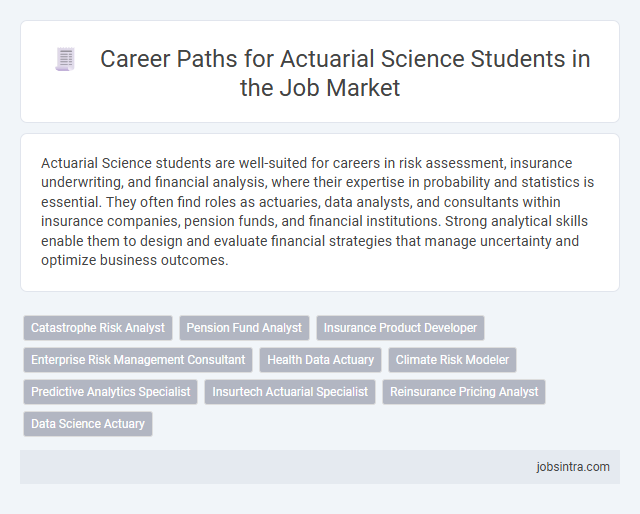

Actuarial Science students are well-suited for careers in risk assessment, insurance underwriting, and financial analysis, where their expertise in probability and statistics is essential. They often find roles as actuaries, data analysts, and consultants within insurance companies, pension funds, and financial institutions. Strong analytical skills enable them to design and evaluate financial strategies that manage uncertainty and optimize business outcomes.

Catastrophe Risk Analyst

Catastrophe Risk Analysts specialize in assessing and modeling the financial impact of natural and man-made disasters, utilizing actuarial science skills to predict potential losses. These professionals analyze data on events such as hurricanes, earthquakes, and floods to develop risk mitigation strategies and inform insurance underwriting decisions. Their expertise supports insurance companies and government agencies in managing catastrophe-related risks effectively.

Pension Fund Analyst

Pension Fund Analysts play a crucial role in managing and optimizing retirement fund portfolios to ensure long-term financial stability. You evaluate investment strategies, assess risks, and analyze actuarial data to help organizations meet their pension obligations. This career leverages your expertise in statistics and financial modeling to secure the future of beneficiaries.

Insurance Product Developer

Insurance Product Developers play a crucial role in designing and pricing new insurance products that meet market demands and regulatory standards. They analyze risk data, evaluate policy features, and collaborate with actuaries to create competitive and profitable insurance offerings. This career path leverages strong analytical skills and deep understanding of actuarial principles to drive innovation in the insurance industry.

Enterprise Risk Management Consultant

Enterprise Risk Management Consultants analyze and mitigate financial risks within organizations, utilizing actuarial models to predict potential losses and improve decision-making processes. They develop strategies to manage uncertainties related to insurance, investments, and operational risks, ensuring organizational resilience and regulatory compliance. Expertise in data analysis, risk assessment, and communication skills are essential for success in this role.

Health Data Actuary

Health Data Actuaries analyze complex medical and insurance data to predict healthcare costs and improve risk management strategies. Combining statistical expertise with knowledge of healthcare systems, they support insurance companies, hospitals, and government agencies in making data-driven decisions. Your skills in actuarial science prepare you to excel in this specialized role, driving innovations in health economics and policy planning.

Climate Risk Modeler

Climate Risk Modelers use advanced actuarial techniques to analyze and predict the financial impact of climate-related risks such as natural disasters and environmental changes. They develop models that help insurance companies, governments, and businesses manage uncertainties linked to climate variability. This role requires strong statistical skills combined with knowledge of environmental science and risk management.

Predictive Analytics Specialist

Predictive Analytics Specialists leverage statistical models and machine learning techniques to forecast future trends and inform strategic decisions. With a strong foundation in actuarial science, you can analyze complex data sets to identify risk patterns and optimize business outcomes. This role is crucial in industries like insurance, finance, and healthcare, where accurate predictions drive profitability and efficiency.

