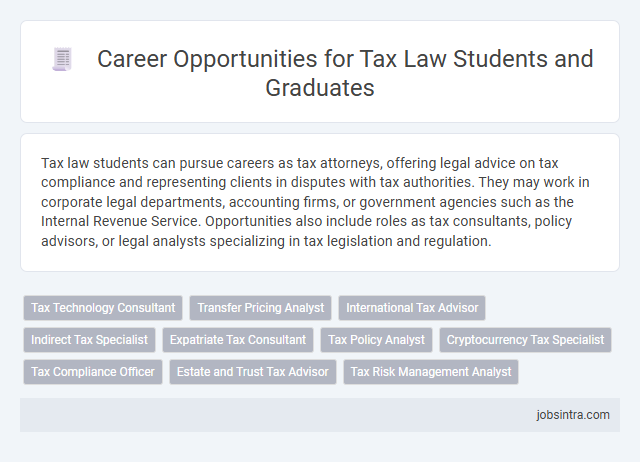

Tax law students can pursue careers as tax attorneys, offering legal advice on tax compliance and representing clients in disputes with tax authorities. They may work in corporate legal departments, accounting firms, or government agencies such as the Internal Revenue Service. Opportunities also include roles as tax consultants, policy advisors, or legal analysts specializing in tax legislation and regulation.

Tax Technology Consultant

Tax technology consultants specialize in leveraging advanced software and data analytics to optimize tax compliance and reporting processes for businesses. You can apply your tax law knowledge combined with technical skills to help organizations navigate complex regulations while implementing efficient digital solutions. This role offers a unique blend of legal expertise and technology, making it ideal for tax law students interested in innovative career paths.

Transfer Pricing Analyst

Transfer Pricing Analysts specialize in evaluating and documenting transactions between related entities to ensure compliance with tax regulations and prevent profit shifting. They analyze financial data, interpret tax laws, and prepare transfer pricing reports to support multinational corporations in minimizing tax risks. Strong analytical skills and knowledge of international tax policies are essential for success in this role.

International Tax Advisor

International tax advisors specialize in navigating complex cross-border tax regulations, helping individuals and corporations minimize tax liabilities while ensuring compliance with global tax laws. They analyze international tax treaties, transfer pricing rules, and tax planning strategies to optimize financial outcomes in multinational transactions. Expertise in foreign tax systems and regulatory environments makes this role essential for businesses operating across multiple jurisdictions.

Indirect Tax Specialist

Indirect Tax Specialists analyze and ensure compliance with VAT, sales tax, and other consumption taxes for businesses. They advise corporations on minimizing tax liabilities through strategic planning and help navigate complex regulatory frameworks. Expertise in indirect taxation regulations enables them to support companies in optimizing tax efficiency while meeting legal requirements.

Expatriate Tax Consultant

Expatriate Tax Consultants specialize in advising individuals and companies on tax obligations related to international assignments, ensuring compliance with cross-border tax laws and regulations. This role requires a deep understanding of tax treaties, foreign income reporting, and expatriate payroll issues to optimize tax benefits and minimize liabilities. You can leverage your tax law knowledge to provide strategic planning and support for multinational clients navigating complex expatriate tax challenges.

Tax Policy Analyst

Tax law students pursuing a career as a Tax Policy Analyst analyze government tax regulations and propose reforms to improve fiscal fairness and efficiency. They evaluate the economic impact of tax laws, conduct research on tax codes, and prepare detailed reports to guide policymakers. Strong analytical skills and expertise in tax legislation are essential for influencing effective tax policy decisions.

Cryptocurrency Tax Specialist

Cryptocurrency tax specialists analyze and interpret tax regulations related to digital assets, ensuring compliance with rapidly evolving laws. They assist clients in accurately reporting cryptocurrency transactions and minimizing tax liabilities while navigating complex IRS guidelines. Expertise in blockchain technology and tax policy makes this role essential for individuals and businesses operating in the digital currency space.

Tax Compliance Officer

Tax law students can pursue a career as a Tax Compliance Officer, where they ensure individuals and businesses adhere to tax regulations by reviewing financial documents and identifying discrepancies. This role involves interpreting complex tax codes, conducting audits, and advising on compliance requirements to minimize legal risks. A strong understanding of tax legislation and analytical skills are essential for success in this position.

Estate and Trust Tax Advisor

Estate and Trust Tax Advisors specialize in managing and planning the tax implications associated with estates and trusts, ensuring compliance with federal and state tax laws. They analyze complex financial documents, prepare tax returns, and develop strategies to minimize tax liabilities for clients. This role requires strong expertise in tax regulations, attention to detail, and the ability to communicate intricate concepts to beneficiaries and legal professionals.

