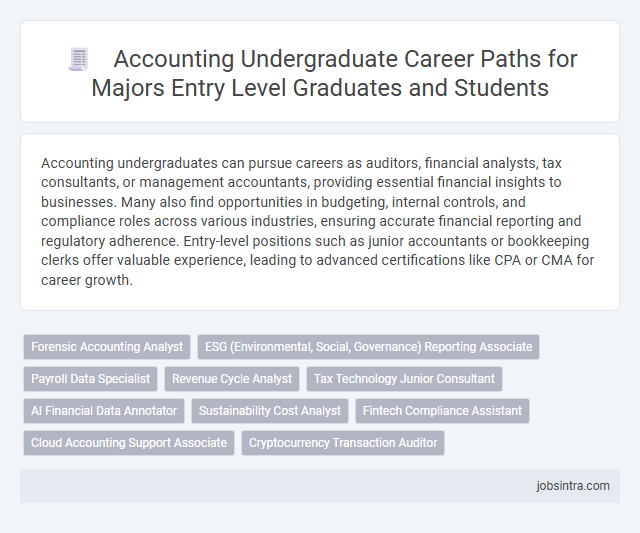

Accounting undergraduates can pursue careers as auditors, financial analysts, tax consultants, or management accountants, providing essential financial insights to businesses. Many also find opportunities in budgeting, internal controls, and compliance roles across various industries, ensuring accurate financial reporting and regulatory adherence. Entry-level positions such as junior accountants or bookkeeping clerks offer valuable experience, leading to advanced certifications like CPA or CMA for career growth.

Forensic Accounting Analyst

A Forensic Accounting Analyst specializes in investigating financial discrepancies, fraud, and legal disputes by analyzing accounting records and transactions. This role requires strong analytical skills, attention to detail, and the ability to interpret complex financial data to support legal cases or corporate investigations. Your expertise in forensic accounting can lead to opportunities in law enforcement agencies, consulting firms, or corporate fraud departments.

ESG (Environmental, Social, Governance) Reporting Associate

An Accounting undergraduate can pursue a career as an ESG Reporting Associate, specializing in the analysis and preparation of sustainability and corporate social responsibility reports. This role involves evaluating company performance against environmental, social, and governance criteria to ensure compliance with regulatory standards and stakeholder expectations. Your skills in data accuracy and financial reporting enable the provision of transparent ESG disclosures that drive responsible business practices.

Payroll Data Specialist

A Payroll Data Specialist in accounting manages employee compensation records, ensuring accuracy in salary calculations, tax deductions, and benefits administration. They utilize payroll software systems to process timely payments and maintain compliance with labor laws and financial regulations. Proficiency in data analysis and attention to detail are essential for handling confidential payroll information efficiently.

Revenue Cycle Analyst

A Revenue Cycle Analyst plays a crucial role in managing and optimizing the financial processes related to an organization's revenue generation. This position involves analyzing billing, collections, and payment data to identify inefficiencies and implement improvements that increase cash flow and reduce revenue leakage. Your analytical skills and accounting knowledge will be essential in ensuring accurate revenue tracking and compliance with financial regulations.

Tax Technology Junior Consultant

A Tax Technology Junior Consultant supports organizations in implementing and optimizing tax software and digital tools to ensure accurate compliance and efficient reporting. This role involves analyzing tax data, automating processes, and collaborating with tax and IT teams to enhance system functionalities. Strong knowledge of accounting principles combined with technology skills is essential for success in this position.

AI Financial Data Annotator

An AI Financial Data Annotator for accounting undergraduates involves labeling and categorizing financial documents and transactions to train machine learning models. This role requires strong attention to detail, knowledge of accounting principles, and familiarity with financial terminology to ensure high-quality, accurate data annotation. It offers a unique intersection of accounting expertise and AI technology, enhancing career prospects in fintech and data science fields.

Sustainability Cost Analyst

Sustainability Cost Analysts specialize in evaluating the financial impact of sustainable practices within organizations, helping companies reduce environmental costs while maintaining profitability. They analyze data related to energy consumption, waste management, and resource efficiency to identify cost-saving opportunities and support sustainable decision-making. Their accounting expertise enables accurate reporting on sustainability investments and compliance with environmental regulations.

Fintech Compliance Assistant

Fintech Compliance Assistants play a crucial role in ensuring financial technology companies adhere to regulatory standards and internal policies. They monitor transactions, review documentation, and assist in risk assessments to prevent fraud and legal breaches. Strong analytical skills and knowledge of accounting principles help them support compliance teams effectively in dynamic fintech environments.

