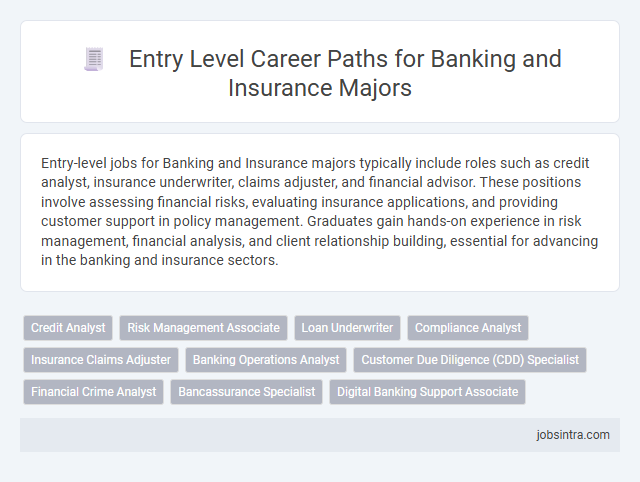

Entry-level jobs for Banking and Insurance majors typically include roles such as credit analyst, insurance underwriter, claims adjuster, and financial advisor. These positions involve assessing financial risks, evaluating insurance applications, and providing customer support in policy management. Graduates gain hands-on experience in risk management, financial analysis, and client relationship building, essential for advancing in the banking and insurance sectors.

Credit Analyst

A Credit Analyst evaluates the creditworthiness of individuals or businesses, helping banks and insurance companies make informed lending decisions. You will analyze financial statements, assess risk factors, and prepare detailed reports to support loan approvals and policy underwriting. Strong analytical skills and attention to detail are essential for success in this entry-level role.

Risk Management Associate

Risk Management Associates play a crucial role in identifying, assessing, and mitigating potential risks within banking and insurance firms. These entry-level professionals analyze financial data, monitor regulatory compliance, and develop strategies to protect assets and ensure organizational stability. Your strong analytical skills and attention to detail will be essential for success in this dynamic position.

Loan Underwriter

Loan underwriters evaluate creditworthiness by analyzing financial documents and assessing risks to approve or deny loan applications. They work closely with banks and insurance companies to ensure thorough risk management and compliance with regulatory standards. Your attention to detail and strong analytical skills are essential for successfully entering this role in the banking and insurance sectors.

Compliance Analyst

Entry-level Compliance Analysts in banking and insurance play a crucial role in ensuring organizations adhere to regulatory requirements and internal policies. They review transactions, conduct risk assessments, and monitor compliance programs to prevent legal issues and financial penalties. Proficiency in regulatory frameworks and strong analytical skills are essential for success in this position.

Insurance Claims Adjuster

Insurance Claims Adjusters play a vital role in evaluating insurance claims to determine the extent of the company's liability. You can start your career by investigating, assessing damages, and negotiating settlements to ensure fair compensation. This position offers valuable experience in risk assessment and customer service within the insurance industry.

Banking Operations Analyst

Banking Operations Analysts play a crucial role in managing and improving banking processes, ensuring accuracy and efficiency in transaction processing and compliance. They analyze operational workflows, identify risks, and recommend solutions to streamline activities within retail or corporate banking environments. Entry-level positions typically involve data analysis, report generation, and collaboration with various departments to support daily banking operations and regulatory requirements.

Customer Due Diligence (CDD) Specialist

Customer Due Diligence (CDD) Specialists play a crucial role in banking and insurance by assessing client backgrounds to prevent fraud and ensure regulatory compliance. Entry-level CDD positions involve verifying customer identities, analyzing transaction patterns, and preparing risk assessment reports. Mastery of anti-money laundering (AML) protocols and strong analytical skills are essential for success in this role.

Financial Crime Analyst

Entry-level Financial Crime Analysts in banking and insurance focus on identifying and preventing fraudulent activities, money laundering, and compliance breaches. They analyze transaction data, monitor suspicious behavior, and support regulatory reporting to protect organizations from financial risks. Strong analytical skills and knowledge of regulatory frameworks are essential for success in this role.

Bancassurance Specialist

A Bancassurance Specialist bridges the gap between banking and insurance sectors by promoting and selling insurance products through bank channels. You will work closely with bank clients to understand their financial needs and offer tailored insurance solutions, enhancing cross-selling opportunities. This role requires strong interpersonal skills and knowledge of both banking products and insurance policies to drive revenue growth for both industries.

Good to know: jobs for Banking and Insurance majors entry level

Overview of Banking and Insurance Sectors

Entry-level jobs for Banking and Insurance majors include positions such as credit analyst, loan officer, insurance underwriter, and claims adjuster. These roles focus on assessing financial risks, evaluating creditworthiness, and managing insurance policies.

