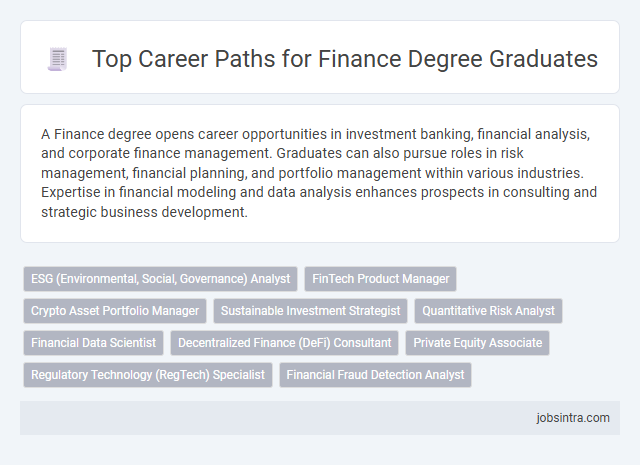

A Finance degree opens career opportunities in investment banking, financial analysis, and corporate finance management. Graduates can also pursue roles in risk management, financial planning, and portfolio management within various industries. Expertise in financial modeling and data analysis enhances prospects in consulting and strategic business development.

ESG (Environmental, Social, Governance) Analyst

Finance graduates can excel as ESG Analysts by evaluating companies' environmental, social, and governance practices to guide sustainable investment decisions. This role involves analyzing financial data alongside non-financial factors to assess risks and opportunities that impact long-term value. Your expertise in finance combined with ESG knowledge positions you to influence responsible investing and corporate accountability.

FinTech Product Manager

A Finance degree equips candidates with essential skills for a FinTech Product Manager role, including financial analysis, risk assessment, and technology integration. This position demands expertise in developing innovative financial products that meet market demands and regulatory standards. Strong knowledge of finance principles paired with project management abilities enables effective collaboration with cross-functional teams to deliver user-centric solutions.

Crypto Asset Portfolio Manager

A Crypto Asset Portfolio Manager specializes in overseeing and strategizing investments within digital currencies and blockchain-based assets. They analyze market trends, assess risk, and optimize portfolio performance to maximize returns in the volatile crypto environment. This role requires strong financial acumen, knowledge of blockchain technology, and expertise in asset allocation and risk management.

Sustainable Investment Strategist

Sustainable Investment Strategists analyze environmental, social, and governance (ESG) factors to create ethical portfolios aimed at long-term financial performance and positive societal impact. They research market trends and assess risks to guide investment decisions that align with sustainability goals. Your expertise in finance combined with a commitment to responsible investing positions you to influence capital allocation toward greener, more equitable opportunities.

Quantitative Risk Analyst

A Finance degree opens the door to careers such as a Quantitative Risk Analyst, where you apply mathematical models to assess financial risks and improve decision-making. This role involves analyzing complex data sets to identify potential threats to investments and developing strategies to mitigate those risks. Your expertise in finance and quantitative methods drives effective risk management and supports organizational stability.

Financial Data Scientist

A Finance degree equips graduates with the analytical skills necessary to become a Financial Data Scientist, a role that involves interpreting complex financial datasets to guide investment strategies and risk management. This position combines expertise in finance, statistics, and data science to develop predictive models and optimize financial decision-making. Proficiency in programming languages like Python or R and knowledge of machine learning techniques are essential for success in this data-driven career.

Decentralized Finance (DeFi) Consultant

A career as a Decentralized Finance (DeFi) Consultant leverages expertise in blockchain technology and financial systems to advise companies on integrating DeFi solutions. This role involves analyzing smart contracts, assessing risks, and designing decentralized protocols that optimize transparency and efficiency. Your skills in finance and technology position you to drive innovation in this rapidly growing sector.

Private Equity Associate

Private Equity Associates analyze investment opportunities, conduct financial modeling, and support deal execution to help firms acquire and manage portfolio companies. They play a critical role in due diligence, market research, and financial analysis to maximize returns on investments. Strong analytical skills and a deep understanding of financial markets are essential for success in this role.

Regulatory Technology (RegTech) Specialist

A Finance degree opens doors to careers like Regulatory Technology (RegTech) Specialist, where professionals leverage technology to ensure compliance with financial regulations. This role involves designing and implementing software solutions that monitor regulatory changes and automate compliance processes. Expertise in finance, risk management, and technology is key to driving innovation and reducing regulatory risks in financial institutions.

