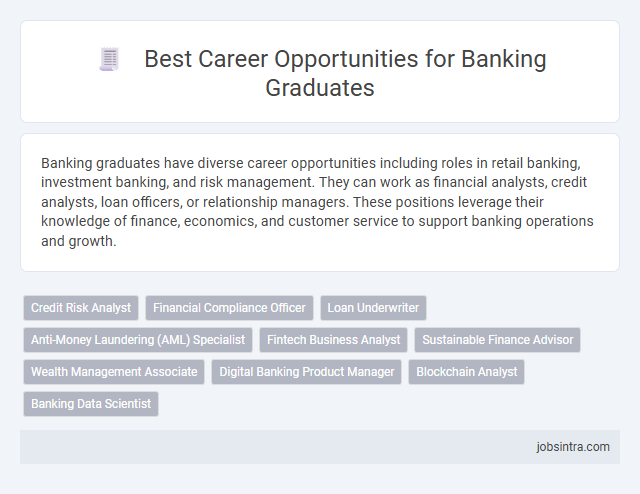

Banking graduates have diverse career opportunities including roles in retail banking, investment banking, and risk management. They can work as financial analysts, credit analysts, loan officers, or relationship managers. These positions leverage their knowledge of finance, economics, and customer service to support banking operations and growth.

Credit Risk Analyst

Credit Risk Analysts assess the creditworthiness of individuals and businesses by analyzing financial data and market trends to minimize potential losses for banks. They develop risk models, evaluate loan applications, and monitor existing portfolios to ensure compliance with regulatory requirements. Proficiency in financial analysis, data interpretation, and risk management tools is essential for success in this role.

Financial Compliance Officer

Financial Compliance Officers play a crucial role in ensuring banks adhere to regulatory requirements and internal policies, minimizing legal and financial risks. They analyze transactions, implement compliance programs, and train staff to maintain ethical standards within the institution. Your expertise in banking regulations can lead to a rewarding career in safeguarding the organization's integrity and reputation.

Loan Underwriter

Loan underwriters analyze financial information to assess the creditworthiness of potential borrowers, ensuring loans meet regulatory and company standards. Banking graduates in this role evaluate applications, verify documentation, and determine risk levels to approve or deny loan requests. Strong analytical skills and attention to detail are essential for success as a loan underwriter.

Anti-Money Laundering (AML) Specialist

Anti-Money Laundering (AML) Specialists play a crucial role in financial institutions by detecting and preventing illegal money laundering activities. You will analyze complex transactions, ensure compliance with regulatory requirements, and develop strategies to mitigate risks associated with financial crimes. This role demands strong analytical skills, attention to detail, and a deep understanding of banking laws and regulations.

Fintech Business Analyst

A Fintech Business Analyst plays a crucial role in bridging the gap between financial services and technology by analyzing market trends, customer needs, and regulatory requirements. You will leverage data analytics and business intelligence tools to develop innovative financial products and improve operational efficiency. Expertise in banking principles combined with technological insights positions you to drive transformation in the rapidly evolving fintech landscape.

Sustainable Finance Advisor

Banking graduates can pursue a career as Sustainable Finance Advisors, specializing in guiding financial institutions and corporations to integrate environmental, social, and governance (ESG) criteria into their investment strategies. These professionals assess risks and opportunities related to sustainability, develop green financing solutions, and help organizations align with global sustainability goals. Expertise in both finance and sustainability enables them to drive impactful investments that support long-term economic and environmental resilience.

Wealth Management Associate

Wealth Management Associates play a crucial role in helping banking graduates apply their financial knowledge to manage client portfolios and provide tailored investment advice. They analyze market trends, assess client risk tolerance, and develop strategies to grow assets effectively. This position offers valuable experience in client relationship management and comprehensive financial planning within the banking sector.

Digital Banking Product Manager

Digital Banking Product Managers lead the development and enhancement of innovative digital financial services, ensuring seamless user experiences and competitive product offerings. They analyze market trends, customer needs, and technological advancements to design strategic solutions that drive customer engagement and business growth. Strong skills in project management, data analysis, and digital technologies are essential for success in this role.

