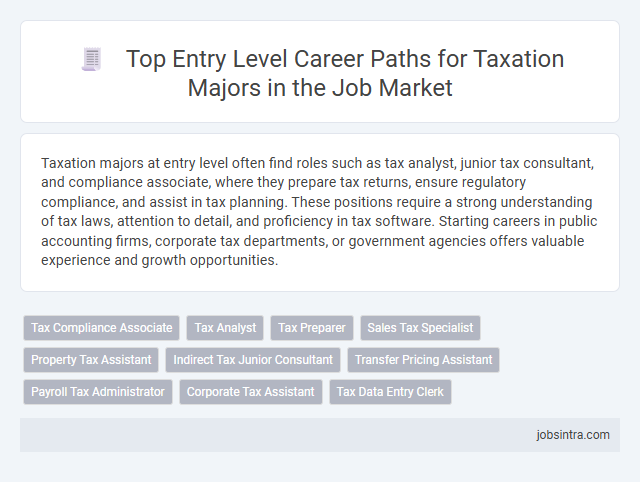

Taxation majors at entry level often find roles such as tax analyst, junior tax consultant, and compliance associate, where they prepare tax returns, ensure regulatory compliance, and assist in tax planning. These positions require a strong understanding of tax laws, attention to detail, and proficiency in tax software. Starting careers in public accounting firms, corporate tax departments, or government agencies offers valuable experience and growth opportunities.

Tax Compliance Associate

Tax Compliance Associates play a crucial role in ensuring organizations adhere to tax regulations, preparing and reviewing tax returns accurately. This entry-level position often involves research on tax laws, assisting with audits, and maintaining detailed documentation to support compliance efforts. Your strong analytical skills and attention to detail are essential for navigating complex tax codes and minimizing risks.

Tax Analyst

Tax Analysts play a crucial role in helping companies comply with tax regulations by analyzing financial data and preparing tax returns. Your expertise in interpreting tax laws ensures accurate reporting and identifies opportunities for tax savings. Entry-level Tax Analysts develop valuable skills in tax research, compliance, and data analysis, paving the way for a successful career in taxation.

Tax Preparer

Tax preparers assist individuals and businesses in accurately filing tax returns by gathering financial information and applying current tax laws. They analyze deductions, credits, and liabilities to minimize tax obligations while ensuring compliance with IRS regulations. Entry-level tax preparers often work for accounting firms, tax service companies, or government agencies, gaining practical experience in tax code and software applications.

Sales Tax Specialist

Sales Tax Specialists manage the accurate calculation and filing of sales tax returns, ensuring compliance with state and local tax regulations. They analyze transaction data, identify tax liabilities, and assist businesses in minimizing exposure to penalties through thorough documentation and reporting. Strong attention to detail and knowledge of tax codes are essential for entry-level professionals pursuing this role.

Property Tax Assistant

Property Tax Assistants support local governments and real estate firms by helping assess property values and managing tax records. They analyze property data, prepare assessments, and assist with tax compliance to ensure accurate taxation. Entry-level roles demand strong analytical skills, attention to detail, and familiarity with tax regulations.

Indirect Tax Junior Consultant

An Indirect Tax Junior Consultant supports businesses by ensuring compliance with value-added tax (VAT), goods and services tax (GST), and other indirect tax regulations. You will analyze financial transactions, prepare tax returns, and assist in tax audits, developing a strong foundation in indirect tax laws and procedures. This entry-level role offers practical experience in tax advisory services, helping you build expertise in a specialized area of taxation.

Transfer Pricing Assistant

A Transfer Pricing Assistant supports companies in aligning their intercompany transactions with tax regulations to minimize risks and ensure compliance. Your role involves collecting data, analyzing financial information, and preparing documentation to justify transfer pricing policies under local and international tax laws. This entry-level position builds a strong foundation in taxation, finance, and global business operations.

Payroll Tax Administrator

Payroll Tax Administrators play a crucial role in ensuring compliance with tax laws by managing payroll tax calculations, filings, and reporting for organizations. They work closely with accounting teams to accurately process employee tax withholdings and maintain up-to-date knowledge of federal, state, and local tax regulations. Your expertise in taxation principles prepares you to handle complex payroll tax issues and support efficient tax administration from an entry-level position.

