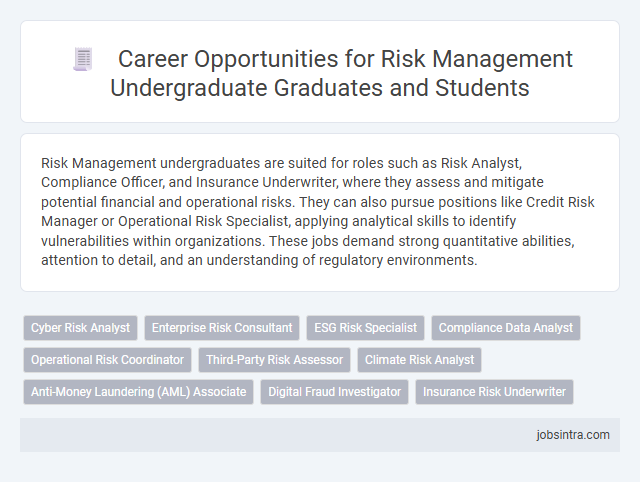

Risk Management undergraduates are suited for roles such as Risk Analyst, Compliance Officer, and Insurance Underwriter, where they assess and mitigate potential financial and operational risks. They can also pursue positions like Credit Risk Manager or Operational Risk Specialist, applying analytical skills to identify vulnerabilities within organizations. These jobs demand strong quantitative abilities, attention to detail, and an understanding of regulatory environments.

Cyber Risk Analyst

Cyber Risk Analysts specialize in identifying, assessing, and mitigating risks associated with information technology and cybersecurity threats. They analyze data to detect vulnerabilities and develop strategies to protect an organization's digital assets. Their expertise is critical in preventing cyberattacks and ensuring compliance with cybersecurity regulations.

Enterprise Risk Consultant

Enterprise Risk Consultants analyze potential risks that could impact an organization's operations and develop strategic plans to mitigate them. They collaborate with various departments to identify vulnerabilities, assess financial and operational risks, and ensure compliance with regulatory requirements. These professionals often work in industries such as finance, insurance, and consulting, leveraging their expertise to protect and enhance business resilience.

ESG Risk Specialist

ESG Risk Specialists analyze environmental, social, and governance factors to identify potential risks that could impact your organization's sustainability and compliance. They develop strategies to mitigate ESG-related risks while ensuring adherence to regulatory standards and stakeholder expectations. This role requires strong analytical skills, knowledge of ESG frameworks, and the ability to integrate risk management practices into corporate decision-making.

Compliance Data Analyst

A Compliance Data Analyst in Risk Management plays a crucial role in identifying and mitigating regulatory risks by analyzing data to ensure adherence to laws and internal policies. They utilize advanced data analytics tools to monitor compliance trends, detect anomalies, and support decision-making processes that protect the organization from legal and financial penalties. Strong skills in data interpretation, regulatory standards, and risk assessment are essential for success in this role.

Operational Risk Coordinator

An Operational Risk Coordinator plays a crucial role in identifying, assessing, and mitigating risks within an organization's daily operations. You will analyze potential vulnerabilities, develop risk management strategies, and ensure compliance with regulatory requirements to protect company assets. This position is ideal for Risk Management undergraduates seeking to apply their skills in risk assessment and operational efficiency in a dynamic corporate environment.

Third-Party Risk Assessor

Third-Party Risk Assessors evaluate and manage risks associated with external vendors and partners to ensure compliance and protect organizational interests. They conduct thorough assessments, monitor third-party performance, and implement risk mitigation strategies. Proficiency in risk analysis, regulatory standards, and communication skills is essential for success in this role.

Climate Risk Analyst

Climate Risk Analysts evaluate the impact of climate change on financial assets and business operations, using data models to predict risks associated with environmental factors. You will analyze regulatory requirements and help companies develop strategies to mitigate climate-related risks, ensuring compliance and sustainability. This role combines knowledge of risk management, environmental science, and finance to address evolving challenges in a changing climate.

Anti-Money Laundering (AML) Associate

An Anti-Money Laundering (AML) Associate plays a crucial role in identifying and preventing financial crimes by analyzing suspicious transactions and ensuring compliance with regulatory requirements. Your skills in risk assessment, data analysis, and regulatory knowledge are essential for investigating potential money laundering activities and reporting findings to authorities. Career opportunities for AML Associates are available in banks, financial institutions, and regulatory agencies focused on maintaining financial integrity.

Digital Fraud Investigator

Digital Fraud Investigators play a crucial role in identifying and preventing fraudulent activities across online platforms and financial systems. Utilizing advanced data analytics and cybersecurity tools, they analyze patterns, track suspicious behaviors, and implement strategies to protect organizations from digital threats. Your expertise in risk management equips you with the skills to detect vulnerabilities and enhance security protocols effectively.

Good to know: jobs for Risk Management undergraduate

Overview of Risk Management as a Career Path

Risk Management is a critical field in business, focusing on identifying, assessing, and mitigating potential threats to an organization's assets and earnings. Careers in Risk Management include roles such as Risk Analyst, Compliance Officer, and Risk Consultant, each responsible for different aspects of organizational safety and regulatory adherence. Your background as a Risk Management undergraduate equips you with analytical and problem-solving skills essential for protecting businesses from financial loss and operational disruptions.

Top Industries Hiring Risk Management Graduates

Risk Management graduates possess skills highly sought after in industries requiring strategic assessment and mitigation of financial, operational, and compliance risks. Top industries hiring these graduates include finance, insurance, healthcare, energy, and technology.

