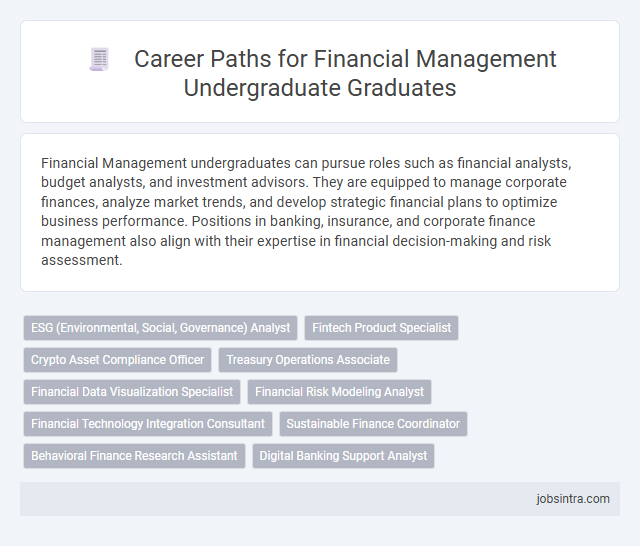

Financial Management undergraduates can pursue roles such as financial analysts, budget analysts, and investment advisors. They are equipped to manage corporate finances, analyze market trends, and develop strategic financial plans to optimize business performance. Positions in banking, insurance, and corporate finance management also align with their expertise in financial decision-making and risk assessment.

ESG (Environmental, Social, Governance) Analyst

Financial Management undergraduates can pursue roles as ESG (Environmental, Social, Governance) Analysts, where they evaluate companies' sustainability practices and governance structures to guide responsible investment decisions. These professionals analyze environmental impact, social responsibility, and corporate governance factors to assess risk and opportunity for investors. Their insights support organizations in aligning financial performance with ethical and regulatory standards.

Fintech Product Specialist

A Financial Management undergraduate can excel as a Fintech Product Specialist by leveraging their understanding of finance and technology to develop innovative financial products that meet market demands. You will analyze customer needs, collaborate with development teams, and ensure regulatory compliance to create seamless digital financial solutions. This role combines financial expertise with technological insight, making it ideal for those interested in transforming traditional finance through technology.

Crypto Asset Compliance Officer

Financial Management undergraduates can pursue a career as a Crypto Asset Compliance Officer, ensuring adherence to regulatory standards in the rapidly evolving cryptocurrency sector. They are responsible for developing and implementing compliance policies, monitoring transactions for suspicious activities, and staying updated on legal frameworks governing digital assets. This role requires a strong understanding of financial regulations, risk management, and the unique challenges posed by blockchain technology.

Treasury Operations Associate

Treasury Operations Associates play a crucial role in managing an organization's cash flow, banking relationships, and liquidity risk. They are responsible for monitoring daily cash positions, processing payments, and ensuring compliance with financial regulations. This role suits Financial Management undergraduates seeking hands-on experience in corporate finance and treasury functions.

Financial Data Visualization Specialist

A Financial Data Visualization Specialist transforms complex financial datasets into clear, visually engaging charts and dashboards that support strategic decision-making. This role requires proficiency in data analytics tools and an understanding of financial principles to effectively communicate insights. Your expertise can enhance reporting accuracy and help organizations identify trends and opportunities swiftly.

Financial Risk Modeling Analyst

A Financial Risk Modeling Analyst develops quantitative models to assess and manage potential financial risks within organizations. They analyze market trends, credit risks, and operational risks to provide data-driven strategies that minimize losses and optimize investment decisions. Proficiency in statistical software, financial theory, and programming languages like Python or R is essential for this role.

Financial Technology Integration Consultant

Financial Management undergraduates can excel as Financial Technology Integration Consultants by leveraging their expertise in finance and technology to streamline operations and enhance digital solutions. This role involves analyzing financial systems, implementing fintech tools, and ensuring seamless integration to improve efficiency and decision-making. Proficiency in financial software, data analytics, and strategic planning is essential for driving innovation within organizations.

Sustainable Finance Coordinator

A Sustainable Finance Coordinator develops and implements strategies that integrate environmental, social, and governance (ESG) criteria into financial decision-making processes. This role involves analyzing investment portfolios to ensure alignment with sustainability goals and regulatory requirements. Expertise in financial management and sustainability principles is essential to promote responsible investment and corporate social responsibility initiatives.

