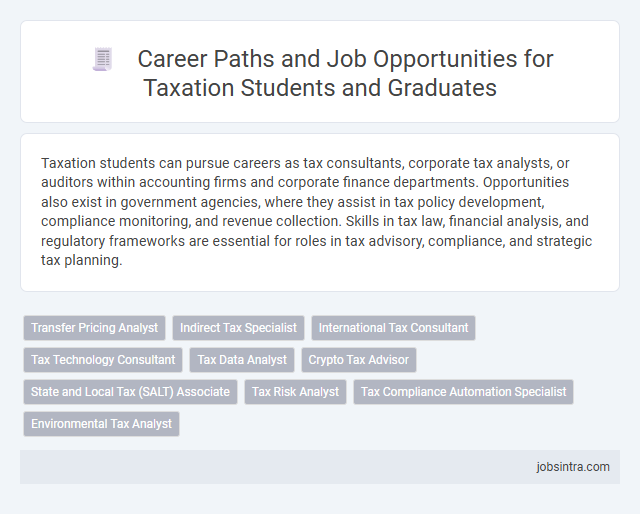

Taxation students can pursue careers as tax consultants, corporate tax analysts, or auditors within accounting firms and corporate finance departments. Opportunities also exist in government agencies, where they assist in tax policy development, compliance monitoring, and revenue collection. Skills in tax law, financial analysis, and regulatory frameworks are essential for roles in tax advisory, compliance, and strategic tax planning.

Transfer Pricing Analyst

Transfer Pricing Analysts specialize in evaluating and documenting intercompany transactions to ensure compliance with tax regulations and avoid double taxation. They analyze transfer pricing policies, prepare reports, and collaborate with tax authorities to manage risks associated with multinational corporations. Strong analytical skills and knowledge of international tax laws are essential for success in this role.

Indirect Tax Specialist

Indirect Tax Specialists analyze and manage taxes on goods and services rather than income or profits. They ensure compliance with VAT, GST, customs duties, and other indirect tax regulations, helping businesses minimize liabilities and avoid penalties. Expertise in indirect tax laws and strong analytical skills make this role vital for companies operating in multiple jurisdictions.

International Tax Consultant

International Tax Consultants specialize in advising multinational corporations on cross-border tax regulations, ensuring compliance with diverse tax laws while optimizing tax liabilities. They analyze international tax treaties, transfer pricing, and tax planning strategies to minimize risks and enhance global business efficiency. Expertise in foreign tax systems and international financial regulations makes these professionals essential for companies navigating complex global markets.

Tax Technology Consultant

Tax Technology Consultants specialize in implementing and optimizing software solutions that enhance tax compliance and reporting processes. You can leverage expertise in both tax regulations and IT systems to streamline workflows, improve data accuracy, and support strategic decision-making. This role bridges the gap between tax professionals and technology teams, making it ideal for students looking to combine finance knowledge with technological skills.

Tax Data Analyst

Tax Data Analysts play a crucial role in interpreting complex tax data to help organizations comply with regulations and optimize their tax strategies. They utilize advanced analytical tools and software to identify trends, discrepancies, and potential savings within vast datasets. Your expertise in taxation combined with data analysis skills can open doors to careers in accounting firms, corporate finance departments, and government tax agencies.

Crypto Tax Advisor

Taxation students can pursue a career as a Crypto Tax Advisor, specializing in the complex tax regulations surrounding cryptocurrencies and digital assets. This role involves advising individuals and businesses on compliance with tax laws, reporting requirements, and strategies for minimizing tax liabilities related to crypto transactions. Expertise in blockchain technology and tax legislation is essential for effectively navigating this rapidly evolving field.

State and Local Tax (SALT) Associate

A career as a State and Local Tax (SALT) Associate offers taxation students the opportunity to specialize in complex state and local tax regulations, compliance, and planning. You will analyze tax laws to help businesses navigate sales, property, income, and other state-specific taxes efficiently. This role sharpens your expertise in tax research, client advisory, and government filings, making it a vital step in a taxation career path.

Tax Risk Analyst

Tax Risk Analysts evaluate financial data to identify potential tax compliance issues and mitigate risks for organizations. They analyze tax regulations, assess internal controls, and ensure adherence to tax laws to prevent costly penalties. Their expertise supports informed decision-making and strategic tax planning within corporate finance teams.

Tax Compliance Automation Specialist

Tax Compliance Automation Specialists design and implement automated systems to streamline tax reporting and ensure adherence to regulatory requirements. They utilize expertise in tax codes and software technology to optimize data processing, reduce errors, and improve efficiency in tax filing. Their role bridges taxation knowledge with IT skills, making them vital in modernizing tax departments.