Cloud Accounting Support Associate

A Cloud Accounting Support Associate specializes in assisting businesses with cloud-based accounting software, ensuring seamless integration and operation. You will troubleshoot technical issues, provide training, and support financial data management through platforms like QuickBooks Online or Xero. This role combines accounting knowledge with IT skills to optimize cloud accounting solutions for improved financial processes.

Good to know: jobs for Accounting undergraduate

Top Entry-Level Accounting Roles for Recent Graduates

Recent graduates with an accounting degree can pursue several entry-level roles that build foundational skills in the business world. Common positions include Junior Accountant, Accounts Payable/Receivable Specialist, and Tax Associate, each offering exposure to financial reporting, auditing, and compliance. These roles provide hands-on experience with accounting software, financial statements, and regulatory standards, preparing graduates for advanced career opportunities.

Essential Skills for Launching an Accounting Career

Accounting undergraduates possess foundational knowledge in financial reporting, auditing, and tax regulations. These core competencies prepare graduates for various entry-level roles in the accounting field.

Essential skills for launching an accounting career include proficiency in bookkeeping, familiarity with accounting software like QuickBooks and Excel, and strong analytical abilities. Effective communication skills are crucial for explaining financial information to non-accountants. Attention to detail ensures accuracy in financial records and compliance with regulatory standards.

Industries Hiring Accounting Majors

| Industry | Job Roles for Accounting Undergraduates | Key Employers | Job Market Insights |

|---|---|---|---|

| Public Accounting | Auditor, Tax Associate, Assurance Analyst, Compliance Specialist | Big Four firms (Deloitte, PwC, EY, KPMG), Mid-tier CPA firms | Strong demand for audit and tax expertise; opportunities for CPA certification |

| Financial Services | Financial Analyst, Risk Analyst, Internal Auditor, Credit Analyst | Investment banks, Commercial banks, Credit rating agencies | Growing demand for financial reporting and risk management skills |

| Corporate Sector | Cost Accountant, Budget Analyst, Management Accountant, Accounts Payable/Receivable Specialist | Multinational corporations, Manufacturing firms, Retail companies | Focus on financial control, budgeting, and internal reporting; increasing use of ERP systems |

| Government and Public Sector | Government Auditor, Tax Examiner, Financial Compliance Officer, Budget Officer | Local, State, and Federal agencies, Public institutions | Stable employment with emphasis on regulatory compliance and public financial management |

| Nonprofit Organizations | Grant Accountant, Fund Accountant, Financial Reporting Specialist | Charities, Foundations, Educational institutions | Opportunities to manage fund accounting and donor reporting; increasing transparency requirements |

| Technology and FinTech | Data Analyst, Financial Systems Analyst, Accounting Systems Specialist | FinTech startups, Software companies, Payment platforms | Demand for integrating accounting with technology; focus on automation and blockchain |

Professional Certifications and Further Education

Accounting undergraduates have diverse career opportunities in finance, auditing, and tax consultancy. Securing professional certifications like CPA, CMA, or ACCA significantly enhances employability.

Further education such as a master's degree in accounting or finance deepens expertise and opens doors to senior roles. Continuous professional development is essential to stay competitive in the evolving accounting landscape.

Career Advancement Opportunities in Accounting

Accounting undergraduates have diverse career paths that offer significant opportunities for growth and specialization. Gaining experience in various accounting roles can lead to advanced positions in finance and management within the business sector.

- Auditor - Auditors examine financial records to ensure accuracy and compliance with regulations, building a foundation for roles in risk management and consultancy.

- Financial Analyst - Financial analysts assess economic data to guide investment and business decisions, paving the way for leadership roles in corporate finance.

- Tax Accountant - Tax accountants specialize in tax preparation and planning, which can lead to expert advisory positions and senior roles in taxation departments.

Career advancement in accounting often involves obtaining professional certifications like CPA or CMA to unlock higher-level opportunities.

Networking and Internship Strategies for Accounting Students

Accounting undergraduates have a wide range of job opportunities in finance, auditing, and taxation. Effective networking and targeted internships significantly enhance career prospects in the accounting field.

- Build Professional Relationships - Engage with accounting professionals through events and online platforms to expand your industry network.

- Seek Relevant Internships - Target internships in public accounting firms, corporate finance departments, or government agencies to gain practical experience.

- Utilize University Resources - Leverage career services and alumni connections to find exclusive internship and job opportunities in accounting.

Salary Expectations and Job Market Trends for Accounting Graduates

Accounting undergraduates can explore roles such as financial analyst, auditor, tax consultant, and budget analyst. Salary expectations for accounting graduates typically range from $50,000 to $75,000 annually, with potential growth as experience increases. The job market trends indicate strong demand in corporate finance, public accounting firms, and government agencies due to increasing regulatory requirements and financial complexity.

jobsintra.com

jobsintra.com