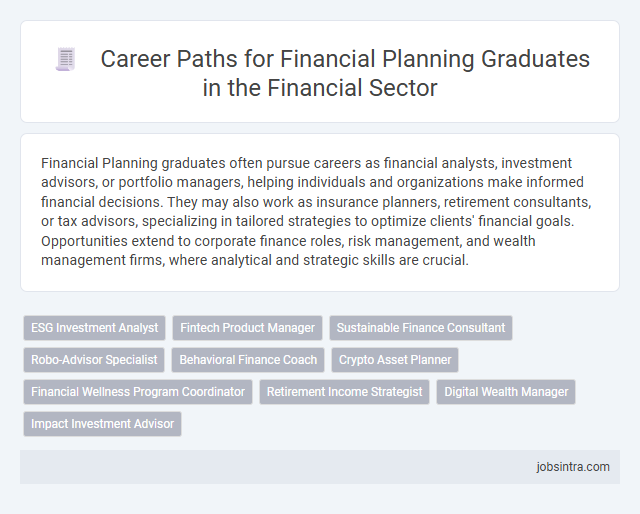

Financial Planning graduates often pursue careers as financial analysts, investment advisors, or portfolio managers, helping individuals and organizations make informed financial decisions. They may also work as insurance planners, retirement consultants, or tax advisors, specializing in tailored strategies to optimize clients' financial goals. Opportunities extend to corporate finance roles, risk management, and wealth management firms, where analytical and strategic skills are crucial.

ESG Investment Analyst

Financial Planning graduates can pursue a career as an ESG Investment Analyst, specializing in evaluating environmental, social, and governance factors to guide sustainable investment decisions. This role involves analyzing corporate responsibility data and integrating ethical considerations into financial strategies to maximize long-term value. Your expertise in financial planning combined with ESG insight helps drive impactful investment choices that align with clients' values and market trends.

Fintech Product Manager

Financial Planning graduates pursuing a career as a Fintech Product Manager leverage their expertise in financial analysis and market trends to design innovative financial products that meet evolving consumer needs. They coordinate cross-functional teams to develop user-centric solutions, optimize product performance, and ensure compliance with regulatory standards. This role demands strong analytical skills, a deep understanding of financial technologies, and the ability to translate complex financial concepts into practical applications.

Sustainable Finance Consultant

Sustainable Finance Consultants help organizations integrate environmental, social, and governance (ESG) factors into their financial strategies, promoting long-term value creation. Your expertise in financial planning allows you to guide investments toward sustainable projects that balance economic returns with positive social impact. This role requires strong analytical skills and a deep understanding of sustainable development principles.

Robo-Advisor Specialist

Financial Planning graduates can excel as Robo-Advisor Specialists by leveraging their expertise in automated investment platforms to design, implement, and optimize digital financial advice tools. They analyze client data to customize algorithm-driven portfolios, ensuring personalized and efficient investment strategies. Their role bridges technology and client-centric financial planning, enhancing accessibility and scalability of advisory services.

Behavioral Finance Coach

A Behavioral Finance Coach helps clients understand and improve their financial decision-making by addressing psychological biases and emotional influences. This role combines expertise in financial planning with insights from behavioral economics to design personalized strategies that promote better saving, investing, and spending habits. Graduates can leverage their knowledge to guide individuals and organizations toward achieving long-term financial wellness through informed, rational choices.

Crypto Asset Planner

A Crypto Asset Planner helps clients manage and optimize their cryptocurrency investments alongside traditional financial portfolios, ensuring a balanced approach to wealth growth. Your expertise in blockchain technology and market trends enables strategic advice on digital assets, tax implications, and security measures. This role requires strong analytical skills and a deep understanding of financial regulations to navigate the evolving crypto landscape effectively.

Financial Wellness Program Coordinator

Financial Planning graduates can thrive as Financial Wellness Program Coordinators by designing and implementing initiatives that promote employees' financial literacy and well-being. These professionals assess financial needs, develop educational resources, and collaborate with organizations to enhance financial health and reduce stress among workers. Expertise in budgeting, retirement planning, and investment strategies is essential for creating impactful programs that empower participants to make informed financial decisions.

Retirement Income Strategist

Retirement Income Strategists specialize in developing personalized financial plans that ensure clients have a stable and sustainable income throughout retirement. They analyze investment portfolios, Social Security benefits, and pension options to create tailored withdrawal strategies. These professionals often work with financial advisory firms, retirement planning agencies, and wealth management companies.

