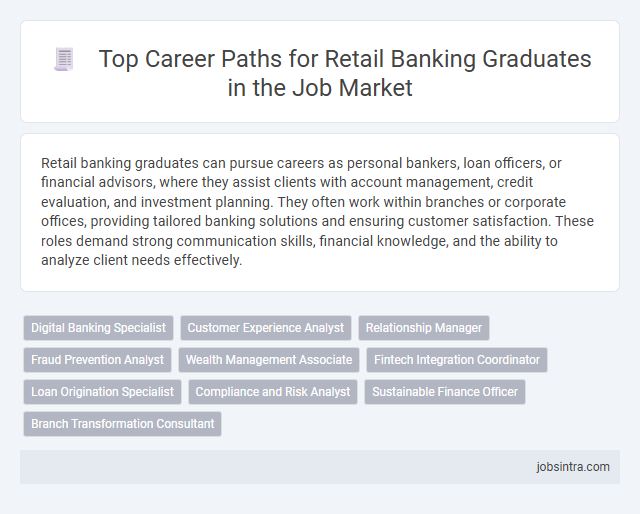

Retail banking graduates can pursue careers as personal bankers, loan officers, or financial advisors, where they assist clients with account management, credit evaluation, and investment planning. They often work within branches or corporate offices, providing tailored banking solutions and ensuring customer satisfaction. These roles demand strong communication skills, financial knowledge, and the ability to analyze client needs effectively.

Digital Banking Specialist

Retail Banking graduates can pursue careers as Digital Banking Specialists, focusing on enhancing customer experiences through innovative digital platforms. They utilize data analytics and technology to optimize online banking services, ensuring seamless and secure transactions for clients. This role requires a strong understanding of digital tools, customer behavior, and financial regulations to drive the bank's digital transformation initiatives.

Customer Experience Analyst

A Customer Experience Analyst in retail banking evaluates and enhances client interactions to improve satisfaction and loyalty. You analyze customer feedback, identify pain points, and collaborate with teams to implement data-driven solutions that streamline banking services. This role is essential for driving customer-centric strategies and boosting overall business performance.

Relationship Manager

Relationship Managers in retail banking play a crucial role in building and maintaining strong connections between the bank and its customers by offering personalized financial advice and tailored product solutions. You can leverage your skills to manage client portfolios, identify opportunities for cross-selling, and ensure customer satisfaction through effective communication and problem-solving. This position demands strong interpersonal abilities and a deep understanding of banking products to drive customer loyalty and business growth.

Fraud Prevention Analyst

Fraud Prevention Analysts in retail banking specialize in detecting and mitigating fraudulent activities to protect financial assets and customer information. They analyze transaction patterns, use data analytics tools, and collaborate with compliance teams to identify suspicious behavior early. Their role is critical in maintaining trust and security within the banking environment.

Wealth Management Associate

Wealth Management Associates in retail banking play a crucial role in managing client portfolios and providing personalized financial advice to high-net-worth individuals. They analyze market trends, assess risk factors, and recommend investment opportunities to help clients achieve their financial goals. This position requires strong analytical skills, client relationship management, and knowledge of various financial products and services.

Fintech Integration Coordinator

A Fintech Integration Coordinator in retail banking manages the seamless incorporation of fintech solutions into traditional banking systems, enhancing digital service offerings. Your role involves collaborating with cross-functional teams to optimize technology adoption for improved customer experiences and operational efficiency. This position requires strong project management skills and an understanding of both banking operations and emerging financial technologies.

Loan Origination Specialist

A Loan Origination Specialist plays a crucial role in retail banking by assessing and processing loan applications efficiently. You will evaluate creditworthiness, verify documentation, and ensure compliance with banking regulations to facilitate smooth loan approval. This position offers a pathway to develop expertise in lending practices and customer financial assessment.

Compliance and Risk Analyst

Retail banking graduates pursuing careers as Compliance and Risk Analysts play a crucial role in ensuring financial institutions adhere to regulatory standards and mitigate potential risks. They conduct thorough assessments of banking operations, identify vulnerabilities, and implement policies to prevent fraud and financial crimes. Expertise in regulatory frameworks and risk management strategies enables these analysts to safeguard the bank's integrity and promote a secure banking environment.