Behavioral Finance Research Assistant

A Financial Management undergraduate can excel as a Behavioral Finance Research Assistant by applying knowledge of psychological factors influencing investor decisions and market behavior. This role involves analyzing data patterns, designing experiments, and contributing to studies that explore biases and decision-making processes in financial contexts. Skills in statistical software and a strong foundation in finance principles enhance effectiveness in supporting research and advancing insights in behavioral finance.

Good to know: jobs for Financial Management undergraduate

Overview of Financial Management Careers

Financial Management graduates have diverse career opportunities across industries. They play crucial roles in budgeting, investment analysis, and financial planning to drive organizational success.

- Financial Analyst - Evaluates financial data to assist companies in making investment decisions and forecasting future revenues.

- Budget Analyst - Develops and monitors budget plans to ensure efficient allocation of resources within organizations.

- Corporate Treasurer - Manages a company's liquidity, investments, and risk related to financial activities.

Strong analytical skills and knowledge of financial principles are essential for success in financial management careers.

Key Skills Required for Financial Management Roles

Financial Management undergraduates often pursue roles such as financial analysts, budget analysts, and investment managers. Key skills required for these positions include strong analytical abilities, proficiency in financial modeling, and expertise in risk assessment. Effective communication, attention to detail, and knowledge of accounting principles are crucial for successful financial decision-making and management.

Entry-Level Job Opportunities

Financial Management undergraduates possess strong analytical and budgeting skills highly valued in various industries. Entry-level roles provide foundational experience in financial analysis, reporting, and decision-making.

Common entry-level job opportunities include financial analyst, junior accountant, and budgeting assistant positions. These roles involve data interpretation, preparing financial statements, and supporting senior management in strategic planning. Rapid skill development in these positions opens pathways to advanced financial management careers.

Advancement and Specialization Options

Financial Management undergraduates have diverse career paths that emphasize both advancement and specialization opportunities. These roles combine analytical skills with strategic decision-making to drive organizational financial health.

- Financial Analyst - Specializes in assessing investment opportunities and financial data to guide business decisions and enhance portfolio performance.

- Corporate Finance Manager - Advances by managing company finances, including budgeting, forecasting, and capital structuring to optimize financial growth.

- Risk Management Specialist - Focuses on identifying and mitigating financial risks through advanced quantitative analysis and regulatory compliance expertise.

Industry Sectors Hiring Financial Management Graduates

Financial Management graduates find diverse opportunities across multiple industry sectors. Key industries hiring these graduates include banking, corporate finance, and investment firms.

The insurance sector and government agencies also seek professionals skilled in financial analysis and risk management. Additionally, consulting firms and multinational corporations offer roles for managing company finances and strategic planning.

Certifications and Further Education

| Job Role | Relevant Certifications | Further Education Opportunities |

|---|---|---|

| Financial Analyst | Certified Financial Analyst (CFA), Financial Risk Manager (FRM) | Master's in Finance, MBA with Finance specialization |

| Portfolio Manager | Chartered Financial Analyst (CFA), Certified Investment Management Analyst (CIMA) | Master's in Investment Management, MBA in Financial Services |

| Risk Manager | Financial Risk Manager (FRM), Professional Risk Manager (PRM) | Master's in Risk Management, MBA in Risk and Insurance |

| Corporate Financial Manager | Certified Management Accountant (CMA), Chartered Financial Analyst (CFA) | MBA in Corporate Finance, Master's in Business Administration |

| Financial Planner | Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC) | Master's in Financial Planning, MBA with a Finance focus |

| Controller | Certified Public Accountant (CPA), Certified Management Accountant (CMA) | Master's in Accounting, MBA in Financial Management |

| Investment Banker | Chartered Financial Analyst (CFA), Certified Investment Banking Professional (CIBPTM) | MBA in Finance, Master's in Financial Engineering |

| Budget Analyst | Certified Government Financial Manager (CGFM), Certified Budget Analyst | Master's in Public Administration, MBA with Budgeting focus |

Tips for Building a Successful Financial Management Career

Financial Management undergraduates have diverse job opportunities in roles such as financial analyst, budget analyst, investment banker, and risk manager. These positions require strong analytical skills, financial knowledge, and decision-making abilities.

Building a successful financial management career starts with gaining relevant certifications like CFA or CPA to enhance credibility. Networking with industry professionals and staying updated with market trends are essential strategies for long-term career growth.

jobsintra.com

jobsintra.com