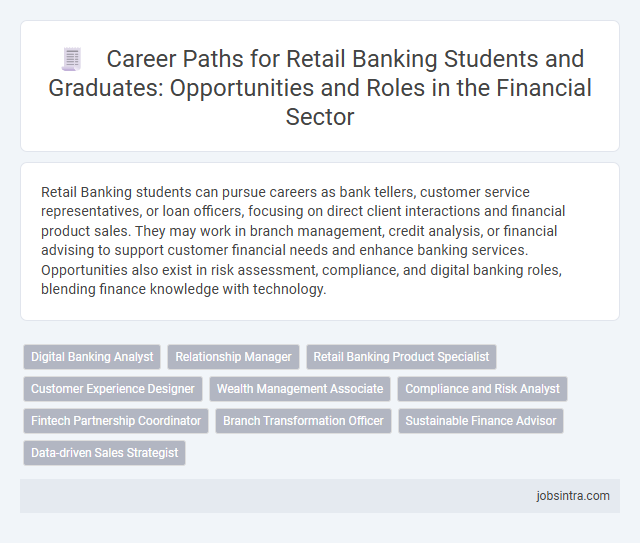

Retail Banking students can pursue careers as bank tellers, customer service representatives, or loan officers, focusing on direct client interactions and financial product sales. They may work in branch management, credit analysis, or financial advising to support customer financial needs and enhance banking services. Opportunities also exist in risk assessment, compliance, and digital banking roles, blending finance knowledge with technology.

Digital Banking Analyst

Retail Banking students can pursue a career as a Digital Banking Analyst, where they analyze digital banking trends and customer data to enhance online services. This role involves optimizing digital platforms for seamless user experiences and identifying opportunities for technological innovation in retail financial services. Proficiency in data analytics, customer behavior insights, and digital tools is essential for success in this position.

Relationship Manager

A Relationship Manager in retail banking builds and maintains strong connections with clients, helping to manage their financial portfolios and offer tailored banking solutions. This role requires excellent interpersonal skills and a deep understanding of banking products to meet customer needs effectively. You can expect to work closely with individuals to enhance their financial well-being while driving business growth for the bank.

Retail Banking Product Specialist

Retail Banking Product Specialists design and manage financial products tailored to meet customer needs, including savings accounts, loans, and credit cards. They analyze market trends and customer behavior to optimize product offerings and enhance customer satisfaction. This role requires strong communication skills, market knowledge, and the ability to collaborate with sales and marketing teams to ensure successful product launches.

Customer Experience Designer

Customer Experience Designers in retail banking specialize in creating seamless and engaging interactions between customers and financial services. They analyze customer behavior and feedback to design intuitive digital interfaces and personalized service strategies that enhance satisfaction and loyalty. Their role bridges technology and human-centered design to improve overall banking experiences.

Wealth Management Associate

Wealth Management Associates in retail banking assist clients in managing their investment portfolios and financial plans to achieve long-term financial goals. They analyze market trends, provide personalized financial advice, and support relationship managers in delivering tailored wealth solutions. This role requires strong analytical skills, customer service expertise, and a thorough understanding of financial products.

Compliance and Risk Analyst

A career as a Compliance and Risk Analyst in retail banking involves monitoring regulatory requirements and assessing financial risks to ensure your institution operates within legal frameworks. You analyze data to identify potential compliance issues and develop strategies to mitigate risks, safeguarding both the bank and its customers. Strong attention to detail and knowledge of banking regulations are essential for success in this role.

Fintech Partnership Coordinator

Fintech Partnership Coordinators in retail banking bridge the gap between traditional financial institutions and innovative technology companies to enhance customer experiences and streamline banking services. They manage collaboration projects, evaluate emerging fintech solutions, and ensure regulatory compliance throughout partnership developments. This role requires strong communication skills, industry knowledge, and a strategic mindset to drive digital transformation in retail banking.

Branch Transformation Officer

A Branch Transformation Officer plays a crucial role in modernizing retail banking operations by implementing innovative technologies and improving customer service processes. This position requires strong analytical skills and the ability to manage change effectively within branch networks. Your expertise can drive seamless digital adoption and enhance overall branch performance, ensuring a competitive edge in the evolving banking landscape.

