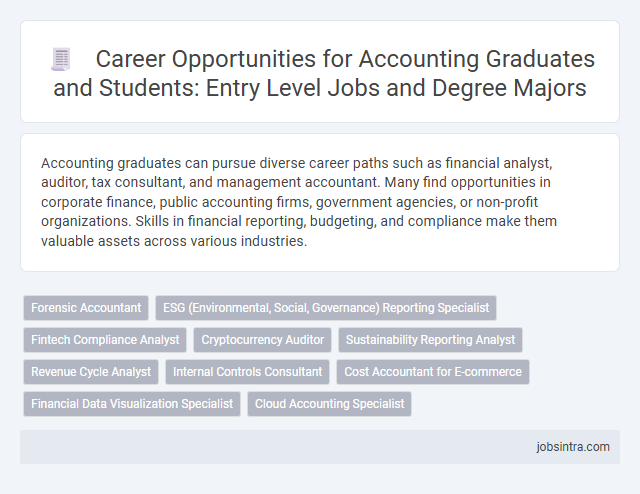

Accounting graduates can pursue diverse career paths such as financial analyst, auditor, tax consultant, and management accountant. Many find opportunities in corporate finance, public accounting firms, government agencies, or non-profit organizations. Skills in financial reporting, budgeting, and compliance make them valuable assets across various industries.

Forensic Accountant

Forensic accountants specialize in investigating financial discrepancies, fraud, and legal disputes by analyzing complex financial data and transactions. They play a crucial role in legal cases, insurance claims, and corporate investigations, providing expert testimony and detailed reports. Your skills in accounting and analytical thinking are essential for uncovering hidden assets and ensuring financial transparency in this dynamic career path.

ESG (Environmental, Social, Governance) Reporting Specialist

Accounting graduates can pursue a career as ESG Reporting Specialists, where they analyze and report on a company's environmental, social, and governance practices to ensure transparency and compliance with sustainability standards. This role involves preparing detailed reports that help organizations meet regulatory requirements and attract socially responsible investors. You will leverage your accounting skills to integrate financial data with ESG metrics, driving responsible business decisions and supporting long-term value creation.

Fintech Compliance Analyst

Fintech Compliance Analysts specialize in ensuring that financial technology companies adhere to regulatory requirements and industry standards. They analyze policies, monitor transactions for fraud or money laundering, and coordinate with legal teams to maintain compliance. Accounting graduates bring a strong foundation in financial principles and attention to detail, making them well-suited for this role in the evolving fintech sector.

Cryptocurrency Auditor

Cryptocurrency auditors specialize in examining blockchain transactions and digital asset accounts to ensure accuracy and compliance with financial regulations. Your expertise in accounting principles combined with knowledge of cryptocurrency protocols makes you valuable for verifying the integrity of crypto financial records. This role demands strong analytical skills to detect fraud, assess risks, and enhance transparency in the emerging digital currency market.

Sustainability Reporting Analyst

Sustainability Reporting Analysts play a crucial role in helping organizations measure and communicate their environmental and social impact through detailed financial and non-financial reports. Accounting graduates with strong analytical skills and knowledge of sustainability standards can excel in preparing accurate, transparent disclosures that meet regulatory requirements and stakeholder expectations. Your expertise in accounting principles combined with sustainability insights makes you valuable in driving corporate responsibility and enhancing company reputation.

Revenue Cycle Analyst

Revenue Cycle Analysts play a crucial role in managing and optimizing the financial processes related to revenue generation for organizations, particularly in healthcare and finance sectors. They analyze billing, collections, and accounts receivable data to identify inefficiencies and recommend improvements that enhance cash flow. Expertise in data analysis and familiarity with accounting software are essential skills for Revenue Cycle Analysts to ensure accurate financial reporting and compliance.

Internal Controls Consultant

An Internal Controls Consultant plays a crucial role in evaluating and improving an organization's risk management and compliance processes. Your expertise helps establish effective financial controls, ensuring accuracy and preventing fraud within business operations. This position offers accounting graduates the opportunity to apply their knowledge of regulations and standards while enhancing corporate governance frameworks.

Cost Accountant for E-commerce

Cost Accountants in e-commerce play a crucial role in analyzing and managing the costs associated with online retail operations, helping businesses optimize pricing strategies and inventory expenses. Your expertise enables companies to track spending patterns, forecast budgets, and improve profitability by identifying cost-saving opportunities. This role demands strong analytical skills and a deep understanding of both accounting principles and e-commerce dynamics.

