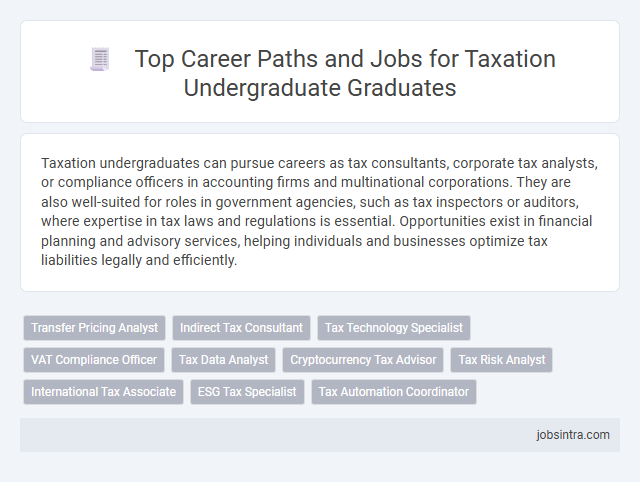

Taxation undergraduates can pursue careers as tax consultants, corporate tax analysts, or compliance officers in accounting firms and multinational corporations. They are also well-suited for roles in government agencies, such as tax inspectors or auditors, where expertise in tax laws and regulations is essential. Opportunities exist in financial planning and advisory services, helping individuals and businesses optimize tax liabilities legally and efficiently.

Transfer Pricing Analyst

Transfer Pricing Analysts specialize in developing and implementing strategies to ensure compliance with international tax laws and regulations, helping multinational corporations allocate income and expenses accurately across different countries. Your role involves analyzing financial data, conducting market research, and preparing documentation to support transfer pricing policies that minimize tax risks and optimize tax liabilities. Strong analytical skills, attention to detail, and knowledge of taxation principles are essential for success in this dynamic and crucial position.

Indirect Tax Consultant

An Indirect Tax Consultant specializes in advising businesses on value-added tax (VAT), goods and services tax (GST), customs duties, and excise taxes to ensure compliance and optimize tax liabilities. You can work with multinational corporations, government agencies, or consulting firms to assist in tax planning, audits, and dispute resolution. Expertise in indirect tax regulations helps organizations minimize risks and capitalize on available tax incentives.

Tax Technology Specialist

A Tax Technology Specialist leverages advanced software and automation tools to streamline tax compliance and reporting processes. They analyze tax data, implement tax software solutions, and ensure integration with accounting systems to improve accuracy and efficiency. This role combines expertise in taxation principles with IT skills to enhance tax function performance in organizations.

VAT Compliance Officer

A VAT Compliance Officer ensures businesses adhere to value-added tax regulations by accurately calculating, reporting, and submitting VAT returns. Your expertise in tax legislation and auditing supports minimizing risks of penalties and optimizing tax liabilities. This role demands strong analytical skills and meticulous attention to detail for effective tax compliance management.

Tax Data Analyst

A Tax Data Analyst specializes in interpreting complex tax data to support accurate reporting and compliance. They use advanced data analysis tools and software to identify trends, optimize tax strategies, and assist in regulatory filings. Proficiency in tax regulations, data management, and analytical skills is essential for success in this role.

Cryptocurrency Tax Advisor

A Cryptocurrency Tax Advisor specializes in navigating the complex tax regulations related to digital currencies, ensuring compliance with local and international tax laws. This role involves analyzing transactions, advising clients on tax implications, and optimizing tax strategies for cryptocurrency investments. Expertise in both taxation principles and blockchain technology is essential for accurately managing tax liabilities and minimizing risks in this evolving field.

Tax Risk Analyst

Tax Risk Analysts specialize in identifying and mitigating potential tax compliance issues within organizations, ensuring adherence to evolving tax laws and regulations. They analyze financial data to assess tax risks, prepare comprehensive reports, and implement strategies that minimize liabilities while maximizing tax efficiency. This role demands strong analytical skills and a deep understanding of tax codes, making it ideal for Taxation undergraduates seeking to apply their expertise in risk management.

International Tax Associate

International Tax Associates specialize in navigating complex global tax regulations to support multinational corporations in compliance and strategic tax planning. They analyze cross-border tax issues, prepare transfer pricing documentation, and advise on international tax treaties to minimize liabilities. Expertise in international tax laws and strong analytical skills enable them to optimize tax structures for global business operations.

ESG Tax Specialist

An ESG Tax Specialist leverages expertise in environmental, social, and governance criteria to guide companies on tax strategies that align with sustainable business practices. This role involves analyzing tax policies related to carbon credits, green investments, and sustainability incentives to maximize tax benefits while ensuring compliance. Professionals in this position help organizations integrate ESG considerations into their financial planning, promoting responsible corporate citizenship and long-term value creation.