Good to know: jobs for Finance degree

Introduction to Careers in Finance

| Job Title | Job Description | Key Skills | Typical Employers |

|---|---|---|---|

| Financial Analyst | Analyze financial data, forecast business performance, and provide investment recommendations to drive financial decisions. | Data analysis, financial modeling, forecasting, Excel | Investment firms, banks, corporations, government agencies |

| Investment Banker | Assist companies with capital raising, mergers, and acquisitions by providing strategic financial advice and structuring deals. | Negotiation, financial analysis, market research, communication | Investment banks, financial advisory firms |

| Financial Planner | Develop personalized financial plans to help clients achieve their long-term financial goals, including retirement and investments. | Client relationship management, financial planning, risk assessment | Financial advisory companies, banks, insurance firms |

| Risk Manager | Identify, analyze, and mitigate financial risks to protect company assets and ensure regulatory compliance. | Risk assessment, quantitative analysis, regulatory knowledge | Corporations, banks, insurance companies |

| Corporate Treasurer | Manage company's cash flow, investment activities, and financial strategies to maintain liquidity and optimize capital structure. | Cash management, strategic planning, financial reporting | Large corporations, multinational companies |

| Credit Analyst | Evaluate creditworthiness of individuals or companies to help lenders make informed credit decisions. | Financial statement analysis, risk evaluation, attention to detail | Banks, credit rating agencies, lending institutions |

| Budget Analyst | Assess organizational budgets, monitor spending, and recommend budget adjustments to ensure fiscal responsibility. | Budgeting, analytical skills, financial reporting | Government agencies, corporations, nonprofits |

| Financial Auditor | Review financial records and statements for accuracy and compliance with regulations and accounting standards. | Attention to detail, accounting knowledge, auditing standards | Accounting firms, internal audit departments, regulatory bodies |

| Portfolio Manager | Oversee investment portfolios, allocate assets, and implement strategies to maximize returns and control risks. | Investment analysis, strategic planning, client management | Asset management firms, mutual funds, pension funds |

| Financial Consultant | Advise businesses or individuals on financial planning, investment strategies, and risk management to optimize financial outcomes. | Financial expertise, communication, problem solving | Consulting firms, financial services companies |

| Your finance degree opens pathways to diverse careers emphasizing analytical, quantitative, and strategic skills required in today's financial markets and corporate environments. | |||

Investment Banking Opportunities

Finance degree graduates often pursue careers in investment banking, where they analyze financial data and advise clients on mergers, acquisitions, and capital raising. Key roles include financial analyst, associate, and investment banker, each requiring strong quantitative skills and market knowledge. Investment banking opportunities provide high earning potential and expose professionals to large-scale financial transactions and strategic decision-making.

Corporate Finance Roles

What career opportunities are available with a Finance degree in Corporate Finance? Corporate Finance roles focus on managing a company's financial activities, including budgeting, forecasting, and investment analysis. You can pursue positions such as financial analyst, treasury analyst, or corporate finance manager.

Financial Planning and Analysis

A Finance degree with a focus on Financial Planning and Analysis opens the door to diverse career opportunities in the business sector. Your analytical skills and financial expertise are highly valued in roles that drive strategic decision-making.

- Financial Analyst - Evaluates financial data to support budgeting, forecasting, and investment decisions.

- FP&A Manager - Oversees financial planning processes to guide company growth and profitability.

- Budget Analyst - Develops and monitors budgets to ensure efficient use of resources and cost control.

Careers in Asset and Wealth Management

A Finance degree opens diverse career paths in asset and wealth management, including roles such as portfolio manager, financial analyst, and wealth advisor. These jobs focus on maximizing client investments and managing financial risks to ensure growth and stability.

Your expertise in financial markets, investment strategies, and client relationship management is essential for success in this field. Asset managers handle investment portfolios for institutions, while wealth managers cater to high-net-worth individuals. Strong analytical skills and knowledge of regulatory environments enhance your ability to deliver tailored financial solutions.

Risk Management and Compliance Paths

A Finance degree with a focus on Risk Management and Compliance opens pathways to specialized roles such as Risk Analyst, Compliance Officer, and Regulatory Consultant. These positions require expertise in identifying, assessing, and mitigating financial risks while ensuring adherence to industry regulations.

You can pursue careers in financial institutions, consulting firms, or corporate risk departments where proactive risk assessment and regulatory compliance are critical. Strong analytical skills and knowledge of legal frameworks enhance your ability to protect organizations from financial and operational threats.

Emerging Roles in FinTech and Data Analytics

A Finance degree opens doors to a variety of career paths, especially in innovative sectors like FinTech and Data Analytics. Emerging roles in these fields combine finance expertise with technology and data skills.

- FinTech Product Manager - Oversees the development and implementation of financial technology products to enhance user experience and efficiency.

- Data Analyst in Finance - Analyzes complex financial data to support decision-making and identify trends in markets and consumer behavior.

- Blockchain Specialist - Develops and manages blockchain solutions to improve transaction security and transparency in financial services.

Your finance background can be a key advantage in pursuing careers that integrate technology with financial strategy.

jobsintra.com

jobsintra.com