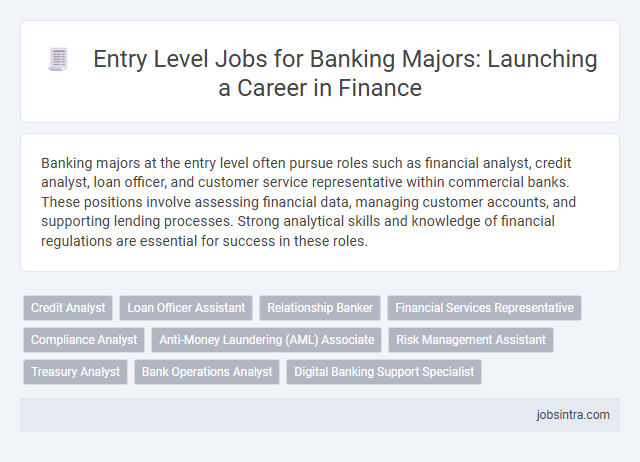

Banking majors at the entry level often pursue roles such as financial analyst, credit analyst, loan officer, and customer service representative within commercial banks. These positions involve assessing financial data, managing customer accounts, and supporting lending processes. Strong analytical skills and knowledge of financial regulations are essential for success in these roles.

Credit Analyst

Entry-level credit analysts in banking evaluate the creditworthiness of individuals or businesses by analyzing financial statements, credit reports, and market trends to make informed lending decisions. They assist in preparing credit proposals, monitoring loan performance, and identifying potential risks to maintain portfolio quality. Strong analytical skills, attention to detail, and proficiency in financial modeling are essential for success in this role.

Loan Officer Assistant

A Loan Officer Assistant helps streamline the loan application process by collecting and organizing borrower information, verifying documents, and supporting loan officers with client communication. This entry-level position is ideal for banking majors seeking hands-on experience in the financial industry and gaining insight into credit analysis and loan underwriting. Your role as a Loan Officer Assistant builds a strong foundation for advancing into loan origination and financial advising careers.

Relationship Banker

Relationship Bankers excel in building strong connections with clients by understanding their financial needs and offering tailored solutions. You can expect to work closely with customers to manage accounts, provide product guidance, and support loan applications. This entry-level role serves as a crucial foundation for career growth within the banking sector.

Financial Services Representative

A Financial Services Representative provides essential support by assisting clients with banking products, processing transactions, and addressing inquiries to ensure a smooth banking experience. This entry-level position helps build your knowledge of financial products, customer service skills, and regulatory compliance. Strong communication and problem-solving abilities are key to succeeding in this role within the banking sector.

Compliance Analyst

Entry-level compliance analyst positions in banking involve monitoring and ensuring that financial institutions adhere to regulatory requirements and internal policies. You will analyze transactions, identify potential risks, and help implement compliance programs to prevent legal or financial penalties. Strong attention to detail and knowledge of banking regulations are essential for success in this role.

Anti-Money Laundering (AML) Associate

Entry-level Anti-Money Laundering (AML) Associates play a crucial role in identifying and preventing financial crimes by analyzing transactions and monitoring suspicious activities within banks. Your responsibilities often include conducting customer due diligence, maintaining compliance with regulatory requirements, and supporting investigations to mitigate risks. This position offers valuable experience in compliance and risk management, essential for building a career in banking and finance.

Risk Management Assistant

A Risk Management Assistant plays a crucial role in identifying, assessing, and mitigating potential financial risks within banking institutions. You will support the risk management team by analyzing data, preparing reports, and ensuring compliance with regulatory requirements. This position offers valuable experience in credit risk, market risk, and operational risk, making it ideal for entry-level banking majors.

Treasury Analyst

Entry-level Treasury Analysts in banking focus on managing an institution's liquidity, monitoring cash flow, and optimizing capital allocation to support daily operations and strategic goals. They analyze financial data, prepare reports on cash positions, and assist in risk management related to interest rates and currency fluctuations. This role develops critical skills in financial planning, forecasting, and treasury management systems, essential for a successful career in banking.

