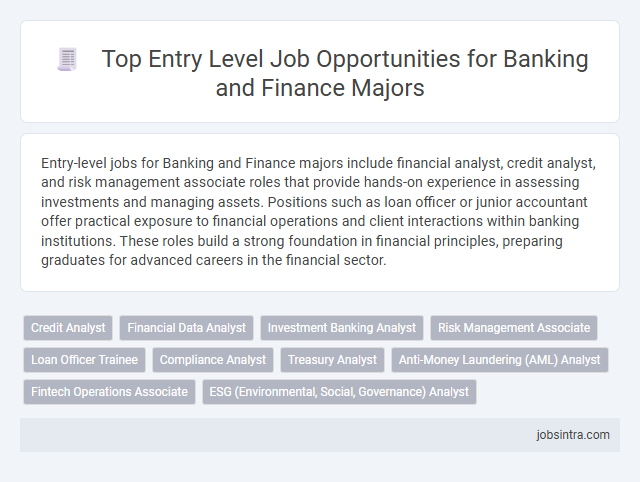

Entry-level jobs for Banking and Finance majors include financial analyst, credit analyst, and risk management associate roles that provide hands-on experience in assessing investments and managing assets. Positions such as loan officer or junior accountant offer practical exposure to financial operations and client interactions within banking institutions. These roles build a strong foundation in financial principles, preparing graduates for advanced careers in the financial sector.

Credit Analyst

Credit Analyst roles offer entry-level opportunities for Banking and Finance majors to evaluate the creditworthiness of individuals or companies, analyzing financial data to assess risk. You will develop expertise in financial statement analysis, risk assessment, and decision-making to support lending and investment strategies. This position provides a strong foundation for advancing careers in credit management, risk analysis, and financial consulting.

Financial Data Analyst

Financial Data Analysts interpret complex financial data to help businesses make informed decisions, focusing on trends, risk assessment, and investment opportunities. Entry-level roles emphasize skills in data visualization, statistical analysis, and familiarity with financial software tools. This position suits Banking and Finance majors seeking to apply quantitative analysis to real-world financial scenarios and support strategic planning.

Investment Banking Analyst

Investment Banking Analysts play a crucial role in financial institutions by conducting market research, preparing financial models, and assisting in mergers and acquisitions. This entry-level position demands strong analytical skills and proficiency in data interpretation to support decision-making processes. Your ability to work under pressure and attention to detail can set you apart in this competitive career path.

Risk Management Associate

Risk Management Associates in the banking and finance sector analyze financial risks and develop strategies to minimize potential losses. They assess credit, market, and operational risks while ensuring compliance with regulatory requirements. This entry-level role requires strong analytical skills and a solid understanding of financial instruments and risk assessment techniques.

Loan Officer Trainee

Loan Officer Trainees assess creditworthiness and guide clients through loan application processes, providing essential support to experienced loan officers. They analyze financial information to recommend suitable loan options while ensuring compliance with banking regulations. This entry-level role offers foundational experience in credit evaluation and customer service within the banking and finance sector.

Compliance Analyst

Compliance Analysts play a critical role in banking and finance by ensuring that organizations adhere to regulatory requirements and internal policies. Entry-level professionals in this position conduct risk assessments, monitor transactions for suspicious activities, and assist in developing compliance programs to prevent legal and financial penalties. Strong analytical skills and knowledge of financial regulations are essential for success in this role.

Treasury Analyst

Treasury Analysts play a crucial role in managing an organization's liquidity, cash flow, and financial risk at the entry-level stage for Banking and Finance majors. They analyze cash management systems, monitor daily cash positions, and assist in forecasting financial requirements to optimize capital deployment. These professionals collaborate with other departments to ensure efficient treasury operations and support strategic financial planning.

Anti-Money Laundering (AML) Analyst

An entry-level Anti-Money Laundering (AML) Analyst plays a critical role in detecting and preventing financial crimes by monitoring transactions and conducting risk assessments. You will analyze suspicious activities, ensure compliance with regulatory requirements, and support investigations to protect institutions from fraud and money laundering. Strong analytical skills and attention to detail are essential for success in this position.

Fintech Operations Associate

A Fintech Operations Associate in the banking and finance sector manages daily operational processes to ensure seamless financial technology services. This role involves coordinating with technology teams, monitoring transaction workflows, and resolving issues to optimize efficiency and compliance. Entry-level candidates gain valuable experience in fintech ecosystems, risk management, and customer support functions.