Good to know: jobs for Taxation students

Overview of Taxation as a Career Field

Taxation offers a dynamic career field with opportunities in government, corporate sectors, and private consultancy. Professionals analyze tax laws, prepare tax returns, and develop strategies to optimize financial outcomes for clients or organizations.

Your expertise in tax codes and regulations can lead to roles such as tax consultant, auditor, compliance officer, or tax advisor. These positions require strong analytical skills and detailed understanding of local and international tax systems.

Key Skills and Qualifications for Taxation Professionals

Taxation students have diverse career opportunities in fields such as corporate tax, public accounting, and government agencies. Mastery of tax laws, analytical skills, and attention to detail are essential for success in taxation roles.

- Strong knowledge of tax codes and regulations - Understanding complex tax legislation is critical for compliance and advisory roles.

- Proficiency in accounting and finance principles - Skills in accounting help in accurate financial reporting and tax planning.

- Effective communication and problem-solving skills - Ability to explain tax concepts clearly and resolve client issues efficiently is vital.

Entry-Level Roles for Taxation Graduates

Entry-level roles for taxation graduates offer diverse opportunities across public and private sectors. These positions help build a strong foundation in tax laws, compliance, and advisory services.

- Tax Associate - Prepare tax returns and support tax planning for individuals and businesses under the supervision of senior staff.

- Junior Tax Consultant - Assist clients with tax compliance, research tax regulations, and identify potential savings.

- Tax Analyst - Analyze financial data to ensure accurate tax reporting and support audit processes.

Your career in taxation begins with gaining practical experience and understanding complex tax environments.

Career Progression and Advancement Opportunities

| Job Title | Career Progression | Advancement Opportunities |

|---|---|---|

| Tax Consultant | Start as a Junior Consultant, advance to Senior Consultant, then Tax Manager | Specialize in corporate tax, move to advisory roles, or become a partner in a consulting firm |

| Tax Analyst | Begin with data analysis and compliance, progress to Senior Analyst, then Tax Supervisor | Develop expertise in international tax, transition to policy design and strategic roles |

| Tax Accountant | Entry-level Accountant, promote to Senior Accountant, then Tax Controller | Opportunity for specialization in VAT, GST, or income tax; shift to financial management or consultancy |

| Tax Auditor | Start as an Auditor, advance to Senior Auditor, then Audit Manager | Expand into compliance consulting, risk management, or senior government tax roles |

| Corporate Tax Officer | Begin in compliance and reporting, advance to Tax Compliance Manager, then Head of Tax Department | Opportunity to lead corporate tax strategy, influence business decisions, or transition into CFO roles |

Diverse Employment Sectors for Taxation Experts

Taxation students can explore diverse employment sectors including public accounting firms, corporate finance departments, government tax agencies, and consulting firms. Roles such as tax analyst, compliance officer, and tax advisor require specialized knowledge in tax laws and regulations. Your expertise is valuable in industries ranging from healthcare and technology to manufacturing and retail, offering numerous career advancement opportunities.

Professional Certifications and Further Education

Taxation students have diverse career paths available in commerce, emphasizing the importance of professional certifications and further education. Acquiring specialized credentials enhances job prospects and expertise in tax-related fields.

- Certified Public Accountant (CPA) - This credential is crucial for tax professionals advising on compliance and financial reporting.

- Chartered Tax Advisor (CTA) - Specializing in taxation law and practice, this certification boosts career opportunities in corporate and personal tax planning.

- Master's Degree in Taxation or Accounting - Advanced education provides deep knowledge and opens roles in consultancy, research, and senior management.

Emerging Trends and Future Prospects in Taxation Careers

What career paths are available for taxation students in the modern commerce landscape? Taxation students can explore roles such as tax analyst, compliance officer, and tax consultant. Emerging trends include specialization in international tax law and digital taxation technologies.

How is technology shaping the future of taxation jobs? Automation and artificial intelligence are transforming tax preparation and auditing processes. Your skills in data analytics and blockchain will be highly valued in this evolving field.

What industries offer the best opportunities for taxation graduates? Financial services, consulting firms, and government agencies are primary employers. Growth areas include environmental tax advisory and transfer pricing specialists.

What certifications enhance job prospects for taxation students? Credentials like CPA, Chartered Tax Advisor (CTA), and Certified Tax Specialist are crucial. These certifications demonstrate expertise and open doors to senior roles in tax strategy and planning.

How important is continuous learning for a taxation career? Tax laws change frequently, requiring constant updates in knowledge. Staying current with regulations and new tax technologies ensures career advancement and job security.

jobsintra.com

jobsintra.com