Bank Operations Analyst

Bank Operations Analysts play a crucial role in improving the efficiency and compliance of banking processes by analyzing transaction workflows and identifying areas for optimization. They collaborate with various departments to implement operational changes, ensuring adherence to regulatory requirements and minimizing risks. Strong analytical skills and knowledge of financial systems are essential for success in this entry-level position.

Good to know: jobs for Banking majors entry level

Overview of Banking Careers for Commerce Graduates

What entry-level jobs are available for Banking majors in the commerce field? Commerce graduates specializing in Banking have diverse career opportunities in areas such as retail banking, credit analysis, and risk management. These roles offer a foundation in financial services, customer relations, and regulatory compliance.

How can a commerce graduate start a successful career in banking? Your background in commerce provides essential skills for positions like financial analyst, loan officer, and bank teller. These jobs help build expertise in financial products, market trends, and client management, essential for career growth.

Which skills do banking employers seek in entry-level candidates? Employers prioritize knowledge in financial accounting, data analysis, and familiarity with banking regulations. Commerce graduates with strong communication and problem-solving abilities are highly valued for banking roles.

What sectors within banking are accessible to commerce graduates at the start of their careers? Options include commercial banking, investment banking, and treasury management. Entry-level roles in these sectors expose candidates to portfolio management, credit evaluation, and cash flow optimization.

Why is an entry-level banking job beneficial for commerce graduates? It provides practical experience in financial operations and customer service while offering opportunities for professional certifications. Early exposure to banking procedures and technology platforms prepares graduates for advanced positions.

Key Skills Required for Entry-Level Banking Jobs

Entry-level banking jobs include roles such as bank teller, credit analyst, loan officer, and customer service representative. Key skills required for these positions are strong analytical abilities, excellent communication, attention to detail, and proficiency with financial software. Your ability to manage customer inquiries and perform accurate data analysis will be crucial for success in the banking sector.

Popular Entry-Level Positions in Banking and Finance

Banking majors have a variety of popular entry-level positions available in the finance sector. These roles provide foundational experience and are stepping stones for a successful career in banking and finance.

- Financial Analyst - You analyze financial data to help businesses make informed investment decisions.

- Credit Analyst - This role involves evaluating creditworthiness of individuals or companies to minimize risk for lenders.

- Bank Teller - Entry-level position responsible for processing transactions and providing customer service in a bank branch.

Top Employers and Recruitment Channels

Banking majors have numerous entry-level job opportunities that align with their academic background. Top employers and recruitment channels play a crucial role in securing positions within the banking sector.

- Top Employers - Prominent banks like JPMorgan Chase, Bank of America, and Citibank actively recruit recent graduates for roles in retail banking, risk management, and financial analysis.

- Recruitment Channels - Campus recruitment drives, online job portals like LinkedIn and Indeed, and internships are primary channels for entry-level banking positions.

- Job Roles - Common entry-level jobs include credit analyst, relationship manager, and operations associate, offering a strong foundation for your banking career.

Engaging with top recruiters and utilizing strategic recruitment platforms enhances your chances of landing a valuable banking role.

Navigating the Banking Recruitment Process

Entry-level banking jobs for commerce majors include roles such as financial analyst, credit analyst, and banking associate. Navigating the banking recruitment process involves preparing a strong resume, understanding key industry terms, and practicing behavioral interview questions. Candidates should also research the bank's values and recent market performance to tailor their applications effectively.

Professional Growth and Advancement Opportunities

Entry-level jobs for Banking majors include roles such as Financial Analyst, Credit Analyst, and Loan Officer. These positions provide foundational experience in financial services and client management.

Career paths in banking offer substantial professional growth through certifications and hands-on experience. You can advance to positions like Relationship Manager, Investment Banker, or Risk Manager. Opportunities to specialize in areas such as compliance or wealth management further enhance advancement potential.

Tips for Standing Out as a Banking Job Applicant

Entry-level jobs for banking majors include positions such as financial analyst, credit analyst, loan officer, and teller. These roles provide crucial experience in understanding financial products, risk assessment, and customer service within the banking sector.

Standing out as a banking job applicant requires emphasizing strong analytical skills, attention to detail, and effective communication abilities. Highlight internships, relevant coursework, and proficiency with financial software to demonstrate your readiness for industry demands.

jobsintra.com

jobsintra.com