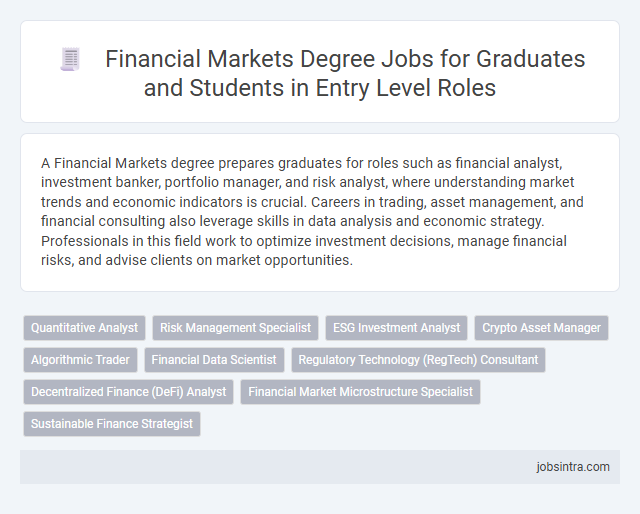

A Financial Markets degree prepares graduates for roles such as financial analyst, investment banker, portfolio manager, and risk analyst, where understanding market trends and economic indicators is crucial. Careers in trading, asset management, and financial consulting also leverage skills in data analysis and economic strategy. Professionals in this field work to optimize investment decisions, manage financial risks, and advise clients on market opportunities.

Quantitative Analyst

A degree in Financial Markets opens the door to a career as a Quantitative Analyst, where you apply advanced mathematical models and statistical techniques to assess financial risks and opportunities. This role involves analyzing market trends, pricing complex securities, and developing algorithms for trading strategies that maximize returns. Your expertise in data interpretation and financial theory is crucial for making informed investment decisions and enhancing portfolio performance.

Risk Management Specialist

A Risk Management Specialist identifies, analyzes, and mitigates financial risks to protect an organization's assets and ensure regulatory compliance. They use quantitative models, market analysis, and stress testing to forecast potential losses and develop strategies to minimize exposure. Expertise in financial markets, risk assessment techniques, and regulatory frameworks is essential for success in this role.

ESG Investment Analyst

ESG Investment Analysts evaluate environmental, social, and governance factors to guide sustainable investment decisions in financial markets. They analyze corporate practices, assess risks, and identify opportunities aligned with ethical and regulatory standards. Their expertise supports investment portfolios that prioritize long-term value and social responsibility.

Crypto Asset Manager

A Financial Markets degree prepares graduates for roles such as Crypto Asset Manager, where expertise in digital currencies, blockchain technology, and market analysis is essential. This position involves managing investment portfolios comprising cryptocurrencies, assessing market trends, and developing strategies to maximize returns while mitigating risks. Proficiency in financial modeling and regulatory knowledge further enhances effectiveness in navigating the evolving crypto asset landscape.

Algorithmic Trader

Algorithmic Traders use complex mathematical models and computer algorithms to execute trades at high speeds, optimizing investment strategies within financial markets. This role requires strong analytical skills, programming expertise, and a deep understanding of market microstructure and financial instruments. Graduates with a Financial Markets degree are well-prepared to design, test, and implement algorithmic trading systems that enhance portfolio performance and reduce risk.

Financial Data Scientist

Financial Data Scientists analyze large datasets to uncover trends and insights that drive investment strategies and risk management in financial markets. They apply statistical techniques, machine learning algorithms, and programming skills to optimize portfolio performance and predict market movements. Their expertise bridges finance and technology, making them essential for data-driven decision-making in trading, asset management, and regulatory compliance.

Regulatory Technology (RegTech) Consultant

A career as a Regulatory Technology (RegTech) Consultant leverages your Financial Markets degree by combining expertise in finance, compliance, and advanced technology solutions. You help financial institutions navigate complex regulatory requirements through the implementation of innovative software that enhances risk management and reporting accuracy. Your role is critical in ensuring firms stay compliant while optimizing operational efficiency in an ever-evolving regulatory landscape.

Decentralized Finance (DeFi) Analyst

A Decentralized Finance (DeFi) Analyst evaluates blockchain-based financial products and monitors market trends to identify investment opportunities within the DeFi ecosystem. They analyze smart contracts, assess risk factors, and provide insights on liquidity pools and yield farming strategies. Expertise in financial markets combined with blockchain technology knowledge is essential for driving innovation in decentralized finance.

Financial Market Microstructure Specialist

A Financial Market Microstructure Specialist analyzes the processes and systems that facilitate trading and price formation in financial markets, helping firms optimize their trading strategies. This role requires a deep understanding of market behavior, order execution, and regulatory frameworks to improve market efficiency and reduce transaction costs. Your expertise in this niche can drive better decision-making in investment banks, hedge funds, and trading firms.

