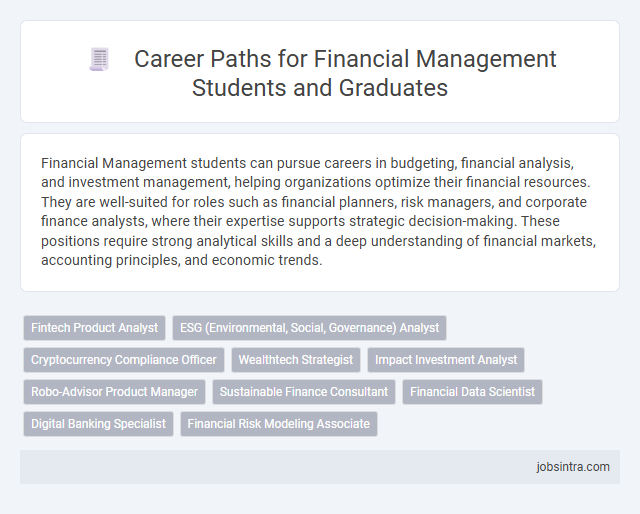

Financial Management students can pursue careers in budgeting, financial analysis, and investment management, helping organizations optimize their financial resources. They are well-suited for roles such as financial planners, risk managers, and corporate finance analysts, where their expertise supports strategic decision-making. These positions require strong analytical skills and a deep understanding of financial markets, accounting principles, and economic trends.

Fintech Product Analyst

Fintech Product Analysts leverage financial management expertise to develop innovative digital products that meet market demands in the financial technology sector. You analyze user data, market trends, and regulatory requirements to optimize product performance and drive business growth. This role bridges the gap between finance, technology, and customer experience, making it ideal for financial management students seeking dynamic career opportunities.

ESG (Environmental, Social, Governance) Analyst

Financial Management students can pursue a career as an ESG (Environmental, Social, Governance) Analyst, where they assess and integrate sustainability factors into investment decisions and corporate strategies. This role requires analyzing non-financial data to evaluate a company's ethical impact, social responsibility, and environmental sustainability, which is increasingly valued by investors. Developing expertise in ESG metrics enables you to influence responsible investment practices and promote long-term financial performance aligned with societal goals.

Cryptocurrency Compliance Officer

Financial Management students can pursue a career as Cryptocurrency Compliance Officers, ensuring adherence to regulatory standards within the rapidly evolving digital currency sector. This role involves monitoring transactions, developing risk management strategies, and staying updated on legal frameworks to prevent fraud and money laundering. Expertise in financial regulations and blockchain technology is essential for safeguarding organizational integrity in the crypto space.

Wealthtech Strategist

Financial Management students can excel as Wealthtech Strategists by leveraging their expertise in finance and technology to develop innovative solutions for wealth management. They analyze market trends, client data, and investment tools to create personalized digital wealth platforms that enhance user experience and optimize portfolio performance. Their role bridges financial analysis with cutting-edge technology, driving the future of financial advisory services.

Impact Investment Analyst

Impact Investment Analysts evaluate financial opportunities that generate positive social and environmental outcomes alongside financial returns. They analyze data, assess risks, and measure the impact of investments to guide decision-making for socially responsible portfolios. Your expertise in financial management equips you to drive sustainable growth while aligning investments with ethical values.

Robo-Advisor Product Manager

Robo-Advisor Product Manager roles offer Financial Management students a dynamic opportunity to blend finance expertise with technology innovation. You will oversee the development and optimization of automated investment platforms, ensuring alignment with market trends and client needs. Mastery of financial algorithms, user experience design, and regulatory compliance is essential to excel in this position.

Sustainable Finance Consultant

A career as a Sustainable Finance Consultant allows you to leverage your financial management skills to support businesses in incorporating environmental, social, and governance (ESG) factors into their investment decisions and strategies. This role involves analyzing sustainability risks and opportunities, helping clients align their portfolios with responsible and ethical investing principles. Sustainable Finance Consultants play a crucial role in driving the transition to a greener economy by advising on green bonds, impact investing, and regulatory compliance.

Financial Data Scientist

Financial Management students can excel as Financial Data Scientists by leveraging their strong analytical and quantitative skills to interpret complex financial data sets. This role involves using advanced statistical techniques and machine learning algorithms to provide actionable insights that drive investment strategies and risk management. Your expertise in finance combined with data science tools positions you to optimize financial decision-making and forecasting.

Digital Banking Specialist

Financial Management students can excel as Digital Banking Specialists by leveraging their expertise in finance and technology to enhance online banking platforms and services. They analyze financial data, optimize digital transaction processes, and develop user-friendly solutions to improve customer experience. This role demands a strong understanding of financial products, cybersecurity, and digital innovation within the banking sector.

