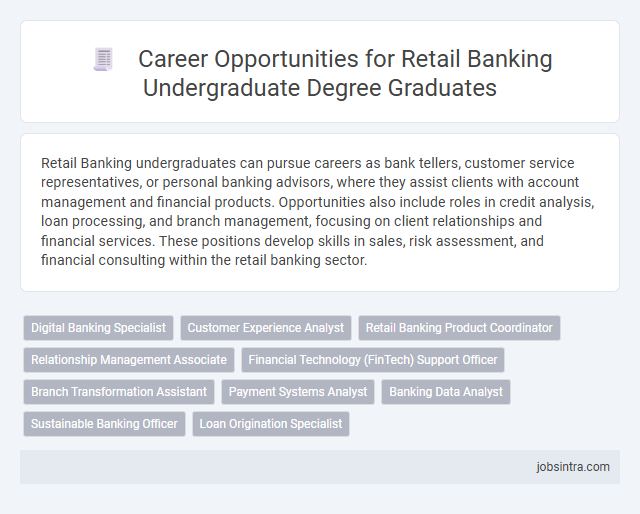

Retail Banking undergraduates can pursue careers as bank tellers, customer service representatives, or personal banking advisors, where they assist clients with account management and financial products. Opportunities also include roles in credit analysis, loan processing, and branch management, focusing on client relationships and financial services. These positions develop skills in sales, risk assessment, and financial consulting within the retail banking sector.

Digital Banking Specialist

A Digital Banking Specialist in retail banking focuses on enhancing online and mobile banking platforms to improve customer experience and increase digital adoption. They analyze user behavior, implement new technologies, and collaborate with IT and marketing teams to develop seamless, secure digital services. Expertise in data analytics, user interface design, and cybersecurity is essential for driving innovation and meeting evolving consumer needs.

Customer Experience Analyst

A Customer Experience Analyst in retail banking evaluates client interactions to optimize satisfaction and loyalty. You analyze customer feedback, identify pain points, and recommend improvements to enhance service quality. This role requires strong data interpretation skills and a deep understanding of banking products and customer behavior.

Retail Banking Product Coordinator

A Retail Banking Product Coordinator supports the development and management of banking products tailored to customer needs. Your role involves collaborating with cross-functional teams to optimize product features, ensuring compliance, and enhancing customer experience. This position offers a pathway to deepen your knowledge in banking operations and strategic product management.

Relationship Management Associate

A Relationship Management Associate in retail banking plays a crucial role in building and maintaining strong client relationships while understanding their financial needs. They provide personalized banking solutions, promote products, and assist customers with account management to enhance satisfaction and loyalty. This position offers valuable experience in client interaction, sales, and financial advisory within the banking sector.

Financial Technology (FinTech) Support Officer

A Financial Technology (FinTech) Support Officer in retail banking plays a crucial role in bridging technology and customer service by managing the implementation and maintenance of digital banking tools. You will ensure seamless operation of payment systems, mobile apps, and online platforms, resolving technical issues and supporting both staff and customers. Expertise in fintech solutions enhances efficiency and drives innovation within the retail banking sector.

Branch Transformation Assistant

A Branch Transformation Assistant plays a crucial role in modernizing retail banking operations by supporting the implementation of new technologies and improving customer service processes. You will collaborate with various teams to streamline branch workflows and enhance the overall client experience. This position offers hands-on exposure to operational change management and digital innovation within the banking sector.

Payment Systems Analyst

A Payment Systems Analyst in retail banking ensures the accuracy and security of electronic transactions, optimizing payment processing systems for efficiency. You analyze payment data, troubleshoot system issues, and implement improvements to enhance customer experience while maintaining compliance with financial regulations. This role is ideal for those interested in combining financial knowledge with technical problem-solving skills within the retail banking sector.

Banking Data Analyst

A Banking Data Analyst in retail banking interprets complex financial data to identify trends, improve customer experiences, and optimize branch performance. By leveraging data analytics tools, you can support strategic decision-making that enhances product offerings and risk management. This role demands strong analytical skills and an understanding of banking operations to drive business growth.

Sustainable Banking Officer

A Sustainable Banking Officer in retail banking develops and implements strategies that promote environmentally and socially responsible lending practices. You focus on assessing the sustainability impact of financial products while ensuring compliance with green finance regulations and standards. This role combines risk management with a commitment to driving positive environmental and social outcomes through everyday banking services.

