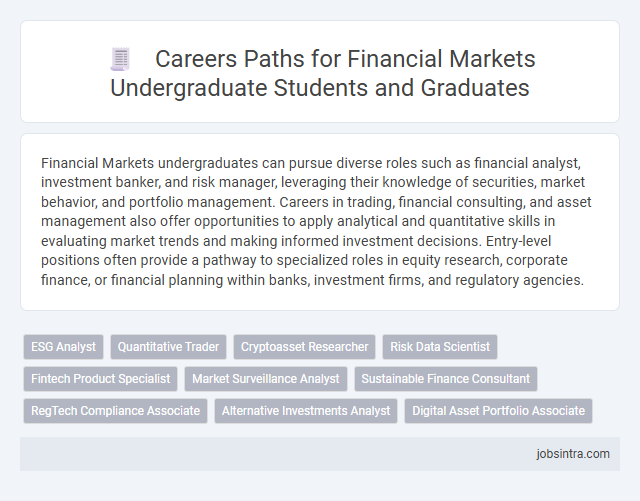

Financial Markets undergraduates can pursue diverse roles such as financial analyst, investment banker, and risk manager, leveraging their knowledge of securities, market behavior, and portfolio management. Careers in trading, financial consulting, and asset management also offer opportunities to apply analytical and quantitative skills in evaluating market trends and making informed investment decisions. Entry-level positions often provide a pathway to specialized roles in equity research, corporate finance, or financial planning within banks, investment firms, and regulatory agencies.

ESG Analyst

ESG Analysts evaluate environmental, social, and governance factors to help financial institutions integrate sustainable practices into investment decisions. They analyze non-financial data, assess company risks, and create reports that guide responsible investing strategies. This role combines financial expertise with a commitment to sustainability, making it essential in today's evolving financial markets.

Quantitative Trader

A Quantitative Trader in financial markets uses mathematical models and algorithms to identify trading opportunities and execute strategies that capitalize on market inefficiencies. Proficiency in programming languages such as Python or C++, combined with strong analytical and statistical skills, is essential for developing and optimizing automated trading systems. This role demands a deep understanding of market dynamics, risk management, and real-time data analysis to maximize profitability in fast-paced environments.

Cryptoasset Researcher

Cryptoasset Researchers analyze blockchain technologies and digital currencies to identify market trends and investment opportunities. This role involves evaluating the impact of regulatory changes, market sentiment, and technological advancements on cryptoassets. Your skills in financial markets and data analysis position you well for navigating this fast-evolving sector.

Risk Data Scientist

Risk Data Scientists in financial markets analyze vast datasets to identify and mitigate potential risks, using advanced statistical models and machine learning techniques. They build predictive algorithms that assess credit risk, market volatility, and operational threats, helping firms make informed decisions. Their expertise combines financial knowledge with data analytics to enhance risk management and regulatory compliance.

Fintech Product Specialist

Fintech Product Specialists leverage their expertise in financial markets and technology to design and manage innovative financial products that meet market demands. They collaborate closely with development teams, clients, and stakeholders to ensure products align with regulatory standards and customer needs. Strong analytical skills and a thorough understanding of market trends enable them to drive successful product launches and continuous improvements.

Market Surveillance Analyst

Market Surveillance Analysts play a crucial role in monitoring trading activities to detect and prevent market manipulation or fraudulent behavior. They analyze large volumes of market data using advanced analytical tools and ensure compliance with regulatory standards. This role demands strong attention to detail, knowledge of financial regulations, and proficiency in data analysis techniques.

Sustainable Finance Consultant

A Sustainable Finance Consultant helps organizations integrate environmental, social, and governance (ESG) criteria into their financial strategies and investment decisions, promoting long-term ethical growth. Your expertise in financial markets enables you to evaluate risks and opportunities related to sustainability, influencing corporate policies and funding through green bonds, impact investing, and ESG reporting. This role requires strong analytical skills, knowledge of regulatory frameworks, and a commitment to driving positive environmental and social impact within financial institutions.

RegTech Compliance Associate

A RegTech Compliance Associate in financial markets leverages regulatory technology to ensure firms adhere to evolving legal standards and industry regulations. This role involves monitoring compliance systems, analyzing risk data, and supporting audit processes to mitigate regulatory risks. Expertise in financial regulations, data analytics, and technology integration is essential for success in this position.

Alternative Investments Analyst

An Alternative Investments Analyst evaluates non-traditional investment opportunities such as hedge funds, private equity, real estate, and commodities to diversify portfolios and enhance returns. Your role involves conducting in-depth financial modeling, market research, and risk analysis to identify promising assets outside conventional equity and fixed income markets. Strong analytical skills and a deep understanding of market trends are essential for success in this dynamic area of financial markets.

