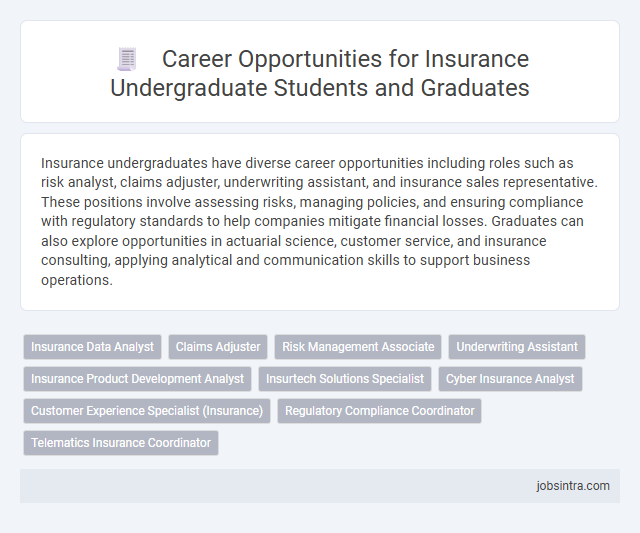

Insurance undergraduates have diverse career opportunities including roles such as risk analyst, claims adjuster, underwriting assistant, and insurance sales representative. These positions involve assessing risks, managing policies, and ensuring compliance with regulatory standards to help companies mitigate financial losses. Graduates can also explore opportunities in actuarial science, customer service, and insurance consulting, applying analytical and communication skills to support business operations.

Insurance Data Analyst

An Insurance Data Analyst plays a crucial role in interpreting complex data sets to identify trends and risks within the insurance industry. You utilize statistical tools and software to support decision-making processes, enhance underwriting accuracy, and optimize claims management. This role combines analytical skills with industry knowledge, offering graduates a pathway to influence strategic business outcomes.

Claims Adjuster

A career as a Claims Adjuster is an excellent choice for insurance undergraduates seeking hands-on experience in evaluating and settling insurance claims. You will analyze policy coverage, investigate claims, and negotiate settlements to ensure fair outcomes for both the insurer and policyholders. This role sharpens your analytical skills and provides a deep understanding of risk management within the insurance industry.

Risk Management Associate

A Risk Management Associate in the insurance industry evaluates potential risks and develops strategies to minimize financial losses for clients. They analyze data, assess policies, and collaborate with underwriters to ensure comprehensive coverage. This role requires strong analytical skills, attention to detail, and knowledge of insurance regulations to effectively manage and mitigate risks.

Underwriting Assistant

Underwriting Assistants play a crucial role in the insurance industry by supporting underwriters in evaluating risk and processing insurance applications. You will analyze data, prepare reports, and maintain communication with clients to ensure accurate policy assessments. This entry-level position builds a strong foundation for a career in risk management and insurance underwriting.

Insurance Product Development Analyst

Insurance Product Development Analysts play a crucial role in designing and improving insurance products to meet market demands and regulatory requirements. They conduct market research, analyze data, and collaborate with actuaries and underwriters to create innovative and competitive insurance offerings. Your skills in risk assessment and customer insights will help shape products that address evolving consumer needs effectively.

Insurtech Solutions Specialist

An Insurtech Solutions Specialist leverages technology to innovate and improve traditional insurance processes, enhancing efficiency and customer experience. This role requires a blend of insurance knowledge and technical expertise to develop, implement, and manage digital platforms and tools that address industry challenges. Your skills in data analysis, software applications, and understanding of insurance products position you well for this dynamic role within the evolving insurtech landscape.

Cyber Insurance Analyst

Cyber Insurance Analysts evaluate risks associated with digital threats and cybersecurity breaches to help insurance companies develop tailored policies for clients. By analyzing data on cyber incidents, vulnerabilities, and threat landscapes, they determine coverage terms and premium rates that balance protection and profitability. Your expertise in both insurance principles and cybersecurity enables organizations to mitigate financial losses from evolving cyber risks.

Customer Experience Specialist (Insurance)

Customer Experience Specialists in insurance play a crucial role in enhancing client satisfaction by managing inquiries, resolving issues, and providing tailored policy information. They analyze customer feedback to improve service delivery while ensuring compliance with industry regulations. Strong communication skills and a deep understanding of insurance products empower these specialists to build lasting client relationships and support business growth.

