analysis and financial modeling are highly valued in these initial career steps.

Advancement and Specialization Paths

Investment Management students gain skills applicable to diverse roles in finance and asset management sectors. Career paths emphasize both advancement opportunities and specialization in niche investment areas.

- Portfolio Manager - Oversees asset portfolios to optimize returns and manage risks for clients.

- Financial Analyst - Conducts detailed market research and financial modeling to guide investment decisions.

- Risk Manager - Specializes in identifying and mitigating financial risks within investment portfolios.

Certifications and Professional Development

What career paths are available for Investment Management students?

Investment Management students can pursue various roles such as portfolio analysts, risk managers, and financial advisors. Obtaining certifications like the Chartered Financial Analyst (CFA) or Certified Investment Management Analyst (CIMA) enhances job prospects and technical expertise.

How do certifications impact job opportunities in Investment Management?

Certifications validate industry knowledge and increase credibility with employers. Credentials such as CFA, Certified Financial Planner (CFP), and Financial Risk Manager (FRM) are highly regarded and can lead to higher salary potential.

Which professional development options complement Investment Management education?

Continuous learning through workshops, industry seminars, and online finance courses supports career growth. Networking through professional associations like the CFA Institute or Investment Management Consultants Association (IMCA) is crucial for advancement.

What specific skills should Investment Management students develop alongside certifications?

Strong analytical skills, understanding of financial modeling, and proficiency in software like Bloomberg Terminal are essential. Effective communication and ethical decision-making also play a vital role in career success.

How can internships benefit Investment Management students in career preparation?

Internships provide practical experience and exposure to real-world investment scenarios, which improve employability. Many investment firms prefer candidates with hands-on experience combined with recognized certifications.

Industry Trends and Future Outlook

Investment management students are entering a dynamic field shaped by technological innovation and evolving market demands. Jobs in this sector offer opportunities to engage with data-driven decision making and global financial markets.

- Quantitative Analyst Roles Are Expanding - Growing use of artificial intelligence and machine learning in investment strategies increases demand for skilled quantitative analysts.

- Sustainability Investing Careers Are Rising - Environmental, social, and governance (ESG) criteria are becoming central, driving job growth in sustainable investment management.

- Data Science Integration Is Accelerating - Investment firms require professionals adept in big data analytics to improve portfolio performance and risk assessment.

Tips for Securing a Position

Investment Management students can pursue roles such as financial analyst, portfolio manager, risk analyst, or research associate within asset management firms, banks, and hedge funds. Developing strong analytical skills, gaining internships, and obtaining relevant certifications like the CFA can significantly enhance employability. Networking with industry professionals and tailoring your resume to highlight quantitative and qualitative competencies improves the chances of securing a position.

jobsintra.com

jobsintra.com