Good to know: jobs for Banking and Finance majors entry level

Overview of Entry-Level Banking and Finance Careers

| Job Title | Overview | Key Responsibilities | Skills Required | Typical Employers |

|---|---|---|---|---|

| Financial Analyst | Entry-level financial analysts support decision-making by analyzing financial data, preparing reports, and forecasting economic trends. | Conduct financial modeling, evaluate investment opportunities, prepare financial reports, monitor market trends. | Analytical skills, proficiency in Excel and financial software, attention to detail, strong communication. | Investment banks, commercial banks, asset management firms, consulting agencies. |

| Credit Analyst | Credit analysts assess creditworthiness of individuals or organizations to assist lenders in managing risk. | Evaluate credit data, prepare credit reports, assess borrowing risk, monitor loan portfolios. | Financial statement analysis, risk assessment, critical thinking, knowledge of credit software. | Commercial banks, credit rating agencies, lending institutions. |

| Bank Teller | Bank tellers provide frontline customer service handling routine banking transactions. | Process deposits, withdrawals, payments, maintain transaction records, assist customers with inquiries. | Customer service, numeracy, attention to detail, basic banking products knowledge. | Retail banks, credit unions, community banks. |

| Investment Banking Analyst | Entry-level investment banking analysts support deal execution, prepare pitch books, and perform financial valuations. | Analyze financial statements, build valuation models, assist in mergers and acquisitions, prepare presentations. | Strong quantitative skills, financial modeling, presentation skills, teamwork. | Investment banks, boutique advisory firms, financial consultancies. |

| Financial Planner Assistant | Assist senior financial planners in developing investment strategies and client financial plans. | Gather client financial data, prepare financial reports, support portfolio management, maintain client records. | Interpersonal skills, understanding of investment products, data analysis, organization. | Financial advisory firms, wealth management companies, insurance firms. |

| Risk Analyst | Risk analysts evaluate potential risks affecting financial assets or institutions to minimize losses. | Analyze risk data, develop risk mitigation strategies, monitor regulatory compliance, report findings. | Quantitative analysis, regulatory knowledge, critical thinking, risk management software. | Banks, insurance companies, investment firms, regulatory bodies. |

Essential Skills Required for Finance Graduates

Entry-level jobs for Banking and Finance majors include financial analyst, credit analyst, and junior accountant positions. Your ability to master essential skills will determine your success in these competitive roles.

- Analytical Thinking - Ability to evaluate financial data and market trends critically to support investment decisions.

- Communication Skills - Proficiency in presenting financial information clearly to stakeholders and clients.

- Technical Proficiency - Knowledge of accounting software, Excel, and financial modeling tools essential for daily tasks.

Developing these core competencies will help you secure a strong foundation in Banking and Finance careers.

Top Entry-Level Positions in Commercial Banking

Banking and Finance majors have numerous opportunities in commercial banking, particularly in entry-level roles that build foundational expertise. These positions provide critical exposure to financial analysis, client relationship management, and risk assessment.

Top entry-level jobs include Credit Analyst, who evaluates loan applications and assesses credit risk, and Relationship Banker, focusing on customer service and financial product sales. Other key roles such as Loan Officer Assistant and Treasury Analyst support loan processing and liquidity management, essential for a robust banking career.

Leading Roles in Investment Banking for Freshers

Entry-level opportunities for Banking and Finance majors in investment banking offer a pathway to impactful careers. Leading roles focus on financial analysis, client advisory, and transaction management to drive firm success.

- Analyst Positions - Freshers perform detailed financial modeling and market research to support senior bankers in deal execution.

- Associate Roles - Entry-level associates assist in preparing presentations and conducting due diligence for mergers and acquisitions.

- Client Relationship Management - Leading roles emphasize building relationships with clients to identify investment opportunities and tailor financial solutions.

Financial Analyst Opportunities for Recent Graduates

Recent graduates with Banking and Finance majors have promising entry-level opportunities as Financial Analysts. These roles offer hands-on experience in financial modeling, market analysis, and investment strategies crucial for career growth.

- Junior Financial Analyst Positions - Entry-level roles focusing on data collection, financial reporting, and assisting senior analysts to support business decisions.

- Investment Analyst Roles - Opportunities to evaluate investment portfolios and market trends helping companies optimize asset allocation and risk management.

- Corporate Finance Analyst Jobs - Positions that involve budgeting, forecasting, and analyzing financial performance to improve organizational efficiency.

In-Demand Compliance and Risk Management Positions

Entry-level jobs for Banking and Finance majors in compliance and risk management include roles such as Compliance Analyst, Risk Assessment Associate, and Regulatory Reporting Specialist. These positions focus on ensuring adherence to financial regulations, identifying potential risks, and supporting the development of risk mitigation strategies. Your skills in financial analysis and regulatory knowledge are highly sought after in today's competitive market.

Career Growth and Advancement Prospects in Finance

Entry-level jobs for Banking and Finance majors include roles such as financial analyst, credit analyst, and investment banking analyst. These positions offer structured career growth paths with opportunities to advance into senior analyst, portfolio manager, or financial advisor roles. Strong demand in sectors like corporate finance, investment firms, and commercial banks supports continuous professional development and upward mobility.

jobsintra.com

jobsintra.com