Good to know: jobs for Taxation undergraduate

Overview of Taxation as a Career Field

Taxation is a dynamic career field encompassing roles such as tax analyst, tax consultant, and compliance officer. Professionals in this sector specialize in understanding tax laws, preparing tax returns, and advising businesses on tax strategies to maximize savings and ensure regulatory compliance. Your knowledge in taxation opens opportunities across public accounting firms, corporations, government agencies, and consultancy services.

Core Skills Required for Taxation Graduates

Taxation undergraduates possess specialized knowledge essential for careers in finance, accounting, and government sectors. Core skills in tax law, compliance, and analytical thinking enable these graduates to excel in various professional roles.

- Strong Analytical Skills - Ability to interpret complex tax codes and financial data to ensure accurate tax reporting and compliance.

- Attention to Detail - Precision in preparing tax returns and identifying discrepancies to minimize errors and avoid penalties.

- Proficiency in Tax Software - Skilled in using advanced tax preparation and accounting software to streamline tax processes and enhance efficiency.

Career Opportunities in Public Practice and Accounting Firms

| Job Title | Description | Key Skills | Potential Employers | Career Growth |

|---|---|---|---|---|

| Tax Consultant | Provides expert advice on tax planning, compliance, and legislation to individuals and businesses. | Tax law knowledge, analytical skills, client communication, regulatory compliance | Accounting firms, tax advisory firms, public practice firms | Progression to senior consultant or tax manager roles; specialization in corporate or international tax |

| Tax Auditor | Examines financial records to ensure accuracy and compliance with tax laws and regulations. | Attention to detail, auditing standards, tax regulations, investigative skills | Public accounting firms, government tax agencies, consulting firms | Advancement to audit manager, senior auditor, or tax compliance specialist |

| Tax Compliance Analyst | Responsible for preparing and reviewing tax returns, ensuring adherence to local and international tax laws. | Tax preparation, data analysis, regulatory knowledge, time management | Accounting firms, corporate finance departments, tax consultancy firms | Opportunities to become compliance manager or tax director |

| Transfer Pricing Specialist | Focuses on setting and documenting pricing strategies for transactions between related business entities across different tax jurisdictions. | Transfer pricing regulations, economic analysis, negotiation, documentation skills | Multinational accounting firms, consulting agencies, tax advisory groups | Growth to senior transfer pricing consultant or advisory roles in international taxation |

| Tax Associate | Assists senior tax professionals with research, preparation of tax returns, and client communication in public practice. | Tax research, communication, organization, proficiency in tax software | Accounting firms, tax advisory services, public practice firms | Pathway to become tax consultant or tax manager |

Government and Regulatory Jobs for Taxation Graduates

What government and regulatory jobs are ideal for Taxation graduates? Taxation undergraduates can pursue careers as Tax Analysts, ensuring compliance with tax codes and regulations. Regulatory bodies also hire Taxation graduates as Tax Auditors to review financial documents and enforce tax laws.

Corporate Taxation Roles in the Private Sector

Graduates with a degree in Taxation have strong career prospects in corporate taxation within the private sector. These roles involve managing tax compliance, planning, and strategy for businesses to optimize their tax obligations.

Corporate tax analysts, tax compliance officers, and tax consultants are common positions available to Taxation undergraduates. Professionals in these roles ensure companies adhere to tax laws while minimizing liabilities through effective planning. Expertise in corporate tax codes, financial reporting, and regulatory frameworks is essential for success in this field.

Emerging Careers in Tax Technology and Compliance

Taxation undergraduates are increasingly finding opportunities in the evolving field of tax technology and compliance. These emerging careers combine expertise in tax law with advanced technological skills to enhance regulatory adherence and data management.

- Tax Technology Specialist - Develops and implements software solutions to automate tax processes and improve accuracy.

- Compliance Analyst - Ensures corporate adherence to tax regulations using data analytics and risk assessment tools.

- Digital Tax Consultant - Advises businesses on integrating digital tax systems and leveraging AI for efficient tax reporting.

Expertise in both taxation principles and technology tools is essential for success in these innovative career paths.

Professional Growth and Certification Pathways

Taxation undergraduates have a wealth of career opportunities within accounting firms, government agencies, and corporate finance departments. Roles such as tax analyst, compliance officer, and tax consultant offer specialized paths for professional growth.

Certification pathways like CPA (Certified Public Accountant), EA (Enrolled Agent), and CMA (Certified Management Accountant) enhance credibility and open doors to higher-level positions. Continuous professional development in tax law changes and financial regulations is essential for career advancement.

jobsintra.com

jobsintra.com