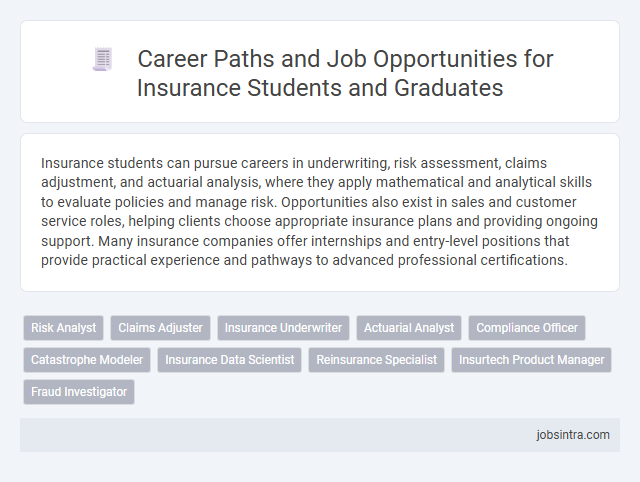

Insurance students can pursue careers in underwriting, risk assessment, claims adjustment, and actuarial analysis, where they apply mathematical and analytical skills to evaluate policies and manage risk. Opportunities also exist in sales and customer service roles, helping clients choose appropriate insurance plans and providing ongoing support. Many insurance companies offer internships and entry-level positions that provide practical experience and pathways to advanced professional certifications.

Risk Analyst

Risk Analysts assess potential financial risks for insurance companies by analyzing data and identifying trends to minimize losses. They develop risk management strategies and collaborate with underwriters to determine appropriate coverage options. Their work enhances decision-making processes and ensures regulatory compliance within the insurance sector.

Claims Adjuster

A Claims Adjuster plays a critical role in the insurance industry by evaluating policyholders' claims to determine the extent of the insurer's liability. You can expect to analyze damage assessments, review policy coverage, and negotiate settlements to ensure fair compensation. This job requires strong analytical skills, attention to detail, and effective communication to resolve claims efficiently.

Insurance Underwriter

Insurance underwriters evaluate risk by analyzing insurance applications and deciding the terms and coverage suitable for clients. They use statistical data and industry knowledge to determine appropriate premiums and ensure policies meet regulatory standards. This role requires strong analytical skills and attention to detail to balance profitability and client protection effectively.

Actuarial Analyst

Actuarial Analysts use mathematical skills to assess risk and financial stability within the insurance industry. You analyze data, create models, and provide insights that help insurance companies set premiums and manage policyholder risks effectively. This role is ideal for insurance students seeking to combine statistical knowledge with business strategy.

Compliance Officer

Compliance Officers in the insurance sector ensure companies adhere to regulatory requirements and internal policies, minimizing legal risks and protecting company reputation. They conduct audits, implement compliance programs, and provide training to staff on industry regulations. This role demands strong analytical skills, attention to detail, and a thorough understanding of insurance laws and standards.

Catastrophe Modeler

Catastrophe Modelers analyze the financial impact of natural disasters on insurance portfolios by simulating potential events such as hurricanes, earthquakes, and floods. They utilize advanced statistical techniques and specialized software to assess risks, helping insurance companies develop strategies for risk management and pricing. Proficiency in data analysis, programming, and a strong understanding of environmental science are essential skills for this role.

Insurance Data Scientist

Insurance Data Scientists play a vital role in analyzing complex data sets to identify risk patterns and predict future claims, helping companies optimize pricing and underwriting strategies. Your skills in statistical modeling and machine learning enable you to improve fraud detection and customer segmentation, driving more accurate decision-making. This career path combines deep industry knowledge with advanced analytics to enhance risk management and operational efficiency in insurance.

Reinsurance Specialist

Reinsurance specialists analyze and manage risks by helping insurance companies transfer portions of their risk portfolios to other insurers, ensuring financial stability and protection against large claims. They assess reinsurance contracts, negotiate terms, and monitor regulatory compliance to optimize risk management strategies. Strong analytical skills and an understanding of insurance principles are essential for a successful career in reinsurance specialization.

Insurtech Product Manager

An Insurtech Product Manager innovates at the intersection of insurance and technology, designing digital solutions that meet customer needs and enhance operational efficiency. You will leverage data analytics, user experience insights, and industry trends to develop products that disrupt traditional insurance models. This role demands a blend of technical expertise, business acumen, and a deep understanding of insurance policies and regulations.

Good to know: jobs for Insurance students

Overview of the Insurance Industry and Its Importance

The insurance industry is a vital sector that manages risk and provides financial protection to individuals and businesses. It offers diverse career opportunities for students specializing in insurance and risk management.

- Underwriting - Assessing risks and determining policy terms to ensure profitable coverage for clients and insurers.

