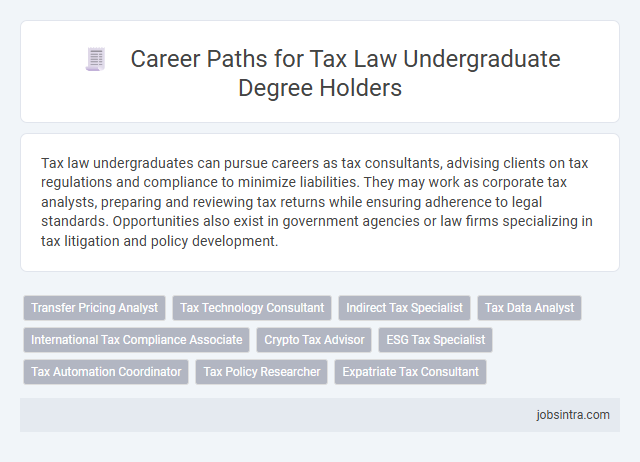

Tax law undergraduates can pursue careers as tax consultants, advising clients on tax regulations and compliance to minimize liabilities. They may work as corporate tax analysts, preparing and reviewing tax returns while ensuring adherence to legal standards. Opportunities also exist in government agencies or law firms specializing in tax litigation and policy development.

Transfer Pricing Analyst

A Transfer Pricing Analyst specializes in evaluating and documenting intercompany transactions to ensure compliance with tax regulations and prevent profit shifting. This role requires strong analytical skills and a solid understanding of tax law, economics, and financial reporting. Your expertise in transfer pricing can lead to opportunities within multinational corporations, consulting firms, and government tax authorities.

Tax Technology Consultant

Tax technology consultants leverage their expertise in tax law and technology to optimize tax processes and ensure compliance using advanced software solutions. They analyze complex tax regulations and implement automated systems to enhance accuracy and efficiency within corporate tax departments or consulting firms. Their role bridges the gap between tax knowledge and cutting-edge technology, making them essential for businesses navigating evolving tax landscapes.

Indirect Tax Specialist

An Indirect Tax Specialist focuses on advising businesses on taxes such as VAT, GST, and sales tax to ensure compliance with local and international regulations. This role involves analyzing tax legislation, conducting audits, and implementing tax strategies to optimize financial outcomes. Proficiency in accounting software and strong analytical skills are essential for success in this profession.

Tax Data Analyst

Tax Data Analysts interpret complex tax regulations by analyzing financial data to ensure compliance and optimize tax strategies. They use advanced software tools to identify patterns, detect discrepancies, and prepare accurate reports for tax filing and audits. Strong analytical skills, proficiency in tax codes, and expertise in data management are crucial for success in this role.

International Tax Compliance Associate

International Tax Compliance Associates specialize in ensuring that multinational companies adhere to complex tax regulations across different jurisdictions. Your role involves preparing and reviewing tax filings, analyzing cross-border transactions, and supporting tax audits to minimize compliance risks. Expertise in global tax laws and proficiency in compliance software are essential for success in this position.

Crypto Tax Advisor

Crypto Tax Advisors specialize in navigating complex tax regulations related to cryptocurrency transactions and investments. They provide expert guidance on reporting obligations, ensuring compliance with evolving tax laws, and optimizing tax liabilities for individuals and businesses involved in digital assets. This role requires strong analytical skills, knowledge of blockchain technology, and up-to-date understanding of tax codes applicable to crypto activities.

ESG Tax Specialist

An ESG Tax Specialist leverages expertise in tax law and environmental, social, and governance criteria to help organizations navigate complex tax incentives and compliance related to sustainable business practices. This role involves analyzing tax policies to optimize benefits from green investments, ensuring adherence to evolving ESG regulations, and advising companies on tax-efficient strategies that align with their corporate social responsibility goals. Professionals in this field are in high demand as businesses prioritize sustainability and seek to integrate ESG considerations into their financial and tax planning.

Tax Automation Coordinator

A Tax Automation Coordinator specializes in designing and implementing software solutions to streamline tax processes and improve accuracy within organizations. Your expertise in tax law combined with technical skills enables you to develop automated systems that efficiently handle complex tax calculations and compliance reporting. This role bridges the gap between tax regulations and technology, making tax operations more productive and reliable.

