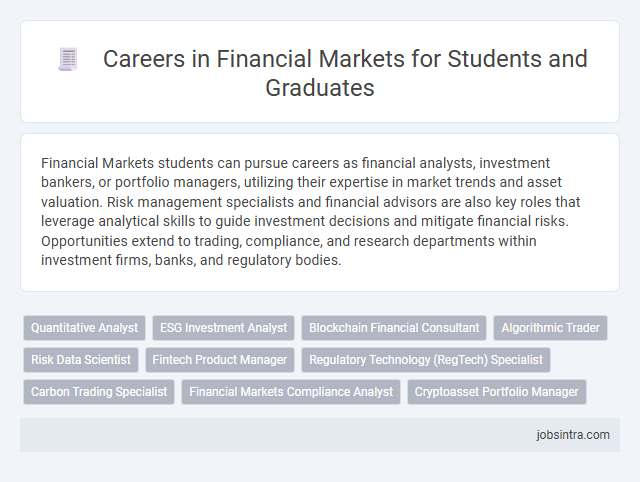

Financial Markets students can pursue careers as financial analysts, investment bankers, or portfolio managers, utilizing their expertise in market trends and asset valuation. Risk management specialists and financial advisors are also key roles that leverage analytical skills to guide investment decisions and mitigate financial risks. Opportunities extend to trading, compliance, and research departments within investment firms, banks, and regulatory bodies.

Quantitative Analyst

Financial Markets students pursuing a career as a Quantitative Analyst apply advanced mathematical models and statistical techniques to analyze market data and develop trading strategies. You will work with complex algorithms and coding to optimize investment portfolios and manage financial risks effectively. This role requires strong analytical skills and proficiency in programming languages such as Python, R, or MATLAB.

ESG Investment Analyst

ESG Investment Analysts evaluate companies based on environmental, social, and governance criteria to guide sustainable investment decisions. They analyze financial data alongside non-financial factors to identify risks and opportunities that impact long-term value creation. Their expertise supports investors seeking to align portfolios with ethical and regulatory standards in financial markets.

Blockchain Financial Consultant

Blockchain Financial Consultants specialize in integrating blockchain technology into financial markets to enhance security, transparency, and efficiency. They analyze market trends and develop strategies that leverage decentralized finance (DeFi) solutions to optimize investment portfolios and risk management. Your expertise in both finance and blockchain technology positions you for roles that bridge technical innovation with financial strategy.

Algorithmic Trader

Algorithmic traders design and implement automated trading strategies using advanced mathematical models and programming skills to capitalize on market inefficiencies. Financial Markets students with strong analytical abilities and knowledge of quantitative finance often excel in developing algorithms that can execute high-frequency trades with precision. This role requires continuous market analysis, coding expertise, and a deep understanding of market microstructure to optimize trading performance and manage risk effectively.

Risk Data Scientist

Risk Data Scientists analyze complex financial data to identify potential risks and develop predictive models that enhance decision-making in financial markets. Your expertise in data analytics, statistical modeling, and risk assessment helps organizations minimize losses and optimize investment strategies. This role is essential for maintaining financial stability and improving risk management within banks, hedge funds, and investment firms.

Fintech Product Manager

Financial Markets students seeking dynamic roles can excel as Fintech Product Managers, where they merge finance expertise with technology innovation. This position involves overseeing the development and enhancement of digital financial products, ensuring alignment with market trends and client needs. Mastery of financial instruments, regulatory environments, and user experience design drives success in this evolving sector.

Regulatory Technology (RegTech) Specialist

Financial Markets students can pursue a career as Regulatory Technology (RegTech) Specialists, where they develop and implement advanced solutions to ensure compliance with financial regulations. These experts use data analytics, artificial intelligence, and blockchain technology to streamline reporting, monitor transactions, and mitigate risks within financial institutions. Their role is critical in helping organizations navigate complex regulatory environments efficiently and cost-effectively.

Carbon Trading Specialist

A Carbon Trading Specialist plays a critical role in financial markets by managing the buying and selling of carbon credits, helping companies comply with environmental regulations and reduce their carbon footprint. This job requires strong analytical skills and knowledge of carbon markets, emissions trading schemes, and sustainability policies. Your expertise can drive profitable strategies that align with global climate goals while navigating complex regulatory frameworks.

