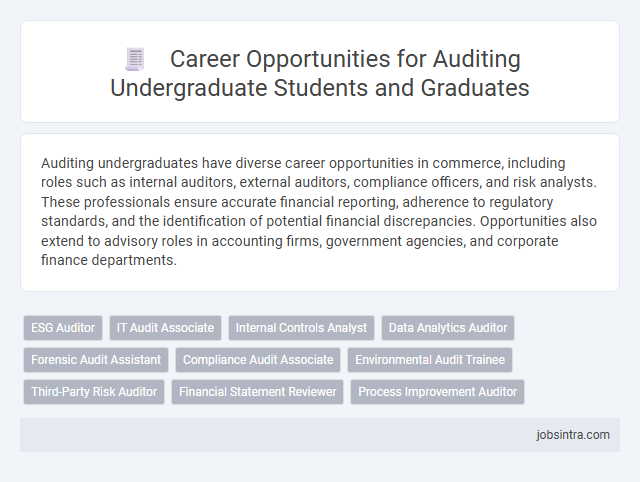

Auditing undergraduates have diverse career opportunities in commerce, including roles such as internal auditors, external auditors, compliance officers, and risk analysts. These professionals ensure accurate financial reporting, adherence to regulatory standards, and the identification of potential financial discrepancies. Opportunities also extend to advisory roles in accounting firms, government agencies, and corporate finance departments.

ESG Auditor

An ESG Auditor specializes in evaluating a company's environmental, social, and governance practices to ensure compliance with regulatory standards and sustainability goals. This role involves analyzing data, assessing risk management, and verifying transparent reporting on ethical and ecological criteria. Proficiency in auditing principles combined with knowledge of ESG frameworks positions graduates for impactful careers in sustainable business practices.

IT Audit Associate

As an IT Audit Associate, you evaluate an organization's information systems to ensure data integrity and security compliance. This role involves identifying vulnerabilities in IT infrastructure and recommending solutions to mitigate risks. Your expertise supports both financial and operational audits, strengthening overall business controls.

Internal Controls Analyst

An Internal Controls Analyst plays a crucial role in evaluating and improving a company's internal operations to ensure compliance with regulatory standards and mitigate risks. This position involves assessing financial and operational processes, identifying control gaps, and recommending enhancements to strengthen the organization's internal control environment. Professionals with an auditing background are well-equipped to analyze data, conduct risk assessments, and support continuous improvement initiatives in governance and compliance frameworks.

Data Analytics Auditor

A Data Analytics Auditor leverages advanced data analysis techniques to evaluate financial records and identify risks, fraud, or inefficiencies within an organization. This role requires proficiency in data visualization tools, statistical software, and auditing standards to provide actionable insights that enhance decision-making. Your skills in auditing combined with data analytics open opportunities in various sectors such as finance, government, and consulting firms.

Forensic Audit Assistant

A Forensic Audit Assistant plays a critical role in investigating financial discrepancies and fraud by analyzing accounting records and gathering evidence for legal proceedings. This position requires strong analytical skills, attention to detail, and familiarity with auditing techniques to support forensic accountants and auditors. Your expertise in auditing principles equips you to contribute effectively to fraud prevention and detection in various industries.

Compliance Audit Associate

A Compliance Audit Associate plays a crucial role in ensuring organizations adhere to regulatory requirements and internal policies by conducting thorough reviews of financial and operational processes. This position involves analyzing compliance risks, identifying control weaknesses, and recommending corrective actions to mitigate potential issues. Graduates with an auditing background bring strong analytical skills and attention to detail, making them ideal candidates for this role in sectors such as finance, healthcare, and manufacturing.

Environmental Audit Trainee

Environmental Audit Trainees support organizations in assessing their compliance with environmental laws and sustainability standards. They analyze data related to waste management, energy use, and pollution control to identify risks and improvement areas. This role offers valuable experience for auditing undergraduates interested in combining financial acumen with environmental responsibility.

Third-Party Risk Auditor

A Third-Party Risk Auditor evaluates the risks associated with an organization's external vendors, suppliers, and service providers, ensuring compliance with regulatory standards and internal policies. You analyze contracts, assess security controls, and identify potential vulnerabilities that could impact business operations or reputation. This role is essential for minimizing financial, operational, and reputational risks in today's interconnected business environment.