Good to know: jobs for Financial Management students

Introduction to Financial Management Careers

Financial Management students develop skills essential for roles that involve planning, directing, and controlling an organization's financial activities. Careers in this field combine analytical expertise with strategic decision-making to ensure financial health and growth.

Common job titles include Financial Analyst, Budget Analyst, and Financial Manager, each requiring knowledge of financial reporting, investment strategies, and risk management. Graduates may work in diverse sectors such as banking, corporate finance, and government agencies. Opportunities expand with experience and professional certifications like CFA or CPA.

Core Skills Required in Financial Management

Financial Management students are prepared for a wide range of roles in finance, accounting, and investment sectors. Their expertise enables them to drive strategic decision-making and enhance organizational financial health.

- Analytical Skills - Ability to interpret complex financial data to support budgeting and forecasting processes.

- Risk Management - Proficiency in identifying and mitigating financial risks to protect company assets.

- Communication Skills - Capability to clearly present financial information and collaborate with stakeholders.

Entry-Level Job Opportunities for Financial Management Graduates

Financial Management students have diverse entry-level job opportunities that build foundational skills in finance, analysis, and decision-making. These roles provide practical experience crucial for career growth in various sectors.

- Financial Analyst - Entry-level analysts evaluate financial data to support investment decisions and budgeting processes.

- Budget Analyst - Professionals in this role assist organizations in developing and managing budgets efficiently.

- Credit Analyst - These analysts assess the creditworthiness of individuals or businesses to manage lending risks.

Graduates in Financial Management gain valuable exposure to real-world financial challenges through these entry-level positions, setting the stage for advanced career opportunities.

Specialized Career Paths in Financial Management

Financial Management students have access to specialized career paths that leverage their expertise in budgeting, investment analysis, and risk management. Careers such as Financial Analyst, Treasury Manager, and Risk Manager emphasize advanced skills in financial planning and strategy.

Roles in Corporate Finance, Asset Management, and Financial Consulting offer opportunities to influence organizational growth and optimize financial performance. Your specialized knowledge prepares you for positions requiring detailed financial modeling and regulatory compliance expertise.

Industry Sectors Hiring Financial Management Professionals

| Industry Sector | Job Roles for Financial Management Students | Key Skills Required |

|---|---|---|

| Banking and Financial Services | Financial Analyst, Risk Manager, Credit Analyst, Portfolio Manager, Investment Banker | Financial modeling, risk assessment, regulatory compliance, data analysis |

| Corporate Finance | Financial Planner, Budget Analyst, Corporate Treasurer, Cost Analyst, Mergers & Acquisitions Specialist | Budget forecasting, financial reporting, capital budgeting, strategic planning |

| Consulting Firms | Financial Consultant, Management Consultant, Business Analyst, Strategic Advisor | Analytical thinking, client management, problem solving, financial strategy development |

| Insurance Sector | Actuarial Analyst, Claims Manager, Financial Underwriter, Risk Analyst | Risk analysis, actuarial science, regulatory knowledge, claims assessment |

| Government and Public Sector | Budget Officer, Financial Controller, Tax Analyst, Public Finance Manager | Policy analysis, budget management, tax regulations, public finance principles |

| Nonprofit Organizations | Financial Administrator, Grant Manager, Fundraising Analyst, Budget Coordinator | Grant management, donor relations, budget planning, financial reporting |

| Technology Firms | Financial Data Analyst, Revenue Analyst, Financial Systems Manager, Strategic Finance Partner | Data analytics, financial software proficiency, strategic finance, performance metrics |

Your career opportunities in financial management span these diverse industry sectors, providing roles that match a wide range of financial expertise and interests.

Advancement and Leadership Roles in Financial Management

Financial Management students have a diverse range of job opportunities, including financial analysts, budget managers, and investment advisors. These roles require strong analytical skills and an understanding of market trends to drive organizational success.

Advancement in financial management often leads to leadership positions such as Chief Financial Officer (CFO) or Finance Director. These roles involve strategic decision-making, risk management, and leading financial teams to optimize company performance.

Tips for Career Development and Growth

Financial Management students have diverse career opportunities across various industries. Focusing on career development and growth enhances long-term success in this competitive field.

- Corporate Financial Analyst - Analyze company finances to support budgeting and investment decisions.

- Investment Banker - Facilitate capital raising and provide advisory services for mergers and acquisitions.

- Financial Planner - Develop personalized strategies for clients to manage their financial goals and retirement plans.

jobsintra.com

jobsintra.com