Tax Policy Researcher

Tax Policy Researchers analyze and evaluate the impact of tax laws and regulations to advise policymakers on effective fiscal strategies. They conduct in-depth research on tax systems, economic data, and legal frameworks to recommend improvements that promote fairness and efficiency. These professionals often work for government agencies, think tanks, or consulting firms specializing in tax legislation and public finance.

Good to know: jobs for tax law undergraduate

Overview of Tax Law Careers

Tax law offers diverse career paths for undergraduates interested in legal and financial sectors. Understanding the roles available helps in making informed decisions about your professional future.

- Tax Attorney - Specializes in advising clients on tax regulations, compliance, and litigation.

- Corporate Tax Advisor - Works within companies to develop tax strategies and ensure adherence to tax laws.

- Government Tax Examiner - Reviews and audits tax returns to enforce state or federal tax policies.

Exploring these roles provides a foundation for a successful career in tax law.

Core Skills Needed in Tax Law

| Job Title | Core Skills Needed | Job Description |

|---|---|---|

| Tax Attorney | In-depth knowledge of tax codes, Strong analytical skills, Legal research proficiency, Communication skills, Negotiation abilities | Provides expert advice on tax regulations, represents clients in tax disputes, and drafts tax-related legal documents. |

| Tax Consultant | Comprehensive understanding of tax laws, Problem-solving skills, Client advisory experience, Attention to detail, Regulatory compliance knowledge | Advises individuals and businesses on tax planning strategies, prepares tax returns, and ensures compliance with tax legislation. |

| Corporate Tax Analyst | Financial analysis, Tax regulation expertise, Data interpretation, Risk assessment, Communication and reporting skills | Analyzes corporate financial statements for tax purposes, assists in tax planning, and ensures company adherence to tax laws. |

| Tax Compliance Officer | Knowledge of tax compliance requirements, Detail-oriented approach, Regulatory knowledge, Auditing skills, Time management | Monitors and enforces adherence to tax laws, prepares compliance reports, and assists in regulatory audits. |

| Tax Policy Advisor | Research and analytical skills, Understanding of tax legislation, Policy development, Strategic thinking, Stakeholder communication | Develops and evaluates tax policies, provides guidance on tax reform, and communicates policy impact to stakeholders. |

Public vs. Private Sector Opportunities

Graduates in tax law have diverse career paths in both the public and private sectors. Public sector roles often include positions within government tax agencies, regulatory bodies, and law enforcement related to taxation.

Private sector opportunities typically involve working for law firms, corporate tax departments, or financial consulting companies. Your expertise in tax law can be valuable for advising clients on compliance, tax planning, and dispute resolution.

Government and Regulatory Agency Roles

Careers in tax law for undergraduates often lead to positions within government departments such as the Internal Revenue Service (IRS) or the Treasury Department. Regulatory agencies seek professionals skilled in tax compliance, policy analysis, and enforcement to ensure adherence to tax laws and regulations. Your expertise can support the development and implementation of tax policies that impact national fiscal management and public finance.

Corporate Tax Specialist Positions

What career paths can a tax law undergraduate pursue in corporate tax? Corporate Tax Specialist positions offer an opportunity to apply your legal knowledge to complex financial transactions and tax compliance. These roles involve advising corporations on tax strategies, ensuring regulatory adherence, and optimizing tax liabilities.

Paths in Tax Consulting and Advisory

Tax law undergraduates have diverse career opportunities in tax consulting and advisory firms, where they analyze complex tax regulations to optimize client financial strategies. Your expertise is crucial in helping businesses navigate corporate tax compliance, international taxation, and estate planning. Roles include tax analyst, compliance advisor, and transfer pricing consultant, each requiring strong analytical skills and up-to-date knowledge of tax legislation.

Further Education and Professional Certification Options

Pursuing a career in tax law opens a variety of opportunities in legal firms, government agencies, and corporate tax departments. Specializing in this field often requires advanced education and professional certifications to enhance expertise and marketability.

Further education options include a Master of Laws (LL.M.) in Taxation, which provides in-depth knowledge of tax regulations and compliance. Professional certifications such as Certified Public Accountant (CPA) or Chartered Tax Adviser (CTA) significantly improve career prospects. These qualifications demonstrate proficiency in tax law and are highly valued by employers in both public and private sectors.

jobsintra.com

jobsintra.com