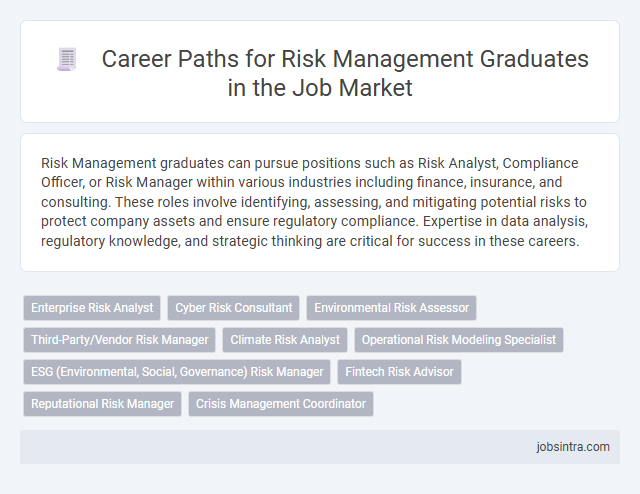

Risk Management graduates can pursue positions such as Risk Analyst, Compliance Officer, or Risk Manager within various industries including finance, insurance, and consulting. These roles involve identifying, assessing, and mitigating potential risks to protect company assets and ensure regulatory compliance. Expertise in data analysis, regulatory knowledge, and strategic thinking are critical for success in these careers.

Enterprise Risk Analyst

Enterprise Risk Analysts play a crucial role in identifying, assessing, and mitigating risks that could impact an organization's financial health and operational efficiency. They utilize data analysis, risk assessment tools, and industry knowledge to recommend strategies that enhance decision-making and promote sustainable growth. These professionals are essential in helping businesses navigate uncertainties and comply with regulatory requirements.

Cyber Risk Consultant

Risk Management graduates can excel as Cyber Risk Consultants by identifying, assessing, and mitigating cyber threats to protect organizational assets. They analyze potential vulnerabilities in IT systems, develop comprehensive risk management strategies, and ensure compliance with cybersecurity regulations. Their expertise helps companies minimize financial loss and maintain business continuity in an increasingly digital landscape.

Environmental Risk Assessor

Environmental Risk Assessors evaluate potential hazards related to natural and man-made environmental factors, analyzing data to prevent harm to ecosystems and human health. They conduct risk assessments for industries such as construction, chemical manufacturing, and waste management to ensure compliance with environmental regulations. Proficiency in risk analysis, environmental science, and regulatory standards is essential for success in this role.

Third-Party/Vendor Risk Manager

Third-Party/Vendor Risk Managers play a critical role in assessing and mitigating risks associated with external suppliers and partners. They identify potential vulnerabilities in vendor relationships to protect your organization from financial, operational, and reputational harm. Expertise in compliance, contract management, and continuous monitoring is essential for success in this position.

Climate Risk Analyst

A career as a Climate Risk Analyst allows you to evaluate and mitigate the impacts of climate change on businesses and communities by analyzing environmental data and regulatory developments. This role involves assessing financial risks related to natural disasters, carbon emissions, and climate policies to inform strategic decisions. Employers across finance, insurance, and consulting sectors highly value these skills for building resilience against climate-related hazards.

Operational Risk Modeling Specialist

Risk Management graduates can excel as Operational Risk Modeling Specialists by analyzing and quantifying potential risks within business processes to minimize financial loss. They develop sophisticated models to predict operational failures and assess the impact of risk events on organizational performance. Expertise in data analysis, statistical techniques, and regulatory compliance is essential for success in this role.

ESG (Environmental, Social, Governance) Risk Manager

Risk Management graduates specializing in ESG risk management can pursue roles evaluating and mitigating environmental, social, and governance risks within organizations. These professionals develop strategies to ensure compliance with regulatory standards and promote sustainable business practices. They work closely with stakeholders to integrate ESG factors into risk assessment and corporate decision-making processes.

Fintech Risk Advisor

Fintech Risk Advisors specialize in identifying, assessing, and mitigating financial risks within technology-driven financial services. They develop risk frameworks and compliance strategies to protect digital assets and ensure regulatory adherence. Your expertise in risk management makes you a valuable asset for fintech companies aiming to secure innovations and maintain stakeholder trust.

Reputational Risk Manager

Risk Management graduates can pursue careers as Reputational Risk Managers, where they identify, assess, and mitigate risks that could damage an organization's public image and stakeholder trust. These professionals develop strategies to monitor brand reputation, manage crisis communication, and ensure compliance with ethical standards. Strong analytical skills and expertise in risk assessment tools are essential for effectively safeguarding corporate reputation.

