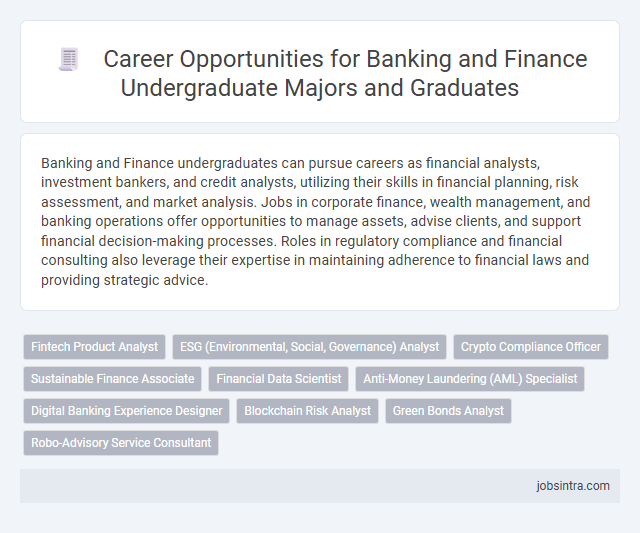

Banking and Finance undergraduates can pursue careers as financial analysts, investment bankers, and credit analysts, utilizing their skills in financial planning, risk assessment, and market analysis. Jobs in corporate finance, wealth management, and banking operations offer opportunities to manage assets, advise clients, and support financial decision-making processes. Roles in regulatory compliance and financial consulting also leverage their expertise in maintaining adherence to financial laws and providing strategic advice.

Fintech Product Analyst

A Fintech Product Analyst in the Banking and Finance sector combines financial expertise with technology to develop innovative digital products and services. They analyze market trends, user data, and regulatory requirements to optimize product features and enhance customer experience. Proficiency in data analytics, financial modeling, and agile methodologies is essential for driving product success in competitive fintech environments.

ESG (Environmental, Social, Governance) Analyst

A Banking and Finance undergraduate can pursue a career as an ESG (Environmental, Social, Governance) Analyst, evaluating companies' sustainable and ethical impact to guide responsible investment decisions. This role involves analyzing financial data alongside ESG criteria to support portfolios that align with environmental stewardship and social responsibility. Your expertise helps organizations integrate ESG factors into financial strategies, promoting long-term value and risk mitigation.

Crypto Compliance Officer

A Crypto Compliance Officer ensures that cryptocurrency transactions and operations adhere to regulatory standards, mitigating risks associated with digital assets. This role requires strong knowledge of financial regulations, anti-money laundering (AML) laws, and blockchain technology. Banking and Finance undergraduates equipped with analytical skills and understanding of compliance frameworks are well-suited for this emerging position.

Sustainable Finance Associate

A Sustainable Finance Associate supports the integration of environmental, social, and governance (ESG) criteria into investment decisions and financial strategies. This role involves analyzing sustainability risks, preparing impact reports, and collaborating with stakeholders to promote responsible finance initiatives. Proficiency in financial modeling, sustainability frameworks, and regulatory compliance is essential for driving green investments and sustainable growth in banking and finance.

Financial Data Scientist

Financial Data Scientist roles for Banking and Finance undergraduates involve analyzing complex financial datasets to identify market trends, risks, and opportunities. Professionals apply machine learning algorithms and statistical models to enhance decision-making processes and optimize investment strategies. These positions require strong programming skills, domain expertise, and the ability to communicate insights effectively to stakeholders.

Anti-Money Laundering (AML) Specialist

An Anti-Money Laundering (AML) Specialist plays a crucial role in identifying and preventing illicit financial activities within banks and financial institutions. They analyze transactions, monitor suspicious activities, and ensure compliance with regulatory requirements to mitigate risks associated with money laundering and financial crimes. Expertise in AML software, regulatory frameworks, and investigative techniques is essential for protecting organizations from legal and reputational damage.

Digital Banking Experience Designer

Digital Banking Experience Designers create seamless, user-friendly interfaces for online banking platforms, enhancing customer engagement through intuitive navigation and personalized features. They apply user experience (UX) principles and utilize data analytics to tailor digital services that meet evolving consumer needs. This role blends financial knowledge with design skills to innovate banking solutions that improve accessibility and streamline transactions.

Blockchain Risk Analyst

Blockchain Risk Analysts evaluate and manage risks associated with blockchain technologies in financial institutions. You analyze security vulnerabilities, regulatory compliance, and transaction integrity to protect assets and prevent fraud. This role combines expertise in banking, finance, and emerging digital ledgers to ensure secure and efficient operations.

Green Bonds Analyst

A Green Bonds Analyst evaluates fixed-income securities that fund environmentally sustainable projects, ensuring investments align with green finance standards. Your expertise in banking and finance enables you to assess risk, market trends, and regulatory compliance specific to green bonds. This role supports the growing demand for sustainable investment strategies within financial institutions.

