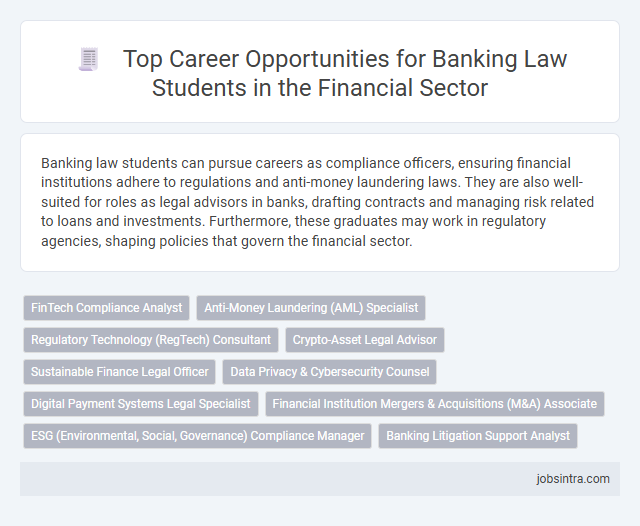

Banking law students can pursue careers as compliance officers, ensuring financial institutions adhere to regulations and anti-money laundering laws. They are also well-suited for roles as legal advisors in banks, drafting contracts and managing risk related to loans and investments. Furthermore, these graduates may work in regulatory agencies, shaping policies that govern the financial sector.

FinTech Compliance Analyst

FinTech Compliance Analysts in banking law specialize in ensuring that financial technology companies adhere to regulatory standards and legal requirements. They analyze evolving regulations, assess risk management practices, and develop compliance strategies to avoid legal penalties. This role integrates legal expertise with technology insights, making it ideal for banking law students interested in innovation and regulatory frameworks.

Anti-Money Laundering (AML) Specialist

Anti-Money Laundering (AML) Specialists play a crucial role in identifying and preventing financial crimes within the banking sector. They analyze transactions and customer data to detect suspicious activities, ensuring compliance with regulatory standards and minimizing risk exposure. Expertise in AML regulations and investigative skills make this position ideal for banking law students seeking to protect financial institutions from legal and reputational harm.

Regulatory Technology (RegTech) Consultant

Banking law students can excel as Regulatory Technology (RegTech) Consultants by leveraging their expertise in compliance and financial regulations to develop and implement advanced technological solutions. These professionals analyze regulatory requirements and design systems that help banks and financial institutions manage risk, ensure compliance, and streamline reporting processes. Proficiency in both legal frameworks and emerging technologies positions them to bridge the gap between regulatory demands and innovative tech applications.

Crypto-Asset Legal Advisor

Crypto-Asset Legal Advisors guide financial institutions and fintech firms through the complex regulatory landscape of digital currencies, ensuring compliance with anti-money laundering (AML) and securities laws. They draft and review contracts related to token offerings, custody agreements, and smart contracts while advising on risk management and dispute resolution. Expertise in both banking law and blockchain technology is essential to navigate evolving regulations and support innovation in crypto-asset financial products.

Sustainable Finance Legal Officer

Sustainable Finance Legal Officers play a crucial role in guiding financial institutions through complex regulations related to green investments and environmental, social, and governance (ESG) criteria. This position requires expertise in banking law, sustainability standards, and regulatory compliance to ensure ethical financing and risk management. Your skills can directly influence the development of sustainable economic policies and promote responsible investment practices within the banking sector.

Data Privacy & Cybersecurity Counsel

Banking law students specializing in data privacy and cybersecurity counsel play a crucial role in protecting financial institutions from cyber threats and ensuring compliance with privacy regulations. They provide legal guidance on data breach responses, risk management strategies, and regulatory requirements such as GDPR and CCPA. Expertise in this field positions them to advise on safeguarding sensitive customer information and mitigating potential legal liabilities.

Digital Payment Systems Legal Specialist

Digital Payment Systems Legal Specialists navigate the complex regulatory landscape governing electronic transactions, ensuring compliance with privacy, security, and anti-fraud laws in the banking sector. They draft and review contracts, advise on digital wallet integrations, and liaise with regulatory bodies to mitigate legal risks in emerging payment technologies. Expertise in fintech regulations and data protection laws is essential for safeguarding financial institutions and their customers in the digital economy.