Financial Markets Compliance Analyst

Financial Markets Compliance Analysts play a critical role in ensuring that financial institutions adhere to regulatory requirements and internal policies. These professionals analyze trading activities, identify potential risks, and implement compliance controls to prevent violations. Your knowledge of financial markets equips you to monitor complex transactions and maintain the integrity of the institution's operations.

Good to know: jobs for Financial Markets students

Overview of Financial Markets Careers

Careers in financial markets offer diverse opportunities for students interested in finance, economics, and trading. Understanding key roles provides a clearer path to success in this dynamic industry.

- Investment Banking Analyst - Supports clients in raising capital through equity or debt issuance, mergers, and acquisitions.

- Equity Research Analyst - Analyzes stocks and provides recommendations based on market trends and company performance.

- Risk Manager - Identifies and mitigates financial risks to protect an institution's assets and earnings.

Key Roles and Job Titles in Financial Markets

Financial Markets students have diverse career opportunities in dynamic roles that shape the economy. Key positions include Financial Analyst, Trader, and Portfolio Manager, each requiring strong analytical skills and market knowledge.

Risk Manager and Investment Banker are pivotal jobs focusing on managing uncertainties and raising capital for businesses. Your expertise can also lead to roles such as Market Research Analyst or Compliance Officer, ensuring regulatory adherence and market insights.

Essential Skills and Qualifications

Financial Markets students are well-suited for roles such as financial analyst, investment banker, and portfolio manager. Essential skills include strong analytical abilities, proficiency in financial modeling, and a deep understanding of market trends. Qualifications often require a degree in finance or economics, certifications like CFA, and experience with trading platforms and data analysis software.

Educational Pathways and Certifications

What career opportunities await Financial Markets students? Graduates often pursue roles such as financial analysts, portfolio managers, and risk managers. Specialized certifications enhance career prospects in these competitive fields.

Which educational pathways best prepare you for a career in financial markets? Degrees in finance, economics, or business administration provide essential knowledge and skills. Coursework in statistics, investment analysis, and market regulation is highly recommended.

How do certifications impact job prospects in financial markets? Professional credentials like CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), and CPA (Certified Public Accountant) are highly valued by employers. These certifications demonstrate expertise and commitment to industry standards.

Entry-Level Opportunities for Students and Graduates

Financial Markets students possess a strong foundation in economics, trading, and risk management that opens doors to various entry-level roles. Positions such as junior analyst, trading assistant, and compliance trainee provide practical experience in dynamic market environments.

Investment banking analyst roles offer exposure to mergers, acquisitions, and capital raising processes, ideal for fresh graduates. Wealth management firms also seek entry-level associates to assist with portfolio analysis and client advisory services, helping you launch your career effectively.

Career Progression and Advancement

| Job Role | Career Progression | Advancement Opportunities |

|---|---|---|

| Financial Analyst | Entry-level position analyzing market trends, financial statements, and investment opportunities. | Promotion to Senior Financial Analyst, Portfolio Manager, or Risk Manager with increased responsibility. |

| Investment Banker | Starting as an analyst or associate, supporting mergers, acquisitions, and capital raising activities. | Advancement to Vice President, Director, and Managing Director roles, leading major transactions. |

| Trader | Beginning as a junior trader executing buy and sell orders under supervision. | Progression to Senior Trader, Trading Desk Manager, or Head of Trading with strategic decision-making duties. |

| Risk Manager | Initial role in identifying, evaluating, and mitigating financial risks. | Growth towards Chief Risk Officer or Risk Management Director, influencing company-wide risk policies. |

| Quantitative Analyst (Quant) | Applying mathematical models to identify market opportunities and optimize portfolios. | Moving up to Lead Quant, Quantitative Research Director, or Head of Quantitative Strategies. |

| Portfolio Manager | Managing investment portfolios with a focus on asset allocation and performance tracking. | Advancement to Senior Portfolio Manager or Fund Manager, overseeing larger funds or multiple portfolios. |

| Financial Consultant | Advising clients on wealth management, investment products, and financial planning. | Promotion to Senior Consultant, Client Relationship Manager, or Financial Advisory Director. |

Tips for Success and Professional Growth

Financial Markets students have diverse career opportunities in roles such as financial analyst, portfolio manager, risk manager, and investment banker. These positions require strong analytical skills, market knowledge, and decision-making abilities.

To succeed, students should build expertise in financial modeling, stay updated with market trends, and gain certifications like CFA or FRM. Networking with industry professionals and securing internships provide practical experience and job prospects. Continuous learning and adaptability are key for professional growth in the dynamic financial sector.

jobsintra.com

jobsintra.com