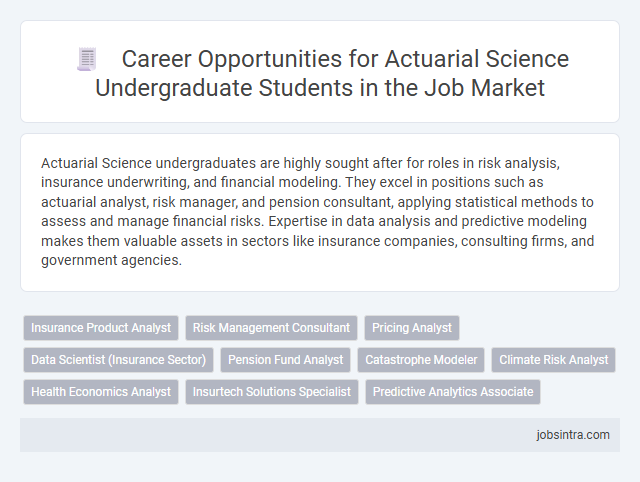

Actuarial Science undergraduates are highly sought after for roles in risk analysis, insurance underwriting, and financial modeling. They excel in positions such as actuarial analyst, risk manager, and pension consultant, applying statistical methods to assess and manage financial risks. Expertise in data analysis and predictive modeling makes them valuable assets in sectors like insurance companies, consulting firms, and government agencies.

Insurance Product Analyst

An Insurance Product Analyst evaluates and develops insurance products by analyzing market trends, customer needs, and risk factors. This role requires strong analytical skills, proficiency in data modeling, and knowledge of actuarial principles to optimize product performance and profitability. Your expertise in actuarial science equips you to create competitive insurance solutions that meet regulatory standards and business objectives.

Risk Management Consultant

Risk management consultants analyze financial data to identify potential risks and develop strategies that minimize losses for businesses and organizations. They use actuarial models to assess probabilities of events such as natural disasters, market fluctuations, or operational failures. Expertise in quantitative analysis and risk assessment enables these professionals to provide actionable insights that improve decision-making and financial stability.

Pricing Analyst

Pricing Analysts in Actuarial Science utilize statistical techniques and financial theory to determine optimal pricing strategies for insurance products. They analyze risk factors, market trends, and customer data to develop competitive and profitable premium rates. Strong analytical skills and proficiency in data modeling tools are essential for success in this role.

Data Scientist (Insurance Sector)

Actuarial Science undergraduates possess strong analytical and statistical skills that are highly valuable in the insurance sector for data scientist roles. You can leverage your expertise to develop predictive models, assess risk, and optimize insurance pricing strategies using large datasets. This specialized career path combines actuarial knowledge with advanced data science techniques to drive informed decision-making in insurance companies.

Pension Fund Analyst

Pension Fund Analysts use actuarial science principles to evaluate and manage retirement funds, ensuring financial stability and compliance with regulations. They assess risks, calculate funding requirements, and develop strategies to optimize pension plan performance. Expertise in statistical analysis and financial forecasting is essential for success in this role.

Catastrophe Modeler

Catastrophe Modelers analyze the financial impact of natural disasters and other catastrophic events using advanced statistical and actuarial techniques. They develop predictive models to assess risks and support insurance companies in setting premiums and managing exposures. Expertise in data analysis, risk assessment, and programming is essential for success in this role.

Climate Risk Analyst

Actuarial Science undergraduates possess strong analytical skills to assess and model financial risks related to climate change. As a Climate Risk Analyst, you apply statistical methods and predictive models to evaluate environmental impacts on insurance, investments, and corporate strategies. This role helps organizations make informed decisions in managing long-term climate risks.

Health Economics Analyst

Health Economics Analysts evaluate data to determine the financial impact of healthcare policies and treatments. They use analytical models to forecast costs, improve resource allocation, and support decision-making in insurance companies, government agencies, and healthcare providers. Expertise in actuarial science enhances their ability to assess risks and optimize healthcare strategies effectively.

Insurtech Solutions Specialist

An Insurtech Solutions Specialist leverages actuarial science expertise to develop innovative insurance technologies and data-driven risk models. They analyze complex datasets to optimize pricing strategies, improve customer experience, and streamline claims processing. This role requires a blend of actuarial knowledge and technology skills to drive digital transformation in the insurance industry.