Insurtech Actuarial Specialist

Actuarial Science students can excel as Insurtech Actuarial Specialists by combining their expertise in risk assessment with innovative technology solutions to optimize insurance products and pricing models. These specialists use advanced data analytics and machine learning algorithms to improve underwriting accuracy and enhance claims management processes. Their role is crucial in driving digital transformation within insurance companies, enabling more efficient and customer-centric services.

Reinsurance Pricing Analyst

Reinsurance pricing analysts specialize in evaluating and determining the cost of reinsurance policies by analyzing risk, claims data, and market trends. They use advanced statistical models and actuarial techniques to assess potential losses and set premiums that balance profitability with risk management. This role is ideal for actuarial science students interested in leveraging data analytics and financial theory to support insurance companies in managing large-scale risks.

Good to know: jobs for Actuarial Science students

Overview of the Actuarial Science Profession

Actuarial Science students are equipped with strong analytical and statistical skills essential for evaluating financial risks in insurance, finance, and pension sectors. Career opportunities span roles such as actuarial analyst, risk consultant, and financial modeler, where they apply mathematical models to predict future events.

These professionals assess probabilities of events like death, accidents, or natural disasters to help organizations minimize risk and ensure financial stability. The actuarial profession demands proficiency in mathematics, economics, and business, offering high job security and competitive salaries across industries.

In-Demand Career Paths for Actuarial Graduates

Actuarial Science graduates possess analytical skills that open doors to various high-demand career paths in the business sector. Employers seek professionals who can apply statistical methods to assess financial risk and support strategic decision-making.

- Insurance Analyst - Evaluates risk and designs insurance policies using mathematical models to optimize company profits.

- Risk Manager - Develops strategies to minimize financial losses by identifying potential risks in investments and operations.

- Data Scientist - Applies statistical analysis and machine learning techniques to interpret complex business data and inform policy decisions.

Key Skills and Certifications for Actuarial Careers

Actuarial Science students pursue careers as actuaries, risk analysts, and financial consultants in insurance, finance, and pension industries. Key skills include proficiency in mathematics, statistics, data analysis, and strong problem-solving abilities. Earning certifications such as ASA (Associate of the Society of Actuaries) or ACAS (Associate of the Casualty Actuarial Society) significantly enhances career prospects.

Emerging Trends Shaping the Actuarial Job Market

Actuarial Science students are increasingly sought after in diverse sectors beyond traditional insurance roles. Emerging trends are expanding job opportunities into data analytics, financial technology, and risk management.

Demand for actuaries with expertise in predictive modeling and machine learning is rising rapidly. Companies in healthcare, cybersecurity, and environmental risk are hiring actuarial graduates to address complex data challenges. The integration of big data and artificial intelligence is reshaping the actuarial profession, emphasizing interdisciplinary skills.

Roles in Insurance, Finance, and Consulting

| Industry | Job Roles | Key Responsibilities | Relevant Skills |

|---|---|---|---|

| Insurance |

|

|

|

| Finance |

|

|

|

| Consulting |

|

|

|

Exploring these roles helps you align your actuarial expertise with diverse career paths in Insurance, Finance, and Consulting industries.

Navigating Internships and Entry-Level Opportunities

Actuarial Science students can explore internships in insurance companies, consulting firms, and financial institutions to gain practical experience. Entry-level roles such as actuarial analyst, risk management associate, and data analyst offer valuable exposure to actuarial modeling and statistical analysis. Networking with industry professionals and leveraging platforms like the Society of Actuaries enhances chances of securing relevant positions early in their careers.

Advancing Your Actuarial Career: Growth and Specialization

Actuarial Science students have diverse career opportunities that support growth and specialization in the business sector. Understanding these roles helps in planning a focused and successful actuarial career.

- Risk Analyst - Evaluates financial risks using statistical models to support business decision-making and risk management.

- Pricing Actuary - Develops pricing strategies for insurance products by analyzing market trends and loss data.

- Pension Consultant - Advises organizations on pension plan design and funding to ensure long-term financial stability.

Advancing your actuarial career involves continuous professional development and acquiring expertise in specialized areas within the business environment.

jobsintra.com

jobsintra.com