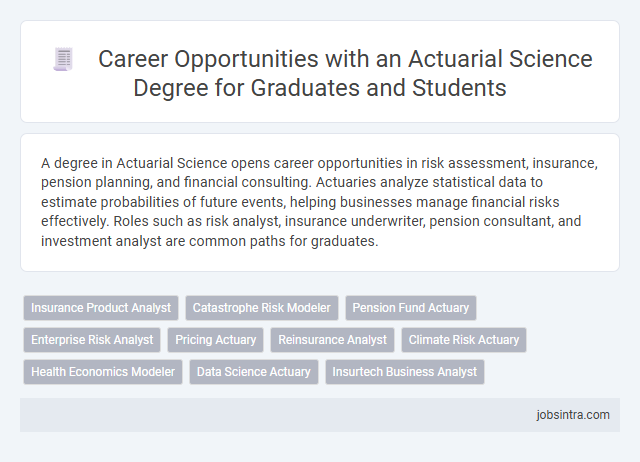

A degree in Actuarial Science opens career opportunities in risk assessment, insurance, pension planning, and financial consulting. Actuaries analyze statistical data to estimate probabilities of future events, helping businesses manage financial risks effectively. Roles such as risk analyst, insurance underwriter, pension consultant, and investment analyst are common paths for graduates.

Insurance Product Analyst

An Insurance Product Analyst leverages actuarial science expertise to evaluate and develop insurance products, ensuring profitability and risk management. They analyze statistical data and market trends to recommend pricing strategies and policy designs that align with company goals. Strong analytical skills and knowledge of insurance regulations are essential for success in this role.

Catastrophe Risk Modeler

Catastrophe Risk Modelers analyze and quantify the financial impact of natural disasters using advanced statistical and actuarial techniques. Your expertise in probability, statistics, and risk assessment plays a crucial role in developing models that help insurance companies and governments prepare for and manage catastrophic events. This career combines data analysis with real-world applications to minimize potential losses from hurricanes, earthquakes, and other disasters.

Pension Fund Actuary

A Pension Fund Actuary specializes in analyzing and managing the financial risks associated with retirement plans and pension funds. You evaluate mortality rates, investment returns, and employee demographics to ensure the fund's long-term sustainability and compliance with regulatory requirements. This role requires strong skills in statistical modeling, financial theory, and risk assessment to provide accurate projections and strategic advice.

Enterprise Risk Analyst

Enterprise Risk Analysts with an Actuarial Science degree specialize in identifying, assessing, and mitigating financial risks within organizations. They apply statistical models and data analysis techniques to forecast potential losses and develop strategies to minimize impact. Their expertise supports informed decision-making in insurance, finance, and corporate risk management sectors.

Pricing Actuary

A Pricing Actuary analyzes data to develop accurate insurance premium rates, balancing risk and profitability for insurance companies. Your expertise in statistics and financial theory enables you to design models that reflect claim likelihood and cost trends. This role is crucial for sustaining competitive pricing while ensuring the company remains financially stable.

Reinsurance Analyst

A Reinsurance Analyst evaluates and manages risk by analyzing data related to insurance policies that companies transfer to reinsurers. Your expertise in probability, statistics, and financial modeling enables accurate assessment of loss exposure and premium calculation. This role requires strong analytical skills to support risk mitigation and optimize reinsurance strategies.

Climate Risk Actuary

Climate Risk Actuaries specialize in assessing and managing the financial impacts of climate change on insurance and investment portfolios. They use statistical models and climate data to predict risks related to natural disasters, regulatory changes, and market shifts. Their expertise helps organizations develop strategies to mitigate climate-related losses and improve resilience.

Health Economics Modeler

Health Economics Modelers utilize actuarial science skills to analyze healthcare data and predict economic outcomes of medical treatments and policies. Your expertise in statistical modeling and risk assessment helps optimize healthcare resource allocation and improve patient care cost-effectiveness. These professionals often work in insurance companies, government agencies, or healthcare organizations to support data-driven decision-making.

Data Science Actuary

Data Science Actuaries combine advanced statistical methods with actuarial expertise to analyze large datasets, assess risks, and develop predictive models that drive strategic decision-making. Your skills in probability, machine learning, and programming enable you to optimize insurance pricing, improve risk management, and support financial forecasting across various industries. This role bridges traditional actuarial science and modern data analytics, offering a dynamic career path with high demand for specialized knowledge.