Good to know: jobs for Banking and Finance undergraduate

Overview of Banking and Finance as a Career Field

What career opportunities are available for Banking and Finance undergraduates? The banking and finance sector offers diverse roles including financial analyst, investment banker, and risk manager. These positions require strong analytical skills and a keen understanding of market trends.

How does a degree in Banking and Finance prepare you for the job market? Your education provides a solid foundation in economic principles, financial reporting, and asset management. Employers seek graduates who can navigate complex financial systems and advise on investment strategies.

Top Job Roles for Banking and Finance Graduates

Banking and Finance graduates have a wide range of career opportunities in sectors such as investment banking, financial analysis, and risk management. Popular job roles include Financial Analyst, Investment Banker, Credit Analyst, and Portfolio Manager, each requiring strong analytical and quantitative skills. Your expertise can help organizations make informed financial decisions, manage assets, and optimize investments for sustained growth.

Essential Skills Required in Banking and Finance Careers

Banking and Finance undergraduates have diverse career opportunities in roles such as financial analysts, investment bankers, loan officers, and risk managers. These positions require a strong foundation in financial principles, economic analysis, and market trends.

Essential skills include quantitative analysis, proficiency in financial software, and understanding of regulatory compliance. Effective communication, critical thinking, and attention to detail are crucial for success in banking and finance careers.

Key Industries Hiring Banking and Finance Majors

Banking and Finance undergraduates have diverse career opportunities available across various key industries. These sectors actively seek skilled graduates to drive financial strategy and analysis.

- Commercial Banking - Offers roles in credit analysis, loan management, and customer financial services.

- Investment Firms - Employ graduates for portfolio management, risk assessment, and trading positions.

- Insurance Companies - Provide career options in underwriting, claims analysis, and financial consulting.

Professional Certifications and Further Education Options

| Job Role | Relevant Professional Certifications | Further Education Options |

|---|---|---|

| Financial Analyst | Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), Certified Investment Management Analyst (CIMA) | Master's in Finance, MBA with Finance specialization, MSc in Financial Economics |

| Investment Banker | Certified Investment Banking Professional (CIBPTM), CFA, Chartered Market Technician (CMT) | MBA in Investment Banking, Master's in Finance, Executive Education Programs |

| Risk Manager | Financial Risk Manager (FRM), Professional Risk Manager (PRM), Certified Risk Manager (CRM) | Master's in Risk Management, MSc in Finance, MBA with Risk specialization |

| Accountant | Certified Public Accountant (CPA), Chartered Accountant (CA), Certified Management Accountant (CMA) | Master's in Accounting, Chartered Accountancy courses, MBA in Finance or Accounting |

| Credit Analyst | Certified Credit Analyst (CCA), CFA, Credit Risk Certification | Master's in Finance, MBA with Finance or Banking specialization |

| Financial Planner | Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), Personal Financial Specialist (PFS) | Master's in Financial Planning, MBA in Finance, Advanced Diploma in Financial Planning |

| Banking Operations Manager | Certified Treasury Professional (CTP), Six Sigma Green Belt, Professional in Banking (CPB) | MBA in Banking and Finance, Master's in Business Administration, Postgraduate Diploma in Banking |

| Compliance Officer | Certified Anti-Money Laundering Specialist (CAMS), Certified Regulatory Compliance Manager (CRCM) | Master's in Law and Finance, MBA with Compliance specialization, LLM in Financial Law |

| Trader | Chartered Market Technician (CMT), Certified Financial Technician (CFTe), Series 7 License | Master's in Finance, MBA in Financial Markets, Specialized Trading Certification |

| Corporate Finance Executive | Certified Treasury Professional (CTP), CFA, Chartered Alternative Investment Analyst (CAIA) | MBA in Finance, Master's in Corporate Finance, Executive Certificates in Corporate Strategy |

Emerging Trends and Opportunities in Finance

Banking and Finance undergraduates are exploring a dynamic job market shaped by technological advancements and evolving financial regulations. Emerging trends open new career opportunities that align with digital transformation in the finance sector.

- FinTech Analyst - Analyzes financial technology innovations to help firms adopt cutting-edge payment and lending solutions.

- Data Scientist in Finance - Utilizes big data to enhance risk assessment, investment strategies, and fraud detection processes.

- Sustainability Finance Specialist - Focuses on green finance and ESG investing to support sustainable business practices and regulatory compliance.

Your skills can position you at the forefront of finance, leveraging technology and market trends for a successful career.

Career Growth and Advancement Paths in Banking and Finance

Banking and Finance undergraduates have diverse career options with significant potential for growth. Your skills in financial analysis, risk management, and investment strategies open doors to multiple advancement paths.

- Financial Analyst - Develop expertise in evaluating financial data to support business decisions and progress toward senior analyst roles.

- Investment Banker - Gain experience in mergers, acquisitions, and capital raising to move into associate or vice president positions.

- Risk Manager - Identify and mitigate financial risks, leading to opportunities for leadership in compliance and risk strategy departments.

jobsintra.com

jobsintra.com