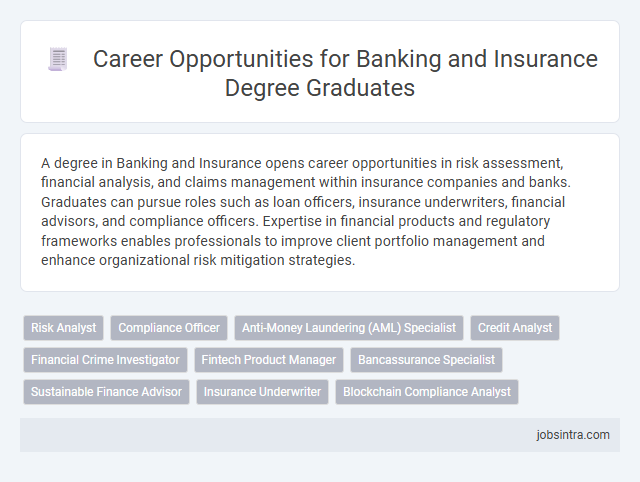

A degree in Banking and Insurance opens career opportunities in risk assessment, financial analysis, and claims management within insurance companies and banks. Graduates can pursue roles such as loan officers, insurance underwriters, financial advisors, and compliance officers. Expertise in financial products and regulatory frameworks enables professionals to improve client portfolio management and enhance organizational risk mitigation strategies.

Risk Analyst

A Risk Analyst in the banking and insurance sectors evaluates financial risks to help organizations minimize potential losses and ensure regulatory compliance. They use statistical models and data analysis to identify, assess, and mitigate risks related to credit, market fluctuations, and operational processes. This role is crucial for maintaining financial stability and supporting strategic decision-making within financial institutions.

Compliance Officer

A Compliance Officer in banking and insurance ensures that your organization adheres to legal standards and internal policies to minimize risks and avoid penalties. Proficiency in regulatory frameworks, risk management, and ethical practices is essential to effectively monitor and implement compliance programs. This role demands strong analytical skills and attention to detail to protect your company's integrity and maintain trust with clients and regulators.

Anti-Money Laundering (AML) Specialist

An Anti-Money Laundering (AML) Specialist plays a crucial role in detecting and preventing financial crimes within banking and insurance sectors. Your expertise helps ensure compliance with regulatory requirements by analyzing transactions and identifying suspicious activities. This position offers a dynamic career path focused on safeguarding institutions from financial fraud and maintaining integrity in financial operations.

Credit Analyst

A Credit Analyst evaluates the creditworthiness of individuals or businesses by analyzing financial data, credit reports, and market trends to minimize lending risks. This role requires strong analytical skills, attention to detail, and a solid understanding of financial statements and risk assessment techniques. Graduates with a Banking and Insurance degree are well-prepared for this position due to their knowledge of financial principles, risk management, and regulatory frameworks.

Financial Crime Investigator

A Banking and Insurance degree equips you with the skills to become a Financial Crime Investigator, a role focused on detecting and preventing fraud, money laundering, and other financial offenses. This job involves analyzing complex financial data, conducting thorough investigations, and collaborating with law enforcement agencies to protect institutions and clients from financial threats. Pursuing this career path leverages your expertise in risk assessment and regulatory compliance within the financial sector.

Fintech Product Manager

A Banking and Insurance degree opens the door to a dynamic career as a Fintech Product Manager, where expertise in financial services and technology drives innovative product development. This role involves overseeing the lifecycle of digital financial products, collaborating with cross-functional teams to align solutions with customer needs and regulatory standards. Strong analytical skills and knowledge of FinTech trends empower professionals to optimize user experience while ensuring secure and compliant financial transactions.

Bancassurance Specialist

A Bancassurance Specialist bridges the gap between banking and insurance sectors by promoting insurance products within bank channels, maximizing cross-selling opportunities. This role requires deep knowledge of both financial products and customer relationship management to tailor solutions that meet diverse client needs. Expertise in regulatory compliance and market analysis enhances their ability to drive business growth and customer satisfaction.

Sustainable Finance Advisor

Sustainable Finance Advisors play a crucial role in guiding financial institutions to invest in environmentally and socially responsible projects. They assess the sustainability risks and opportunities associated with various financial products, ensuring compliance with evolving regulations and helping to create long-term value. This career blends expertise in banking, insurance, and sustainability principles to drive impactful investment strategies.

Insurance Underwriter

Insurance underwriters assess risks and determine appropriate premiums for insurance policies by analyzing applicant information and market trends. They collaborate with agents, review applications, and ensure compliance with regulatory guidelines to optimize profitability and minimize losses for insurance companies. Proficiency in data analysis, decision-making, and risk management is crucial for success in this role.

