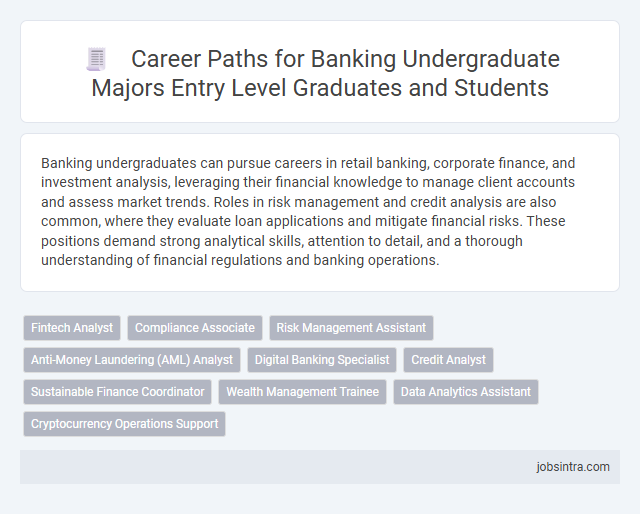

Banking undergraduates can pursue careers in retail banking, corporate finance, and investment analysis, leveraging their financial knowledge to manage client accounts and assess market trends. Roles in risk management and credit analysis are also common, where they evaluate loan applications and mitigate financial risks. These positions demand strong analytical skills, attention to detail, and a thorough understanding of financial regulations and banking operations.

Fintech Analyst

A Fintech Analyst in banking evaluates emerging financial technologies to improve services and optimize operations. They analyze market trends, assess risk management solutions, and support digital transformation strategies. Their expertise helps financial institutions stay competitive and innovate in a rapidly evolving sector.

Compliance Associate

A Compliance Associate in the banking sector ensures that financial institutions adhere to regulatory requirements and internal policies, reducing the risk of legal penalties and financial losses. Their role involves monitoring transactions, conducting audits, and preparing reports to maintain transparency and safeguard the bank's integrity. Strong analytical skills and attention to detail are essential for effectively identifying compliance issues and implementing corrective actions.

Risk Management Assistant

A Risk Management Assistant in banking supports the identification, assessment, and mitigation of financial risks to protect institutional assets. They analyze market trends, prepare risk reports, and ensure compliance with regulatory standards. This role requires strong analytical skills and a solid understanding of financial instruments and risk management frameworks.

Anti-Money Laundering (AML) Analyst

An Anti-Money Laundering (AML) Analyst plays a crucial role in the banking sector by monitoring financial transactions to detect and prevent illegal activities such as money laundering and fraud. This position requires strong analytical skills, familiarity with regulatory compliance, and proficiency in using specialized software to identify suspicious patterns. Banking undergraduates with a keen interest in finance and law enforcement can excel in this career by contributing to the integrity and security of financial institutions.

Digital Banking Specialist

Digital Banking Specialists develop and manage online banking platforms, ensuring seamless user experiences and secure transactions. They analyze customer behavior to optimize digital services and implement innovative financial technologies. Proficiency in cybersecurity, data analytics, and fintech trends is essential for success in this role.

Credit Analyst

Credit analysts in banking assess the creditworthiness of individuals, businesses, and organizations by analyzing financial statements, credit data, and economic conditions. They play a crucial role in making informed lending decisions, minimizing risk exposure for financial institutions. Expertise in financial analysis, risk assessment, and knowledge of credit policies ensures accurate evaluation of loan applications and credit limits.

Sustainable Finance Coordinator

A Sustainable Finance Coordinator in the banking sector develops and implements strategies that align financial products with environmental and social governance (ESG) criteria. This role involves analyzing sustainability risks and opportunities to support investment decisions that promote long-term economic and ecological benefits. Collaboration with cross-functional teams ensures adherence to regulatory standards while driving innovation in green finance initiatives.

Wealth Management Trainee

Wealth Management Trainee programs offer banking undergraduates a valuable opportunity to develop expertise in financial planning, investment strategies, and client relationship management. These roles provide hands-on experience with portfolio analysis and risk assessment, preparing you for a successful career in wealth advisory services. By participating in such programs, you can build essential skills to guide high-net-worth clients in achieving their financial goals.

Data Analytics Assistant

A Banking undergraduate can excel as a Data Analytics Assistant by leveraging strong quantitative and analytical skills to interpret complex financial data and generate actionable insights. This role involves using statistical tools and software to analyze trends, helping banks improve decision-making and risk management. Mastery of data visualization and reporting techniques enables effective communication of findings to support strategic banking operations.

