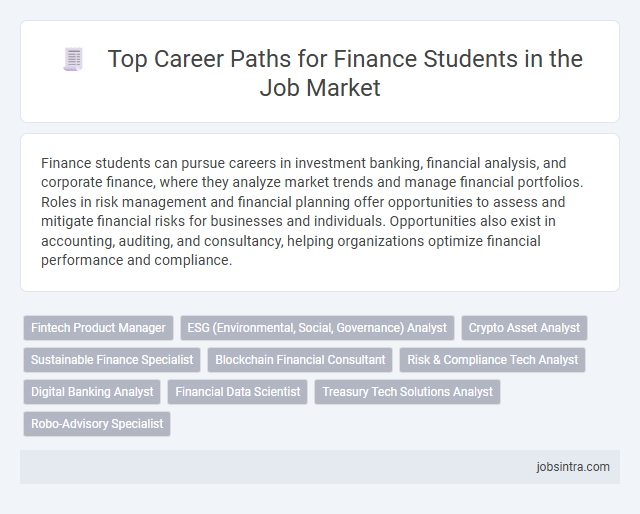

Finance students can pursue careers in investment banking, financial analysis, and corporate finance, where they analyze market trends and manage financial portfolios. Roles in risk management and financial planning offer opportunities to assess and mitigate financial risks for businesses and individuals. Opportunities also exist in accounting, auditing, and consultancy, helping organizations optimize financial performance and compliance.

Fintech Product Manager

Fintech Product Managers bridge the gap between technology and finance by developing innovative financial products that meet market needs. Your role involves collaborating with cross-functional teams to design, launch, and optimize digital solutions such as payment systems, lending platforms, and investment tools. Strong knowledge of financial markets, customer behavior, and agile methodologies is essential to succeed in this dynamic career path.

ESG (Environmental, Social, Governance) Analyst

ESG Analysts assess how companies perform on environmental, social, and governance criteria to guide sustainable investment decisions. Your expertise in financial analysis paired with knowledge of ESG factors positions you to influence corporate responsibility and drive positive impact. Skills in data interpretation, regulatory frameworks, and stakeholder communication are essential for succeeding in this role.

Crypto Asset Analyst

Crypto asset analysts specialize in evaluating digital currencies and blockchain technologies to guide investment strategies. Their expertise includes market trends analysis, risk assessment, and portfolio management within the rapidly evolving crypto space. This role demands strong quantitative skills, financial modeling, and a deep understanding of tokenomics and regulatory environments.

Sustainable Finance Specialist

Sustainable Finance Specialists focus on integrating environmental, social, and governance (ESG) criteria into financial decision-making processes to promote responsible investment and corporate practices. They analyze the impact of investments on sustainability goals while advising institutions on managing risks related to climate change and social responsibility. Expertise in financial analysis, sustainability reporting, and regulatory compliance is essential for success in this role.

Blockchain Financial Consultant

Blockchain Financial Consultants specialize in integrating blockchain technology with traditional finance, helping organizations streamline transactions and improve transparency. You can leverage expertise in finance and blockchain to advise on cryptocurrency investments, smart contracts, and decentralized finance (DeFi) solutions. This role combines analytical skills with innovative technology to transform financial operations and strategies.

Risk & Compliance Tech Analyst

A career as a Risk & Compliance Tech Analyst offers finance students a unique opportunity to merge financial expertise with advanced technology skills. You will analyze data to identify potential risks and ensure that organizations adhere to regulatory standards, helping to prevent financial losses and maintain integrity. This role demands proficiency in risk management software, regulatory knowledge, and strong analytical capabilities.

Digital Banking Analyst

A Digital Banking Analyst plays a crucial role in transforming traditional banking services through technology and data-driven insights. Your expertise in financial analysis, combined with skills in digital platforms, enables you to optimize online banking experiences and improve customer engagement. This position offers a dynamic career path where finance meets innovation, driving growth in the evolving digital financial landscape.

Financial Data Scientist

Finance students can pursue careers as Financial Data Scientists, where they analyze complex financial datasets to uncover trends and insights. This role combines expertise in finance, statistics, and machine learning to develop predictive models that optimize investment strategies and risk management. Proficiency in programming languages like Python or R and knowledge of big data tools are essential for success in this field.

Treasury Tech Solutions Analyst

A Treasury Tech Solutions Analyst specializes in optimizing financial operations through advanced technology, ensuring efficient cash management and risk assessment. You will analyze and implement treasury systems, collaborate with finance teams, and support real-time data processing to enhance decision-making. This role combines financial expertise with tech-savviness, ideal for finance students seeking to bridge finance and technology careers.

Good to know: jobs for Finance students

Overview of the Finance Job Market

The finance job market offers a diverse range of career opportunities for students with strong analytical and quantitative skills. Demand remains high across various sectors, reflecting the critical role of financial expertise in business strategy and operations.