Digital Wealth Manager

A Digital Wealth Manager leverages technology to provide personalized financial advice and portfolio management through online platforms. This role requires strong analytical skills and a deep understanding of digital tools to optimize investment strategies and enhance client experiences. Your expertise in financial planning makes you well-suited to guide clients toward achieving their long-term financial goals efficiently in a rapidly evolving digital landscape.

Good to know: jobs for Financial Planning graduates

Overview of the Financial Sector and Its Opportunities

| Job Role | Description | Key Skills | Sector Opportunities |

|---|---|---|---|

| Financial Analyst | Analyzes financial data, prepares reports, and provides investment recommendations. | Data analysis, forecasting, Excel, financial modeling | Strong demand in banking, investment firms, and corporate finance departments |

| Financial Planner | Develops personalized financial plans to help clients meet long-term financial goals. | Client advisory, risk assessment, retirement planning, tax strategies | Growing opportunities in wealth management and independent advisory firms |

| Investment Analyst | Evaluates securities, market trends, and economic data to guide investment decisions. | Market research, portfolio management, statistical analysis | High demand in asset management, hedge funds, and mutual funds |

| Risk Manager | Identifies and mitigates financial risks for organizations. | Risk assessment, compliance, financial regulations, data analytics | Key role in banking, insurance, and corporate risk departments |

| Compliance Officer | Ensures organizational adherence to financial laws, regulations, and policies. | Regulatory knowledge, auditing, communication, ethical standards | Increasing opportunities due to stricter financial regulations worldwide |

| Corporate Finance Analyst | Supports corporate budgeting, capital raising, and financial strategy implementation. | Financial modeling, budgeting, valuation, strategic planning | Essential function in large corporations and private equity firms |

| Financial Consultant | Advises businesses or individuals on financial planning and investment strategies. | Client relationship management, analytical skills, investment knowledge | Expanding roles in consulting firms and financial advisory services |

Core Skills Required for Financial Planning Graduates

Financial Planning graduates are well-positioned for careers in wealth management, corporate finance, and retirement planning. Strong analytical skills and attention to detail are critical for success in these roles.

- Analytical Thinking - Enables the assessment of complex financial data to create effective strategies.

- Communication Skills - Essential for explaining financial concepts clearly to clients and stakeholders.

- Regulatory Knowledge - Ensures compliance with financial laws and ethical standards.

Your career opportunities expand significantly by mastering these core skills.

Entry-Level Roles for Financial Planning Graduates

Financial Planning graduates have a strong foundation for various entry-level roles in the finance sector. Positions such as Financial Analyst, Junior Financial Advisor, and Budget Analyst are popular starting points.

These roles involve evaluating financial data, assisting in investment planning, and helping clients meet their financial goals. You can expect to develop skills in risk assessment, portfolio management, and client communication.

Advancement and Specialization Opportunities

Financial Planning graduates have a diverse range of job opportunities in sectors such as banking, insurance, wealth management, and corporate finance. Roles often include financial analyst, investment advisor, risk manager, and retirement planner.

Advancement opportunities typically arise through gaining certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst), which enhance credibility and specialization. Graduates can specialize in areas such as tax planning, estate planning, or asset management to increase their market value. Leadership roles such as financial manager or director of financial planning become accessible with experience and further education.

Professional Certifications and Ongoing Education

Financial Planning graduates can pursue careers such as financial analysts, investment advisors, and wealth managers. Obtaining professional certifications like CFP(r) (Certified Financial Planner) and CFA(r) (Chartered Financial Analyst) enhances job prospects and credibility.

Ongoing education through workshops, seminars, and specialized courses ensures up-to-date knowledge of market trends and regulatory changes. Your commitment to continuous learning supports career advancement and expert status in the financial planning industry.

Emerging Trends Impacting Financial Planning Careers

Financial Planning graduates are increasingly finding opportunities in sustainable investing, leveraging expertise to guide clients toward socially responsible portfolios. The rise of fintech innovations, such as robo-advisors and AI-driven analytics, is reshaping traditional advisory roles and creating demand for tech-savvy planners. Careers in personalized wealth management are expanding as clients seek customized financial strategies supported by advanced data tools and behavioral finance insights.

Tips for Navigating and Succeeding in Financial Sector Careers

Graduates in Financial Planning can pursue roles such as financial analyst, investment advisor, portfolio manager, and risk assessor. Success in the financial sector requires strong analytical skills, continuous education on market trends, and effective communication with clients. Building a professional network and gaining relevant certifications like CFP can significantly enhance career prospects and credibility.

jobsintra.com

jobsintra.com