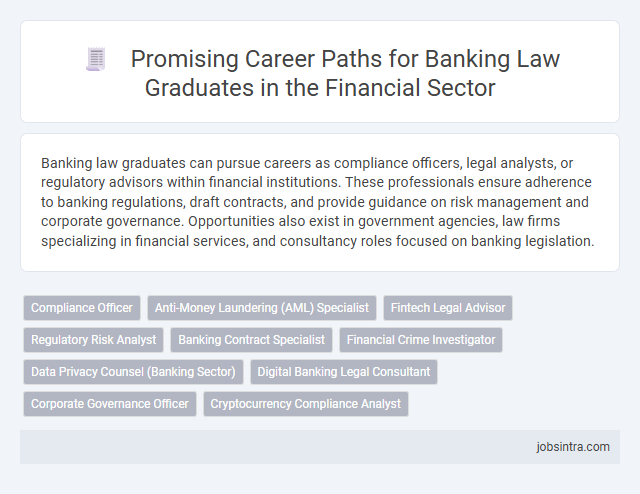

Banking law graduates can pursue careers as compliance officers, legal analysts, or regulatory advisors within financial institutions. These professionals ensure adherence to banking regulations, draft contracts, and provide guidance on risk management and corporate governance. Opportunities also exist in government agencies, law firms specializing in financial services, and consultancy roles focused on banking legislation.

Compliance Officer

Compliance Officers in banking ensure adherence to financial regulations and internal policies, helping institutions avoid legal risks and penalties. They analyze regulatory changes, implement compliance programs, and conduct training to maintain ethical standards. Their expertise is critical in safeguarding the bank's reputation and fostering trust among clients and regulators.

Anti-Money Laundering (AML) Specialist

Banking law graduates often pursue careers as Anti-Money Laundering (AML) Specialists, focusing on detecting and preventing illicit financial activities. They analyze transactions, ensure compliance with regulatory frameworks, and develop internal policies to mitigate risks associated with money laundering. Expertise in financial law, regulatory standards, and investigative techniques is essential for success in this role.

Fintech Legal Advisor

Fintech legal advisors provide specialized counsel on regulatory compliance, licenses, and data protection for financial technology companies. They navigate complex legal frameworks to support innovations in digital payments, blockchain, and online lending. Their expertise ensures fintech firms operate within legal boundaries while fostering growth and consumer trust.

Regulatory Risk Analyst

Regulatory Risk Analysts specialize in identifying and managing compliance risks within financial institutions, ensuring adherence to banking laws and regulations. Your expertise in banking law enables you to interpret complex legal frameworks and translate them into effective risk management strategies. This role demands strong analytical skills and a deep understanding of regulatory environments to help prevent legal issues and financial penalties.

Banking Contract Specialist

Banking law graduates are well-suited for roles as Banking Contract Specialists, where they analyze, draft, and negotiate banking agreements to ensure compliance with regulatory standards and mitigate risks. Their expertise in financial regulations and contract law allows them to support banks in managing legal obligations and securing favorable terms in lending, deposits, and other financial transactions. This specialization contributes to the legal integrity and operational efficiency of banking institutions.

Financial Crime Investigator

Financial crime investigators in banking law specialize in detecting and preventing fraud, money laundering, and other illicit activities within financial institutions. They analyze transaction patterns, conduct thorough investigations, and collaborate with regulatory bodies to ensure compliance with anti-money laundering laws and financial regulations. These professionals play a crucial role in safeguarding the integrity of banking operations and protecting clients from financial risks.

Data Privacy Counsel (Banking Sector)

Data Privacy Counsel in the banking sector specializes in navigating complex regulations to ensure compliance with data protection laws while safeguarding sensitive financial information. They advise on policies related to data privacy and security, manage risk assessments, and oversee data breach responses within financial institutions. Expertise in banking regulations and privacy legislation is essential for guiding banks through evolving compliance challenges.