- Investment Banking - Professionals advise clients on mergers, acquisitions, and capital raising strategies.

- Financial Analysis - Analysts evaluate financial data to guide business decisions and optimize performance.

- Risk Management - Specialists identify and mitigate financial risks to protect organizational assets.

Essential Skills for Finance Professionals

Finance students have a variety of career opportunities available in sectors such as banking, investment, and corporate finance. Developing essential skills is critical for success and competitiveness in finance-related roles.

- Analytical skills - Ability to interpret financial data and make informed decisions supports investment and risk assessment.

- Financial modeling - Creating and using models to predict financial performance guides budgeting and strategic planning.

- Communication skills - Explaining complex financial concepts clearly to stakeholders enhances collaboration and decision-making.

Mastering these essential skills prepares finance students for diverse roles including financial analyst, investment banker, and financial planner.

Traditional Career Paths in Finance

Finance students often pursue traditional career paths such as investment banking, financial analysis, and corporate finance. These roles demand strong analytical skills and a keen understanding of market trends.

You can build a rewarding career as a financial planner, risk manager, or portfolio manager, all of which are key positions in the finance industry. Employers in banks, investment firms, and corporations seek candidates with solid financial knowledge and strategic thinking.

Emerging Roles in Financial Technology (FinTech)

| Job Title | Description | Key Skills | Industry Relevance |

|---|---|---|---|

| Blockchain Analyst | Analyzes blockchain technology applications in finance, focusing on improving transaction security, transparency, and efficiency. | Blockchain technology, Cryptography, Financial Analysis, Data Analytics | Cryptocurrency, Payment Systems, Secure Transaction Solutions |

| FinTech Product Manager | Leads the development of innovative financial products leveraging technology to meet market demands and regulatory standards. | Product Development, Financial Services, Market Research, Agile Methodologies | Digital Banking, Lending Platforms, InsurTech |

| Data Scientist - FinTech | Utilizes big data and machine learning techniques to analyze financial datasets for enhancing decision-making and risk management. | Data Analytics, Machine Learning, Statistical Modeling, Finance | Credit Scoring, Fraud Detection, Algorithmic Trading |

| Regulatory Technology (RegTech) Specialist | Develops and implements technology solutions to manage compliance with financial regulations efficiently and reduce risks. | Regulatory Compliance, Software Development, Risk Management, Financial Law | Compliance Automation, Risk Assessment, Reporting Tools |

| Financial Software Developer | Builds and maintains software applications that support financial operations, including payment gateways and trading platforms. | Programming, Software Engineering, Financial Systems, API Integration | Digital Payments, Investment Platforms, Banking Systems |

| Cybersecurity Analyst - Finance Sector | Protects financial data and systems from cyber threats by implementing security measures and monitoring vulnerabilities. | Cybersecurity, Risk Analysis, Network Security, Financial Compliance | Banking Security, Payment Systems Protection, Data Privacy |

| Financial Automation Consultant | Advises organizations on automating financial processes using robotics process automation (RPA) and AI technologies. | Process Analysis, RPA, AI, Change Management | Accounting Automation, Loan Processing, Financial Reporting |

High-Demand Certifications and Qualifications

What high-demand certifications can boost job prospects for finance students? Certifications like CFA (Chartered Financial Analyst) and CPA (Certified Public Accountant) significantly increase employability in competitive finance roles. Earning credentials such as FRM (Financial Risk Manager) also opens doors to specialized risk management positions.

Which qualifications are most valued by employers in the finance industry? Employers prioritize candidates with a strong foundation in accounting, financial analysis, and data interpretation. Advanced qualifications in financial modeling, investment analysis, and regulatory compliance are highly sought after.

How can certifications impact career growth in finance? Obtaining recognized certifications demonstrates your expertise and commitment, often leading to higher salaries and leadership roles. Many finance professionals use certifications to differentiate themselves and access global job markets.

Career Growth and Advancement Opportunities

Finance students have diverse career paths available, including roles such as financial analyst, investment banker, and risk manager. These positions offer strong foundations for understanding markets, managing assets, and advising clients.

Career growth in finance is driven by gaining certifications like CFA or CPA, which enhance expertise and credibility. Advancement opportunities often lead to senior roles such as portfolio manager, finance director, or chief financial officer. Networking, continuous learning, and strategic thinking further accelerate progression in this competitive field.

Tips for Landing a Finance Job

Finance students have diverse career options including roles like financial analyst, investment banker, and financial planner. Understanding industry requirements and gaining practical experience enhances job prospects significantly.

Building a strong resume with internships and relevant certifications such as CFA or CPA increases employability. Networking through industry events and using online platforms like LinkedIn helps connect with potential employers in the finance sector.

jobsintra.com

jobsintra.com