Good to know: jobs for Banking and Insurance degree

Overview of Banking and Insurance Degrees

What career opportunities are available for graduates with a Banking and Insurance degree? Careers in banking and insurance offer roles such as financial analyst, risk manager, and insurance underwriter. These positions demand strong analytical skills and knowledge of financial regulations to manage assets and assess risks effectively.

How does a Banking and Insurance degree prepare students for the job market? This degree provides comprehensive education in financial services, risk assessment, and regulatory frameworks. Graduates gain expertise in managing financial products and navigating the dynamic landscape of banking and insurance sectors.

Which industries actively seek professionals with a Banking and Insurance background? Key industries include commercial banks, insurance companies, investment firms, and credit institutions. These sectors capitalize on graduates' skills to optimize financial operations and ensure compliance with industry standards.

Essential Skills Acquired by Graduates

Graduates with a Banking and Insurance degree acquire essential skills that prepare them for diverse roles in the commerce sector. These skills include financial analysis, risk assessment, and customer relationship management.

Jobs available include financial analyst, insurance underwriter, and risk management specialist. You develop strong analytical thinking, problem-solving abilities, and communication skills. These competencies enable success in dynamic banking and insurance environments.

Core Career Paths in Banking

A Banking and Insurance degree opens doors to diverse career opportunities in the financial sector. Core career paths in banking focus on roles that leverage your analytical and customer service skills.

- Credit Analyst - Evaluates loan applications and assesses credit risks to support lending decisions.

- Relationship Manager - Manages client portfolios and builds long-term banking relationships to enhance customer satisfaction.

- Risk Management Specialist - Identifies and mitigates financial risks to protect the bank's assets and comply with regulations.

Diverse Roles in the Insurance Sector

A Banking and Insurance degree opens diverse career opportunities in the insurance sector, including roles such as underwriter, claims adjuster, and risk analyst. Professionals in underwriting assess risk and determine policy terms, while claims adjusters handle claims verification and settlement processes. Risk analysts focus on evaluating financial risks to develop strategies that minimize losses for insurance companies.

Emerging Trends and New Opportunities

A Banking and Insurance degree opens doors to diverse job roles such as risk analyst, financial advisor, insurance underwriter, and compliance officer. Emerging trends in fintech, digital insurance, and blockchain technology are reshaping career opportunities in this sector.

New roles focus on data analytics, cyber risk management, and customer-centric financial solutions. Your expertise in these areas will position you at the forefront of innovation and growth within the banking and insurance industries.

Professional Certifications and Growth

| Job Role | Professional Certifications | Career Growth |

|---|---|---|

| Financial Analyst | Certified Financial Analyst (CFA), Financial Risk Manager (FRM), Chartered Market Technician (CMT) | Entry-level to Senior Analyst, Portfolio Manager, Chief Investment Officer |

| Insurance Underwriter | Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (AU), Associate in Personal Insurance (API) | Junior Underwriter, Senior Underwriter, Underwriting Manager, Risk Manager |

| Bank Relationship Manager | Certified Treasury Professional (CTP), Certified Bank Auditor (CBA), Project Management Professional (PMP) | Relationship Manager, Branch Manager, Regional Manager, Banking Director |

| Risk Manager | Certified Risk Manager (CRM), Financial Risk Manager (FRM), Professional Risk Manager (PRM) | Risk Analyst, Risk Manager, Chief Risk Officer, Compliance Head |

| Insurance Claims Adjuster | Associate in Claims (AIC), Certified Insurance Counselor (CIC) | Claims Adjuster, Senior Claims Adjuster, Claims Manager, Director of Claims |

| Compliance Officer | Certified Regulatory Compliance Manager (CRCM), Certified Anti-Money Laundering Specialist (CAMS) | Compliance Analyst, Compliance Officer, Head of Compliance, Chief Compliance Officer |

| Investment Banker | Chartered Financial Analyst (CFA), Certified Investment Banking Professional (CIBPTM) | Analyst, Associate, Vice President, Managing Director |

| Actuarial Analyst | Associate of the Society of Actuaries (ASA), Fellow of the Society of Actuaries (FSA) | Actuarial Analyst, Senior Actuarial Analyst, Actuary, Chief Actuary |

| Credit Analyst | Chartered Financial Analyst (CFA), Certified Credit Risk Analyst (CCRA) | Credit Analyst, Senior Credit Analyst, Credit Manager, Credit Director |

| Personal Financial Advisor | Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC) | Financial Advisor, Senior Financial Advisor, Wealth Manager, Advisory Director |

Tips for Launching a Successful Career

Graduates with a Banking and Insurance degree have diverse career options, including roles in risk management, financial analysis, and underwriting. High-demand positions also include claims adjusters, credit analysts, and insurance sales agents.

Networking with industry professionals and gaining certifications like Chartered Financial Analyst (CFA) or Certified Insurance Counselor (CIC) can enhance job prospects. Developing strong analytical skills and staying updated on regulatory changes are crucial for long-term success.

jobsintra.com

jobsintra.com