The banking sector offers opportunities in retail banking, corporate finance, and risk management, emphasizing customer service and financial analysis. The insurance sector provides roles in policy administration, claims processing, and actuarial support, ensuring proper coverage and claims settlement.

Key Entry-Level Positions for Commerce Graduates

Banking and Insurance majors have a wide range of entry-level job opportunities in the commerce sector. Key positions include roles such as Credit Analyst, Insurance Underwriter, and Financial Services Representative, which offer foundational experience in financial assessment and risk management.

These roles equip graduates with essential skills in customer service, data analysis, and regulatory compliance. Starting careers in fields like loan processing, claims adjustment, or risk evaluation provides a strong basis for advancement in banking and insurance industries.

Essential Skills and Qualifications Required

Entry-level jobs for Banking and Insurance majors include financial analyst, insurance underwriter, and loan officer. Essential skills comprise strong analytical abilities, proficiency in risk assessment, and knowledge of financial regulations. Your qualifications should include a relevant degree, attention to detail, and effective communication skills.

Top Employers and Recruitment Channels

What entry-level jobs are available for Banking and Insurance majors in commerce? Top employers include multinational banks like JPMorgan Chase, HSBC, and insurance giants such as AIG and Prudential. Recruitment channels often involve campus placements, online job portals like LinkedIn, and industry-specific career fairs.

Where can you find the best opportunities for starting your career in Banking and Insurance? Leading companies hire through internship programs and referral networks. Your applications can gain visibility on platforms like Glassdoor and Naukri.com, which are widely used for entry-level recruitment.

Career Growth and Advancement Opportunities

| Entry-Level Jobs for Banking and Insurance Majors | Career Growth and Advancement Opportunities |

|---|---|

| Bank Teller | Starting as a bank teller provides foundational knowledge of banking operations. Progression paths include roles such as Personal Banker, Loan Officer, and Branch Manager. Advancement is supported by certifications and experience, leading to senior management positions. |

| Credit Analyst | Credit analysts evaluate loan applications and financial data. Career growth often moves toward risk management, portfolio management, and financial consultancy roles. Advanced analytics and certifications enhance promotion prospects. |

| Insurance Underwriter | Underwriters assess insurance applications to determine risk levels. Growth can lead to senior underwriting positions, team leadership, and specialization in fields like life, health, or property insurance. Professional designations improve career trajectory. |

| Claims Adjuster | Claims adjusters investigate insurance claims and negotiate settlements. Career advancement includes claims management, fraud examination, and supervisory roles. Expertise in industry regulations boosts advancement potential. |

| Financial Advisor | Financial advisors guide clients on investments and financial planning. Growth leads to senior advisory roles, wealth management, and portfolio advisory positions. Building a client base and earning certifications accelerate career development. |

| Risk Analyst | Risk analysts identify and measure risks within banking and insurance organizations. Career progression includes risk management leadership, compliance officer positions, and strategic planning roles. Advanced degrees and certifications strengthen advancement opportunities. |

| Customer Service Representative (Banking or Insurance) | Customer service positions develop communication and problem-solving skills. Promotion paths lead to team leadership, branch operations, and client relationship manager roles. Gaining product knowledge and sales skills enhances upward mobility. |

| Insurance Sales Agent | Sales agents promote and sell insurance policies. Growth focuses on building a strong client network, leading sales teams, or moving into marketing and product development. Performance metrics and licensing credentials impact career advancement. |

| You can leverage practical experience and industry certifications in these roles to expand your career in banking and insurance fields significantly. |

Certification and Training Programs

Entry-level jobs for Banking and Insurance majors include roles such as banking associates, insurance claims processors, and financial analysts. Certification programs like the Certified Banking & Credit Analyst (CBCA) and Chartered Property Casualty Underwriter (CPCU) enhance job prospects and professional knowledge. Training programs focused on risk management, financial regulations, and customer service equip you with practical skills essential for career growth in these sectors.

Tips for Landing Your First Job in Banking or Insurance

Banking and insurance majors have diverse entry-level job opportunities such as financial analyst, credit analyst, insurance underwriter, and claims adjuster. These roles provide practical experience in risk assessment, financial management, and client relations within the commerce sector.

To land your first job in banking or insurance, tailor your resume to highlight relevant coursework and internships. Build a strong professional network by attending industry events and connecting with alumni. Prepare thoroughly for interviews by researching the company's services, recent news, and key industry trends.

jobsintra.com

jobsintra.com