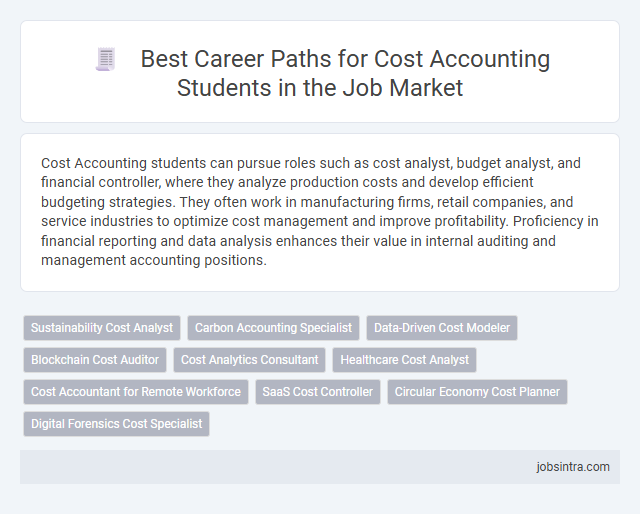

Cost Accounting students can pursue roles such as cost analyst, budget analyst, and financial controller, where they analyze production costs and develop efficient budgeting strategies. They often work in manufacturing firms, retail companies, and service industries to optimize cost management and improve profitability. Proficiency in financial reporting and data analysis enhances their value in internal auditing and management accounting positions.

Sustainability Cost Analyst

Sustainability Cost Analysts play a crucial role in evaluating the environmental and economic impacts of business operations, helping companies minimize waste and reduce carbon footprints while optimizing resource allocation. Your expertise in cost accounting enables you to analyze data related to sustainable practices, support decision-making, and implement strategies that drive long-term financial and environmental benefits. This position bridges accounting, sustainability, and strategic planning, making it ideal for students aiming to integrate cost efficiency with responsible business practices.

Carbon Accounting Specialist

Cost accounting students can leverage their skills to become Carbon Accounting Specialists, where they analyze and track carbon emissions and environmental costs for organizations. This role involves measuring carbon footprints, ensuring regulatory compliance, and helping companies optimize sustainability efforts financially. Your expertise in cost analysis supports businesses in reducing carbon-related expenses while enhancing environmental responsibility.

Data-Driven Cost Modeler

Cost accounting students can excel as data-driven cost modelers by leveraging their expertise in analyzing financial data to develop precise cost models that enhance budgeting and forecasting accuracy. They utilize advanced software and statistical techniques to identify cost-saving opportunities and optimize resource allocation. This role demands strong analytical skills and the ability to interpret complex data to support strategic decision-making within organizations.

Blockchain Cost Auditor

Blockchain Cost Auditors specialize in verifying and analyzing financial transactions recorded on decentralized ledgers, ensuring cost accuracy and compliance within blockchain-integrated businesses. They utilize expertise in cost accounting principles combined with blockchain technology to detect discrepancies, optimize cost structures, and enhance transparency. Your skills in auditing and cost management position you to excel in this emerging role, bridging finance and innovative blockchain solutions.

Cost Analytics Consultant

Cost Accounting students pursuing a career as Cost Analytics Consultants analyze financial data to optimize cost management and improve profitability for businesses. They utilize advanced analytical tools and software to identify cost-saving opportunities and support strategic decision-making. Expertise in cost behavior, budgeting, and variance analysis is essential for providing actionable insights in this role.

Healthcare Cost Analyst

Healthcare Cost Analysts specialize in evaluating and managing expenses within medical institutions to optimize financial efficiency and ensure sustainable budgeting. Your expertise in cost accounting enables you to analyze patient care costs, implement cost-saving strategies, and improve resource allocation in hospitals or clinics. This role demands strong analytical skills and a deep understanding of healthcare finance to support effective decision-making.

Cost Accountant for Remote Workforce

Cost accounting students can excel as cost accountants in a remote workforce, leveraging digital tools to track and analyze expenses efficiently. This role involves budgeting, cost control, and financial reporting, all adaptable to virtual collaboration environments. Your analytical skills will ensure businesses optimize resources and enhance profitability, regardless of location.

SaaS Cost Controller

SaaS Cost Controller roles offer Cost Accounting students the opportunity to manage and optimize subscription-based software expenses, ensuring accurate cost tracking and financial reporting. Your expertise in analyzing cloud service expenditures and budgeting helps drive profitability and strategic decision-making within SaaS companies. This position demands strong skills in cost allocation, variance analysis, and financial forecasting specific to the software-as-a-service industry.

