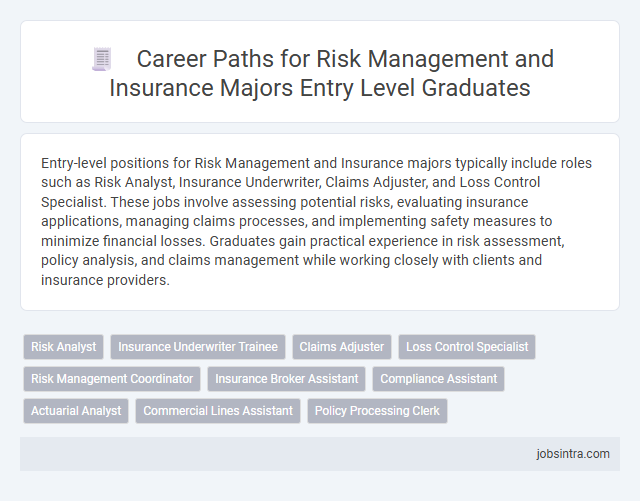

Entry-level positions for Risk Management and Insurance majors typically include roles such as Risk Analyst, Insurance Underwriter, Claims Adjuster, and Loss Control Specialist. These jobs involve assessing potential risks, evaluating insurance applications, managing claims processes, and implementing safety measures to minimize financial losses. Graduates gain practical experience in risk assessment, policy analysis, and claims management while working closely with clients and insurance providers.

Risk Analyst

Risk Analyst roles for Risk Management and Insurance majors involve assessing potential risks that could affect an organization's financial health. These entry-level positions require strong analytical skills to evaluate data, identify vulnerabilities, and recommend mitigation strategies. Proficiency in risk assessment tools and knowledge of industry regulations enhance effectiveness in safeguarding company assets.

Insurance Underwriter Trainee

Insurance Underwriter Trainees assess risk factors and determine policy terms for individuals and businesses, applying analytical skills to evaluate applications accurately. They collaborate with agents and actuaries to gather necessary information and learn to balance risk and profitability. This entry-level role provides a strong foundation in underwriting principles and risk assessment techniques essential for career growth in insurance.

Claims Adjuster

A Claims Adjuster evaluates insurance claims to determine the extent of the insurer's liability, ensuring fair settlements for policyholders. This role requires strong analytical skills and attention to detail to investigate damages and verify coverage eligibility. You can begin your career by working with insurance companies, third-party claims administrators, or government agencies handling property, casualty, or health insurance claims.

Loss Control Specialist

A Loss Control Specialist identifies potential risks and develops strategies to minimize losses for businesses and insurance companies. You will analyze safety protocols and inspect properties to ensure compliance with regulations, helping reduce claims and improve workplace safety. This entry-level role offers hands-on experience in risk assessment and mitigation, vital for a career in risk management and insurance.

Risk Management Coordinator

Risk Management Coordinator roles for entry-level candidates typically involve identifying and assessing potential risks to an organization's assets and operations. These professionals assist in developing risk mitigation strategies, managing insurance policies, and ensuring compliance with regulatory requirements. They work closely with various departments to implement risk control measures and support claim management processes.

Insurance Broker Assistant

Insurance Broker Assistants support insurance brokers by managing client records, processing policy documents, and providing administrative assistance. You will develop strong communication and organizational skills while gaining valuable industry knowledge that can lead to advanced roles in risk management and insurance. This entry-level position serves as a foundational step toward a successful career in the insurance sector.

Compliance Assistant

Compliance Assistants play a critical role in monitoring and ensuring that companies adhere to industry regulations and internal policies, making them ideal entry-level positions for Risk Management and Insurance majors. You will analyze documentation, support audits, and assist in identifying potential compliance risks to help maintain organizational integrity. Gaining experience in this role builds a strong foundation for advancing within regulatory affairs and risk management careers.

Actuarial Analyst

Entry-level Actuarial Analysts in Risk Management and Insurance evaluate statistical data to assess financial risks and support decision-making processes. They use mathematical models to predict future events such as claims, policyholder behavior, and market trends, helping companies set premiums and reserves accurately. Strong analytical skills and proficiency in tools like Excel, SQL, and actuarial software are essential in this role.

Commercial Lines Assistant

Commercial Lines Assistants support insurance agents by managing policy documentation, processing claims, and maintaining client records in the risk management and insurance sector. They assist with underwriting tasks, ensuring accurate data entry and compliance with company standards to reduce exposure to potential losses. This entry-level role provides a foundation in commercial insurance operations, preparing individuals for advanced positions in risk assessment and policy management.

Good to know: jobs for Risk Management and Insurance majors entry level

Overview of Careers in Risk Management and Insurance

Entry-level careers in Risk Management and Insurance include roles such as Risk Analyst, Insurance Underwriter, and Claims Adjuster. These positions involve assessing risks, evaluating insurance applications, and managing claims processes to minimize financial losses. Graduates gain experience in risk assessment, regulatory compliance, and insurance policy analysis, providing a strong foundation for advancement in the field.

