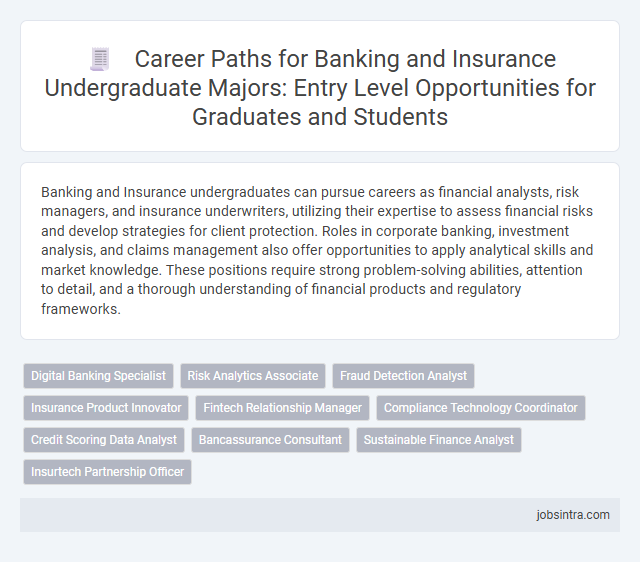

Banking and Insurance undergraduates can pursue careers as financial analysts, risk managers, and insurance underwriters, utilizing their expertise to assess financial risks and develop strategies for client protection. Roles in corporate banking, investment analysis, and claims management also offer opportunities to apply analytical skills and market knowledge. These positions require strong problem-solving abilities, attention to detail, and a thorough understanding of financial products and regulatory frameworks.

Digital Banking Specialist

Digital Banking Specialists in the banking and insurance sectors manage online platforms, optimize digital customer experiences, and implement innovative financial technologies. They analyze data to improve mobile banking services, enhance cybersecurity measures, and streamline digital transactions. Their expertise bridges traditional financial services with cutting-edge digital solutions, driving growth and customer satisfaction.

Risk Analytics Associate

Risk Analytics Associates in Banking and Insurance analyze data to identify potential risks and develop strategies to mitigate financial losses. They use statistical models and predictive analytics to assess credit risk, fraud, and market fluctuations, supporting decision-making processes. Expertise in data analysis, financial modeling, and regulatory compliance is essential for success in this role.

Fraud Detection Analyst

A Fraud Detection Analyst in the banking and insurance sectors plays a crucial role in identifying and preventing fraudulent activities by analyzing transaction data and monitoring suspicious behavior patterns. Your expertise in detecting anomalies helps protect financial institutions from monetary losses and ensures compliance with regulatory requirements. This career demands strong analytical skills, attention to detail, and proficiency in data analysis tools to effectively safeguard assets and maintain trust.

Insurance Product Innovator

Insurance Product Innovators design and develop new insurance offerings tailored to evolving market needs and risk profiles. They analyze consumer trends, regulatory changes, and technological advancements to create innovative policies that enhance customer value and competitive advantage. These professionals collaborate with actuarial teams, underwriters, and marketing departments to ensure products are profitable and compliant.

Fintech Relationship Manager

A Fintech Relationship Manager in the banking and insurance sectors oversees partnerships between financial institutions and technology companies, driving innovative solutions to enhance customer experiences and operational efficiency. This role requires strong knowledge of both finance and emerging technologies, along with excellent communication and negotiation skills to manage collaborations effectively. Professionals in this position play a key role in bridging traditional financial services with cutting-edge digital advancements.

Compliance Technology Coordinator

A Compliance Technology Coordinator in banking and insurance ensures adherence to regulatory requirements through the implementation and management of advanced compliance software and tools. This role involves monitoring evolving regulations, conducting risk assessments, and collaborating with IT and legal teams to maintain data integrity and security. Proficiency in compliance frameworks and technology-driven solutions is essential to support organizational governance and reduce operational risks.

Credit Scoring Data Analyst

A Credit Scoring Data Analyst in banking and insurance evaluates credit risk by analyzing financial data and customer behavior to develop accurate credit scoring models. They utilize statistical techniques and machine learning algorithms to predict loan repayment probabilities and minimize default rates. Expertise in data visualization and risk management software enhances decision-making and supports regulatory compliance.

Bancassurance Consultant

Bancassurance Consultants bridge the gap between banking and insurance, advising clients on tailored financial products that enhance security and wealth management. Your role involves analyzing customer needs to recommend suitable insurance policies integrated with banking services, maximizing value for both the client and the institution. This position demands strong communication skills, financial acumen, and the ability to navigate regulatory requirements within the banking and insurance sectors.