Good to know: jobs for Financial Markets degree

Overview of Financial Markets Degrees

A degree in Financial Markets opens doors to careers such as financial analyst, investment banker, and portfolio manager. Your expertise in market trends, risk assessment, and economic principles is highly sought after by banks, asset management firms, and regulatory agencies. This degree provides a strong foundation for roles in trading, financial consulting, and wealth management within the global financial sector.

Key Skills Gained from Financial Markets Education

A Financial Markets degree equips graduates with key skills such as market analysis, risk assessment, and investment strategy development. Careers for graduates include roles like financial analyst, portfolio manager, and investment banker. Proficiency in data interpretation, economic trends, and regulatory frameworks is essential for success in these positions.

Top Entry-Level Jobs for Financial Markets Graduates

What are the top entry-level jobs for Financial Markets graduates? Many employers seek candidates with strong analytical skills and a solid understanding of market dynamics. Roles such as Financial Analyst, Risk Analyst, and Investment Banking Analyst offer excellent starting points.

Which positions best leverage a Financial Markets degree in the commerce sector? Graduates often find opportunities as Portfolio Assistants, Trading Assistants, or Compliance Analysts. These jobs provide hands-on experience in market research, asset management, and regulatory frameworks.

How can a Financial Markets degree enhance your career prospects? It equips you with knowledge of securities, trading strategies, and financial instruments. Common entry roles include Market Research Analyst and Credit Analyst, where your skills in data interpretation and decision-making are valued.

Major Employers in the Financial Markets Sector

Graduates with a degree in Financial Markets find diverse job opportunities in investment banking, asset management, and financial analysis. Major employers include global financial institutions such as JPMorgan Chase, Goldman Sachs, and Morgan Stanley.

These firms offer roles like traders, financial analysts, risk managers, and portfolio managers. Other significant employers in the sector include hedge funds, insurance companies like AIG, and regulatory bodies like the Securities and Exchange Commission (SEC).

Career Growth and Advancement Opportunities

A Financial Markets degree opens doors to dynamic roles such as financial analyst, investment banker, portfolio manager, and risk analyst. These positions offer exposure to market trends, asset management, and strategic investment planning.

Career growth in financial markets often leads to senior roles like chief financial officer, hedge fund manager, or financial consultant. Professionals gain expertise in market analysis, economic forecasting, and regulatory compliance. Continuous advancement is supported by certifications such as CFA, CPA, and FRM, enhancing job prospects and salary potential.

Certifications and Training for Career Boost

| Job Role | Relevant Certifications | Recommended Training |

|---|---|---|

| Financial Analyst | CFA (Chartered Financial Analyst), FRM (Financial Risk Manager) | Advanced Excel, Financial Modeling, Equity Research Workshops |

| Investment Banker | CFA Level 1 & 2, Certified Investment Banking Professional (CIBPTM) | Corporate Finance, Mergers & Acquisitions, Valuation Techniques |

| Risk Manager | FRM, PRM (Professional Risk Manager) | Risk Assessment, Derivatives & Hedging Strategies, Regulatory Compliance |

| Portfolio Manager | CFA, CAIA (Chartered Alternative Investment Analyst) | Asset Allocation, Portfolio Optimization, Alternative Investments |

| Trader | Series 7, CFA Level 1 | Technical Analysis, Algorithmic Trading, Market Microstructure |

| Quantitative Analyst | CQF (Certificate in Quantitative Finance), CFA | Programming (Python, R, MATLAB), Statistical Modeling, Machine Learning |

| Compliance Officer | Certified Regulatory Compliance Manager (CRCM), CAMS (Certified Anti-Money Laundering Specialist) | Regulatory Frameworks, AML Practices, Financial Law Training |

| Financial Planner | CFP (Certified Financial Planner), ChFC (Chartered Financial Consultant) | Retirement Planning, Tax Strategies, Investment Planning |

Tips for Securing Entry-Level Financial Markets Roles

A Financial Markets degree opens doors to various entry-level roles in trading, investment analysis, and risk management. Understanding these roles helps tailor your job search and improve your chances of securing a position.

- Build strong analytical skills - Employers seek candidates who can interpret market data and assess financial trends effectively.

- Gain practical experience - Internships or simulations provide hands-on exposure to trading platforms and financial modeling.

- Network within the industry - Connecting with professionals increases access to job opportunities and market insights.

Preparation combined with targeted job search strategies significantly enhances your ability to secure entry-level financial markets roles.

jobsintra.com

jobsintra.com