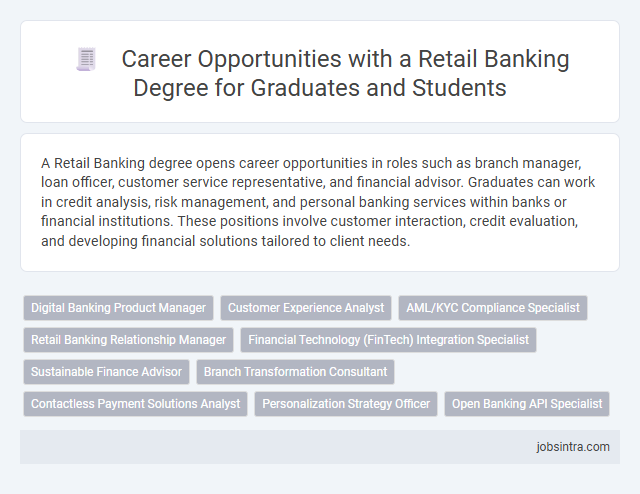

A Retail Banking degree opens career opportunities in roles such as branch manager, loan officer, customer service representative, and financial advisor. Graduates can work in credit analysis, risk management, and personal banking services within banks or financial institutions. These positions involve customer interaction, credit evaluation, and developing financial solutions tailored to client needs.

Digital Banking Product Manager

A Digital Banking Product Manager leverages expertise in retail banking to develop and enhance online financial products that meet customer needs. Your role involves analyzing market trends, coordinating with IT and marketing teams, and driving innovation to improve user experience and operational efficiency. Strong skills in project management and digital strategy are essential for success in this position.

Customer Experience Analyst

A Retail Banking degree opens the door to roles like Customer Experience Analyst, where you analyze customer interactions to enhance satisfaction and loyalty. This position involves using data-driven insights to improve banking services, streamline processes, and tailor products to meet client needs. Your expertise can directly impact the quality of customer journeys, driving growth and retention for financial institutions.

AML/KYC Compliance Specialist

An AML/KYC Compliance Specialist in retail banking ensures adherence to anti-money laundering regulations by monitoring transactions and verifying customer identities to prevent fraud and financial crimes. Your expertise in regulatory requirements and risk assessment enables the bank to maintain legal compliance and protect its reputation. This role demands strong analytical skills and attention to detail to identify suspicious activities and implement effective compliance strategies.

Retail Banking Relationship Manager

A Retail Banking Relationship Manager specializes in managing and growing a portfolio of individual and small business clients, providing tailored financial solutions to meet their needs. This role involves assessing clients' financial goals, offering products such as loans, savings accounts, and credit services, and ensuring customer satisfaction through personalized service. Strong communication skills and a deep understanding of banking products are essential for success in this position.

Financial Technology (FinTech) Integration Specialist

A Financial Technology (FinTech) Integration Specialist in retail banking ensures seamless incorporation of innovative fintech solutions into existing banking systems to enhance customer experience and operational efficiency. Your role involves collaborating with IT teams and fintech providers to implement secure, scalable technology that supports digital banking services like mobile payments, online lending, and blockchain applications. Mastering this position requires a blend of financial knowledge, technical expertise, and project management skills tailored to the evolving landscape of retail banking technology.

Sustainable Finance Advisor

A Sustainable Finance Advisor in retail banking specializes in guiding financial institutions and clients toward environmentally and socially responsible investment opportunities. Your role involves assessing the sustainability impacts of projects, developing green financing strategies, and ensuring compliance with evolving regulations on sustainable finance. This position merges expertise in banking with a commitment to promoting eco-friendly and ethical financial solutions that support long-term economic growth.

Branch Transformation Consultant

Branch Transformation Consultants specialize in redesigning and enhancing retail banking operations to improve customer experience and operational efficiency. They analyze current branch workflows, implement innovative technologies, and develop strategic plans that align with the bank's digital transformation goals. Their expertise enables banks to stay competitive by integrating modern solutions such as digital kiosks, automated services, and personalized customer engagement strategies.

Contactless Payment Solutions Analyst

A Contactless Payment Solutions Analyst specializes in evaluating and optimizing payment technologies that enable tap-to-pay transactions, ensuring seamless and secure customer experiences. They analyze market trends, assess the effectiveness of contactless systems, and collaborate with technology teams to implement cutting-edge solutions in retail banking. Proficiency in payment processing protocols and strong analytical skills are essential for driving innovation in secure, frictionless payment methods.