Sustainable Finance Advisor

Retail banking students can pursue a career as a Sustainable Finance Advisor, specializing in integrating environmental, social, and governance (ESG) criteria into financial products and services. They assess clients' portfolios to promote investments that support sustainable development goals while ensuring long-term financial returns. Expertise in sustainable finance regulations and market trends enables them to guide both individuals and businesses toward responsible banking solutions.

Good to know: jobs for Retail Banking students

Overview of Retail Banking Careers

Careers in retail banking offer diverse opportunities for students specializing in commerce, focusing on personal financial services and customer relationship management. These roles require strong analytical skills, knowledge of financial products, and a customer-centric approach.

- Bank Teller - Facilitates daily financial transactions and assists customers with account-related inquiries.

- Personal Banker - Provides personalized financial advice and helps customers choose appropriate banking products.

- Loan Officer - Evaluates loan applications and advises clients on borrowing options and creditworthiness.

Key Skills Required in Retail Banking

Retail Banking offers diverse career opportunities such as Personal Banker, Loan Officer, and Customer Service Representative. These roles demand strong interpersonal skills and an understanding of financial products.

Key skills required include excellent communication, problem-solving abilities, and proficiency in financial software. Your ability to analyze customer needs and provide tailored banking solutions is critical for success.

Entry-Level Roles for Banking Graduates

Retail banking offers a variety of entry-level roles ideal for recent graduates entering the finance sector. Positions such as banking associate, teller, and customer service representative provide foundational experience.

These roles develop skills in client interaction, transaction processing, and financial product knowledge. Opportunities include credit analyst, loan officer assistant, and branch support specialist. Your career can advance quickly through training programs and on-the-job learning in these entry-level positions.

Career Progression and Advancement Opportunities

What career opportunities are available for retail banking students? Retail banking offers entry-level roles such as banking associates and financial service representatives. These positions serve as a foundation for career growth within the industry.

How does career progression typically occur in retail banking? Retail banking professionals can advance to roles like branch manager, loan officer, or financial advisor. Continuous training and certification enhance promotion prospects.

What skills enhance advancement opportunities in retail banking? Strong customer service, sales skills, and knowledge of banking products are crucial. Leadership abilities further improve chances for higher management roles.

Can retail banking students transition to other financial sectors? Yes, skills gained in retail banking can lead to careers in corporate banking, wealth management, or risk management. Cross-functional experience broadens career advancement potential.

What role does technology play in retail banking careers? Digital banking proficiency and data analytics skills are increasingly important. Expertise in fintech tools supports career advancement in the evolving banking landscape.

Specialized Roles within Retail Banking

Retail Banking offers a variety of specialized roles designed for students to develop expertise in customer-focused financial services. Your career path can lead to positions that combine analytical skills with personalized client interaction.

- Credit Analyst - Evaluates loan applications and assesses credit risk to ensure sound lending decisions.

- Personal Banker - Provides tailored banking solutions and financial advice to individual clients.

- Branch Operations Manager - Oversees daily branch functions to enhance efficiency and customer satisfaction.

Emerging Trends and Future Prospects in Retail Banking

Retail banking offers a range of job opportunities including financial analysts, customer relationship managers, and digital banking specialists. Emerging trends such as AI-driven customer service, blockchain technology, and personalized banking solutions are shaping the future landscape. Your skills in data analytics and fintech innovation will be crucial for career growth in this evolving sector.

Tips for Securing a Job in Retail Banking

Retail banking offers diverse career opportunities for students interested in finance and customer service. Securing a job in this competitive field requires focused strategies and relevant skills.

- Develop strong interpersonal skills - Effective communication with customers is essential for success in retail banking roles.

- Gain practical experience through internships - Internships provide hands-on knowledge and improve your resume for retail banking positions.

- Stay informed about banking regulations and products - Understanding industry trends helps you adapt and excel in retail banking jobs.

Building a solid network and continuously enhancing your financial knowledge will increase your chances of landing a retail banking job.

jobsintra.com

jobsintra.com