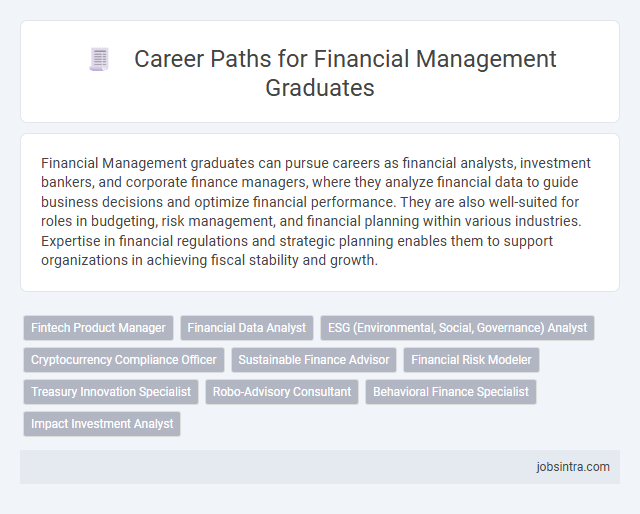

Financial Management graduates can pursue careers as financial analysts, investment bankers, and corporate finance managers, where they analyze financial data to guide business decisions and optimize financial performance. They are also well-suited for roles in budgeting, risk management, and financial planning within various industries. Expertise in financial regulations and strategic planning enables them to support organizations in achieving fiscal stability and growth.

Fintech Product Manager

Financial Management graduates can excel as Fintech Product Managers by leveraging their expertise in financial analysis and market trends to develop innovative financial technologies. This role involves overseeing product development cycles, collaborating with cross-functional teams, and ensuring solutions meet regulatory standards and customer needs. Your financial acumen and strategic thinking are critical for driving product success in the fast-evolving fintech industry.

Financial Data Analyst

Financial Management graduates can excel as Financial Data Analysts by using their expertise to interpret complex financial data and provide actionable insights. This role involves analyzing market trends, evaluating investment opportunities, and helping organizations optimize their financial strategies. You can leverage your analytical skills to support data-driven decision-making and enhance business performance.

ESG (Environmental, Social, Governance) Analyst

Financial Management graduates with a focus on ESG analysis evaluate corporate practices related to environmental impact, social responsibility, and governance standards to guide sustainable investment decisions. You can leverage your financial expertise to assess risks and opportunities in companies' ESG performance, aiding investors in achieving ethical and profitable portfolios. This role combines financial acumen with a commitment to responsible business practices, increasingly valued in today's market.

Cryptocurrency Compliance Officer

Financial Management graduates can pursue a role as a Cryptocurrency Compliance Officer, where they ensure adherence to regulatory standards within the evolving digital currency landscape. You will monitor transactions, develop anti-money laundering policies, and work closely with legal teams to mitigate risks related to cryptocurrency activities. This position demands a strong understanding of financial regulations and blockchain technology to maintain organizational integrity.

Sustainable Finance Advisor

Financial Management graduates equipped with expertise in sustainable finance can pursue roles as Sustainable Finance Advisors, guiding organizations in integrating environmental, social, and governance (ESG) criteria into their investment decisions. You will analyze financial risks and opportunities related to sustainability, ensuring compliance with evolving regulations and promoting ethical investment strategies. This career bridges financial acumen with sustainability goals, driving long-term value for both businesses and communities.

Financial Risk Modeler

Financial Management graduates with expertise in quantitative analysis can excel as Financial Risk Modelers, developing models that identify and mitigate potential financial risks for organizations. This role involves using statistical techniques and data analysis to forecast market trends, credit risks, and operational vulnerabilities. Your ability to interpret complex financial data ensures companies can make informed decisions to safeguard assets and optimize risk-adjusted returns.

Treasury Innovation Specialist

Financial Management graduates can pursue roles as Treasury Innovation Specialists, where they drive the digital transformation of treasury functions through advanced technologies like AI and blockchain. This position involves optimizing cash flow, risk management, and liquidity strategies by implementing innovative tools and data analytics. Expertise in financial systems and strategic problem-solving enables professionals to enhance operational efficiency and support organizational growth.