Core Skills for Entry-Level Professionals

Risk Management and Insurance majors have a variety of entry-level job opportunities that emphasize analytical and decision-making skills. Core skills such as risk assessment, communication, and regulatory knowledge are essential for success in these roles.

- Risk Analyst - Evaluates potential risks and helps develop strategies to minimize financial losses for organizations.

- Insurance Underwriter - Assesses insurance applications to decide coverage terms, focusing on risk evaluation and policy compliance.

- Claims Adjuster - Investigates insurance claims to determine the extent of liability and ensures accurate claim settlements.

Top Entry-Level Job Roles for Graduates

Graduates with a degree in Risk Management and Insurance have access to a variety of entry-level job roles that build foundational skills in assessing and mitigating risks. Common positions include Risk Analyst, Insurance Underwriter, Claims Adjuster, and Compliance Specialist.

These roles provide hands-on experience in evaluating financial exposures, underwriting policies, and managing claims processes. Your expertise in risk assessment can lead to opportunities in corporate risk departments, insurance firms, and consulting agencies.

Career Advancement Opportunities

Entry-level jobs for Risk Management and Insurance majors include roles such as Risk Analyst, Insurance Underwriter, Claims Adjuster, and Loss Control Specialist. These positions provide foundational experience in assessing and mitigating risk across various industries.

Career advancement opportunities often lead to positions like Risk Manager, Insurance Broker, Underwriting Manager, and Compliance Officer. Professionals can enhance their expertise by obtaining certifications such as CRM (Certified Risk Manager) or CPCU (Chartered Property Casualty Underwriter) to accelerate growth.

Key Industries Employing Risk Management and Insurance Majors

| Job Title | Description | Key Industry | Required Skills |

|---|---|---|---|

| Risk Analyst | Identify and assess risks that could impact business operations and recommend risk mitigation strategies. | Financial Services, Banking, Insurance | Analytical Thinking, Data Analysis, Risk Assessment |

| Insurance Underwriter | Evaluate insurance applications and determine coverage terms and premiums based on risk evaluation. | Insurance Companies, Reinsurance Firms | Decision Making, Attention to Detail, Industry Knowledge |

| Claims Adjuster | Investigate insurance claims, assess damages, and negotiate settlements with policyholders. | Insurance, Healthcare, Automotive Industry | Investigation, Communication, Negotiation |

| Risk Management Consultant | Provide organizations with strategies to reduce operational and financial risks. | Consulting Firms, Manufacturing, Energy, Healthcare | Consulting, Risk Analysis, Problem Solving |

| Compliance Specialist | Ensure organizations adhere to regulatory requirements concerning risk and insurance policies. | Banking, Financial Institutions, Insurance | Regulatory Knowledge, Attention to Detail, Communication |

| Loss Control Specialist | Analyze workplace conditions to minimize safety hazards and reduce insurance claims. | Manufacturing, Construction, Insurance | Safety Knowledge, Risk Assessment, Reporting |

| Commercial Insurance Broker | Advise businesses on appropriate insurance policies to manage risk exposure effectively. | Insurance Brokerage, Real Estate, Commercial Trades | Sales, Client Relations, Industry Expertise |

Certifications and Professional Development

What entry-level jobs are available for Risk Management and Insurance majors? Common roles include Risk Analyst, Insurance Underwriter, and Claims Adjuster. These positions provide foundational experience in evaluating and managing financial risks.

How important are certifications for advancing in Risk Management and Insurance careers? Certifications such as the Associate in Risk Management (ARM) and Chartered Property Casualty Underwriter (CPCU) significantly enhance your professional credibility. These credentials demonstrate expertise and commitment to the field.

Which professional development opportunities best support newcomers to Risk Management and Insurance? Workshops, seminars, and industry conferences offer valuable knowledge and networking prospects. These experiences help build skills relevant to evolving risks and insurance products.

What skills do employers seek in entry-level Risk Management and Insurance candidates? Analytical thinking, attention to detail, and familiarity with regulatory standards are critical. Candidates with ongoing education and certifications stand out in competitive job markets.

How can you maximize your career growth in Risk Management and Insurance? Pursuing continuous education, such as obtaining Certified Risk Manager (CRM) or Licensed Insurance Agent credentials, enhances job prospects. Professional development aligns your expertise with industry demands and technological advancements.

Emerging Trends Impacting Job Prospects

Entry-level jobs for Risk Management and Insurance majors include risk analyst, underwriting assistant, and claims adjuster. Emerging trends such as the rise of cyber risk, the integration of data analytics, and changes in regulatory compliance are reshaping job prospects in this field. Professionals with skills in technology, data interpretation, and cybersecurity are increasingly in demand.

jobsintra.com

jobsintra.com