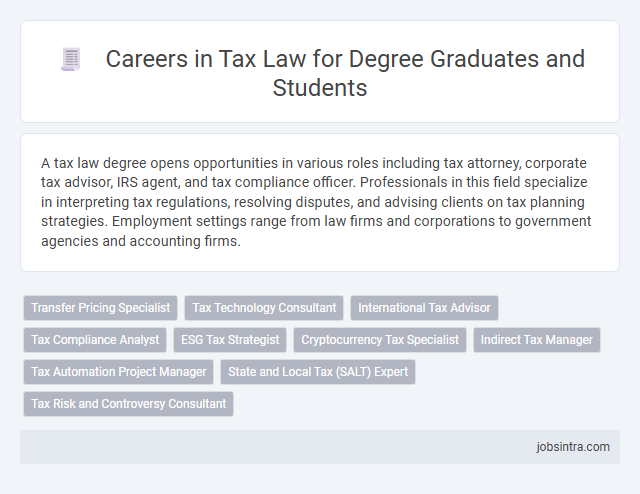

A tax law degree opens opportunities in various roles including tax attorney, corporate tax advisor, IRS agent, and tax compliance officer. Professionals in this field specialize in interpreting tax regulations, resolving disputes, and advising clients on tax planning strategies. Employment settings range from law firms and corporations to government agencies and accounting firms.

Transfer Pricing Specialist

A Transfer Pricing Specialist analyzes and implements pricing strategies for cross-border transactions between related entities to ensure compliance with tax regulations. Your expertise in tax law enables you to advise multinational corporations on optimizing their tax positions while avoiding disputes with tax authorities. This specialized role combines financial analysis, international tax law, and strategic planning to minimize tax liabilities legally.

Tax Technology Consultant

A Tax Technology Consultant leverages specialized knowledge in tax law and technology to help organizations streamline tax compliance and reporting processes. You can expect to work with advanced software systems and data analytics tools to optimize tax strategy and ensure regulatory compliance. This role combines expertise in tax regulations with technical skills to deliver efficient, innovative solutions for complex tax challenges.

International Tax Advisor

An International Tax Advisor specializes in managing cross-border tax issues, helping multinational corporations navigate complex tax regulations and treaties. Your expertise in international tax law enables businesses to optimize their tax strategies, ensure compliance, and minimize liabilities worldwide. This role requires strong analytical skills and up-to-date knowledge of global tax policies.

Tax Compliance Analyst

A Tax Compliance Analyst specializes in ensuring that organizations adhere to tax laws and regulations by reviewing financial documents and preparing accurate tax reports. They analyze tax data, identify discrepancies, and recommend corrective actions to minimize risks and penalties. Their expertise supports businesses in maintaining compliance and optimizing tax liabilities efficiently.

ESG Tax Strategist

An ESG Tax Strategist leverages expertise in tax law to help organizations align their financial practices with environmental, social, and governance (ESG) criteria, ensuring compliance while optimizing tax benefits. This role involves analyzing tax incentives related to sustainable investments, advising on regulatory changes, and developing tax-efficient strategies that support corporate social responsibility goals. Professionals in this field drive value by integrating tax considerations into broader ESG frameworks, enhancing both fiscal performance and ethical impact.

Cryptocurrency Tax Specialist

A Cryptocurrency Tax Specialist leverages expertise in tax law to navigate the complex regulations surrounding digital assets and blockchain transactions. You will analyze cryptocurrency transactions, ensure compliance with evolving tax codes, and advise clients or companies on minimizing tax liabilities related to digital currencies. This role demands a thorough understanding of both tax law and emerging technologies in the financial sector.

Indirect Tax Manager

An Indirect Tax Manager specializes in managing taxes such as VAT, GST, and customs duties, ensuring compliance with complex regulations across jurisdictions. Your expertise in tax law allows you to develop strategies that minimize tax liabilities while maintaining adherence to legal standards. This role often involves advising businesses on audit preparation, regulatory changes, and risk management to optimize their indirect tax position.

Tax Automation Project Manager

A Tax Automation Project Manager leverages expertise in tax law to oversee the implementation of automated systems that streamline tax compliance and reporting processes. This role requires a deep understanding of tax regulations and technology solutions to ensure accurate and efficient tax management. You will coordinate cross-functional teams to deliver projects that reduce manual workload and enhance regulatory compliance.

State and Local Tax (SALT) Expert

A career as a State and Local Tax (SALT) expert involves advising businesses and individuals on tax compliance and planning related to state and local taxes, including income, sales, property, and use taxes. Your expertise will help clients navigate complex tax regulations, minimize liabilities, and respond effectively to audits or disputes with tax authorities. Opportunities exist within law firms, accounting firms, government agencies, and corporations seeking specialized knowledge in SALT matters.