Circular Economy Cost Planner

Cost accounting students equipped with expertise in circular economy principles can pursue roles as Circular Economy Cost Planners, where they analyze and optimize resource use to minimize waste and enhance sustainability. Your skills in cost analysis and budgeting enable you to design financial strategies that support eco-friendly production cycles and promote material reuse. This role bridges environmental goals with financial performance, making it ideal for those passionate about sustainable business practices.

Good to know: jobs for Cost Accounting students

Overview of Cost Accounting Careers

Cost accounting students can pursue diverse career paths including roles such as cost accountant, financial analyst, and budget analyst. These positions involve analyzing production costs, preparing detailed financial reports, and recommending cost-saving measures to improve business efficiency. Your expertise in cost accounting provides a strong foundation for roles in manufacturing firms, consulting agencies, and corporate finance departments.

Essential Skills for Cost Accounting Professionals

Cost accounting students have diverse career opportunities in finance, auditing, budgeting, and financial analysis. Roles such as cost analysts, budget analysts, and financial controllers are common career paths that leverage cost accounting expertise.

Essential skills for cost accounting professionals include proficiency in financial reporting, data analysis, and budgeting techniques. Strong knowledge of accounting software such as SAP and Excel enhances efficiency. Critical thinking and attention to detail are vital for accurate cost management and decision-making.

Top Job Roles for Cost Accounting Graduates

Cost accounting graduates are in high demand for roles such as Cost Analyst, Budget Analyst, and Financial Controller. These positions involve analyzing cost data, preparing budgets, and optimizing financial operations for organizations. You can build a rewarding career by leveraging your expertise in cost management and financial planning.

Industry Sectors Hiring Cost Accountants

Cost accounting students have diverse career opportunities across various industry sectors that prioritize detailed financial management and cost control. These sectors leverage cost accountants to enhance budgeting, pricing strategies, and operational efficiency.

- Manufacturing Sector - Focuses on product cost analysis, inventory management, and cost reduction strategies to optimize production expenses.

- Healthcare Industry - Utilizes cost accountants for budgeting, expense tracking, and financial planning to improve healthcare service delivery.

- Retail and Wholesale Trade - Employs cost accountants to manage supply chain costs, pricing models, and profit margin analysis for competitive advantage.

Salary Trends and Job Prospects

Cost Accounting students have strong job prospects in industries such as manufacturing, finance, and consulting. Common roles include Cost Analyst, Budget Analyst, and Management Accountant, which are critical for business cost control and financial efficiency.

Salary trends show an upward trajectory, with entry-level positions averaging around $55,000 annually, while experienced professionals can earn upwards of $90,000. Specialized skills in cost management software and data analysis further boost earning potential and career growth opportunities.

Certifications and Further Education Opportunities

Cost accounting students have a wide range of career options in both public and private sectors. Pursuing certifications and further education can significantly enhance your job prospects and professional growth.

- Certified Management Accountant (CMA) - A globally recognized certification focusing on financial management and strategic management skills for cost accountants.

- Certified Public Accountant (CPA) - This certification opens doors to advanced roles in audit, taxation, and accounting analysis within corporate and consulting firms.

- Chartered Financial Analyst (CFA) - Ideal for cost accounting professionals interested in investment analysis, portfolio management, and financial planning.

- Master's Degree in Accounting or Finance - Obtaining a master's degree deepens expertise and increases eligibility for senior-level accounting and finance positions.

- Diploma in Cost and Management Accounting (CMA by ICMA) - This diploma offers specialized knowledge in cost control and budgeting, enhancing employability in manufacturing and service industries.

Strategies for Advancing in a Cost Accounting Career

Cost accounting students have diverse career opportunities in industries such as manufacturing, finance, and consulting. Advancing in a cost accounting career requires strategic planning and continuous skill development.

- Gain Professional Certifications - Earning credentials like CMA (Certified Management Accountant) enhances credibility and job prospects.

- Develop Analytical Skills - Mastering data analysis tools and cost management techniques improves decision-making capabilities.

- Network within Industry - Building professional relationships opens doors to mentorships and leadership roles.

Focusing on these strategies empowers cost accounting students to climb the corporate ladder and achieve long-term career success.

jobsintra.com

jobsintra.com