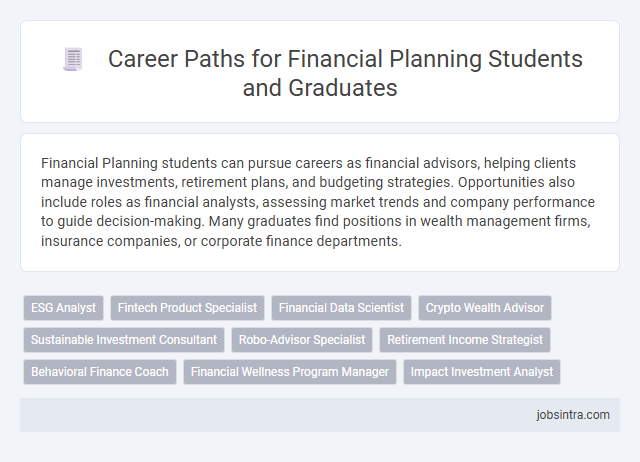

Financial Planning students can pursue careers as financial advisors, helping clients manage investments, retirement plans, and budgeting strategies. Opportunities also include roles as financial analysts, assessing market trends and company performance to guide decision-making. Many graduates find positions in wealth management firms, insurance companies, or corporate finance departments.

ESG Analyst

ESG Analyst roles offer Financial Planning students the opportunity to evaluate environmental, social, and governance factors influencing investment decisions. These professionals analyze company practices to guide sustainable investment strategies that align with long-term financial goals. Expertise in ESG metrics enhances financial planning by integrating ethical considerations with portfolio management.

Fintech Product Specialist

Financial Planning students can excel as Fintech Product Specialists by leveraging their knowledge of financial markets and consumer needs to develop innovative financial products. This role demands expertise in digital finance tools, product lifecycle management, and customer experience optimization. Mastery of data analysis and regulatory compliance further enhances their ability to create solutions that drive growth and improve financial accessibility.

Financial Data Scientist

Financial Planning students can excel as Financial Data Scientists by leveraging their analytical skills to interpret complex financial data and develop predictive models. This role involves transforming raw data into actionable insights that help organizations optimize investment strategies and manage risks effectively. Your knowledge of finance combined with data science techniques makes you a valuable asset in driving data-driven decision-making within financial institutions.

Crypto Wealth Advisor

Crypto Wealth Advisors specialize in managing digital asset portfolios, providing expert guidance on cryptocurrency investments and blockchain technologies. They analyze market trends, assess risk, and develop tailored strategies to help clients optimize their crypto wealth. This role requires strong financial planning skills combined with deep knowledge of emerging digital currencies and regulatory environments.

Sustainable Investment Consultant

Sustainable Investment Consultants specialize in guiding clients to invest in environmentally and socially responsible assets that align with their financial goals and ethical values. Your expertise in financial planning equips you to analyze sustainable funds, assess ESG (Environmental, Social, and Governance) criteria, and develop investment strategies that balance profitability with positive impact. This role is ideal for Financial Planning students passionate about creating long-term value while supporting sustainability initiatives.

Robo-Advisor Specialist

A Robo-Advisor Specialist leverages financial planning expertise to develop and manage automated investment platforms that provide personalized advice to clients. Your role involves analyzing algorithms, optimizing portfolio strategies, and ensuring seamless client experiences through technology-driven solutions. This position combines financial acumen with innovation, ideal for students aiming to integrate finance and technology in their careers.

Retirement Income Strategist

A Retirement Income Strategist specializes in creating tailored plans that ensure clients generate reliable income throughout their retirement years. This role involves analyzing financial resources, investment options, and spending needs to develop sustainable withdrawal strategies. Your expertise helps clients achieve financial security and peace of mind during their retirement.