Regulatory Compliance Coordinator

A Regulatory Compliance Coordinator in the insurance industry ensures that your company adheres to all relevant laws and regulations, minimizing risk and avoiding penalties. Responsibilities include monitoring regulatory changes, preparing compliance reports, and coordinating audits to guarantee alignment with industry standards. This role requires strong attention to detail, knowledge of insurance laws, and effective communication skills to liaise with regulatory bodies.

Good to know: jobs for Insurance undergraduate

Overview of the Insurance Industry

The insurance industry offers diverse career opportunities for insurance undergraduates, including roles in underwriting, claims adjustment, risk management, and actuarial analysis. These positions require strong analytical skills and a deep understanding of risk assessment and policy underwriting.

Insurance undergraduates can also pursue careers in sales, customer service, and insurance brokerage, where communication and relationship management are crucial. The industry continues to grow with advancements in technology, creating demand for professionals skilled in data analysis and digital insurance solutions.

In-Demand Skills for Insurance Graduates

Insurance undergraduates possess valuable skills in risk assessment, data analysis, and customer service management. High demand roles include claims adjusters, underwriters, and risk management analysts who use analytical and decision-making abilities to minimize financial losses. Your proficiency in regulatory compliance and digital technologies enhances job prospects in a rapidly evolving insurance industry.

Entry-Level Roles for Insurance Undergaduates

Insurance undergraduates have a variety of entry-level career opportunities in the insurance industry. These roles provide foundational experience and skills essential for long-term success in the business.

- Claims Adjuster - Investigates insurance claims to determine the extent of the insuring company's liability.

- Underwriting Assistant - Supports underwriters in evaluating risk and preparing insurance policies.

- Insurance Sales Agent - Sells insurance policies and helps clients choose coverage that suits their needs.

Entry-level positions in insurance offer valuable industry exposure and career growth potential for recent graduates.

Career Growth and Advancement Paths

What career opportunities are available for insurance undergraduates? Insurance undergraduates can pursue roles such as underwriters, claims adjusters, risk analysts, and insurance sales agents. These positions offer strong foundations for career growth through specialized certifications and leadership development programs.

How does your career advance in the insurance industry? Advancement paths often include moving from entry-level roles to management positions like insurance brokers, risk managers, or actuaries. Continuous education and gaining expertise in emerging areas like cyber insurance can significantly boost your promotion prospects.

Which skills enhance career growth for insurance graduates? Analytical skills, attention to detail, and knowledge of insurance laws are critical for progression. Mastery of data analysis tools and client relationship management supports advancement into senior roles with greater responsibilities.

What industries hire insurance undergraduates for career advancement? Opportunities exist in sectors such as health insurance, property and casualty, life insurance, and reinsurance companies. Financial services firms and consulting agencies also offer diverse paths for growth and specialization.

Professional Certifications and Further Education

Insurance undergraduates can pursue careers as risk analysts, claims adjusters, or underwriters, leveraging their foundational knowledge in insurance principles. Obtaining professional certifications such as Chartered Property Casualty Underwriter (CPCU) or Associate in Risk Management (ARM) enhances job prospects and expertise. Further education, including a master's degree in business administration or actuarial science, can open advanced career opportunities in insurance management and consulting.

Emerging Trends Impacting Insurance Careers

Insurance undergraduates have expanding career opportunities driven by emerging trends such as data analytics, artificial intelligence, and cybersecurity. These advancements are reshaping risk assessment, claims processing, and customer service within the insurance industry.

Jobs in actuarial science, risk management, and insurance technology are becoming increasingly prominent for graduates. Proficiency in big data analytics and machine learning enhances roles in predictive modeling and fraud detection. Cyber insurance specialists and compliance experts are in high demand due to rising digital threats and regulatory changes.

Tips for Landing a Job in Insurance

Insurance undergraduates have a diverse range of job opportunities, including roles in underwriting, claims adjustment, risk management, and sales. Employers value candidates with strong analytical skills, attention to detail, and a solid understanding of insurance principles.

Networking within the insurance industry and obtaining relevant certifications like CPCU or ARM can significantly enhance job prospects. Tailoring resumes to highlight industry-related coursework and internships increases the likelihood of securing interviews in competitive insurance markets.

jobsintra.com

jobsintra.com