Good to know: jobs for Retail Banking undergraduate

Overview of Retail Banking in the Commerce Sector

| Job Role | Description | Key Skills | Relevance to Retail Banking |

|---|---|---|---|

| Retail Banking Officer | Handles daily banking operations and assists customers with account services, loans, and deposits. | Customer service, financial product knowledge, communication | Direct interaction with retail customers enhances understanding of consumer banking needs. |

| Credit Analyst | Evaluates creditworthiness of individuals applying for personal loans, mortgages, and credit cards. | Financial analysis, risk assessment, data interpretation | Supports risk management by ensuring responsible lending in retail banking. |

| Relationship Manager | Manages client portfolios to provide personalized retail banking solutions and maintain client satisfaction. | Client relationship management, sales, negotiation | Builds long-term customer relationships crucial for retail banking growth. |

| Branch Manager | Oversees branch operations, staff management, and customer service quality at the retail branch level. | Leadership, operational management, customer service | Ensures efficient retail banking service delivery and compliance with sector regulations. |

| Financial Advisor | Provides financial planning and advice on investments, savings, and insurance products to retail clients. | Financial planning, product expertise, advisory skills | Enhances retail banking portfolio by offering tailored financial solutions. |

Core Skills Developed Through a Retail Banking Degree

What core skills are developed through a retail banking degree that prepare undergraduates for jobs in the sector? A retail banking degree equips students with essential skills such as financial analysis, customer relationship management, and risk assessment. These competencies enable graduates to perform effectively in roles like bank teller, loan officer, and financial advisor.

How does a retail banking degree enhance communication and problem-solving abilities? The program emphasizes interpersonal communication and critical thinking through case studies and client interactions. This foundation allows graduates to manage customer inquiries and resolve financial issues efficiently in various retail banking positions.

Which technical skills are mastered by retail banking undergraduates for careers in finance? Students gain proficiency in banking software, data analysis, and regulatory compliance. Mastery of these tools prepares them for roles involving transaction processing, credit evaluation, and compliance monitoring.

Why is knowledge of financial products important for retail banking graduates? Understanding savings accounts, loans, mortgages, and investment options helps graduates advise customers accurately. This expertise fits essential job functions such as personal banking advisor and credit analyst.

What role does risk management training play in retail banking careers? Retail banking degrees train students to identify, assess, and mitigate financial risks in client portfolios and bank operations. Skills in risk management are critical for positions like credit risk analyst and fraud prevention specialist.

Entry-Level Job Roles for Retail Banking Graduates

Entry-level job roles for retail banking graduates offer a solid foundation in finance, customer service, and banking operations. These positions provide opportunities to develop key skills essential for a successful career in retail banking.

- Bank Teller - Handles daily customer transactions, cash management, and basic account services.

- Customer Service Representative - Provides support for retail banking clients, resolving inquiries and offering product information.

- Credit Analyst - Assesses loan applications and evaluates creditworthiness for retail customers.

Advancement Pathways and Leadership Positions

Retail Banking undergraduates have diverse career opportunities ranging from customer service roles to financial advisory positions. These jobs provide foundational experience in banking operations and client management.

Advancement pathways often begin with entry-level positions such as bank teller or personal banker. Progression can lead to roles like branch manager, relationship manager, or credit analyst. Leadership positions include regional manager and executive roles overseeing multiple branches or banking products.

Specialized Career Tracks within Retail Banking

Retail Banking undergraduates have diverse career opportunities focusing on specialized tracks such as Personal Banking, Mortgage Advisory, and Credit Analysis. These roles involve managing client relationships, assessing creditworthiness, and providing tailored financial solutions.

Specialized career tracks also include Wealth Management, Risk Management, and Branch Operations Management. Professionals in these areas work on investment strategies, regulatory compliance, and improving branch efficiency to enhance customer experience.

Emerging Trends Affecting Retail Banking Careers

Emerging trends in retail banking, such as digital transformation, artificial intelligence, and personalized customer experiences, are reshaping career opportunities for undergraduates. Roles in data analytics, fintech integration, and customer relationship management are in high demand as banks adopt advanced technologies to enhance services. Your career in retail banking will benefit from developing skills in cybersecurity, blockchain, and mobile banking platforms to stay competitive in this evolving landscape.

Tips for Maximizing Employability in Retail Banking

Retail banking undergraduates can pursue roles such as banking associate, customer service representative, credit analyst, or financial advisor. Building strong communication skills, understanding financial products, and gaining experience through internships increase job prospects significantly. Focus on developing digital literacy and customer relationship management abilities to enhance your employability in this competitive field.

jobsintra.com

jobsintra.com