Financial Data Visualization Specialist

A Financial Data Visualization Specialist transforms complex financial data into clear, visually engaging charts and dashboards, enabling better decision-making for businesses. Your expertise in accounting combined with skills in data visualization tools like Tableau or Power BI enhances financial reporting and analysis. This role bridges the gap between raw financial data and strategic insights, making numbers easily understandable for stakeholders.

Good to know: jobs for Accounting graduates

Top Entry-Level Jobs for Accounting Graduates

Accounting graduates have a wide range of entry-level job opportunities that provide a strong foundation for career growth. Top positions include Junior Accountant, Audit Associate, and Tax Assistant, each offering valuable experience in financial reporting, compliance, and analysis. Your skills in attention to detail and numerical accuracy make you a great fit for these roles in both public and private sectors.

Essential Degree Majors for Launching an Accounting Career

Accounting graduates possess a versatile skill set ideal for various roles in the finance and business sectors. Selecting the right degree major enhances career prospects and prepares graduates for specialized accounting positions.

- Bachelor of Accounting - Provides comprehensive knowledge of accounting principles, auditing, and tax regulations critical for entry-level accounting roles.

- Bachelor of Finance - Focuses on financial management and investment strategies, complementing accounting expertise in corporate finance positions.

- Bachelor of Business Administration - Offers broad business acumen with courses in management and economics, useful for accounting roles in business consulting.

Graduates choosing these majors strengthen their foundation for successful careers in accounting and related fields.

Key Skills Employers Seek in Accounting Professionals

Accounting graduates possess a strong foundation in financial analysis, auditing, and tax preparation. These skills open doors to diverse roles such as financial accountant, auditor, tax consultant, and management accountant.

Employers prioritize proficiency in accounting software, attention to detail, and regulatory knowledge. Communication skills and ethical judgment are also key attributes that enhance career prospects in the accounting field.

Growing Industries Hiring Accounting Graduates

Accounting graduates have a broad range of job opportunities across various industries driven by market growth and technological advancements. Emerging sectors increasingly demand skilled accountants to manage financial data, compliance, and strategic planning.

- Technology Industry - Growing tech companies require accounting professionals to handle complex financial reporting, budgeting, and regulatory compliance in dynamic environments.

- Healthcare Sector - Healthcare organizations seek accountants to manage auditing, billing, and financial management amid expanding services and regulatory standards.

- Renewable Energy - The renewable energy industry relies on accountants for project financing, cost analysis, and sustainability reporting as the sector experiences rapid growth.

Career Advancement Paths in Accounting

Accounting graduates have diverse career opportunities in fields such as auditing, tax consulting, financial analysis, and corporate accounting. Entry-level roles often lead to specialized positions in areas like forensic accounting or management accounting.

Career advancement paths in accounting include progressing from junior accountant to senior accountant, then to roles like accounting manager or financial controller. Obtaining professional certifications such as CPA, CMA, or ACCA significantly enhances promotion prospects. Your continuous skill development and experience play a crucial role in reaching leadership positions like chief financial officer or partner in an accounting firm.

Certifications and Licenses to Boost Accounting Careers

What jobs are available for accounting graduates? Accounting graduates can pursue roles such as auditor, tax consultant, financial analyst, and management accountant. These positions offer diverse opportunities in public accounting firms, corporate finance departments, and government agencies.

How do certifications impact accounting careers? Certifications enhance professional credibility and open doors to higher-paying jobs and leadership roles. They demonstrate specialized knowledge and commitment to ethical standards within the accounting field.

Which certifications are most valuable for accounting graduates? The Certified Public Accountant (CPA), Certified Management Accountant (CMA), and Chartered Financial Analyst (CFA) are highly regarded certifications. Each provides expertise in different areas, improving job prospects and career advancement.

What licenses should accounting graduates consider obtaining? The CPA license is essential for public accountants and auditors. Other important licenses include Certified Internal Auditor (CIA) and Enrolled Agent (EA), which expand career opportunities in auditing and tax representation.

How do certifications and licenses boost career growth? They validate skills, increase marketability, and often lead to salary increases and promotions. Employers prioritize candidates with recognized credentials to ensure compliance and quality in financial reporting and analysis.

Networking and Job Search Tips for New Accounting Graduates

Accounting graduates have diverse job opportunities in roles such as financial analyst, auditor, tax consultant, and management accountant. Networking plays a crucial role in landing these positions by connecting with industry professionals through LinkedIn, accounting associations, and career fairs. Job search tips include tailoring resumes to specific accounting roles, preparing for technical interviews, and actively seeking internships to gain practical experience.

jobsintra.com

jobsintra.com