Good to know: jobs for tax law degree

Overview of Tax Law as a Career Path

A career in tax law offers diverse opportunities in both public and private sectors. Professionals with a tax law degree specialize in navigating complex tax codes and regulations to help clients minimize liabilities and ensure compliance.

Common career paths include roles as tax attorneys, corporate tax advisors, and government tax examiners. Tax law experts also work in accounting firms, law firms, and corporate legal departments, focusing on estate planning, mergers, acquisitions, and international taxation.

Key Roles and Job Types in Tax Law

Tax law degrees open doors to specialized legal careers focused on tax compliance, planning, and litigation. Key roles include Tax Attorney, Corporate Tax Advisor, and Tax Compliance Officer, each requiring expertise in tax codes and regulations. Your skills can also lead to positions such as IRS Agent, Tax Consultant, or Estate Planner, where in-depth knowledge of tax law drives strategic financial decisions.

Essential Skills and Qualifications for Aspiring Tax Lawyers

| Job Role | Essential Skills | Key Qualifications |

|---|---|---|

| Tax Attorney | Expertise in tax code interpretation, strong analytical abilities, negotiation skills, and legal research proficiency | Juris Doctor (JD) degree, state bar admission, specialized courses in tax law, and continuing legal education (CLE) in taxation |

| Corporate Tax Advisor | Corporate tax planning, advisory skills, understanding of financial statements, and regulatory compliance knowledge | Tax law degree, CPA certification preferred, experience with corporate tax filings, and advanced tax coursework |

| Government Tax Counsel | Policy analysis, litigation skills, expertise in tax statutes, and public sector experience | Law degree with tax specialization, experience in government agencies, and strong understanding of administrative law |

| Estate and Trust Tax Lawyer | Estate planning expertise, knowledge of trust laws, attention to detail, and client advisory skills | JD with focus on estate and tax law, certification in estate planning, and practical experience with estate tax compliance |

| Tax Litigation Specialist | Litigation and courtroom skills, dispute resolution, in-depth knowledge of tax controversies, and strategic thinking | Tax law degree, admission to relevant bar associations, experience in tax dispute cases, and strong oral and written communication skills |

| Essential Capabilities for Aspiring Tax Lawyers | Analytical thinking, comprehensive understanding of local and international tax regulations, meticulous attention to detail, excellent communication and negotiation skills, ethical judgment, and commitment to continual professional development. You must balance technical knowledge with client advocacy to succeed. | |

Educational Pathways and Further Certifications

A tax law degree opens doors to specialized legal careers such as tax attorney, tax advisor, and corporate tax consultant. Educational pathways often include completing a Juris Doctor (JD) with a focus on tax law or pursuing a Master of Laws (LL.M.) in taxation for advanced expertise.

Further certifications like the Certified Tax Law Specialist (CTLS) or the Chartered Tax Advisor (CTA) credential can enhance your professional credibility. Continuing education and passing the relevant bar exams are essential steps to practice effectively in this field.

Top Employers and Workplace Settings in Tax Law

With a tax law degree, you can pursue careers in prestigious law firms, government agencies like the IRS, and major corporations' legal departments. Top employers include multinational accounting firms such as Deloitte, PwC, and EY, where tax law experts manage compliance and strategic planning. Common workplace settings range from corporate offices to government institutions and specialized tax consulting firms, offering diverse environments for tax law professionals.

Career Progression and Advancement Opportunities

A tax law degree opens diverse career paths in legal and financial sectors. Graduates can leverage their expertise to advance into specialized roles with increasing responsibility.

- Tax Attorney - Represents clients on tax disputes, gradually moving from associate to partner in law firms.

- Tax Consultant - Advises businesses and individuals on tax planning, progressing to senior consultant or managerial positions.

- Corporate Tax Advisor - Manages corporate tax compliance and strategy, with potential to advance into executive financial roles.

Career advancement in tax law involves continuous education, professional certifications, and gaining experience in complex tax issues.

Current Trends and Future Prospects in Tax Law

Jobs for individuals with a tax law degree are evolving rapidly due to changing regulations and technological advancements. Understanding current trends and future prospects is crucial for career planning in tax law.

- Growth in International Tax Law Roles - Increasing globalization drives demand for tax lawyers skilled in cross-border tax issues and treaties.

- Emphasis on Tax Technology Expertise - Proficiency in tax software and AI tools is becoming essential for efficient tax compliance and advisory services.

- Expansion of Policy Advisory Positions - Government and corporate sectors seek tax law professionals to navigate evolving tax policies and reform initiatives.

jobsintra.com

jobsintra.com