Financial Statement Reviewer

A Financial Statement Reviewer analyzes and verifies the accuracy of financial reports, ensuring compliance with accounting standards and regulations. This role involves identifying discrepancies, assessing internal controls, and supporting auditors in the preparation of financial documents. Auditing undergraduates develop critical skills for this position, including attention to detail and understanding of financial reporting frameworks.

Good to know: jobs for Auditing undergraduate

Overview of Auditing as a Career Path

Auditing is a vital career path within commerce, focusing on examining financial records to ensure accuracy and compliance with laws and regulations. It offers opportunities in diverse sectors, including public accounting firms, corporate finance departments, and government agencies.

Your role as an auditing undergraduate can lead to positions such as internal auditor, external auditor, compliance auditor, and forensic auditor. These jobs require analytical skills, attention to detail, and a strong understanding of accounting principles. Pursuing certifications like CPA or CIA enhances career prospects and professional growth in this field.

Key Skills Required for Auditing Professionals

| Job Role | Key Skills Required | Description |

|---|---|---|

| Internal Auditor | Risk Assessment, Analytical Thinking, Attention to Detail, Communication, Compliance Knowledge | Conducts internal reviews of financial controls and processes to ensure compliance and risk mitigation within organizations. |

| External Auditor | Financial Reporting, Accounting Standards, Analytical Skills, Ethical Judgement, Time Management | Evaluates financial statements and accounting processes for third-party clients, ensuring accuracy and regulatory compliance. |

| Forensic Auditor | Investigative Skills, Data Analysis, Critical Thinking, Legal Knowledge, Report Writing | Investigates financial fraud, detects irregularities, and supports legal proceedings with evidence-based findings. |

| Compliance Auditor | Regulatory Knowledge, Detail Orientation, Problem-Solving, Communication, Ethics | Ensures company policies and operations comply with external laws and internal standards, minimizing risks. |

| IT Auditor | Information Systems Knowledge, Risk Analysis, Cybersecurity, Analytical Skills, Technical Proficiency | Audits IT infrastructure and controls to safeguard data integrity and support business continuity. |

| Audit Consultant | Consulting Skills, Strategic Thinking, Financial Acumen, Communication, Problem-Solving | Advises organizations on improving audit processes, enhancing internal controls, and achieving compliance efficiency. |

Job Roles Available for Auditing Graduates

Auditing graduates possess a strong foundation in financial analysis and regulatory compliance, opening numerous career opportunities in commerce. Your skills enable you to ensure transparency and accuracy in financial reporting across various industries.

- Internal Auditor - You assess and improve an organization's internal controls and risk management processes.

- External Auditor - Conduct independent examinations of financial statements to ensure adherence to accounting standards.

- Compliance Analyst - Monitor and enforce corporate adherence to laws, regulations, and internal policies.

Industries Hiring Auditing Students and Graduates

What industries hire auditing undergraduates and graduates? Auditing students and graduates find opportunities in diverse sectors including finance, government, and retail. Financial institutions, accounting firms, manufacturing companies, and healthcare organizations frequently seek skilled auditors to ensure compliance and financial accuracy.

Certification and Professional Growth in Auditing

Auditing undergraduates have numerous career opportunities in public accounting firms, corporate finance departments, and government agencies, focusing on financial compliance and risk assessment. Pursuing certifications such as the Certified Public Accountant (CPA) or Certified Internal Auditor (CIA) enhances your professional credibility and opens doors to advanced roles. Continuous professional growth through workshops, seminars, and specialized training is essential to stay updated with evolving auditing standards and regulations.

Entry-Level Salary and Career Progression

Auditing undergraduates have promising career opportunities in various entry-level positions within finance and accounting sectors. Understanding the typical salary range and growth paths helps plan your professional journey effectively.

- Entry-Level Internal Auditor - Starts with a salary ranging from $50,000 to $65,000 annually, focusing on risk management and compliance.

- Junior External Auditor - Earns approximately $55,000 to $70,000 per year, working on financial statement verification for firms or clients.

- Audit Associate - Entry salary is around $52,000 to $68,000, with career progression into senior audit roles within 3 to 5 years.

Career advancement typically leads to management positions such as Audit Manager or Compliance Officer, with salaries increasing significantly over time.

Tips for Landing an Auditing Job After Graduation

Auditing undergraduates can pursue roles such as Internal Auditor, Compliance Auditor, and Financial Auditor in various industries. Building practical experience through internships and obtaining certifications like CPA or CIA increases employability. Networking with professionals and tailoring your resume to highlight relevant skills enhances your chances of landing an auditing job after graduation.

jobsintra.com

jobsintra.com