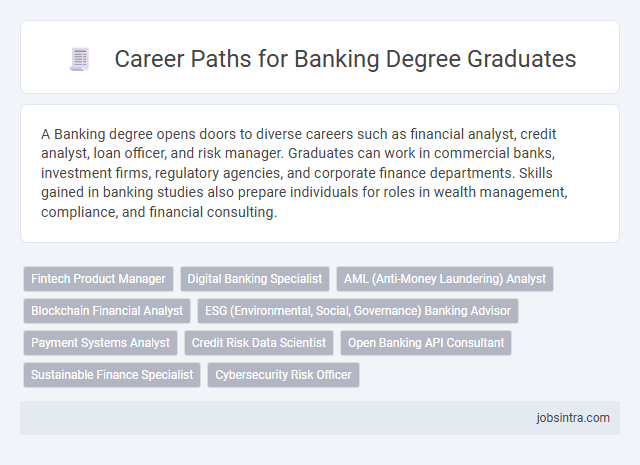

A Banking degree opens doors to diverse careers such as financial analyst, credit analyst, loan officer, and risk manager. Graduates can work in commercial banks, investment firms, regulatory agencies, and corporate finance departments. Skills gained in banking studies also prepare individuals for roles in wealth management, compliance, and financial consulting.

Fintech Product Manager

A Banking degree paves the way for a career as a Fintech Product Manager, where you drive innovation by developing digital financial products tailored to customer needs. This role requires a blend of industry knowledge, technical understanding, and strategic thinking to create seamless user experiences in banking apps, payment systems, and investment platforms. Your expertise helps bridge traditional banking with cutting-edge technology, shaping the future of financial services.

Digital Banking Specialist

A Digital Banking Specialist leverages banking expertise and technology skills to enhance online financial services, improve customer experience, and implement digital solutions within banks. This role involves managing digital platforms, analyzing user data, and ensuring secure, user-friendly transactions that meet regulatory standards. Your knowledge in finance and digital tools will position you to innovate the future of banking and drive technological transformation.

AML (Anti-Money Laundering) Analyst

An AML (Anti-Money Laundering) Analyst plays a critical role in the banking sector by identifying and investigating suspicious financial activities to prevent illegal money laundering. Your expertise in analyzing transaction data and regulatory compliance helps financial institutions mitigate risks and adhere to strict legal standards. This position offers a promising career path for banking graduates interested in financial crime prevention and compliance roles.

Blockchain Financial Analyst

A Blockchain Financial Analyst leverages expertise in banking and blockchain technology to evaluate and implement digital currency solutions within financial institutions. This role involves analyzing blockchain trends, assessing risks, and optimizing financial transactions through decentralized ledger systems. Proficiency in blockchain protocols, regulatory compliance, and financial analysis is essential for driving innovation in banking services.

ESG (Environmental, Social, Governance) Banking Advisor

ESG Banking Advisors specialize in integrating environmental, social, and governance criteria into financial decision-making and investment strategies within banking institutions. They assess risks and opportunities related to sustainability, guide clients on responsible investing, and ensure compliance with evolving regulatory standards. This role is essential for promoting ethical finance practices and fostering long-term value creation in the banking sector.

Payment Systems Analyst

A Payment Systems Analyst plays a crucial role in the banking sector by managing and optimizing electronic payment processes to ensure secure, efficient transactions. You analyze payment system data, troubleshoot issues, and implement improvements that enhance overall financial operations. Strong knowledge in payment technologies, compliance standards, and data analysis is essential for success in this job.

Credit Risk Data Scientist

A Credit Risk Data Scientist applies advanced analytics and machine learning techniques to assess the creditworthiness of individuals and organizations, helping banks minimize financial risk. They analyze large datasets to identify patterns, predict default probabilities, and develop risk models that support lending decisions and regulatory compliance. Expertise in statistical modeling, programming languages like Python or R, and knowledge of credit risk frameworks are essential for success in this role.

Open Banking API Consultant

Open Banking API Consultant roles leverage expertise in banking regulations and technology to help financial institutions implement secure, customer-centric APIs. Your skills in API integration and compliance ensure seamless data sharing between banks and third-party providers, enhancing financial services innovation. Specializing in this position positions you at the forefront of digital transformation in the banking industry.

Sustainable Finance Specialist

A Banking degree opens the door to a career as a Sustainable Finance Specialist, where you analyze and implement financial strategies that promote environmental and social responsibility. You will evaluate investments and loans to ensure they align with sustainability goals, helping organizations meet regulatory requirements and foster long-term positive impact. This role combines financial expertise with a passion for driving responsible economic growth and addressing climate change challenges.

Good to know: jobs for Banking degree

Overview of Banking Degrees

Banking degrees provide specialized knowledge in finance, investment, risk management, and financial regulations. Graduates gain skills essential for various roles in the banking and financial services industry.

- Financial Analyst - Analyzes financial data to guide investment decisions and assess economic trends.