Good to know: jobs for Banking undergraduate

Overview of Banking Career Opportunities

A banking undergraduate has a wide range of career opportunities in the financial sector. These roles leverage knowledge of banking operations, finance, and customer service to support economic growth and individual financial needs.

- Corporate Banking Analyst - Focuses on managing relationships with corporate clients, evaluating credit risk, and structuring loans.

- Risk Management Specialist - Identifies and analyzes financial risks to develop strategies that minimize losses for banking institutions.

- Financial Planner - Provides personalized advice on investments, retirement, and wealth management to help clients achieve financial goals.

Key Skills Required for Banking Roles

Banking undergraduates have diverse career opportunities in financial analysis, risk management, and investment banking. Mastery of specific skills is crucial to excel in these competitive roles.

- Analytical Skills - Ability to interpret financial data and market trends for informed decision-making.

- Attention to Detail - Precision in handling transactions and regulatory compliance reduces errors.

- Communication Skills - Clear articulation of financial information to clients and team members enhances collaboration.

Developing these key skills sharply increases a candidate's employability in banking sectors.

Top Entry-Level Jobs for Banking Graduates

| Job Title | Description | Key Skills | Average Salary (USD) |

|---|---|---|---|

| Financial Analyst | Analyze financial data, create reports, and assist in investment decisions for clients or firms. | Financial modeling, data analysis, Excel, critical thinking | 60,000 - 75,000 |

| Credit Analyst | Evaluate the creditworthiness of individuals or businesses to mitigate lending risk. | Risk assessment, financial statement analysis, communication | 55,000 - 70,000 |

| Investment Banking Analyst | Support mergers, acquisitions, and raising capital through detailed research and financial forecasting. | Valuation, financial modeling, negotiation, attention to detail | 70,000 - 85,000 |

| Banking Relationship Manager | Manage client portfolios, provide tailored banking solutions, and strengthen client relations. | Customer service, sales skills, financial knowledge, networking | 50,000 - 65,000 |

| Risk Analyst | Identify and analyze potential risks affecting bank investments and lending operations. | Statistical analysis, risk management, problem-solving | 60,000 - 75,000 |

| Compliance Officer | Ensure banking operations comply with legal and regulatory requirements to avoid penalties. | Regulatory knowledge, attention to detail, communication, ethics | 55,000 - 70,000 |

| Operations Analyst | Optimize internal banking processes to improve efficiency and reduce operational risks. | Process improvement, data analysis, project management | 50,000 - 65,000 |

| Loan Officer | Assess loan applications, recommend approval or denial based on financial criteria. | Financial assessment, decision-making, customer interaction | 45,000 - 60,000 |

Explore these top entry-level jobs carefully to position your banking undergraduate degree for a successful career in the financial sector.

Internship and Traineeship Programs in Banking

Banking undergraduate students can gain valuable industry experience through internship and traineeship programs in leading financial institutions. These programs provide hands-on training and exposure to various banking operations.

- Internship Opportunities - Internships offer real-world experience in areas such as retail banking, credit analysis, and risk management.

- Traineeship Programs - Traineeships provide structured learning with rotation across departments like investment banking, compliance, and treasury management.

- Skill Development - You will develop essential skills including financial analysis, customer service, and regulatory knowledge during these programs.

Certifications and Further Education for Career Growth

Banking undergraduates have diverse career opportunities in finance, risk management, and investment analysis. Pursuing specialized certifications can significantly enhance job prospects and professional credibility.

Certifications like CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), and FRM (Financial Risk Manager) are highly valued in the banking industry. Further education such as an MBA or a master's in finance deepens expertise and leadership skills. These qualifications help banking graduates secure roles in corporate finance, asset management, and compliance.

Tips for Landing Your First Banking Job

Banking undergraduates can pursue roles such as financial analyst, credit analyst, or investment banking associate. Tailor your resume to highlight relevant coursework, internships, and analytical skills valued by banking employers. Network through industry events and leverage LinkedIn to connect with professionals and access job openings in the banking sector.

Career Advancement and Long-Term Prospects in Banking

Banking undergraduates have a wide range of career opportunities including roles such as financial analyst, credit analyst, loan officer, and investment banker. These positions provide a strong foundation for understanding financial markets, risk management, and customer relations.

Career advancement in banking often involves progressing to senior roles like branch manager, portfolio manager, or risk manager. Long-term prospects include specializing in areas such as wealth management, corporate finance, or compliance, which offer higher salaries and leadership positions.

jobsintra.com

jobsintra.com