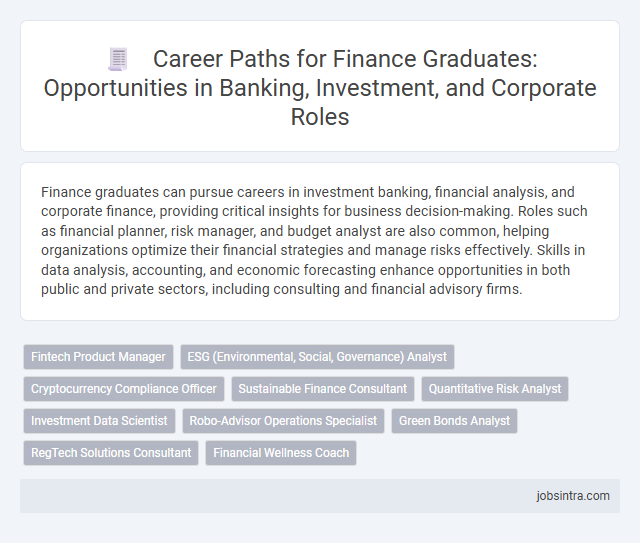

Finance graduates can pursue careers in investment banking, financial analysis, and corporate finance, providing critical insights for business decision-making. Roles such as financial planner, risk manager, and budget analyst are also common, helping organizations optimize their financial strategies and manage risks effectively. Skills in data analysis, accounting, and economic forecasting enhance opportunities in both public and private sectors, including consulting and financial advisory firms.

Fintech Product Manager

Finance graduates can excel as Fintech Product Managers by leveraging their strong understanding of financial markets and technology trends to develop innovative digital financial products. This role involves managing product lifecycles, collaborating with cross-functional teams, and ensuring solutions meet regulatory standards while addressing consumer needs. Fintech Product Managers drive growth by integrating cutting-edge technologies such as AI, blockchain, and data analytics into user-centric financial services.

ESG (Environmental, Social, Governance) Analyst

Finance graduates pursuing a career as an ESG (Environmental, Social, Governance) Analyst assess corporate sustainability practices and evaluate risks related to environmental impact, social responsibility, and governance standards. They analyze data to help investors make responsible decisions while promoting ethical business practices that drive long-term value. This role combines financial expertise with a commitment to sustainable development, making it essential in today's socially conscious investment landscape.

Cryptocurrency Compliance Officer

A Cryptocurrency Compliance Officer ensures that blockchain and digital currency transactions adhere to legal regulations and industry standards, mitigating risks related to money laundering and fraud. Your expertise in finance and regulatory frameworks is essential for developing and implementing policies that protect organizations in the fast-evolving crypto market. This role offers a dynamic career path at the intersection of finance, technology, and law.

Sustainable Finance Consultant

Sustainable Finance Consultants specialize in integrating environmental, social, and governance (ESG) criteria into financial strategies to promote responsible investment and long-term value creation. They analyze the impact of financial decisions on sustainability goals, helping companies manage risks related to climate change and social responsibility. These professionals collaborate with stakeholders to develop sustainable investment portfolios and ensure compliance with evolving regulatory frameworks.

Quantitative Risk Analyst

Quantitative Risk Analysts apply advanced mathematical models and statistical techniques to assess and manage financial risks in banking, investment, and insurance sectors. They analyze market, credit, and operational risks to develop strategies that optimize portfolio performance while minimizing potential losses. Expertise in programming languages such as Python and R, alongside strong analytical skills, is essential for success in this role.

Investment Data Scientist

Finance graduates with analytical skills can pursue careers as Investment Data Scientists, where they analyze vast datasets to identify market trends and investment opportunities. Expertise in machine learning, statistical modeling, and financial theory enables these professionals to develop algorithms that optimize portfolio performance and risk management. Their role bridges finance and technology, driving data-driven decisions in asset management firms and hedge funds.

Robo-Advisor Operations Specialist

Finance graduates can excel as Robo-Advisor Operations Specialists by managing and optimizing automated investment platforms that deliver personalized financial advice. This role involves analyzing algorithms, monitoring system performance, and ensuring compliance with regulatory standards to enhance client experience. Expertise in financial markets and technology integration is essential for maintaining efficient, user-friendly robo-advisory services.

Green Bonds Analyst

Green Bonds Analysts specialize in evaluating and managing investments in environmentally sustainable projects funded by green bonds. This role involves assessing the financial viability and environmental impact of green bond issuances, ensuring that funds are allocated toward projects that meet strict ecological standards. Your expertise helps bridge finance and sustainability, driving growth in the green economy while generating positive environmental outcomes.