- Claims Adjusting - Investigating and evaluating insurance claims to facilitate fair and timely settlements.

- Risk Management - Identifying and mitigating potential financial losses for organizations through strategic planning.

Careers in insurance enable students to contribute to economic stability and support personal and commercial security worldwide.

Key Career Paths Available for Insurance Graduates

What career paths can insurance graduates explore in the business world? Insurance students have diverse opportunities in underwriting, risk management, claims adjustment, and actuarial roles. These positions offer pathways to specialize in assessing risks, managing policies, and analyzing data for insurance companies.

How can insurance graduates contribute to corporate risk management? You can work as risk analysts or risk managers, helping businesses identify and mitigate potential risks. These roles involve strategic planning to safeguard company assets and ensure compliance with regulatory requirements.

What roles are available for insurance graduates in claims and customer service? Claims adjusters and claims examiners evaluate insurance claims to determine coverage and validity. Customer service representatives in insurance companies assist policyholders with inquiries and support, improving client satisfaction.

Are there technical positions suited for insurance graduates? Actuarial analysts utilize mathematics, statistics, and financial theory to assess risk and forecast future events. This career demands strong analytical skills and provides crucial insights for product development and pricing strategies.

What business development opportunities exist for insurance students? Graduates can pursue careers as insurance sales agents or brokers, promoting insurance policies and cultivating client relationships. These roles focus on expanding market reach and driving revenue growth within the insurance sector.

Essential Skills and Qualifications for Insurance Careers

Insurance careers offer a variety of roles such as underwriters, claims adjusters, risk analysts, and actuaries. These positions require a strong understanding of risk management, financial principles, and legal regulations.

Essential skills include analytical thinking, attention to detail, and effective communication. Qualifications often involve degrees in finance, economics, or specialized insurance certifications to enhance your career prospects.

Entry-Level Job Opportunities in Insurance

Entry-level job opportunities in insurance offer a strong foundation for students pursuing careers in risk management, underwriting, and claims analysis. These roles provide practical experience in evaluating policies and managing client relationships.

Positions such as insurance sales agents, claims adjusters, and underwriter trainees are common starting points for insurance students. These jobs help develop analytical skills and industry knowledge essential for career growth in the insurance sector.

Advanced Roles and Specialization Options

Insurance students have diverse career paths available in advanced roles that require specialized knowledge and skills. Specialization enhances your opportunities in complex areas of the insurance industry.

- Actuarial Analyst - Focuses on assessing financial risks using mathematics, statistics, and financial theory to study uncertain future events.

- Underwriting Manager - Oversees risk assessment processes and makes decisions regarding policy approval and pricing strategies.

- Claims Specialist - Manages the investigation, evaluation, and settlement of insurance claims, ensuring accuracy and compliance.

Professional Certifications and Continuing Education

| Job Role | Professional Certifications | Continuing Education Opportunities | Key Skills Developed |

|---|---|---|---|

| Insurance Underwriter |

Chartered Property Casualty Underwriter (CPCU) Associate in Commercial Underwriting (AU) |

Risk assessment workshops Industry-specific legal updates |

Risk evaluation Analytical thinking Attention to detail |

| Claims Adjuster |

Associate in Claims (AIC) Certified Insurance Claims Professional (CICP) |

Claims investigation seminars Ethics and compliance courses |

Negotiation Communication skills Conflict resolution |

| Risk Manager |

Certified Risk Manager (CRM) Associate in Risk Management (ARM) |

Enterprise risk management programs Regulatory requirements training |

Strategic planning Risk analysis Decision making |

| Insurance Sales Agent |

Life and Health Insurance License Certified Insurance Counselor (CIC) |

Sales techniques workshops Customer relationship management courses |

Persuasion Customer service Market knowledge |

| Actuarial Analyst |

Society of Actuaries (SOA) Exams Casualty Actuarial Society (CAS) Exams |

Advanced statistics Data modeling courses |

Quantitative analysis Problem solving Data interpretation |

| Insurance Auditor |

Certified Internal Auditor (CIA) Chartered Life Underwriter (CLU) |

Audit standards training Fraud detection workshops |

Analytical review Compliance knowledge Detail orientation |

Your insurance studies combined with these professional certifications and ongoing education will improve your employability and expertise in competitive roles across the insurance industry.

Industry Trends Impacting Insurance Careers

Insurance students can pursue careers as underwriters, claims adjusters, risk analysts, and insurance sales agents, roles that require strong analytical and communication skills. Emerging industry trends such as digital transformation, artificial intelligence, and data analytics are reshaping job responsibilities and creating demand for tech-savvy professionals. Sustainability and regulatory changes also influence career opportunities by emphasizing risk management and compliance expertise in the insurance sector.

jobsintra.com

jobsintra.com