Financial Institution Mergers & Acquisitions (M&A) Associate

Specializing as a Financial Institution Mergers & Acquisitions (M&A) Associate involves advising banks and financial entities on complex transactions such as mergers, acquisitions, and regulatory compliance. You will analyze deal structures, conduct due diligence, and negotiate terms to ensure seamless integration and adherence to legal standards. This role demands strong expertise in banking regulations and corporate law to facilitate successful financial mergers.

ESG (Environmental, Social, Governance) Compliance Manager

Banking law students can pursue a career as an ESG Compliance Manager, overseeing the integration of environmental, social, and governance criteria within financial institutions. This role involves ensuring that banks comply with evolving ESG regulations and standards, mitigating risks related to sustainability and ethical practices. Your expertise in banking law positions you to navigate complex regulatory frameworks and guide organizations toward responsible investment and operational strategies.

Good to know: jobs for banking law students

Overview of Banking Law Careers in the Financial Sector

Banking law students have diverse career opportunities within the financial sector, including roles as compliance officers, legal advisors, and regulatory analysts. These positions involve ensuring adherence to banking regulations, drafting contracts, and advising financial institutions on legal matters. Expertise in financial regulations, risk management, and contract law is essential for success in these banking law careers.

In-House Counsel Roles at Banks and Financial Institutions

Banking law students can pursue specialized legal careers within financial institutions, focusing on regulatory compliance and risk management. In-house counsel roles at banks involve advising on complex financial transactions, regulatory frameworks, and internal governance.

- Regulatory Compliance Advisor - Ensures the bank adheres to federal and state banking laws and regulations, minimizing legal risks.

- Contract Specialist - Drafts and reviews contracts related to loans, securities, and other financial products to protect institutional interests.

- Risk Management Counsel - Provides legal guidance on risk assessment and mitigation for banking operations and new financial services.

Regulatory Compliance and Risk Management Positions

Banking law students often pursue careers in regulatory compliance and risk management to help financial institutions navigate complex legal requirements. These roles focus on ensuring adherence to laws while minimizing financial and operational risks.

- Compliance Analyst - Monitors bank activities and policies to ensure alignment with regulatory standards and internal guidelines.

- Risk Management Specialist - Identifies, assesses, and mitigates potential legal and financial risks affecting banking operations.

- Regulatory Affairs Officer - Serves as a liaison between banks and regulatory bodies to facilitate timely compliance and reporting.

Financial Litigation and Dispute Resolution Opportunities

Banking law students specializing in Financial Litigation and Dispute Resolution can pursue careers in roles such as litigation associates, dispute resolution analysts, and regulatory compliance advisors. These positions involve navigating complex financial disputes and enforcing banking regulations.

Opportunities exist within law firms, financial institutions, and government agencies focused on resolving conflicts related to banking transactions and financial contracts. Your expertise in interpreting financial regulations and managing litigation cases can lead to roles handling securities disputes, fraud investigations, and contract enforcement. This specialization demands strong analytical skills and a thorough understanding of banking law frameworks.

Investment Banking and Mergers & Acquisitions Legal Careers

Banking law students often pursue specialized legal careers in investment banking and mergers & acquisitions. These fields demand expertise in financial regulations, contract negotiations, and corporate structuring.

- Investment Banking Legal Advisor - Provides counsel on securities law compliance, underwriting agreements, and capital market transactions.

- Mergers & Acquisitions Associate - Supports due diligence, drafting of acquisition agreements, and negotiation processes for corporate mergers.

- Regulatory Compliance Officer - Ensures adherence to banking regulations and assists with risk management in complex financial deals.

Your skills in navigating intricate legal frameworks open pathways to dynamic roles within financial institutions and law firms specializing in banking law.

Opportunities in Corporate Governance and Advisory Services

Banking law students have diverse career opportunities in corporate governance, including roles as compliance officers and governance analysts. Advisory services offer positions such as legal consultants and risk management advisors, where expertise in regulatory frameworks is essential. Your skills in banking regulations and corporate policies position you well for impactful roles in these sectors.

Emerging Roles in Fintech and Digital Banking Law

Banking law students can explore emerging roles in fintech and digital banking law, such as regulatory compliance specialists and blockchain legal advisors. These positions require expertise in both financial regulations and cutting-edge technology innovations.

Opportunities also exist in drafting and negotiating smart contracts, data privacy law, and cybersecurity within digital financial services. Legal professionals in this sector help fintech companies navigate evolving laws related to digital assets, payments, and online lending platforms.

jobsintra.com

jobsintra.com