Finance companies demand expertise in credit risk, market risk, and regulatory compliance to safeguard assets and investments. Insurance firms seek professionals to evaluate underwriting risks, claims management, and policy compliance effectively.

Healthcare organizations rely on risk managers to handle patient safety, regulatory adherence, and operational risk. Energy sector employers prioritize graduates who can analyze environmental risks, safety protocols, and regulatory impacts on production.

Technology companies require risk management specialists to address cybersecurity threats, data privacy, and operational continuity. Your career in these diverse industries offers opportunities to prevent losses and ensure sustainable growth.

Entry-Level Job Roles for Risk Management Students

| Entry-Level Job Role | Job Description | Key Skills Required | Typical Employers | Average Starting Salary (USD) |

|---|---|---|---|---|

| Risk Analyst | Analyze financial and operational risks by collecting and interpreting data to support decision-making processes within organizations. | Data analysis, statistical software (Excel, SQL), risk assessment methodologies, problem-solving. | Financial institutions, consulting firms, insurance companies, corporate risk departments. | $55,000 - $70,000 |

| Compliance Assistant | Support the compliance team to ensure adherence to regulatory requirements and internal policies by conducting audits and monitoring activities. | Regulatory knowledge, attention to detail, communication skills, audit processes. | Banking sector, insurance firms, healthcare organizations, government agencies. | $50,000 - $65,000 |

| Credit Risk Associate | Evaluate creditworthiness of clients and counterparties, preparing risk reports and monitoring credit exposure. | Financial analysis, credit scoring models, communication, decision-making. | Banks, credit rating agencies, lending institutions. | $60,000 - $75,000 |

| Operational Risk Assistant | Assist in identifying and mitigating operational risks by reviewing business processes and reporting risk incidents. | Risk identification, process improvement, reporting skills, teamwork. | Manufacturing, logistics companies, financial services. | $50,000 - $65,000 |

| Insurance Underwriting Assistant | Support underwriting team by assessing risk factors related to insurance applications and compiling relevant data for risk evaluation. | Detail orientation, analytical skills, knowledge of insurance products, customer service. | Insurance companies, brokerage firms. | $48,000 - $60,000 |

| Risk Management Intern | Gain hands-on experience in risk identification, analysis, and mitigation under the guidance of senior risk managers. | Basic risk management concepts, communication, data entry, research. | Corporations, consulting firms, government agencies. | Stipend-based or entry-level salary |

Essential Skills for Success in Risk Management Careers

Risk Management undergraduates build essential skills that prepare them for diverse roles in finance, insurance, and corporate compliance. Key competencies include analytical thinking, problem-solving, and effective communication.

Successful risk management professionals excel in data analysis to identify potential threats and develop mitigation strategies. Proficiency in regulatory knowledge and risk assessment tools ensures compliance and minimizes organizational losses. Strong interpersonal skills facilitate collaboration across departments to implement risk control measures effectively.

Professional Certifications and Further Education

Risk Management undergraduates have diverse career opportunities in various industries, including finance, insurance, and consulting. Professional certifications and further education significantly enhance job prospects and expertise in this field.

- Certified Risk Manager (CRM) - A specialized credential focusing on identifying, analyzing, and mitigating risks within organizations.

- Financial Risk Manager (FRM) - Recognized globally, this certification emphasizes risk assessment in financial markets and institutions.

- Chartered Enterprise Risk Analyst (CERA) - Provides advanced knowledge in enterprise risk management integrating quantitative and strategic skills.

Pursuing a master's degree in risk management or finance deepens analytical skills and opens pathways to senior risk management roles.

Salary Expectations and Career Growth Potential

Risk Management undergraduates have diverse career opportunities in finance, insurance, and corporate sectors. Roles in this field offer competitive salary expectations and substantial potential for career growth.

- Risk Analyst - Entry-level positions typically start with salaries around $60,000, with growth linked to experience and certifications.

- Compliance Officer - Median salaries range from $70,000 to $90,000, reflecting the vital role of regulatory adherence in businesses.

- Risk Manager - Senior roles can command salaries exceeding $120,000, with leadership responsibilities driving career advancement.

Networking and Internship Opportunities in Risk Management

What career paths await Risk Management undergraduates in the business sector?

Risk Management graduates can pursue roles such as Risk Analyst, Compliance Officer, Insurance Underwriter, and Credit Risk Manager. These positions demand strong analytical skills and a deep understanding of financial regulations.

How important is networking for building a successful career in Risk Management?

Networking connects you with industry professionals, mentors, and potential employers in Risk Management. Attending conferences, joining professional associations like the Risk Management Society (RIMS), and participating in online forums can significantly enhance job prospects.

What internship opportunities should Risk Management undergraduates seek to gain practical experience?

Internships at financial institutions, consulting firms, insurance companies, and corporate risk departments offer hands-on exposure. These internships build expertise in risk assessment, compliance procedures, and data analysis, preparing you for full-time roles.

How do internship experiences support future job opportunities in Risk Management?

Internships provide real-world application of classroom knowledge and help develop a professional network. Employers often view internship experience as a key factor when hiring new Risk Management professionals.

What strategies can maximize your networking and internship experience in the Risk Management field?

Engage actively with industry organizations, seek mentorship, and tailor internship applications to companies specializing in credit, market, or operational risk. Leveraging these experiences demonstrates commitment and practical skills to prospective employers.

jobsintra.com

jobsintra.com