Sustainable Finance Analyst

A Sustainable Finance Analyst evaluates investment opportunities and financial products to ensure alignment with environmental, social, and governance (ESG) criteria. This role requires strong analytical skills to assess risks and opportunities related to sustainability within the banking and insurance sectors. Your expertise in sustainable finance helps institutions develop strategies that promote responsible investing and support long-term value creation.

Good to know: jobs for Banking and Insurance undergraduate

Overview of Banking and Insurance Industries

The banking and insurance industries offer diverse career opportunities for undergraduates in commerce. These sectors are integral to financial stability and risk management across the global economy.

- Banking Sector Roles - Positions include credit analyst, loan officer, and financial advisor focused on managing assets and liabilities.

- Insurance Sector Roles - Careers such as underwriter, claims adjuster, and risk assessor help evaluate and mitigate potential losses.

- Industry Growth - Both industries are expanding with innovations in fintech and insurtech reshaping traditional job functions.

Your skills in finance and risk management position you well to enter these dynamic fields.

Core Skills Required for Entry-Level Roles

Banking and Insurance undergraduates seeking entry-level roles must develop strong analytical and numerical skills. Proficiency in financial software and data interpretation is critical to making informed decisions.

Effective communication and customer service abilities are essential for client interactions and relationship management. Attention to detail and risk assessment knowledge help in accurately evaluating financial products and insurance policies.

Popular Entry-Level Positions for Graduates

Graduates with a Banking and Insurance degree have a variety of popular entry-level job opportunities available in the commerce sector. Roles such as financial analyst, insurance claims adjuster, and credit analyst are highly sought after by employers.

You can start your career as a bank teller, loan officer, or insurance underwriting assistant, gaining essential industry experience. These positions offer practical knowledge in financial products, risk assessment, and customer relationship management. Many companies provide structured training programs for new graduates to develop their skills rapidly.

Internship and Training Program Opportunities

What internship and training opportunities are available for Banking and Insurance undergraduates? Many financial institutions and insurance companies offer specialized programs designed to provide practical experience and industry knowledge. These internships and training programs help develop your skills in risk management, financial analysis, and customer service.

How can Banking and Insurance students benefit from internship programs? Internships provide hands-on exposure to real-world banking operations, insurance policies, and regulatory compliance. Completing these programs enhances your resume and improves your chances of securing full-time positions in the sector.

Which companies offer the best internship programs for Banking and Insurance undergraduates? Top banks, insurance firms, and financial services companies such as JPMorgan Chase, Allianz, and State Farm frequently run structured internship schemes. These programs focus on skills development related to underwriting, claims processing, and financial advising.

Why is training important for students pursuing a career in Banking and Insurance? Training programs equip you with essential knowledge about financial markets, product management, and customer relations. This foundation prepares you to tackle complex challenges and succeed in dynamic commercial environments.

What roles can internships lead to within the Banking and Insurance industry? Internships often open doors to entry-level roles such as financial analyst, risk assessor, claims adjuster, or customer service representative. Gaining relevant experience through these programs increases your prospects for career advancement.

Career Growth Prospects and Advancement

Banking and Insurance undergraduates have diverse career opportunities in fields such as financial analysis, risk management, underwriting, and claims adjustment. These roles provide a strong foundation for specialization in areas like investment banking, actuarial science, or insurance brokerage.

Career growth prospects in banking and insurance are promising due to continuous industry evolution and technological advancements. Your advancement depends on acquiring relevant certifications, gaining experience, and developing skills in data analysis and regulatory compliance.

Essential Certifications and Further Studies

Banking and Insurance undergraduates have career opportunities such as financial analyst, risk manager, insurance underwriter, and credit analyst. Essential certifications include CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), and CPCU (Chartered Property Casualty Underwriter) which enhance job prospects and expertise. Pursuing further studies like an MBA in Finance or specialized diplomas in actuarial science or financial planning can elevate your qualifications and career growth.

Tips for Succeeding in the Recruitment Process

Banking and Insurance undergraduates can pursue roles such as financial analyst, insurance underwriter, risk manager, and loan officer. Developing strong analytical skills, understanding regulatory frameworks, and gaining proficiency in financial software are crucial for these positions. Preparing thoroughly for interviews, showcasing relevant internships, and demonstrating problem-solving abilities increase your chances of success in the recruitment process.

jobsintra.com

jobsintra.com