Good to know: jobs for tax law students

Overview of Tax Law as a Career Path

What career opportunities are available for students specializing in tax law? Tax law offers diverse roles in public and private sectors including positions as tax attorneys, compliance analysts, and policy advisors. Your expertise can lead to work in government agencies, law firms, or corporate tax departments.

Essential Skills for Tax Law Professionals

Tax law students pursue careers that require a deep understanding of complex tax codes and regulations. Essential skills enhance your ability to analyze, interpret, and apply tax laws effectively in various professional roles.

- Analytical Thinking - Enables effective evaluation of tax issues and formulation of strategic solutions.

- Attention to Detail - Critical for accurate tax compliance, reporting, and identifying discrepancies.

- Communication Skills - Essential for explaining complex tax concepts clearly to clients and colleagues.

Mastering these skills prepares you for success as a tax attorney, tax advisor, compliance officer, or government tax agent.

Popular Job Roles for Tax Law Graduates

Tax law graduates have diverse career opportunities in both public and private sectors. Popular job roles include tax attorney, tax consultant, and corporate tax advisor.

Tax attorneys specialize in interpreting tax legislation and representing clients in disputes with tax authorities. Corporate tax advisors assist businesses in structuring transactions to optimize tax efficiency and compliance.

Career Opportunities in Private Practice

Tax law students have numerous career opportunities in private practice, including roles as tax associates, compliance advisors, and legal consultants. These positions involve advising clients on complex tax regulations, planning tax strategies, and representing clients in tax disputes.

Private law firms often seek tax law graduates to support corporate clients, high-net-worth individuals, and small businesses with tax planning and litigation. Careers in private practice emphasize strong analytical skills, an understanding of federal, state, and international tax codes, and effective client communication. Tax law associates typically gain experience in drafting legal documents, conducting research, and negotiating settlements with tax authorities.

Government and Public Sector Opportunities

Tax law students interested in government and public sector roles can find numerous career opportunities within federal, state, and local agencies. Positions such as tax examiner, legal advisor, or policy analyst offer hands-on experience in tax legislation and enforcement.

Working for the Internal Revenue Service (IRS) or the Treasury Department provides exposure to complex tax regulations and compliance issues. Your expertise can contribute to shaping tax policies that impact the broader economy and public welfare.

Emerging Areas and Specializations in Tax Law

| Job Title | Emerging Area or Specialization | Description | Key Skills |

|---|---|---|---|

| Digital Tax Consultant | Digital Economy Taxation | Advises on tax implications of digital goods and services, cross-border digital transactions, and application of VAT/GST in digital markets. | International tax law, digital transaction regulations, VAT/GST frameworks |

| Transfer Pricing Analyst | Transfer Pricing and International Tax | Focuses on compliance with transfer pricing regulations, documentation, and risk analysis for multinational enterprises. | OECD guidelines, economics, financial analysis |

| Tax Technology Specialist | Tax Technology and Automation | Implements and manages tax software solutions integrating AI and automation for tax compliance and reporting. | Tax law, software proficiency, process automation |

| Environmental Tax Advisor | Environmental and Green Taxation | Develops strategies related to carbon taxes, sustainable incentives, and compliance with environmental tax policies. | Environmental law, tax incentives, policy analysis |

| Cryptocurrency Tax Consultant | Blockchain and Cryptocurrency Taxation | Guides clients on taxation of digital assets, reporting requirements, and regulatory compliance in blockchain transactions. | Cryptocurrency regulations, tax compliance, blockchain technology |

| International Tax Policy Analyst | Global Tax Policy and Compliance | Analyzes and advises on international tax treaties, Base Erosion and Profit Shifting (BEPS) initiatives, and global tax reforms. | International tax law, policy research, treaty analysis |

| Tax Risk Manager | Tax Risk Management and Compliance | Identifies, evaluates, and mitigates tax risks within corporations to ensure regulatory adherence and minimize liabilities. | Risk assessment, tax law compliance, audit procedures |

| Estate and Trust Tax Specialist | Estate Planning and Taxation | Focuses on tax strategies for estate planning, trust administration, and wealth transfer minimizing tax burdens. | Estate law, tax planning, fiduciary responsibilities |

Strategies for Building a Successful Career in Tax Law

Tax law students can pursue careers as tax attorneys, compliance specialists, or financial advisors, each requiring strong analytical skills and knowledge of tax codes. Internships at law firms, government agencies, or corporate tax departments provide practical experience and networking opportunities crucial for career advancement. Developing expertise in areas like corporate tax, international tax, or estate planning enhances employability and long-term career growth.

jobsintra.com

jobsintra.com