Good to know: jobs for Risk Management graduates

Overview of Risk Management as a Career

Risk Management is a dynamic career that involves identifying, assessing, and prioritizing risks to minimize their impact on organizations. Graduates in this field apply analytical and strategic skills to safeguard assets and ensure business continuity.

- Risk Analyst - Evaluates potential financial, operational, and strategic risks affecting companies.

- Compliance Manager - Ensures organizations adhere to laws, regulations, and internal policies to mitigate legal risks.

- Insurance Risk Manager - Develops and implements insurance strategies to manage exposure to losses and liabilities.

Key Skills Required for Risk Management Roles

What key skills are essential for graduates pursuing jobs in Risk Management? Strong analytical abilities and proficiency in data interpretation help you identify potential risks effectively. Communication skills and decision-making under pressure are vital to implement risk mitigation strategies successfully.

Top Industries Hiring Risk Management Graduates

| Industry | Typical Job Roles | Key Skills Required |

|---|---|---|

| Financial Services | Risk Analyst, Credit Risk Manager, Operational Risk Advisor | Financial modeling, Regulatory knowledge, Data analysis |

| Insurance | Underwriting Analyst, Claims Risk Specialist, Actuarial Risk Manager | Risk assessment, Actuarial science, Claims processing |

| Healthcare | Healthcare Risk Manager, Compliance Officer, Patient Safety Analyst | Regulatory compliance, Health data analytics, Crisis management |

| Energy and Utilities | Environmental Risk Assessor, Safety Risk Manager, Project Risk Analyst | Environmental regulations, Safety protocols, Project management |

| Technology | Cyber Risk Analyst, IT Risk Manager, Data Protection Specialist | Cybersecurity, Data privacy laws, Risk mitigation strategies |

| Manufacturing | Supply Chain Risk Manager, Quality Control Analyst, Safety Compliance Officer | Supply chain risk, Quality assurance, Regulatory compliance |

| Government and Public Sector | Risk Policy Advisor, Disaster Recovery Specialist, Regulatory Risk Analyst | Policy analysis, Crisis response, Public safety regulations |

Your risk management degree opens doors in industries where assessing, mitigating, and managing uncertainty is vital for business success and sustainability.

Common Entry-Level Job Titles in Risk Management

Risk Management graduates often begin their careers in positions such as Risk Analyst, where they assess potential risks to company assets and recommend mitigation strategies. These roles require strong analytical skills and familiarity with financial regulations and compliance.

Other common entry-level job titles include Compliance Associate and Insurance Underwriter, both of which involve evaluating adherence to legal standards and analyzing risk exposure respectively. Professionals in these roles support decision-making processes to minimize financial losses and enhance organizational resilience.

Career Advancement Opportunities and Pathways

Risk Management graduates possess skills highly sought after across various industries. Career paths offer significant advancement opportunities through specialized roles and leadership positions.

- Risk Analyst - Entry-level role focusing on identifying and assessing potential risks to minimize business impact.

- Risk Manager - Mid-level position responsible for developing and implementing risk mitigation strategies.

- Chief Risk Officer (CRO) - Executive role overseeing enterprise-wide risk management policies and strategic planning.

Professional Certifications and Continuing Education

Risk Management graduates have diverse career opportunities in industries such as finance, insurance, and corporate governance. Roles include Risk Analyst, Compliance Officer, and Operational Risk Manager, leveraging specialized knowledge to mitigate potential threats.

Professional certifications like the Certified Risk Manager (CRM), Financial Risk Manager (FRM), and Project Management Professional (PMP) enhance employability and expertise. Continuing education through workshops, seminars, and advanced degrees ensures up-to-date skills aligned with industry standards and evolving regulations.

Future Trends and Job Outlook in Risk Management

Risk Management graduates have diverse career opportunities in finance, insurance, compliance, and consulting sectors. Emerging roles increasingly focus on cybersecurity risk, data analytics, and environmental risk assessment.

Growth in technology-driven risk management is reshaping traditional job functions, emphasizing the need for skills in artificial intelligence and big data interpretation. Companies prioritize professionals who can manage operational, financial, and reputational risks in a rapidly evolving global market. Job outlook predicts steady demand with the integration of risk management strategies into business continuity and sustainability initiatives.

jobsintra.com

jobsintra.com