Robo-Advisory Consultant

Financial Management graduates can excel as Robo-Advisory Consultants, leveraging their expertise in investment strategies and client portfolio management. You analyze market data and algorithmic models to provide automated, personalized financial advice that maximizes returns while minimizing risks. This role demands a strong understanding of both finance principles and cutting-edge technology to optimize client wealth effectively.

Behavioral Finance Specialist

Financial Management graduates can excel as Behavioral Finance Specialists by analyzing how psychological factors influence investment decisions and market trends. They apply insights from cognitive psychology to improve financial strategies, risk management, and client advising. Expertise in this role helps organizations optimize portfolio performance and enhance decision-making processes.

Good to know: jobs for Financial Management graduates

Overview of Financial Management Careers

Financial Management graduates have access to diverse career opportunities in sectors such as banking, corporate finance, investment management, and public administration. These roles focus on budgeting, financial planning, risk assessment, and strategic decision-making to ensure organizational financial health.

Careers in financial management include positions like financial analyst, budget analyst, financial controller, and investment banker. Professionals manage assets, analyze market trends, and develop strategies to maximize profitability and minimize financial risks. Your skills in financial reporting, forecasting, and regulatory compliance make you valuable across industries aiming for sustainable growth.

Entry-Level Job Opportunities

Financial Management graduates possess essential skills for analyzing, planning, and managing financial resources within organizations. Entry-level job opportunities provide a foundation to apply financial principles and develop expertise in diverse business environments.

- Financial Analyst - Evaluates financial data to assist in investment decisions and budgeting processes for businesses or clients.

- Budget Analyst - Prepares and reviews budget reports to ensure efficient allocation of financial resources.

- Credit Analyst - Assesses credit data and financial statements to determine creditworthiness of individuals or companies.

Essential Skills for Financial Management Professionals

Financial Management graduates have numerous career opportunities in corporate finance, banking, investment analysis, and risk management.

- Analytical skills - Ability to interpret complex financial data and make informed decisions.

- Communication skills - Proficiency in conveying financial information clearly to stakeholders.

- Attention to detail - Ensuring accuracy in financial reports and compliance with regulatory standards.

Your expertise in these essential skills positions you for success in diverse financial roles.

Popular Career Paths for Graduates

Graduates in Financial Management can pursue roles such as Financial Analyst, Investment Banker, and Risk Manager, which are highly sought-after in the corporate world. These positions involve analyzing financial data, advising on investment opportunities, and managing financial risks to optimize organizational performance. Your skills in budgeting, forecasting, and strategic planning make you a valuable asset in these popular career paths.

Advancement and Promotion Prospects

Financial Management graduates have access to diverse roles such as Financial Analyst, Budget Manager, Investment Officer, and Risk Manager. These positions provide a strong foundation for understanding corporate finance, investment strategies, and regulatory compliance.

Advancement opportunities include promotion to Senior Financial Manager, Chief Financial Officer (CFO), or Director of Finance based on performance and experience. Your expertise in financial planning and analysis enhances prospects for leadership roles and strategic decision-making responsibilities.

Certifications and Continuing Education

What career paths are available for Financial Management graduates seeking advancement? Graduates often pursue roles such as financial analyst, investment banker, or corporate finance manager. Certifications like CFA, CPA, and CMA significantly enhance job prospects and earning potential.

How do certifications impact the career growth of Financial Management professionals? Earning certifications demonstrates expertise and commitment to the field, leading to higher responsibilities and leadership roles. Continuing education through workshops, seminars, and advanced degrees ensures staying current with industry trends and regulations.

Emerging Trends in Financial Management

Financial Management graduates find growing opportunities in roles such as financial analysts, risk managers, and investment consultants. Emerging trends emphasize data analytics, blockchain technology, and sustainable finance, shaping the future job market.

Demand increases for professionals skilled in artificial intelligence applications and cybersecurity within financial institutions. These trends drive innovation in portfolio management, fraud detection, and regulatory compliance sectors.

jobsintra.com

jobsintra.com