Good to know: jobs for Actuarial Science degree

Overview of Actuarial Science and Its Relevance in Business

What career opportunities are available for graduates with an Actuarial Science degree? Actuarial Science combines mathematics, statistics, and financial theory to assess risk in insurance, finance, and other industries. Professionals with this degree play a crucial role in business decision-making by analyzing data to predict future events and financial outcomes.

How does Actuarial Science contribute to the business sector? Actuaries help companies develop strategies to minimize financial losses and maximize profits through risk management. Their expertise supports the design of insurance policies, pension plans, and investment strategies, ensuring financial stability and compliance.

Core Skills and Competencies Developed Through Actuarial Studies

Actuarial Science degrees open diverse career paths in risk management, insurance, finance, and data analytics. Graduates develop specialized skills essential for evaluating financial risk and uncertainty within business environments.

- Quantitative Analysis - Mastery of mathematical and statistical methods to assess and predict financial risks.

- Data Interpretation - Ability to analyze large datasets to guide strategic decision-making processes.

- Financial Modeling - Proficiency in creating models to forecast economic trends and insurance claims.

These core competencies prepare actuarial professionals for critical roles in risk assessment and business strategy development.

Traditional Career Paths for Actuarial Science Graduates

Actuarial Science graduates have a strong foundation in mathematics, statistics, and financial theory. These skills prepare them for various roles within the insurance and finance industries.

Traditional career paths for Actuarial Science graduates include becoming actuarial analysts, risk consultants, and pension consultants. Actuaries often work in life insurance, health insurance, and property and casualty insurance sectors. Their expertise helps businesses assess and manage financial risks effectively.

Emerging Industries and Non-Traditional Roles for Actuaries

Actuarial Science graduates find expanding opportunities in emerging industries such as fintech, insurtech, and data analytics, where advanced risk modeling and predictive analysis are crucial. Non-traditional roles include positions in healthcare analytics, climate risk assessment, and cybersecurity, leveraging actuarial skills to address complex, evolving risks. Your expertise in statistical modeling and financial theory positions you to drive innovation and strategic decision-making in these dynamic sectors.

Professional Certifications and Their Impact on Career Advancement

Actuarial Science graduates have diverse career opportunities across insurance, finance, and risk management sectors. Professional certifications significantly boost employability and accelerate career growth in these fields.

- Certified Actuarial Analyst (CAA) - This credential validates foundational actuarial skills, making candidates competitive for entry-level roles.

- Associate of the Society of Actuaries (ASA) - Achieving ASA status opens doors to mid-level actuarial positions with increased responsibility and salary potential.

- Fellow of the Society of Actuaries (FSA) - FSA designation reflects advanced expertise, enabling leadership roles and strategic decision-making opportunities.

Career Growth Prospects and Salary Expectations in Actuarial Fields

| Job Title | Career Growth Prospects | Salary Expectations (USD) |

|---|---|---|

| Actuarial Analyst | Entry-level position with clear advancement to senior analyst and actuarial consultant roles. Strong demand in insurance and finance sectors. | $60,000 - $85,000 |

| Risk Analyst | Growing field focused on risk assessment in banking and corporate finance. Opportunities to progress to risk manager and chief risk officer positions. | $70,000 - $100,000 |

| Pricing Actuary | Specialized role in insurance, developing pricing models. Career pathway includes senior pricing actuary and chief actuary positions. | $80,000 - $120,000 |

| Pension Actuary | Focus on pension fund management and retirement benefits. Growth includes consultancy roles and senior actuarial advisor positions. | $75,000 - $110,000 |

| Consulting Actuary | High-growth potential with diverse industry exposure. Path to partner or senior consultant with significant leadership responsibilities. | $90,000 - $150,000 |

| Data Scientist (Actuarial Science background) | Emerging field combining actuarial skills with data analytics. Rapid growth and leadership opportunities in data-driven decision-making roles. | $85,000 - $130,000 |

Your actuarial science degree opens doors to multiple career paths featuring strong growth prospects and competitive salaries in sectors such as insurance, finance, pensions, and consulting.

Tips for Graduates and Students to Maximize Employability

Graduates with an Actuarial Science degree can pursue careers such as actuarial analyst, risk manager, and insurance underwriter. Developing strong analytical skills and proficiency in programming languages like SQL and Python enhances job prospects. Internships and professional certifications like SOA or CAS significantly increase employability in competitive markets.

jobsintra.com

jobsintra.com