Sustainable Finance Officer

A Sustainable Finance Officer in retail banking plays a crucial role in aligning financial products with environmental, social, and governance (ESG) criteria to promote responsible investment. You will analyze and develop sustainable lending practices, ensuring that the bank's portfolio supports green projects and ethical business models. This position requires expertise in evaluating the long-term impact of financing decisions to drive positive change while maintaining profitability.

Good to know: jobs for Retail Banking graduates

Overview of Retail Banking Careers

Retail banking offers a variety of career opportunities for graduates, including roles in customer service, sales, and financial advisory. These positions focus on managing personal accounts, providing tailored financial solutions, and supporting daily banking operations.

Careers in retail banking often start with roles such as relationship managers, loan officers, or branch assistants. These jobs develop skills in communication, sales, and financial product knowledge. Your growth potential includes advancing to senior management, product development, or risk management roles within the banking sector.

Essential Skills for Retail Banking Graduates

| Job Title | Role Description | Essential Skills |

|---|---|---|

| Retail Banking Advisor | Provide personalized financial guidance to customers, manage accounts and recommend appropriate banking products. | Customer Service, Communication, Financial Product Knowledge, Sales Techniques, Problem Solving |

| Credit Analyst | Assess the creditworthiness of loan applicants, analyze financial data and prepare credit reports. | Analytical Thinking, Attention to Detail, Risk Assessment, Financial Analysis, Decision Making |

| Branch Operations Manager | Oversee daily branch functions, ensure compliance with banking regulations and manage staff performance. | Leadership, Organizational Skills, Regulatory Compliance, Staff Management, Operational Efficiency |

| Loan Officer | Evaluate and authorize loan applications, explain loan options to customers and manage loan processing. | Financial Acumen, Communication, Negotiation, Customer Relationship Management, Attention to Detail |

| Customer Service Representative | Assist customers with inquiries, resolve issues and provide product information to enhance customer satisfaction. | Interpersonal Skills, Problem Solving, Product Knowledge, Patience, Empathy |

| Financial Sales Consultant | Promote retail banking products, identify customer needs and achieve sales targets. | Sales Skills, Market Analysis, Communication, Customer Needs Assessment, Negotiation |

Popular Entry-Level Roles in Retail Banking

Retail banking graduates have a variety of popular entry-level roles that help build a foundation in financial services. These positions offer hands-on experience with customer interactions and financial products.

Common entry-level jobs include bank teller, personal banking advisor, and customer service representative. These roles focus on assisting clients with transactions, account setup, and financial guidance.

Advancement Opportunities in Retail Banking

Graduates in retail banking have diverse career paths that offer substantial growth and specialization opportunities. Retail banking careers emphasize customer service, financial advisory, and operational management roles.

- Relationship Manager - Builds and maintains client accounts, providing personalized banking solutions to enhance customer loyalty.

- Credit Analyst - Evaluates creditworthiness of retail clients to support lending decisions and mitigate financial risks.

- Branch Manager - Oversees branch operations, drives sales targets, and mentors staff to improve service delivery and operational efficiency.

Advancement in retail banking often involves moving from entry-level roles to management and specialist positions through experience and continued education.

Specialized Areas within Retail Banking

Retail Banking graduates have diverse career opportunities in specialized areas that focus on customer service, financial products, and risk management. These specialized roles leverage analytical skills and banking knowledge to drive customer satisfaction and operational efficiency.

- Personal Banking Advisor - Provides tailored financial advice and solutions to individual customers to meet their banking needs.

- Credit Analyst - Assesses the creditworthiness of retail customers and manages loan approvals and risk evaluations.

- Branch Operations Manager - Oversees daily branch activities ensuring compliance, efficient service delivery, and team management.

Emerging Trends Impacting Retail Banking Careers

Retail banking graduates have opportunities in roles such as financial analysts, customer relationship managers, and digital banking specialists. The sector values skills in data analytics, customer experience management, and fintech innovation.

Emerging trends like artificial intelligence, blockchain, and personalized banking are reshaping retail banking careers. Your ability to adapt to technology-driven changes will be crucial for long-term success in this dynamic field.

Tips for Securing a Retail Banking Job

Retail banking graduates can pursue roles such as personal bankers, loan officers, customer service representatives, and branch managers. Developing strong communication skills, gaining internships, and obtaining relevant certifications like the Certified Retail Banker (CRB) enhance job prospects. Networking within financial institutions and showcasing problem-solving abilities during interviews are critical tips for securing a retail banking job.

jobsintra.com

jobsintra.com