Digital Banking Legal Consultant

Digital Banking Legal Consultants specialize in navigating the regulatory landscape of online financial services, ensuring compliance with data protection, cybersecurity, and fintech regulations. They advise banks and fintech companies on legal frameworks for digital transactions, blockchain technologies, and digital payment systems. Their expertise supports the development of secure, innovative banking solutions while minimizing legal risks in the evolving digital economy.

Corporate Governance Officer

Corporate Governance Officers ensure compliance with regulatory frameworks and promote ethical practices within financial institutions. Banking law graduates excel in this role by leveraging their expertise in legal standards and risk management to support transparent decision-making processes. Their knowledge helps align corporate policies with evolving banking laws, mitigating legal risks.

Good to know: jobs for banking law graduates

Overview of Banking Law Careers in the Financial Sector

Banking law graduates have a wide range of career opportunities within the financial sector, including roles such as compliance officers, legal advisors, and regulatory analysts. These positions often involve navigating complex regulations to ensure banks operate within legal frameworks and manage risks effectively.

Careers in banking law demand expertise in financial regulations, contract law, and risk management, often requiring collaboration with regulators and financial institutions. Your skills are crucial in shaping policies, advising on mergers and acquisitions, and addressing disputes in the banking industry.

Key Skills Required for Banking Law Professionals

Banking law graduates have diverse career opportunities in financial institutions, regulatory bodies, and law firms specializing in finance. Your expertise is crucial in navigating complex regulations and ensuring compliance in the banking sector.

- Regulatory Knowledge - Understanding banking regulations and financial compliance standards is essential for advising clients and institutions effectively.

- Analytical Skills - Ability to interpret legal documents, contracts, and case law is vital for resolving disputes and drafting accurate legal agreements.

- Communication Skills - Clear and persuasive communication helps in negotiating terms, delivering legal advice, and collaborating with stakeholders in the banking industry.

Top Entry-Level Positions for Banking Law Graduates

Banking law graduates have a wealth of entry-level opportunities in both private and public sectors. Top roles include Compliance Analyst, Legal Assistant in Financial Institutions, and Regulatory Affairs Associate.

These positions provide hands-on experience with banking regulations, risk management, and financial compliance. Your expertise in banking law will be crucial for roles like Contract Review Specialist and Credit Analyst in major banks.

Advancement Opportunities and Career Progression

What career advancement opportunities exist for banking law graduates? Graduates can progress from junior legal advisor roles to senior counsel positions within financial institutions. Specialized knowledge in regulatory compliance and financial legislation often leads to leadership roles in legal departments or consultancy firms.

How can banking law graduates enhance their career progression? Gaining experience in contract negotiation, risk management, and dispute resolution significantly boosts your professional profile. Continuous learning through certifications and networking within the banking sector also accelerates promotion prospects.

Emerging Trends Shaping Banking Law Careers

Banking law graduates are increasingly sought after in compliance, regulatory consulting, and fintech legal advisory roles. Emerging trends in digital banking and cryptocurrency regulations are reshaping career opportunities in this field.

Experts in banking law are now navigating evolving frameworks around blockchain technology, data privacy, and anti-money laundering (AML) standards. Careers are expanding toward legal roles in financial technology startups and global regulatory bodies. Proficiency in cross-border financial regulations and cybersecurity law enhances employability significantly.

In-Demand Specializations within Banking Law

Banking law graduates find numerous career opportunities in specialized fields such as regulatory compliance, financial litigation, and risk management. Expertise in anti-money laundering (AML) regulations, digital banking law, and securities regulation is highly sought after by financial institutions and law firms. Professionals with skills in these areas support banks in navigating complex legal frameworks while ensuring adherence to evolving industry standards.

Tips for Success in the Financial Sector for Law Graduates

Banking law graduates can pursue careers as compliance officers, legal advisors, and risk analysts within financial institutions. Developing expertise in regulatory frameworks such as Basel III, Dodd-Frank, and anti-money laundering laws enhances job prospects. Networking with professionals in finance and gaining certifications like CAMS or FRM contribute to success in the financial sector for law graduates.

jobsintra.com

jobsintra.com