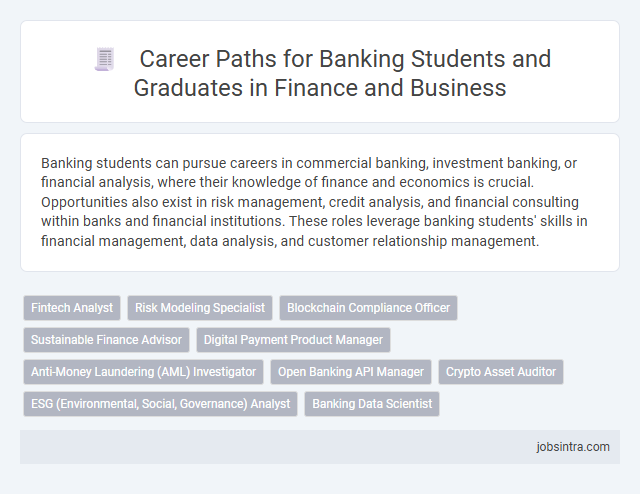

Banking students can pursue careers in commercial banking, investment banking, or financial analysis, where their knowledge of finance and economics is crucial. Opportunities also exist in risk management, credit analysis, and financial consulting within banks and financial institutions. These roles leverage banking students' skills in financial management, data analysis, and customer relationship management.

Fintech Analyst

A Fintech Analyst monitors and evaluates emerging financial technologies to help banks innovate and stay competitive. Your role involves analyzing market trends, assessing technological solutions, and advising on digital transformation strategies. This position combines finance expertise with technology insight, making it ideal for banking students interested in the intersection of finance and innovation.

Risk Modeling Specialist

Risk Modeling Specialists analyze financial data to assess and predict potential risks for banking institutions. They develop quantitative models that help banks manage credit, market, and operational risks effectively. Expertise in statistical software, financial theory, and regulatory requirements is essential for success in this role.

Blockchain Compliance Officer

A Blockchain Compliance Officer ensures that blockchain technologies and digital assets comply with regulatory standards and legal requirements. You play a critical role in monitoring transactions, assessing risks, and implementing policies to prevent fraud and maintain data integrity within the banking sector. This job combines expertise in financial regulations with advanced knowledge of blockchain systems to safeguard your organization's operations.

Sustainable Finance Advisor

A Sustainable Finance Advisor helps banks develop and implement strategies that support environmental, social, and governance (ESG) goals while ensuring financial returns. You assess risks and opportunities related to sustainability, guiding investment decisions to promote long-term economic and ecological benefits. This role combines financial expertise with a commitment to responsible banking practices.

Digital Payment Product Manager

Digital Payment Product Managers in banking oversee the development and implementation of innovative payment solutions, ensuring seamless user experience and security. They analyze market trends and customer needs to design digital products that streamline transactions, promote financial inclusion, and enhance operational efficiency. Your expertise can drive the transformation of traditional banking services into cutting-edge digital platforms, meeting the growing demand for fast, reliable payment systems.

Anti-Money Laundering (AML) Investigator

An Anti-Money Laundering (AML) Investigator plays a crucial role in banking by identifying and preventing financial crimes linked to money laundering activities. Your responsibilities include analyzing suspicious transactions, ensuring compliance with regulatory requirements, and collaborating with law enforcement agencies to protect the financial system's integrity. This career path offers dynamic opportunities for banking students interested in risk management, forensic accounting, and legal compliance.

Open Banking API Manager

Open Banking API Managers play a crucial role in the financial sector by overseeing the integration and management of open banking APIs, enabling secure data sharing between banks and third-party providers. This position requires strong technical expertise, knowledge of banking regulations, and the ability to collaborate with IT and business teams to drive innovation in digital banking services. Your skills in managing API ecosystems can lead to improved customer experiences and new revenue streams within the banking industry.

Crypto Asset Auditor

A career as a Crypto Asset Auditor offers banking students a specialized role in verifying and analyzing digital assets and blockchain transactions to ensure compliance and security. You will apply accounting principles alongside knowledge of cryptocurrency markets to detect fraud, assess risk, and safeguard financial integrity within digital asset portfolios. This emerging job combines expertise in finance, technology, and regulatory frameworks, making it highly relevant for banking graduates interested in the future of digital finance.

ESG (Environmental, Social, Governance) Analyst

Banking students can leverage their financial expertise to become ESG (Environmental, Social, Governance) Analysts, where they evaluate companies' sustainability practices and ethical impact. Your role involves analyzing data on environmental performance, social responsibility, and governance policies to guide investment decisions that prioritize long-term value and risk management. This growing field offers opportunities to influence financial markets while promoting responsible business practices.