Blockchain Analyst

A Blockchain Analyst in banking specializes in evaluating and implementing blockchain technology to enhance security, transparency, and efficiency in financial transactions. This role involves analyzing decentralized systems, monitoring cryptocurrency trends, and ensuring compliance with regulatory standards. Your expertise can drive innovation in payment processing, fraud prevention, and smart contract development within the banking sector.

Good to know: jobs for Banking graduates

Overview of the Banking Sector

The banking sector offers diverse career opportunities for graduates, encompassing areas such as retail banking, investment banking, and risk management. This industry plays a crucial role in the economy by facilitating financial transactions and supporting business growth.

Banking graduates can pursue roles like financial analysts, credit officers, and compliance specialists, which require strong analytical and regulatory knowledge. The sector values skills in customer service, data analysis, and financial technology, making it a dynamic field for career development.

Top In-Demand Roles for Banking Graduates

Banking graduates find diverse career opportunities in the financial sector. Top in-demand roles include financial analyst, credit analyst, and investment banker.

Financial analysts evaluate market trends to guide investment decisions. Credit analysts assess borrowers' creditworthiness to reduce financial risk. Investment bankers facilitate mergers, acquisitions, and capital raising activities for clients.

Essential Skills for Banking Careers

Banking graduates can pursue roles such as financial analyst, loan officer, and investment banker, each requiring a strong foundation in financial principles and market analysis. Essential skills include analytical thinking, effective communication, and proficiency with financial software. Your ability to adapt to regulatory changes and demonstrate ethical judgment enhances career growth in the banking sector.

Career Growth and Advancement Paths

Banking graduates have diverse career opportunities ranging from retail banking to investment banking and financial analysis. These roles offer robust career growth and structured advancement paths within the financial services industry.

- Retail Banking Officer - Entry-level role focused on customer service and financial product sales, offering advancement to branch management and regional leadership positions.

- Credit Analyst - Specialized role in evaluating creditworthiness, paving the way to senior analyst, risk management, and portfolio management roles.

- Investment Banking Analyst - Analytical role in mergers, acquisitions, and capital raising, providing a pathway to associate, vice president, and director roles within investment banks.

High-Paying Banking Careers

Banking graduates can pursue high-paying careers such as investment banking, where they analyze financial markets and manage corporate mergers. Roles in risk management offer lucrative opportunities by evaluating and mitigating financial risks for large institutions. Corporate finance positions provide substantial earnings by overseeing company funding strategies and capital raising initiatives.

Emerging Trends Influencing Banking Jobs

Banking graduates are encountering dynamic career opportunities driven by rapid technological advancements and evolving financial regulations. Emerging trends are reshaping job roles, emphasizing digital skills and data expertise.

- FinTech Integration - Banking jobs increasingly require knowledge of financial technology platforms and digital payment systems.

- Data Analytics - Expertise in big data and predictive analytics is crucial for risk assessment and customer insights.

- Cybersecurity Roles - Protecting financial data has created a demand for professionals skilled in cybersecurity and fraud prevention.

Tips for Securing a Banking Position

| Job Roles for Banking Graduates | Description |

|---|---|

| Investment Banking Analyst | Analyze financial data to support mergers, acquisitions, and capital raising activities. |

| Credit Analyst | Evaluate credit data and financial statements to determine risks in lending money. |

| Commercial Banker | Manage client accounts and provide tailored financial solutions to businesses. |

| Risk Manager | Identify and assess financial risks to minimize potential losses for the bank. |

| Financial Advisor | Offer investment guidance and financial planning services to individual clients. |

| Tips for Securing a Banking Position | |

| Obtain Relevant Certifications | Pursue certifications such as CFA, FRM, or CAIA to enhance your qualifications. |

| Develop Strong Analytical Skills | Strengthen your ability to interpret financial data and market trends. |

| Gain Internship Experience | Complete internships at reputable banks to build practical knowledge and networking contacts. |

| Network Effectively | Attend industry events and join professional banking groups to connect with hiring managers. |

| Prepare for Interviews | Research banks, understand their products, and practice common banking interview questions. |

| Demonstrate Soft Skills | Showcase communication, problem-solving, and customer service abilities during the application process. |

| Tailor Your Resume | Customize your resume to highlight banking-related experiences and skills relevant to each position. |

jobsintra.com

jobsintra.com