- Loan Officer - Evaluates loan applications and assesses creditworthiness to approve financing.

- Risk Manager - Identifies and mitigates financial risks within banking institutions to maintain stability.

Traditional Banking Careers

A degree in banking opens up various traditional career paths within the financial services industry. These roles focus on managing client accounts, assessing credit risk, and overseeing daily banking operations.

- Bank Teller - Responsible for processing customer transactions, handling cash, and providing account information.

- Loan Officer - Evaluates and authorizes loans for individuals and businesses based on creditworthiness and financial data.

- Branch Manager - Oversees branch operations, staff management, and ensures regulatory compliance.

These positions build foundational expertise essential for long-term growth in banking.

Emerging Roles in Fintech

A Banking degree opens diverse career opportunities in the rapidly evolving fintech industry. Emerging roles include blockchain analysts, digital payment specialists, and AI-driven credit risk managers, all crucial for modern financial services. You can leverage your banking knowledge to excel in these innovative positions transforming financial technology.

Finance and Investment Opportunities

Graduates with a banking degree specializing in finance and investment have a broad spectrum of career opportunities. Roles such as financial analyst, investment banker, and portfolio manager are in high demand globally.

Financial analysts evaluate market trends to guide investment decisions, while investment bankers assist corporations in raising capital through equity and debt markets. Portfolio managers oversee investment portfolios to maximize returns for clients. Risk analysts assess financial risks to ensure informed decision-making in volatile markets.

Regulatory and Compliance Careers

A Banking degree opens specialized pathways in Regulatory and Compliance careers, essential for navigating financial laws and industry standards. These roles ensure that banking institutions operate within legal frameworks and maintain ethical practices.

- Compliance Analyst - Monitors bank activities to ensure adherence to regulatory requirements and internal policies.

- Regulatory Affairs Specialist - Interprets and implements financial regulations to maintain organizational compliance.

- Risk Management Officer - Identifies and mitigates risks related to regulatory breaches and financial misconduct.

Skills Required for Banking Professionals

| Job Role | Skills Required | Key Responsibilities |

|---|---|---|

| Bank Teller | Customer service, cash handling, attention to detail, basic accounting | Processing transactions, balancing cash drawers, assisting customers with account inquiries |

| Credit Analyst | Financial analysis, risk assessment, data interpretation, decision-making | Evaluating loan applications, assessing creditworthiness, preparing financial reports |

| Loan Officer | Interpersonal communication, underwriting, negotiation, knowledge of banking products | Approving loans, advising clients on loan options, monitoring loan repayment |

| Financial Analyst | Data analysis, forecasting, financial modeling, proficiency in Excel and financial software | Analyzing market trends, preparing investment reports, supporting strategic decisions |

| Branch Manager | Leadership, team management, operational planning, regulatory compliance | Overseeing branch operations, managing staff, ensuring regulatory adherence, driving sales targets |

| Compliance Officer | Regulatory knowledge, risk management, auditing, attention to detail | Monitoring banking operations for compliance, implementing policies, training staff |

| Investment Banker | Negotiation, financial modeling, market analysis, client relationship management | Raising capital, advising on mergers and acquisitions, structuring financial deals |

| Banking Operations Manager | Process optimization, project management, analytical skills, strong communication | Managing daily banking operations, improving process efficiency, coordinating between departments |

| Risk Manager | Risk assessment, strategic planning, financial knowledge, crisis management | Identifying and mitigating risks, developing risk management frameworks, collaborating with stakeholders |

| Wealth Manager | Financial planning, client advisory, investment strategy, interpersonal skills | Managing client portfolios, advising on wealth growth, ensuring compliance with financial regulations |

Your banking degree opens doors in diverse roles requiring analytical, interpersonal, and technical skills essential for the financial sector.

Strategies for Career Advancement

What career paths can a banking degree open in the commerce sector?

A banking degree qualifies graduates for roles such as financial analyst, credit analyst, loan officer, and risk manager. These positions leverage knowledge of financial products, market analysis, and regulatory compliance to support commercial success.

How can professionals with a banking degree strategically advance their careers?

Obtaining certifications like CFA or FRM enhances expertise and credibility in finance-related roles. Building a strong network within the banking industry and gaining experience in digital finance tools accelerates career progression.

What skills are essential for a banking degree holder aiming for leadership roles?

Leadership in banking requires analytical skills, decision-making ability, and communication proficiency. Developing strategic thinking and staying updated on financial regulations supports effective management and career growth.

How does specialization impact career advancement in the banking sector?

Specializing in areas such as risk management, investment banking, or retail banking creates competitive advantages. Focused expertise enables professionals to take on senior roles and contribute to innovative financial strategies.

What role do internships and practical experience play for banking degree students?

Internships provide valuable exposure to real-world banking operations and client interactions. Practical experience builds skills, enhances resumes, and increases employability in competitive commerce job markets.

jobsintra.com

jobsintra.com