RegTech Solutions Consultant

Finance graduates can excel as RegTech Solutions Consultants by leveraging their understanding of financial regulations and technology to help companies comply efficiently. This role involves analyzing regulatory requirements, implementing software solutions, and ensuring real-time compliance monitoring. Your expertise bridges finance and technology, making you invaluable in navigating complex regulatory landscapes and reducing operational risks.

Good to know: jobs for Finance graduates

Overview of Finance Career Pathways

What career opportunities are available for finance graduates? Finance graduates can pursue roles in investment banking, financial analysis, and corporate finance management. These positions require strong analytical skills and an understanding of market trends.

Which sectors offer the most job prospects for finance professionals? Key sectors include banking, insurance, asset management, and financial consulting. Each sector provides diverse roles such as risk management, portfolio analysis, and financial planning.

How can finance graduates advance in their careers? Gaining certifications like CFA or CPA enhances job prospects and earning potential. Practical experience through internships or entry-level positions is crucial for career growth.

Banking Sector Opportunities for Finance Graduates

| Job Title | Role Description | Key Skills | Career Growth |

|---|---|---|---|

| Banking Analyst | Analyze financial data, assess credit risks, and support lending decisions in retail and corporate banking. | Financial Modeling, Credit Analysis, Risk Management | Entry-level role with advancement to Senior Analyst and Relationship Manager positions. |

| Financial Planner | Develop customized investment strategies and manage client portfolios within private banking divisions. | Investment Analysis, Client Management, Financial Advisory | Progression to Senior Financial Advisor and Wealth Management roles. |

| Credit Risk Officer | Evaluate loan applications, monitor credit exposure, and ensure compliance with banking regulations. | Risk Assessment, Regulatory Knowledge, Analytical Thinking | Opportunity to grow into Risk Manager or Credit Control Head positions. |

| Investment Banking Associate | Support mergers and acquisitions, capital raising, and financial restructuring for clients. | Valuation Techniques, Financial Analysis, Negotiation | Potential to advance to Vice President or Director roles. |

| Compliance Analyst | Ensure adherence to financial laws, monitor transactions, and prepare regulatory reports. | Regulatory Compliance, Attention to Detail, Risk Management | Career growth toward Compliance Manager or Risk Compliance Director. |

Investment and Asset Management Careers

Finance graduates have diverse career opportunities in investment and asset management sectors. These roles focus on maximizing returns and managing financial portfolios efficiently.

- Investment Analyst - Evaluates financial data to recommend investment opportunities and strategies.

- Portfolio Manager - Oversees client investment portfolios to achieve specific financial goals.

- Asset Management Consultant - Advises organizations on asset acquisition, disposition, and optimization for value growth.

Corporate Finance Roles and Responsibilities

Finance graduates often pursue careers in corporate finance, where they play a crucial role in managing a company's financial health. Key positions include financial analyst, corporate finance associate, and treasury analyst.

These roles involve budgeting, forecasting, and analyzing financial data to support strategic decision-making. Responsibilities often extend to managing capital structure, optimizing cash flow, and overseeing investment activities to drive business growth.

Essential Skills for Succeeding in Finance

Finance graduates have diverse career opportunities in fields such as investment banking, financial analysis, and corporate finance. Mastering essential skills increases the likelihood of success and career advancement in these competitive roles.

Key skills for finance professionals include analytical thinking, attention to detail, and proficiency in financial software.

- Analytical Thinking - The ability to interpret complex financial data supports informed decision-making and strategic planning.

- Attention to Detail - Precision in managing financial records and reports ensures accuracy and compliance with regulations.

- Proficiency in Financial Software - Expertise in tools like Excel, Bloomberg, and SAP enhances efficiency and accuracy in financial modeling and analysis.

Industry Certifications and Qualifications

Finance graduates have diverse career opportunities in fields such as investment banking, financial analysis, and corporate finance. Industry certifications like CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), and CFP (Certified Financial Planner) significantly enhance your job prospects and credibility. Earning these qualifications demonstrates expertise and commitment, positioning you competitively in the finance job market.

Emerging Trends and Future Prospects in Finance

Finance graduates can explore careers in data analytics, financial technology (FinTech), and sustainable finance, reflecting emerging trends in the industry. Roles such as blockchain analysts, risk managers, and ESG (Environmental, Social, and Governance) investment specialists are gaining prominence. Your expertise in these areas positions you for growth as the finance sector evolves with digital innovation and ethical investing.

jobsintra.com

jobsintra.com