Good to know: jobs for Financial Markets undergraduate

Overview of Financial Markets Careers

Financial Markets undergraduates pursue careers in asset management, investment banking, and financial analysis, leveraging their understanding of market trends and economic indicators. Roles often involve trading securities, managing portfolios, conducting risk assessments, and advising clients on investment strategies. Expertise in financial instruments, regulatory environments, and data analytics enhances opportunities in both buy-side and sell-side positions within global financial institutions.

Top Entry-Level Job Roles in Financial Markets

Graduates with a Financial Markets degree can pursue a variety of rewarding entry-level roles such as Financial Analyst, Investment Banking Analyst, and Market Research Associate. These positions focus on analyzing market trends, evaluating investment opportunities, and supporting trading activities. Your expertise in financial instruments and economic principles makes you a valuable candidate for these competitive job markets.

Key Skills Required for Financial Markets Professionals

Financial Markets undergraduates are well-positioned for careers in areas like investment analysis, trading, and risk management. Developing key skills enhances their ability to navigate complex financial environments and make informed decisions.

- Analytical Skills - Ability to interpret market data and financial statements to identify investment opportunities and risks.

- Quantitative Skills - Proficiency in mathematical modeling and statistical analysis crucial for pricing assets and managing portfolios.

- Communication Skills - Effective verbal and written communication to present financial insights clearly to clients and stakeholders.

Industry Certifications and Further Education

| Job Role | Industry Certifications | Further Education | Description |

|---|---|---|---|

| Financial Analyst | CFA (Chartered Financial Analyst), FRM (Financial Risk Manager) | Master's in Finance, MBA with Finance specialization | Analyzes financial data, trends, and market conditions to assist businesses in investment decisions. |

| Investment Banker | CFA, Series 7 and Series 63 Licenses | MBA in Finance, Economics or related field | Facilitates capital raising, mergers, and acquisitions within financial markets. |

| Risk Manager | FRM, PRM (Professional Risk Manager) | Master's in Risk Management, MBA with Risk Management focus | Identifies, evaluates, and mitigates financial risks in organizations. |

| Portfolio Manager | CFA, CAIA (Chartered Alternative Investment Analyst) | Master's in Finance or Investment Management | Manages investment portfolios to meet client or organizational financial objectives. |

| Trader | Series 7, Series 63 Licenses, CMT (Chartered Market Technician) | Courses in financial markets, trading strategies, technical analysis | Executes buy and sell orders of securities with an emphasis on market timing and strategy. |

Career Growth and Advancement Opportunities

Graduates with a degree in Financial Markets have diverse career options that offer robust growth and advancement potential. The financial sector values analytical skills and market knowledge, providing clear pathways to senior roles and leadership positions.

- Financial Analyst - Analyze investment opportunities and contribute to portfolio management, often progressing to senior analyst or portfolio manager roles.

- Investment Banker - Facilitate capital raising and mergers, with strong prospects for advancement to associate, vice president, and managing director positions.

- Risk Manager - Identify and mitigate financial risks, enabling career growth into senior risk officer or chief risk officer roles within organizations.

Emerging Trends and Future Outlook

What career opportunities exist for Financial Markets undergraduates in the evolving commerce landscape? Financial Markets graduates can pursue roles such as financial analysts, risk managers, and portfolio managers. Emerging trends include fintech innovations, sustainable finance, and blockchain technology shaping these job prospects.

How is the rise of technology influencing job roles in financial markets? Automation, artificial intelligence, and data analytics are transforming traditional roles, requiring new skill sets in coding and quantitative analysis. This shift creates demand for specialists in algorithmic trading, financial modeling, and cybersecurity within commerce.

What future outlook should Financial Markets graduates consider when planning their careers? The growing importance of ESG (Environmental, Social, Governance) criteria is driving career opportunities in responsible investing and green finance. Market volatility and global economic changes also emphasize adaptability and continuous learning in your professional development.

Tips for Securing a Job in Financial Markets

Graduates with a degree in Financial Markets have diverse career options including roles such as financial analyst, trader, risk manager, and portfolio manager. Understanding market trends, economic indicators, and investment strategies is crucial for success in these positions.

Networking with industry professionals through finance clubs, internships, and job fairs significantly enhances job prospects. Acquiring certifications like CFA or FRM can provide a competitive edge and demonstrate specialized knowledge to potential employers.

jobsintra.com

jobsintra.com