Good to know: jobs for Actuarial Science undergraduate

Growing Demand for Actuarial Science Graduates

| Job Role | Description | Growing Demand Drivers | Sector |

|---|---|---|---|

| Actuarial Analyst | Evaluates financial risks using mathematics, statistics, and financial theory to assess future events. | Increased reliance on data-driven decision making in insurance and finance sectors. | Insurance, Finance |

| Risk Consultant | Advises businesses on risk management strategies to minimize financial loss and improve operational performance. | Growing complexity of global financial markets and regulatory environments. | Consulting, Corporate Risk Management |

| Data Scientist with Actuarial Skills | Combines actuarial expertise with big data analytics to develop predictive models for business optimization. | Expansion of big data usage in predictive modeling and personalized insurance products. | Technology, Finance, Insurance |

| Health Actuary | Analyzes healthcare costs, insurance claims, and risk factors to design sustainable health insurance policies. | Rising healthcare expenditure and need for effective risk-sharing mechanisms. | Healthcare, Insurance |

| Pension Actuary | Assesses pension plan viability, funding strategies, and regulatory compliance for retirement benefits. | Aging populations and reform in pension regulations driving demand for pension risk management. | Finance, Government, Corporate Sector |

| Quantitative Analyst | Develops quantitative models to support investment strategies, asset pricing, and financial forecasting. | Growth in algorithmic trading and sophisticated financial instruments requiring advanced modeling. | Investment Banking, Hedge Funds, Asset Management |

| Enterprise Risk Manager | Leads risk assessment and mitigation initiatives across an organization to safeguard assets and reputation. | Heightened regulatory focus and increasing operational risks in global business environments. | Corporate, Financial Services |

| Insurance Underwriter | Evaluates insurance applications to determine risk exposure and appropriate premium pricing. | Demand for precise risk evaluation driven by emerging risks like cyber threats and climate change. | Insurance |

Key Industries Hiring Actuarial Science Majors

Actuarial Science undergraduates possess valuable analytical skills that open doors across several key industries. Your expertise is highly sought after where risk assessment and financial forecasting are critical.

- Insurance Industry - Leading employers include life, health, and property insurance companies focused on risk management and premium calculation.

- Financial Services - Banks and investment firms hire actuaries for portfolio evaluation, asset management, and economic scenario modeling.

- Government Agencies - Public sector roles involve pension planning, social security analysis, and healthcare program funding assessments.

Essential Skills for Actuarial Careers

Actuarial Science undergraduates pursue careers in risk assessment, insurance, finance, and consulting sectors. These roles require strong analytical skills to evaluate probability and financial impact of uncertain events.

Essential skills include proficiency in mathematics, statistics, and financial theory. Effective communication and problem-solving abilities enable actuaries to present complex data clearly and develop strategic solutions.

Entry-Level Job Roles for Actuarial Graduates

Actuarial Science undergraduates have a diverse range of entry-level job opportunities within the financial and insurance sectors. Your skills in mathematics, statistics, and risk assessment are highly valued in roles that support data-driven decision-making.

- Actuarial Analyst - Assist in analyzing financial risks and preparing reports to support insurance premium calculations and risk management strategies.

- Risk Analyst - Focus on identifying and evaluating potential risks that could affect business operations or investments.

- Pricing Analyst - Develop pricing models for insurance products by analyzing statistical data and market trends.

Professional Certifications and Career Advancement

What career paths can an Actuarial Science undergraduate pursue? Actuarial Science graduates often explore roles such as actuarial analyst, risk consultant, and data analyst in insurance, finance, and consulting sectors. Professional certifications like the SOA (Society of Actuaries) and CAS (Casualty Actuarial Society) significantly enhance job prospects and credibility.

How do professional certifications impact career advancement in actuarial fields? Earning credentials such as ASA, FSA, or ACAS demonstrates expertise and commitment, leading to higher positions and salary increases. Many employers prioritize candidates with these certifications for senior and specialized roles.

Which industries value actuarial science skills and certifications the most? Insurance companies, pension funds, investment firms, and government agencies frequently seek professionals with actuarial knowledge and credentials. Specialized certifications open doors to strategic roles in risk management and financial forecasting.

What steps should you take to advance your actuarial career beyond an undergraduate degree? Pursuing exams offered by recognized bodies like SOA and CAS is crucial for career growth and specialization. Networking with industry professionals and gaining practical experience are essential for long-term success.

Internship and Networking Opportunities

Actuarial Science undergraduates have diverse internship opportunities in insurance companies, financial services, and consulting firms. These internships offer hands-on experience in risk assessment, data analysis, and financial modeling.

Networking events and professional organizations like the Society of Actuaries provide valuable connections to industry professionals. Building relationships during internships enhances career prospects and opens doors to full-time actuarial positions.

Future Trends in the Actuarial Job Market

The future of the actuarial job market is shaped by advancements in data analytics, artificial intelligence, and risk management technologies. Actuarial Science undergraduates can expect growing opportunities in emerging fields such as climate risk assessment, fintech, and cyber insurance. Your skills will be increasingly valuable as businesses demand sophisticated models to navigate complex financial uncertainties and regulatory environments.

jobsintra.com

jobsintra.com