Behavioral Finance Coach

A Behavioral Finance Coach helps clients understand how psychological biases impact their financial decisions, enabling better money management and investment choices. You can apply your knowledge of financial planning and human behavior to guide individuals or organizations toward more rational financial habits. This role bridges finance and psychology, offering a unique career path with growing demand in personal finance and wealth management sectors.

Financial Wellness Program Manager

Financial Planning students can excel as Financial Wellness Program Managers by designing and implementing initiatives that help employees achieve financial stability and literacy. They leverage expertise in budgeting, retirement planning, and debt management to create programs that improve overall financial health. This role requires strong communication skills and knowledge of financial products to effectively support diverse workforce needs.

Good to know: jobs for Financial Planning students

Introduction to Financial Planning Careers

Financial Planning students have a variety of career paths available in the business sector. These roles specialize in managing personal and corporate finances to achieve long-term goals.

Common careers include financial analyst, investment advisor, and wealth manager. Professionals in these roles analyze market trends, create investment strategies, and provide clients with tailored financial advice. Financial planning careers demand strong analytical skills, attention to detail, and excellent communication abilities.

Key Skills for Financial Planning Professionals

| Job Role | Key Skills |

|---|---|

| Financial Analyst | Data analysis, Forecasting, Risk assessment, Financial modeling |

| Investment Advisor | Market research, Client communication, Portfolio management, Regulatory knowledge |

| Financial Planner | Retirement planning, Tax strategies, Budgeting, Client relationship management |

| Risk Manager | Risk evaluation, Compliance, Analytical skills, Decision making |

| Wealth Manager | Asset allocation, Investment strategies, Client advisory, Financial analysis |

| Insurance Advisor | Product knowledge, Claims assessment, Customer service, Regulatory compliance |

| Tax Consultant | Tax law, Financial reporting, Strategic planning, Problem-solving |

Traditional Career Paths in Financial Planning

Financial Planning students often pursue traditional career paths such as Financial Advisor, where they help clients create strategies to manage their finances effectively. Another common role is Wealth Manager, focusing on asset management and investment planning for high-net-worth individuals. You can also consider becoming a Retirement Planner, specializing in preparing clients for long-term financial security after their careers end.

Emerging Roles in the Financial Planning Industry

What are the emerging career opportunities for Financial Planning students in today's dynamic market? The financial planning industry is evolving rapidly, creating new roles that blend technology and personalized advisory services. Students can explore positions such as FinTech analysts, sustainable investment advisors, and data-driven financial strategists.

Certifications and Educational Requirements

Financial Planning students have diverse career paths available, each requiring specific certifications and educational qualifications. Understanding these requirements can help you meet industry standards and excel in your chosen role.

- Certified Financial Planner (CFP) Certification - Essential for most financial planning roles, requiring a bachelor's degree and completion of CFP Board coursework.

- Chartered Financial Analyst (CFA) Designation - Highly valued in investment management, demanding passing three exam levels and a relevant degree or work experience.

- Educational Requirements - A bachelor's degree in finance, economics, or business is typically required, with many positions preferring a master's for advancement.

Meeting certification and educational standards significantly enhances your employability in the financial planning industry.

Industry Sectors and Work Environments

Financial Planning students have diverse career opportunities across various industry sectors and work environments. Your skills align well with roles that demand analytical expertise and client-focused financial strategies.

- Banking Sector - Roles in retail, commercial, or investment banking involve advising clients on financial products and wealth management.

- Insurance Industry - Jobs include risk assessment, policy planning, and financial consultation for individual and corporate clients.

- Corporate Finance Departments - Positions focus on budgeting, forecasting, and managing company financial strategies and investments.

Tips for Advancing in a Financial Planning Career

Financial Planning students can pursue roles such as Financial Analyst, Investment Advisor, or Wealth Manager. Gaining certifications like CFP or CFA enhances credibility and job prospects in these positions. Building strong analytical skills and networking within the finance industry accelerates career advancement.

jobsintra.com

jobsintra.com