Corporate Tax Assistant

Corporate Tax Assistants support companies by preparing tax returns, ensuring compliance with tax laws, and assisting in audit responses. They analyze financial documents to identify tax-saving opportunities and help implement tax strategies under the supervision of senior tax professionals. Proficiency in tax software and strong analytical skills are essential for success in this entry-level role.

Good to know: jobs for Taxation majors entry level

Overview of Taxation as a Career Path

Taxation as a career offers specialized roles focused on understanding and applying tax laws for individuals and businesses. Entry-level positions provide a foundation for growth in financial compliance, consulting, and government sectors.

- Tax Analyst - Examines tax regulations to ensure accurate filings and compliance for clients or employers.

- Junior Tax Consultant - Assists in preparing tax returns and advises on tax planning strategies under supervision.

- Tax Auditor - Reviews financial records to verify tax reports and detect discrepancies for government agencies.

Essential Skills for Entry-Level Taxation Roles

| Entry-Level Taxation Jobs | Essential Skills | Job Description Overview |

|---|---|---|

| Tax Associate |

|

Assist in preparing individual and corporate tax returns, ensuring compliance with relevant laws and regulations. Perform basic tax research and support senior tax consultants. |

| Tax Analyst |

|

Analyze tax data to identify risks and opportunities. Support the tax team with research, audits, and compliance monitoring. |

| Junior Tax Consultant |

|

Provide tax advice under supervision, help clients optimize tax liabilities, and assist with tax planning strategies for individuals and businesses. |

| Tax Compliance Assistant |

|

Support the compliance department by ensuring timely submission of tax documents and maintaining accurate records to avoid penalties for clients or companies. |

In-Demand Entry-Level Jobs for Taxation Majors

Entry-level jobs for taxation majors are highly sought after in the finance and accounting sectors. Positions such as tax associate, junior tax analyst, and tax compliance specialist provide a strong foundation in tax regulations and financial reporting.

These roles involve preparing tax returns, conducting research on tax laws, and assisting with audits to ensure compliance. Companies, accounting firms, and government agencies frequently seek candidates with analytical skills and knowledge of tax codes to fill these positions.

Key Employers Hiring Taxation Graduates

Entry-level jobs for Taxation majors offer diverse opportunities in accounting firms, corporations, and government agencies. Your skills in tax law, compliance, and financial analysis are highly valued by key employers.

- Big Four Accounting Firms - Deloitte, PwC, EY, and KPMG are top recruiters seeking tax associates and consultants.

- Corporate Tax Departments - Large multinational companies hire taxation graduates to manage tax planning and regulatory compliance.

- Government Agencies - Organizations like the IRS and state revenue departments recruit for auditing and tax enforcement roles.

These employers provide strong career growth and professional development for taxation graduates.

Professional Certifications to Boost Employability

Entry-level jobs for Taxation majors include tax analyst, junior tax consultant, and compliance specialist. These roles involve preparing tax returns, conducting tax research, and ensuring regulatory compliance.

Professional certifications like CPA (Certified Public Accountant), EA (Enrolled Agent), and CTP (Certified Tax Professional) significantly boost employability. Earning these credentials demonstrates expertise and commitment to the field. Your qualifications can set you apart in a competitive job market.

Salary Expectations for Entry-Level Taxation Positions

Entry-level positions for taxation majors include roles such as Tax Associate, Tax Analyst, and Junior Tax Consultant. Salary expectations vary based on location and employer but generally range from $50,000 to $65,000 annually.

- Tax Associate - Focuses on preparing tax returns and assisting with tax compliance for individuals and businesses.

- Tax Analyst - Involves analyzing tax regulations and providing support for tax planning and auditing processes.

- Junior Tax Consultant - Assists in advising clients on tax strategies and identifying tax savings opportunities.

Career Growth and Advancement Opportunities

Entry-level jobs for Taxation majors include Tax Analyst, Junior Tax Consultant, and Tax Compliance Associate. These roles provide foundational experience in tax law, filing procedures, and financial analysis. Career growth often leads to senior tax consultant, tax manager, or tax advisor positions with increased responsibility and higher salaries.

jobsintra.com

jobsintra.com