Good to know: jobs for Banking students

Overview of Career Opportunities in Banking and Finance

| Overview of Career Opportunities in Banking and Finance for Banking Students | |

|---|---|

| Career Path | Description |

| Investment Banking Analyst | Analyze market trends, assist with mergers and acquisitions, and support capital raising efforts for corporate clients. |

| Credit Analyst | Evaluate creditworthiness of individuals or companies to manage risk and approve loans. |

| Financial Planner | Advise clients on investment portfolios, retirement plans, and financial goals aligning with personal or business needs. |

| Risk Manager | Assess financial risks and develop strategies to minimize losses for banks and financial institutions. |

| Bank Branch Manager | Oversee daily operations, ensure compliance with regulations, and maintain customer relationships at branch level. |

| Compliance Officer | Monitor and enforce adherence to banking laws, regulatory standards, and internal policies. |

| Financial Analyst | Provide insights on investment decisions, budgeting, and financial forecasting based on data analysis. |

| Credit Officer | Process loan applications, verify documentation, and ensure credit terms meet organizational guidelines. |

| Relationship Manager | Manage and grow client portfolios, offering tailored financial products and services. |

| Audit and Compliance Specialist | Conduct internal audits and evaluate financial processes to ensure integrity and reduce risks. |

| These diverse roles offer you multiple avenues to build a rewarding career in banking and finance with strong growth potential. | |

Core Skills and Qualifications Required

Banking students have diverse career opportunities in sectors like retail banking, investment banking, and financial analysis. Core skills and qualifications are essential to excel in these roles and meet industry standards.

- Analytical Skills - Ability to interpret complex financial data and market trends is crucial for roles like financial analyst and risk manager.

- Communication Skills - Clear and effective communication helps in client relationship management and internal team coordination.

- Educational Qualifications - A degree in banking, finance, or commerce, often supplemented with certifications like CFA or CPA, enhances job prospects.

Entry-Level Roles for Recent Graduates

Banking students have a wide range of entry-level roles available in the finance industry. Common positions include financial analyst, credit analyst, and banking associate, which provide valuable hands-on experience.

These roles develop your understanding of financial markets, risk assessment, and customer service. Starting in entry-level jobs helps build a strong foundation for a successful banking career.

Specialized Banking and Finance Positions

What specialized banking and finance positions are ideal for banking students? Banking students can pursue roles such as financial analysts, credit risk managers, and investment banking associates. These positions require strong analytical skills and deep knowledge of financial markets and instruments.

Which jobs focus on risk management within the banking sector? Careers like compliance officers, internal auditors, and risk assessment specialists are critical in managing financial and regulatory risks. Banking students with expertise in risk management can ensure institutional stability and regulatory adherence.

What opportunities exist in asset management for banking graduates? Asset managers, portfolio analysts, and wealth management advisors play key roles in optimizing client investment portfolios. Banking students trained in asset allocation and market trends excel in these positions.

How can banking students enter the field of corporate finance? Corporate finance analysts, treasury analysts, and mergers and acquisitions consultants are common roles. These careers involve budgeting, financial planning, and strategic investment decisions to support corporate growth.

What are the roles in retail banking suitable for banking students? Positions such as branch managers, loan officers, and customer relationship managers are essential in retail banking operations. Banking students gain practical experience managing client accounts and financial products in this sector.

Career Progression and Advancement Paths

Banking students have diverse career opportunities in financial institutions, corporate finance, and investment sectors. They benefit from structured career progression and numerous advancement paths within the industry.

- Financial Analyst - An entry-level role focused on analyzing financial data to support banking decisions and client advisory.

- Credit Manager - Mid-level position responsible for assessing credit risk and managing loan portfolios to ensure financial stability.

- Branch Manager - Senior role overseeing branch operations, driving sales targets, and managing customer relationships for business growth.

Industry Certifications and Professional Development

Banking students can pursue various job roles such as financial analyst, credit officer, and risk management specialist. Industry certifications like CFA, CPA, and FRM enhance employability and deepen financial expertise.

Professional development through workshops and internships sharpens practical skills and industry knowledge. Your career growth benefits significantly from certifications and continued learning in banking trends and regulations.

Emerging Trends and Future Outlook in Banking Careers

Banking students are increasingly exploring diverse career paths driven by innovation and technology integration. Emerging trends in the banking sector shape future opportunities for dynamic roles.

- Data Analyst - Specializes in interpreting complex financial data to support risk assessment and decision-making processes.

- Fintech Specialist - Focuses on developing and implementing technology solutions that modernize banking operations and customer experiences.

- Compliance Officer - Ensures adherence to regulations and mitigates financial crimes within evolving legal frameworks.

The future outlook for banking careers emphasizes digital proficiency, regulatory knowledge, and adaptability to technological advancements.

jobsintra.com

jobsintra.com