Personalization Strategy Officer

A Personalization Strategy Officer in retail banking specializes in tailoring financial products and services to individual customer needs using data analytics and customer insights. This role involves developing targeted marketing campaigns, enhancing customer experience, and driving customer loyalty through personalized strategies. Expertise in customer segmentation, digital tools, and market trends is essential for success in this position.

Good to know: jobs for Retail Banking degree

Overview of Retail Banking Careers

Retail banking careers offer diverse opportunities in customer service, financial advising, and branch management. Professionals in this field support individuals and small businesses with everyday banking needs and financial products.

You can work as a bank teller, personal banker, loan officer, or financial advisor, each role playing a key part in delivering client-focused services. Strong communication skills, financial knowledge, and problem-solving abilities are essential for success in retail banking careers.

Key Skills Required in Retail Banking

| Job Role | Key Skills Required |

|---|---|

| Retail Banking Officer | Customer Relationship Management, Data Analysis, Financial Product Knowledge, Communication Skills |

| Loan Officer | Credit Assessment, Risk Management, Attention to Detail, Negotiation Skills |

| Branch Manager | Leadership, Team Management, Sales Strategy, Regulatory Compliance |

| Customer Service Representative | Problem-Solving, Patience, Product Knowledge, Multitasking |

| Financial Advisor | Investment Knowledge, Market Research, Client Advisory, Analytical Thinking |

| Risk Analyst | Risk Assessment, Statistical Analysis, Report Writing, Banking Regulations |

| Credit Analyst | Financial Statement Analysis, Risk Evaluation, Decision-Making, Attention to Detail |

| Product Development Specialist | Market Research, Product Design, Innovation, Customer Needs Analysis |

Entry-Level Positions for Retail Banking Graduates

Retail banking graduates can explore a variety of entry-level positions that build foundational skills in customer service, financial products, and banking operations. These roles provide practical experience and a pathway to advanced careers within the banking sector.

Common entry-level jobs include bank teller, customer service representative, and personal banking associate. These positions involve direct interaction with clients, managing transactions, and assisting with account openings and inquiries. Gaining experience in these roles helps graduates understand retail banking services and develop expertise in financial regulations and sales techniques.

Advancement and Specialization Opportunities

Graduates with a Retail Banking degree can pursue various roles such as Branch Manager, Loan Officer, and Financial Analyst, focusing on customer service and financial product management. Advancement opportunities include progressing to Senior Relationship Manager, Regional Sales Director, or Banking Operations Manager, which require specialized skills in risk assessment and regulatory compliance. Specialization areas like digital banking, wealth management, and credit analysis enhance career growth and increase earning potential within the retail banking sector.

Industry Certifications and Further Education

A Retail Banking degree opens doors to various roles such as Branch Manager, Financial Analyst, Loan Officer, and Customer Relationship Manager. Industry certifications like Certified Retail Banker (CRB) and Certified Financial Services Counselor (CFSC) enhance your expertise and improve job prospects.

Further education options include specialized courses in Risk Management, Financial Planning, or an MBA focused on Banking and Finance. These credentials strengthen skills in regulatory compliance, digital banking, and customer service innovation, key areas in retail banking careers.

Emerging Trends in Retail Banking Careers

Emerging trends in retail banking careers highlight the growing demand for digital expertise and customer-centric skills. Careers in this field now blend traditional finance knowledge with technological innovation and data analysis.

- Digital Banking Specialist - Focuses on developing and managing online banking platforms to enhance customer experiences and operational efficiency.

- Financial Technology (FinTech) Analyst - Analyzes new technologies shaping retail banking, including blockchain, AI, and mobile payment systems to drive innovation.

- Customer Experience Manager - Creates personalized banking services by leveraging data analytics to meet evolving consumer expectations.

Tips for Building a Successful Retail Banking Career

What job opportunities are available with a Retail Banking degree? Careers span roles such as branch manager, loan officer, credit analyst, and customer service representative. Each position requires a solid understanding of financial products and customer relationship management.

How can you build a successful career in retail banking? Focus on developing strong communication skills and gaining experience in financial analysis. Networking with professionals in the banking industry enhances career growth and opens doors to advancement.

What skills are essential for retail banking professionals? Analytical thinking, attention to detail, and customer service expertise are critical. Mastery of banking software and regulatory knowledge also increases your value within the sector.

Where should you seek practical experience for a retail banking career? Internships at banks or financial institutions provide hands-on training and industry insights. Real-world experience builds confidence and practical knowledge, making candidates more competitive.

Why is continuous education important in retail banking? The financial industry constantly evolves with new regulations and technologies. Keeping certifications and financial knowledge up to date ensures readiness for emerging challenges and opportunities.

jobsintra.com

jobsintra.com